Japanese airlines adjust to persistent post-pandemic demand extremes

The stark imbalance in the Japanese international travel market is showing no signs of fading, as the glacial pace of the outbound recovery contrasts with surging inbound travel.

Despite the problematic outbound market, Japan Airlines (JAL) and All Nippon Airways (ANA) are benefitting from the strong overall financial performance of their international operations.

The inbound/outbound disconnect has become well-enough established that the airlines are adjusting their strategies accordingly. Economic and market conditions are not changing quickly enough to suggest that the imbalance will shift significantly in the near term.

In the meantime, leveraging inbound demand is allowing international capacity to continue recovering for both airlines.

Senior executives from JAL and ANA discussed these trends at the Association of Asia Pacific Airlines (AAPA) annual assembly in Brunei on 13/14-Nov-2024.

Summary

- Japan’s overall outbound travel is still 30% below pre-pandemic levels, ANA says.

- ANA aims to reach 90% of international capacity in Mar-2025.

- JAL’s leisure outbound is at 50%, although business outbound is higher, at 75%.

- International yields are running 1.7 times higher than in 2019, JAL says.

- Japan’s outbound demand to China is even lower, partly due to visa requirements.

While ANA's outbound demand lags, inbound is continuing to soar even higher

In what has become a familiar theme, outbound leisure traffic is proving very slow to improve, said Katsuya Goto, ANA's EVP for alliances and international affairs, facilities and digital transformation. He cited government figures indicating that Japanese outbound travel was still down by 30% versus 2019 levels in Sep-2024.

The major reason for this is the continued weakness of the Japanese yen, which makes travelling overseas much more expensive. Peak holiday travel has recovered better, but off-peak periods have been softer, ANA executives said.

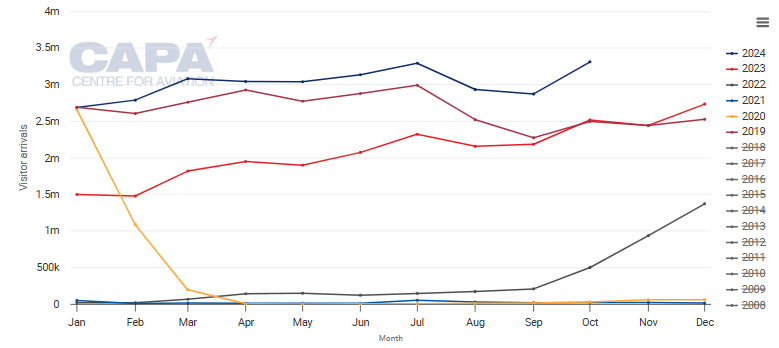

However, the weak yen is also pushing inbound tourism to Japan to new heights. Mr Goto noted that inbound travel is setting records every month, as illustrated by the chart below.

The total of 25 million visitors for the nine months through to the end of Sep-2024 is already ahead of the full calendar year 2023.

Visitors to Japan: monthly totals, 2019-2024

Source: CAPA - Centre for Aviation and JNTO.

Robust international revenue justifies further capacity push for ANA

It is this inbound strength that drove international passenger revenue, and overall revenue, to record levels in ANA's fiscal half-year results, released on 31-Oct-2024.

Next year (2025) the airline is targeting another 10% growth in international passenger numbers, which will be aided by its plans to add routes from Tokyo Haneda Airport to Milan in Dec-2024, Stockholm in Jan-2025, and Istanbul in Feb-2025.

