Asia-Pacific LCCs broaden network options with widebodies and long haul narrowbodies – part one

The trend of low cost carriers adding widebodies for medium haul and long haul routes is still going strong in the Asia-Pacific region, in contrast to Europe and North America, where this model has lost ground over the past four years. Even before the COVID-19 pandemic, the LCC widebody model was most firmly entrenched in Asia-Pacific. Now, the region has increased its lead in this sector even further as more Asian LCCs enter the widebody market or boost existing fleets. LCCs have multiple reasons for introducing widebodies – despite the historical reliance of such airlines on a single narrowbody aircraft type. Widebodies obviously add range and allow more capacity, as well as increasing cargo capabilities. This sector of the market has often been labelled 'long haul low cost', although most LCCs in the Asia-Pacific region use their widebodies for medium haul rather than true long haul flights. Another dynamic for LCCs in medium and long haul markets is the development of new extended-range narrowbodies, which are increasingly allowing LCCs to fulfil network expansion ambitions with smaller aircraft.

Summary:

- Asia-Pacific LCC widebody total has recovered to pre-pandemic levels.

- European and American LCC widebody totals have dropped significantly.

- VietJet has quickly built up a fleet of A330s, which it has used to open Australian routes.

- Japan Airlines (JAL) started ZipAir during the pandemic, and it operates 787s on transpacific routes.

- ANA intends to launch its own widebody subsidiary AirJapan in early 2024.

Asia-Pacific LCCs operate more widebodies than those in other regions, and have recovered faster

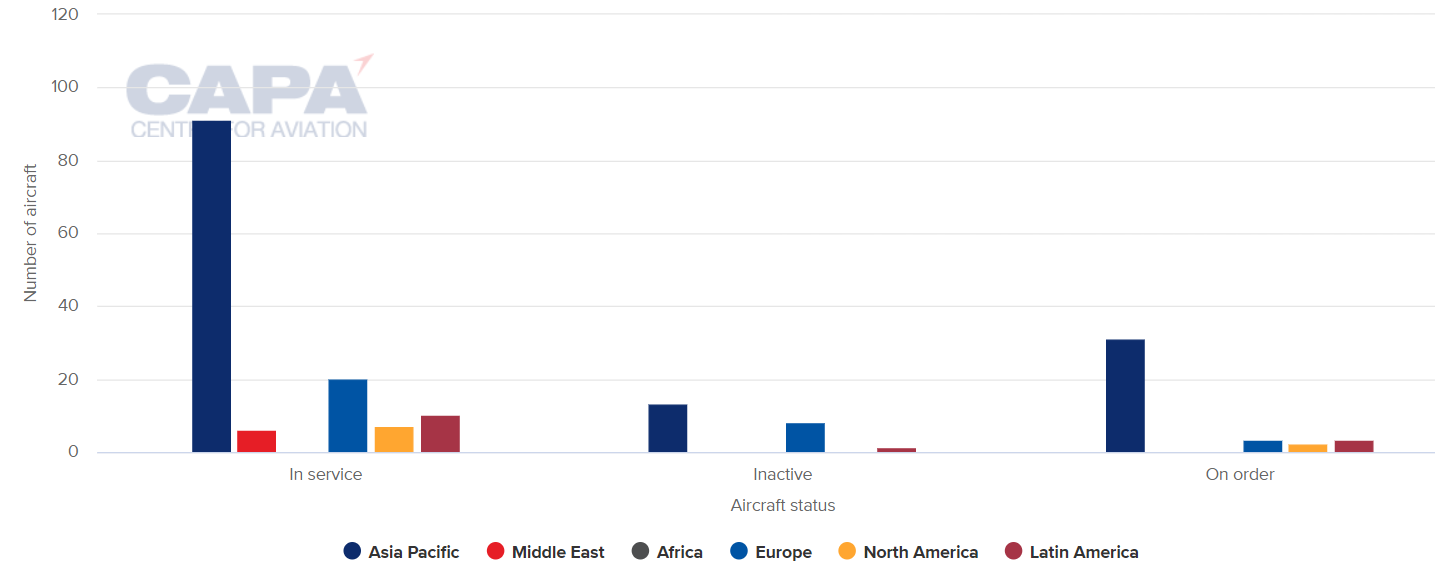

Data from CAPA - Centre for Aviation and OAG shows that LCCs globally are operating 133 widebody aircraft as of 1-Jul-2023, which is down from 176 just before the COVID-19 pandemic hit.

