Asia Pacific start-ups have hurdles to overcome, but can prosper if they hit right growth formula

CAPA ANALYST PERSPECTIVE - a new series where CAPA - Centre for Aviation's analyst team provide personal views on a hot topic facing aviation around the world. Fortunes have varied widely for the handful of start-up airlines that have launched operations in the Asia-Pacific region in the wake of the COVID-19 pandemic. Many have carved out a niche in their home markets and are rapidly growing their fleets, while others are taking a more cautious approach to expansion, or are struggling financially. At least one has had to shut down its operations. Adrian Schofield, Asia Pacific Chief Analyst at CAPA - Centre for Aviation and Senior Air Transport Editor for Aviation Week Network shares his viewpoint.

Asia Pacific start-ups saw post-pandemic opportunities in their local markets while existing airlines recovered

Although there were a few Asia-Pacific airlines that disappeared during the pandemic years, these have been more than offset by the number of start-ups. In some cases the newcomers were following plans laid down before the COVID-19 crisis, but a general theme was that they saw post-pandemic opportunities in their local markets while existing airlines recovered.

They have been able to take advantage of strong demand conditions, but they have also been exposed to the same challenges as the legacy airlines during this period. These include a tight labour market, aircraft delivery delays and supply chain bottlenecks.

Greater Bay Airlines is one of the new LCCs looking to expand its fleet in 2024

Among the Asia-Pacific airlines launched since early 2020 are Hong Kong’s Greater Bay Airlines, Australia’s Bonza, SKS Airways and MYAirline in Malaysia, Akasa Air in India, and Air Premia and Aero K in South Korea. Others are planning to launch, such as Really Cool Airlines in Thailand and Beond in the Maldives.

Greater Bay Airlines is an example of an airline that saw an opening in its market. It launched in 2022, partly to take advantage of Cathay Pacific’s decision to close its Cathay Dragon subsidiary. It will also look to tap into the planned capacity expansion at Hong Kong International Airport.

The airline is currently operating four Boeing 737-800s, and in March it placed orders for 15 Boeing 737 MAX 9s, which are to be delivered beginning next year. Greater Bay is also looking to add more 737-800s before the MAXs start arriving.

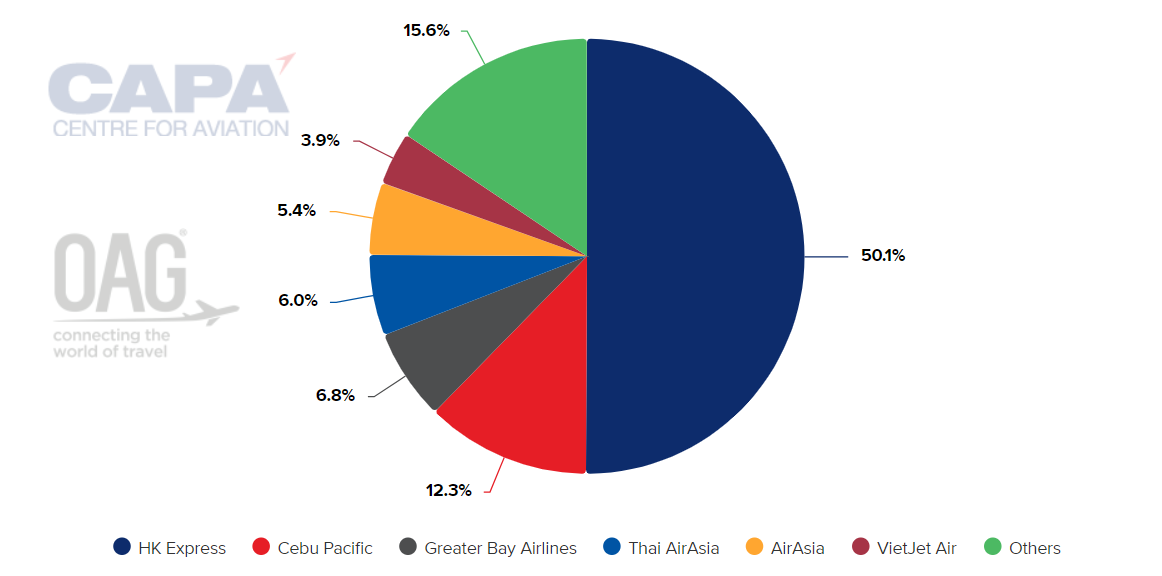

Greater Bay is still a very small player in the overall Hong Kong market. It has less than a 2% share of capacity for all business models, according to data from CAPA - Centre for Aviation and OAG.