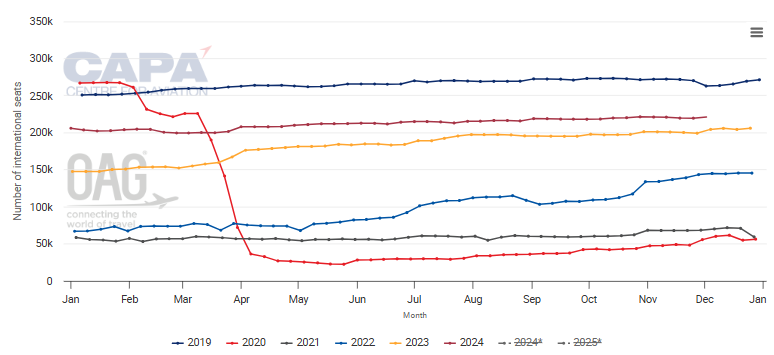

ANA expects that its international capacity will reach 90% of pre-pandemic levels by the end of its fiscal year on 31-Mar-2025. The chart below shows that ANA's international weekly seat capacity was at 81% of 2019 levels for the week of 25-Nov-2024.

ANA international capacity, as measured in weekly seats, 2019-2024

Source: CAPA - Centre for Aviation and OAG.

JAL sees little improvement in outbound demand, so it is focusing more heavily on inbound markets

Meanwhile, JAL has been seeing similar trends.

The airline's leisure outbound traffic is just over 50% of 2019 levels, said Yuji Saito, JAL executive vice president and CFO, during the AAPA assembly.

The percentage has not changed significantly since at least Jun-2024, and there are few indications that it will improve much in the near future, Mr Saito said.

The good news is that outbound business demand is improving more quickly. This segment has risen to 75% of 2019 levels - up from approximately 60% in Apr-2024.

And the much stronger inbound tourism demand has more than offset the overall outbound deficit, Mr Saito said.

International passenger yield is also 1.7 times greater than it was before the pandemic. "So we've been able to maintain profitability in this situation," Mr Saito said.

Given that the outbound leisure traffic recovery is not expected to accelerate dramatically, JAL has been shifting its focus more to the inbound market.

This means more emphasis on routes to markets such as the US and Southeast Asia, and transit traffic between them, said Mr Saito, and less reliance on traditional Japanese outbound tourism routes.

JAL has also been adding more flights to Europe. Demand and yields have been strong in this market, despite the longer flight times caused by the need to detour around Russian airspace.

Visa issues are an extra impediment to China market recovery for Japan's airlines

As with many other Asia Pacific airlines, the recovery of the Chinese market is of particular importance for JAL and ANA.

JAL's outbound demand to China is at just 40% of 2019 levels, which is even lower than the overall average, said Mr Saito. Once again, however, inbound travel from China to Japan is much stronger.

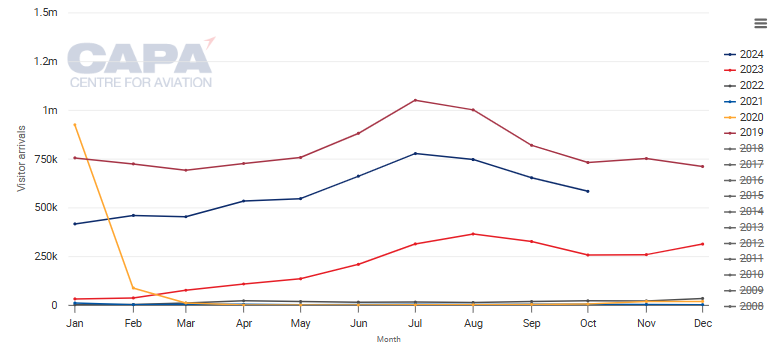

The chart below shows that Chinese tourism to Japan reached nearly 80% of 2019 levels in Oct-2024.

Chinese visitors to Japan, monthly totals, 2019-2024

Source: CAPA - Centre for Aviation and JNTO.

While JAL has focused on business travellers on its China routes, its Spring Japan subsidiary is aimed at Chinese leisure traffic.

ANA is also seeing weak demand from Japan to China.

A major reason for this is that the Chinese government has yet to allow a resumption in visa-free visits for Japanese people, said Mr Goto.

But there is hope on this front, as the Chinese government extended visa-free entry to several more countries, including South Korea, in early Nov-2024.

ANA is optimistic that Japan may soon join this list too.