Global LCC widebody fleet by region and status (as at 11-Jul-2023)

Source: CAPA - Centre for Aviation fleet database

Even when 21 parked aircraft are included, the current total has dropped significantly.

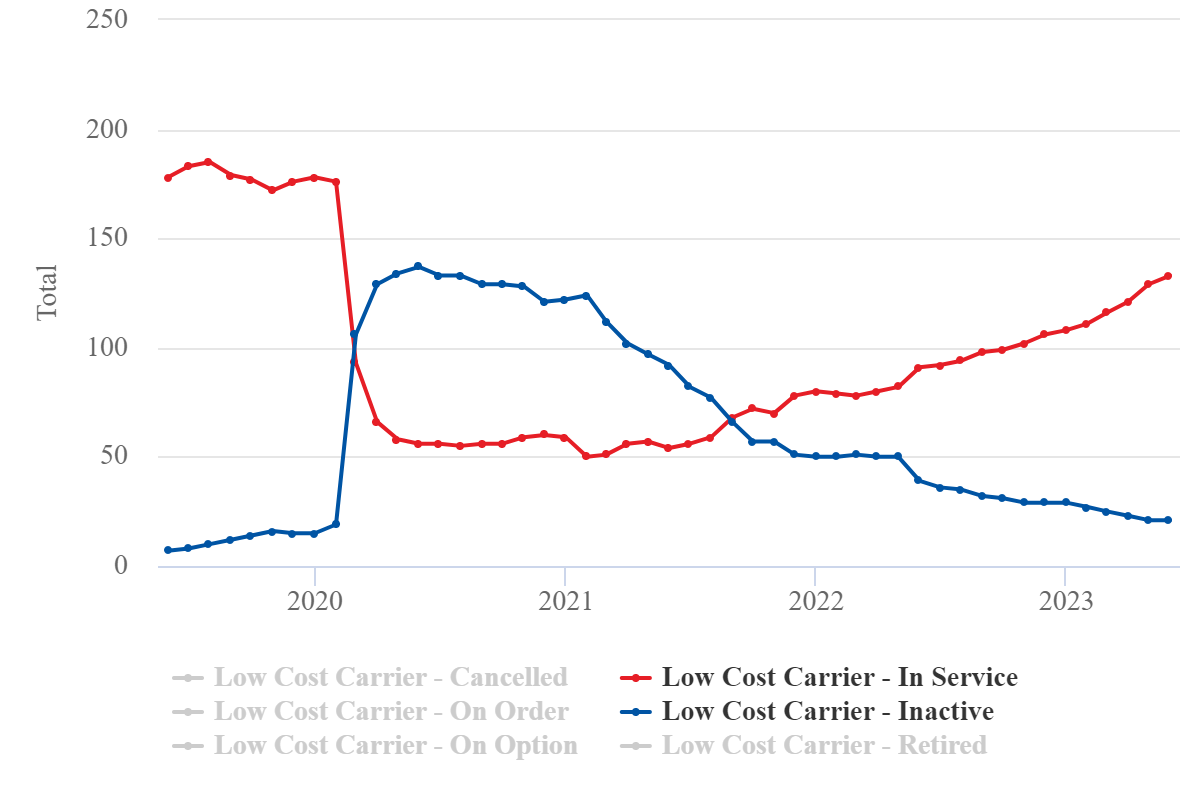

Global LCC widebody fleet: active versus inactive, 2019 to 2023

Source: CAPA - Centre for Aviation fleet database

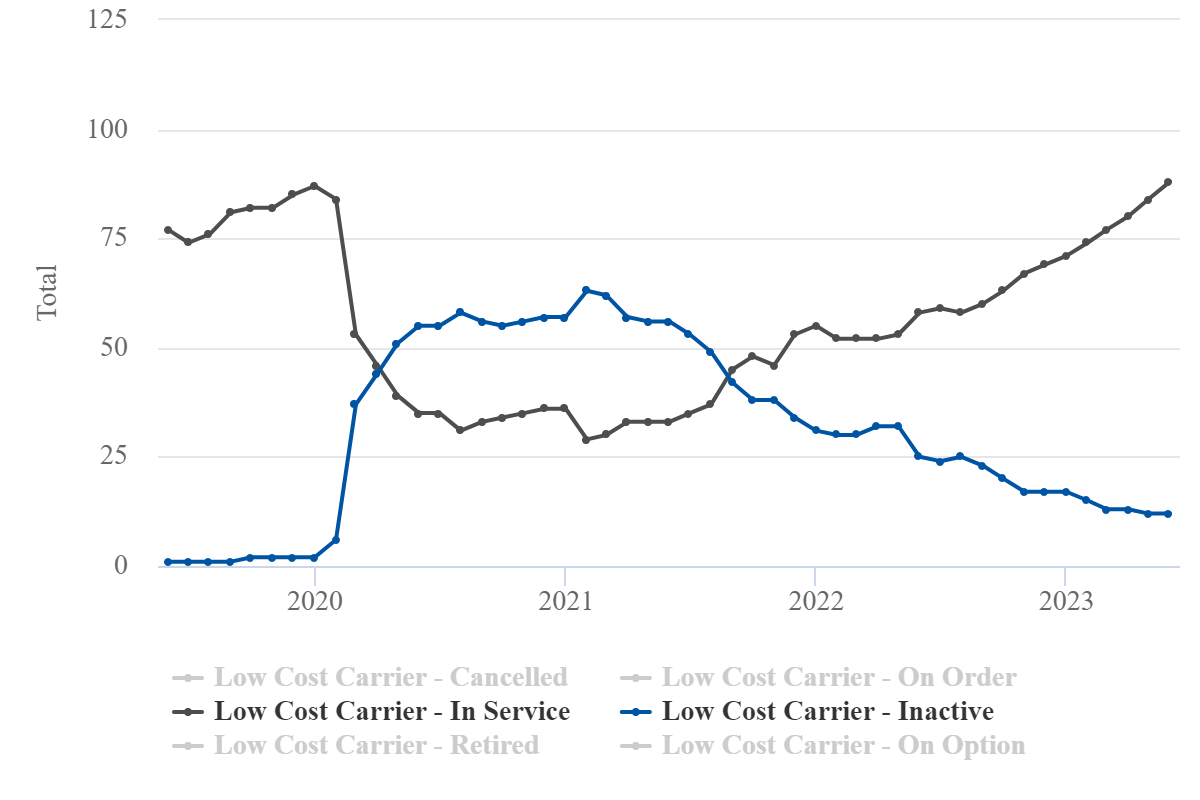

Asia-Pacific LCCs were operating 77 widebodies in Jun-2019 and 87 by Jan-2020, showing the rising trend before the COVID-19 pandemic.

Although this total plummeted during the COVID-19 crisis, it has rebounded well since then to 88. Fleet reductions during the pandemic years have been outweighed by new additions.

Asia-Pacific LCC widebody fleet: active versus inactive, 2019 to 2023

Source: CAPA - Centre for Aviation fleet database

In contrast, LCCs in the Americas have 17 widebodies in service, down from 43 before the pandemic.

And in Europe, LCCs are operating 19 widebodies versus 44 in Feb-2020. The European total had been declining even before that, as it was 58 in Jun-2019.

VietJet and T’Way are among the Asian LCCs that have introduced widebodies

The list of LCC widebody operators in the Asia-Pacific region includes some new names, with a few start-ups, and existing narrowbody operators adding larger aircraft to extend their range.

VietJet is one such example. The airline has built up a fleet of more than 70 Airbus A320-family aircraft, with 261 Airbus and Boeing narrowbodies on order. However, last year the airline decided to add widebodies to the mix as well.