However, the chart below shows that its share climbs to almost 7% among LCCs only.

Hong Kong LCC capacity share, by airline, as measured in seats for the week of 30-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Akasa Air has scaled up quickly, and a major order is forthcoming

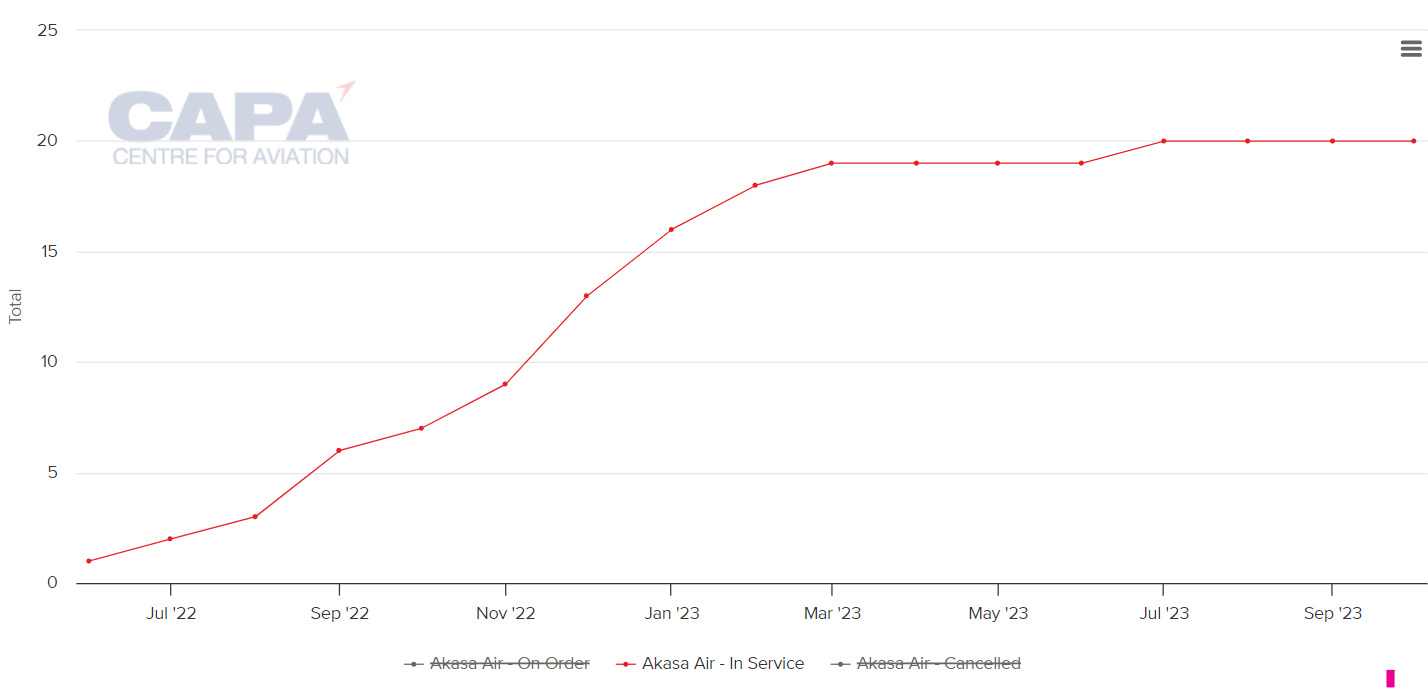

Akasa Air has even bigger plans, as this recent CAPA - Centre for Aviation analysis shows. The airline has grown its fleet to 20 737 MAXs just over a year after launching. It has 56 remaining on order, and it intends to place a triple digit order by the end of 2023.

The following chart shows the very quick initial ramp-up for Akasa Air’s narrowbody fleet.

Akasa Air: fleet in service, (Jul-2022 to Oct-2023), as at Oct-2023

Source: CAPA - Centre for Aviation Fleet Database

Reaching a fleet size of 20 was a major goal for Akasa Air, because Indian authorities require this for an airline to begin international operations. So its growth in 2024 will include overseas routes, to Middle Eastern destinations first.

