LCC vs. FSC traffic growth and the rise of the LCC sector at Athens

easyJet added 7 destinations in the network and Ryanair increased traffic volumes by 26% vs 2023, Norse Atlantic inaugurated a direct trans-Atlantic service

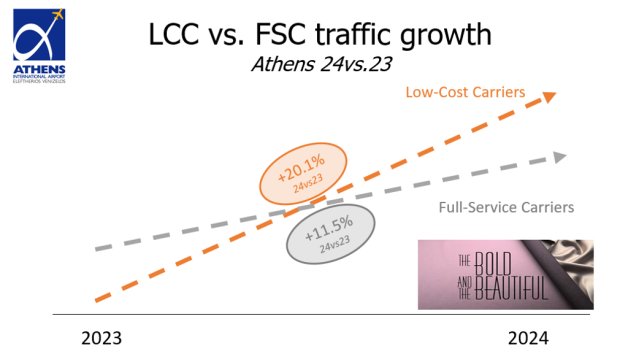

The importance of the Low Cost sector at Athens was further highlighted in 2024 as the sector grew faster to the airport total! When compared to 2023, LCC PAX traffic increased by 20.1% with the FSC increasing by 11.5% (total passenger growth for Athens International Airport at 13.1% vs 2023). In 2024, 1 in every 5 passengers at Athens, travelled with a LCC airline..

From a total of 3.68mio additional PAX last year (vs.2023) almost 30% generated from the LCC sector. Even, the 5.5mio LCC PAX in 2019 have been surpassed in 2024 with the sector generating 6.13mio PAX.

Athens welcomed significant investments from LCC airlines as the demand for travel to and from Greece and Athens is increasing year on year. The popularity of the Country and Athens in specific, is stronger than ever before.

Major LCCs realized this market opportunity and significantly increased available capacity.:

As a result, easyJet “re-discovered” Athens, adding 7 new routes thus increasing the airline’s total network to 17 routes to/from Athens in Summer 2024.

That resulted in +49% increase in passenger traffic for the airline, almost reaching 1mio round-trip passengers.

Ryanair, added 2 routes to its network from Athens in 2024, with services to Bari and Milan-MXP, maintaining services to Bergamo (BGY). Cumulatively at MXP & BGY, Ryanair increased capacity by 30% in 2024 vs. 2023.

With above new routes and increase in frequencies at the existing network, Passenger traffic for Ryanair grew by 26% vs. 2023 carrying a total of 1.8mio PAX.

Vueling, another long-lasting partner at Athens, continued to increase capacity resulting in 18% growth in Pax traffic vs. 2023. That is on top of the 5% growth in 2023 vs. 2019.

Jet2 which was a new arrival to Athens in 2022, increased further its presence with 15% growth this year vs. 2023.

Furthermore, in 2024, Athens welcomed Norse Atlantic, adding a direct Long-Haul route to New York (JFK). The operation in the 1st year was so successful that the airline will add 1 more weekly frequency to 6/7 for Summer 2025, to accommodate the increased demand. Norse Atlantic carried 51.7 thousand round-trip PAX in 2024.

This is the 2nd Long-Haul Low-Cost route at Athens, following Singapore with Scoot. As a reminder, Athens is the 1st route in Europe that Scoot ever operated and continues to operate year-round.

Air Arabia realized the strong popularity for Athens and inaugurated services from Sharja last Summer, operating year-round. The debut was so successful that the airline already increased weekly frequencies to 5/7 in W24/25 from 4/7 in S’24 and will increase further to daily in Summer 2025.

The main drivers for this spectacular growth of the LCC sector at Athens are .:

+12% increase of Foreign residents arriving to Athens (24vs.23)

+22% increase of Greeks traveling to International destinations (24vs.23)

Strong demand in direct traffic from main European markets,

Italy, traffic increase +22% 24vs.23

Spain +15%

France +10%

Germany +15%

UK +5%

Similarly, the most popular destinations for Greeks traveling Internationally are the main European markets, including Italy, Spain, France, UK and Germany.

2024 was a very successful year for LCCs, but 2025 looks even more promising as LCCs already announced frequency increases, and new routes and forward bookings in the main European markets continue to increase, compared to 2024.