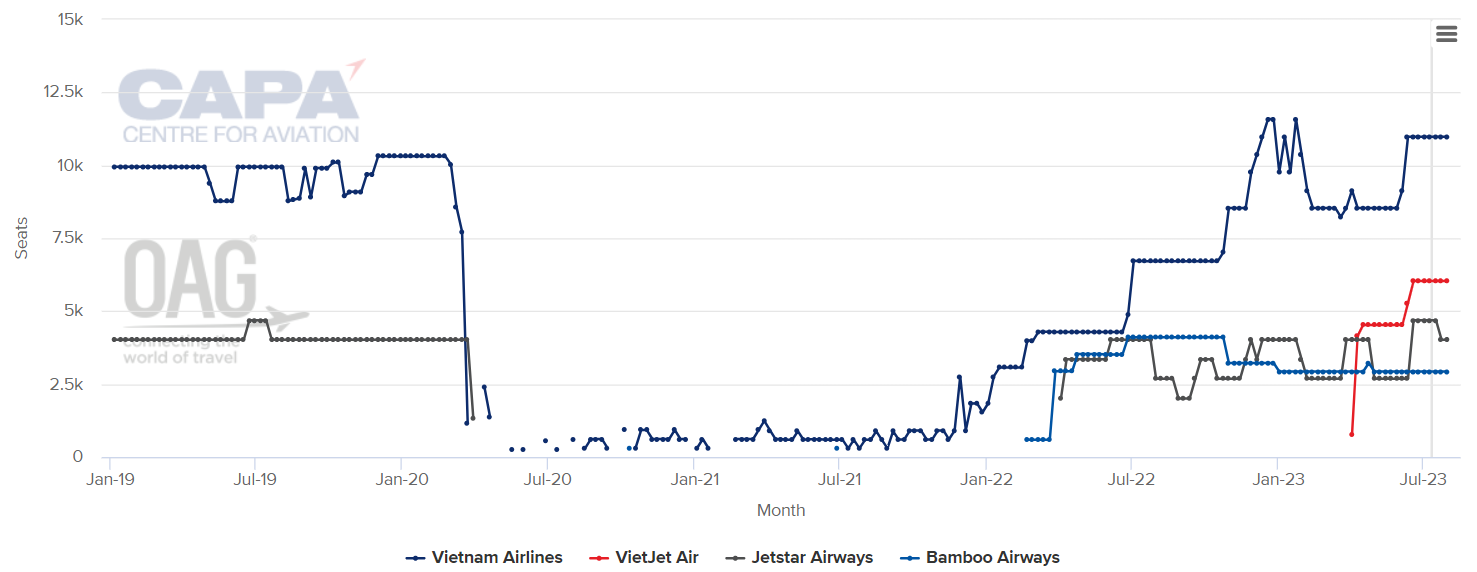

The Vietnam-based airline introduced its first Airbus A330-300 in Dec-2021 and now operates seven of these aircraft. The A330s have allowed VietJet to launch three routes from Ho Chi Minh City to Australian east coast cities.

Just three months after entering the market VietJet has captured nearly 25% of the Vietnam-Australia market, the second highest share behind Vietnam Airlines.

Vietnam-Australia two-way capacity: as measured in weekly seats, by airline, 2019 to 2023

Source: CAPA - Centre for Aviation and OAG

In May-2023 VietJet said that it intended to continue growing its A330 fleet, with more expected in 2023. Last year the airline signed an A330 engine deal with Rolls-Royce covering up to 10 aircraft.

South Korea’s T’Way is another LCC that has branched into widebodies since the COVID-19 pandemic. The airline introduced three A330-300s in the first half of 2022 and operates them on a long haul route from Seoul to Sydney, in addition to their use on other routes.

JAL launched a widebody LCC subsidiary, despite the pandemic, and plans to continue expanding its fleet

Both of Japan’s major airline groups have set up – or plan to set up – widebody LCCs. They have ambitious growth plans for these airlines, as they expect a greater shift in favour of international leisure travel in the pandemic recovery period and beyond.

Japan Airlines (JAL) launched passenger flights with its ZipAir subsidiary in Oct-2020, using Boeing 787-8s. The airline now operates six 787s, most of which were transferred from the parent airline, aside from one delivered new.

ZipAir operates to some medium haul Asian destinations, as well as long haul routes to the US. It added its fourth US route – to San Francisco – in Jun-2023.

The JAL group intends to “aggressively expand” ZipAir’s fleet and network as part of its broader aim of increasing the share of revenue contributed by its LCCs, which also include Spring Japan and the joint venture Jetstar Japan.

ANA's subsidiary AirJapan will also operate 787s and plans to begin flying next year

All Nippon Airways (ANA) intends to launch its AirJapan medium haul widebody subsidiary in Feb-2024. Although ANA describes the airline as a hybrid model, CAPA and others classify it as an LCC.

Like ZipAir, AirJapan will operate 787-8s. The airline plans to start with a single aircraft, increasing to six by Mar-2025. The aircraft will be configured with 324 seats, versus 169-240 on the 787-8s in ANA’s fleet.

AirJapan will begin by serving Southeast Asian routes, but will then expand to other destinations across Asia.

ANA CEO Shinichi Inoue has said that AirJapan will be focused on capturing inbound leisure demand from overseas. This is in contrast to the group’s other LCC, joint venture Peach, which mainly caters to outbound travel from Japan.

Part 2 of this report will focus on more Asia-Pacific LCCs adding to their widebody fleets, and where major cuts in widebody fleets have occurred. It will also include examples of LCCs looking to boost range with longer haul narrowbodies.