For Akasa Air, workforce has been more of a growth challenge than fleet. An increase in pilot resignations earlier in 2023 forced it to cancel some flights.

The Indian market is crowded, but Akasa Air appears to have better prospects than some of the existing airlines that are trying to relaunch operations after restructuring. Akasa Air has the advantage of starting with a clean slate and no legacy debt.

Air Premia could see gains in key long haul markets as larger rivals consolidate

Air Premia is operating five Boeing 787-9s on international routes from South Korea, including some long range services to North America and Europe. It intends to add another four 787s in 2024, and to reach 15 aircraft by 2027.

Financial progress is also being made. Air Premia expects to record an operating profit in this year, and to achieve net profitability in the next year.

The airline may be poised to benefit from the proposed merger of Korean Air and Asiana. Regulators in the US and Europe are likely to require the two applicants to give up some slots for routes to these regions if the deal is approved, and Air Premia would be well placed to secure some of these opportunities.

Air Premia accounts for just 1% of South Korea’s international capacity for the week of 23-Oct-2023. However, it has a 5.4% share of South Korea-US capacity, 14.7% on Seoul-Los Angeles routes, and 16.2% on Seoul-Frankfurt.

Bonza sees opportunities to deploy more narrowbodies in Australian market

Bonza is one of the newer start-ups, having launched in Jan-2023. It flies four 737 MAXs on Australian domestic routes.

The airline plans to boost its fleet to six by the end of 2023, and it wants to add more MAXs in 2024. It can draw from orders placed by its parent company 777 Partners, although 777 Partners has other airlines in its stable that are also looking to grow.

Bonza’s business plan focuses on unserved and underserved markets, allowing it to avoid the larger, more established players.

The airline is so far finding plenty of markets in these categories. Only two of its 38 routes can be found in the list of Australia’s top 30 domestic routes, according to CAPA - Centre for Aviation data.

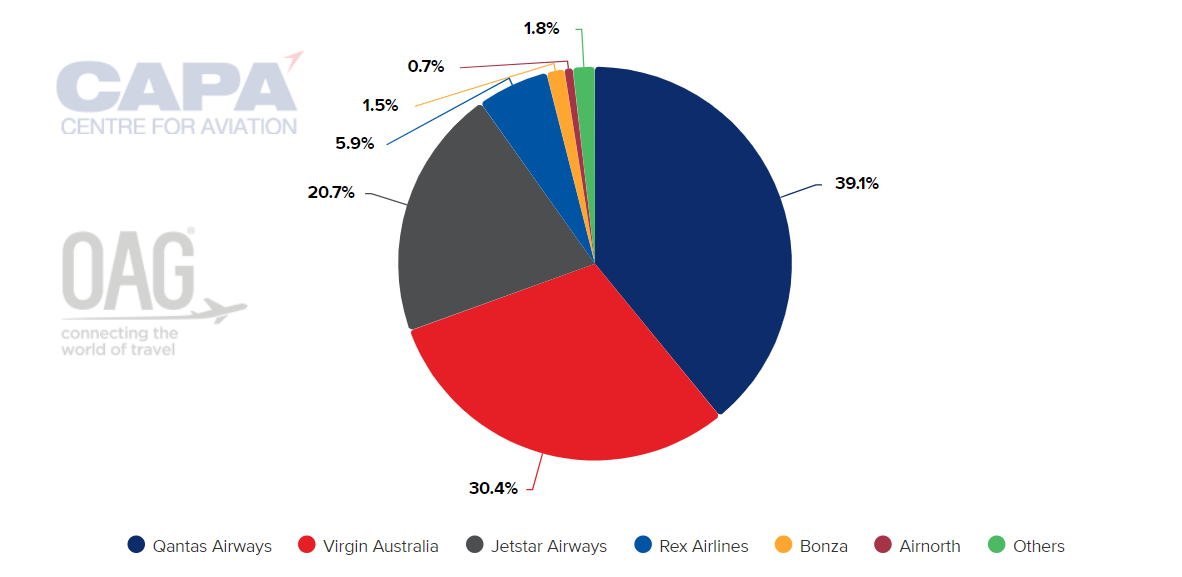

Bonza has a very slim share of Australia’s overall domestic capacity, as the chart below shows. However, such a comparison is less relevant in this case, since Bonza is largely competing in different markets from its rivals.

Australian domestic capacity, by airline, as measured in seats for the week of 30-Oct-2023

Source: CAPA - Centre for Aviation and OAG

More about Bonza’s growth strategy can be found in this CAPA analysis.

Malaysia’s MYAirline could not gain enough early momentum in a tough LCC market

MYAirline serves as a cautionary tale for start-ups.

The LCC suspended operations on 12-Oct-2023, citing financial pressure. MYAirline has said that it is seeking new investors as it restructures.

The airline grounded its fleet of nine Airbus A320s at short notice, causing disruption for many passengers. MYAirline had already cut back some of its routes before its grounding. Malaysian authorities are also investigating claims of unpaid wages.

The airline faces an uphill struggle if it is to resume operations. Malaysian authorities have rescinded its air operator's certificate (AOC), and will audit the airline before the AOC can be reissued.

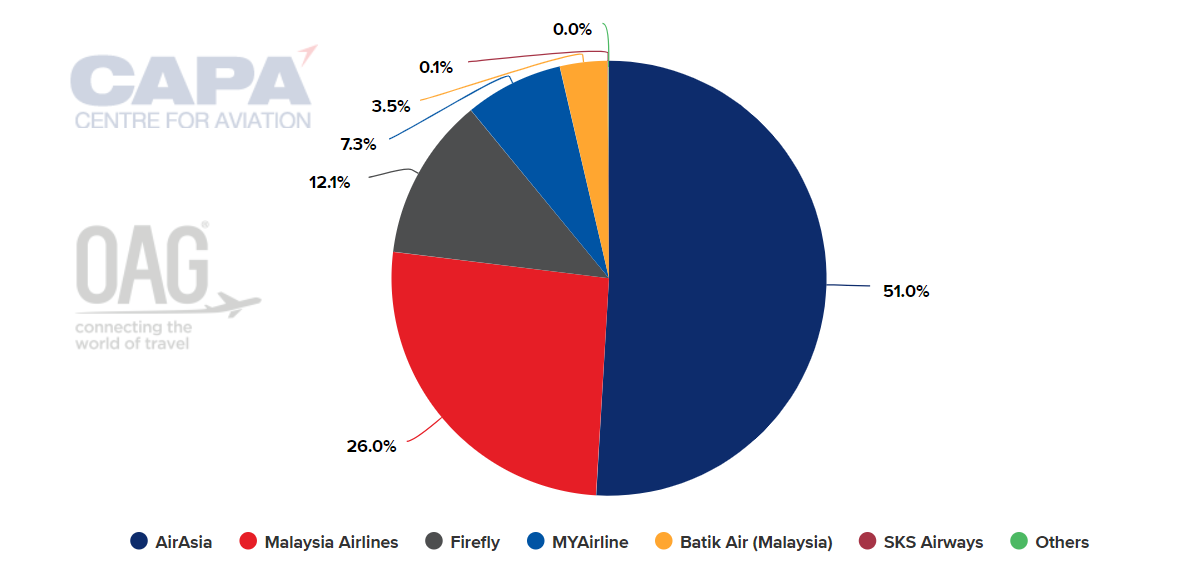

MYAirline confronts a tough competitive environment in Malaysia. Among the airlines it is up against is the low cost giant AirAsia. While AirAsia is still not back to its pre-pandemic capacity levels, it has recovered significantly, and has an extensive network across Southeast Asia.

The chart below illustrates MYAirline’s comparative market share before it suspended operations.

Read more about the airline's plight in this analysis.

Malaysia: domestic capacity share, by airline, as measured in seats for the week of 9-Oct-2023

Source: CAPA - Centre for Aviation and OAG

Start-ups have many hurdles to overcome, but can prosper if they hit the right growth formula

Restructuring or cutbacks by incumbents have helped many of the start-ups get established. However, in each of their markets competition is heating up as more capacity returns – particularly on international routes.

The million-dollar question facing all start-ups is when they will break even. To reach this point they have to grow their fleets to achieve suitable economies of scale, although they also do not want to expand too quickly and risk capacity outpacing demand.

A number of factors play into whether a start-up airline will succeed. These include local and foreign competition, supplier agreements, airport access, and network and fleet plans.

But perhaps the most important element is having investors with deep pockets and the patience to wait out the launch phase when expenses are high and profits elusive.

All of this means that getting the balance right is difficult. But if the stars do align, a start-up airline can be a better investment than sinking more money into a legacy airline with shaky financial health.