Turkish Airlines SWOT: profitable growth continues, network balance improves

On 29-Nov-2024 Turkish Airlines (THY) added Sydney to its network (via Kuala Lumpur) - its second destination in Australia, after launching services to Melbourne (via Singapore).

The addition of Australia to its network is another step in expanding its Asia Pacific presence. This is helping to achieve a better balance of its capacity between the three major aviation markets, Europe, North America and Asia Pacific.

Türkiye is a large and growing aviation market and provides a solid platform for THY's global connecting strategy. THY has an efficient cost structure, a relatively young fleet, and orders to ensure continued profitable growth.

Earlier this year its low cost subsidiary AJet began operations as a separately incorporated subsidiary, increasing the group's focus on high-growth short/medium haul leisure markets.

In this report, CAPA - Centre for Aviation considers Turkish Airlines Group's strengths, weaknesses, opportunities and threats.

Summary

- Strengths: Türkiye’s biggest airline; Türkiye market potential, Istanbul hub; large global network; efficient unit cost; young fleet; growth and profitability; brand.

- Weaknesses: relatively small Asia Pacific network; below-average load factor.

- Opportunities: aircraft utilisation; AJet; fleet improvements; Asia Pacific; cargo growth; use of codeshare.

- Threats: Türkiye's economic/geopolitical context; external events; rising fuel prices; Pegasus/LCC competition; Gulf competition; green transition.

TURKISH AIRLINES GROUP STRENGTHS

1. THY is the biggest airline in Türkiye

According to data from CAPA - Centre for Aviation and OAG, THY is the leading airline in Türkiye. It had a seat share of 34.8% in the country's seasonal peak week of 5-Aug-2024.

Adding the 14.3% share of THY's subsidiary, AJet, the group's share was 49.1% (more than double Pegasus Airlines' 20.3%).

These seat share figures were broadly stable on the equivalent week of 2019, when Turkish Airlines' share was 49.3% (THY also operated on behalf of AJet at that time), and Pegasus had 19.9%.

2. Türkiye is a large market with strong growth potential

Türkiye is Europe's number five aviation market by total seat numbers, up from sixth in 2019.

Türkiye is Europe's second most populous country (more than 85 million inhabitants), but is relatively underpenetrated by air travel by comparison with the larger countries of Western Europe.

This offers significant air traffic growth potential as Türkiye's economy grows (in particular its level of GDP per head, which is below the European average).

According to data from Türkiye's airport authority DHMI, the compound average growth rate in total passenger numbers from 2023 to 2026 is expected to be almost 6% pa, and for international passengers almost 8% pa.

3. THY's Istanbul hub attracts global transfer traffic

THY takes advantage of the geographic location of its Istanbul hub to attract global transfer traffic.

In 2023, 41% of the group's passengers were transfer traffic (36% international to international and 5% international to domestic).

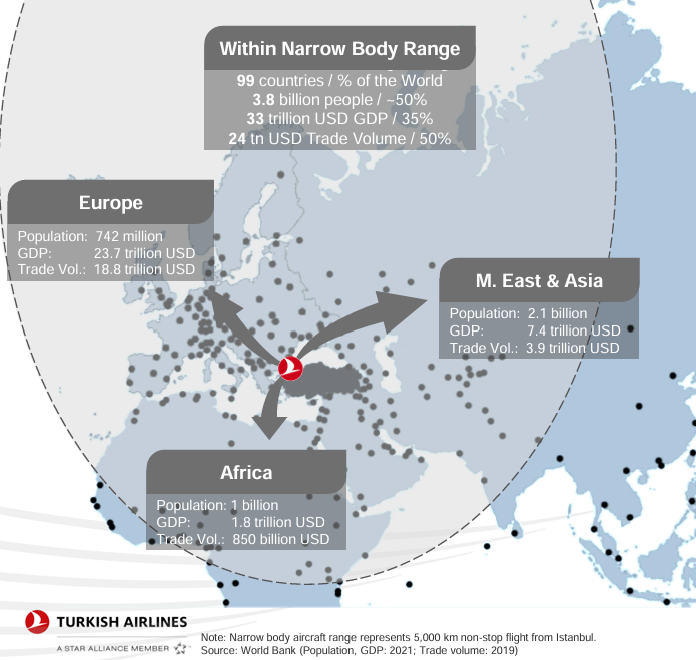

Istanbul is within narrowbody range of 99 countries, and approximately 50% of the world's population. All of Europe, the Middle East, Central Asia, North and East Africa are within narrowbody range.

Out of THY's total of 295 international destinations (more than any other airline), 215 are within narrowbody range of Istanbul.

Within widebody range of Istanbul are all of North and Central America, Upper South America, all of Asia, and the west coast of Australia.

THY's global network reaches more than 90% of the world's population.

According to data quoted by Turkish Airlines in its 3Q2024 results presentation, the airline has the highest connectivity by international city pairs from Europe, Middle East, Africa and Africa to the world.

Destinations within narrowbody range of Istanbul

Source: Turkish Airlines.

4. THY has a large global network, with particular strength in Europe

Compared with the big three Gulf airlines (Emirates Airline, Qatar Airways and Etihad Airways), who also have strategies based on attracting global transfer traffic flows, Turkish Airlines Group has a much stronger position in Europe.

In the first 10 months of 2024, 52.6% of the group's international passengers and 27.6% of its international ASKs were on routes to/from Europe.

Moreover, for the week of 2-Dec-2024, OAG data indicate that THY has 86 international destinations in Europe - almost double the number of the nearest Gulf competitor (Qatar Airways has 45).

Note that this number is for THY only (not including AJet, and is in the seasonal low period).

THY also has more destinations in Africa, North America and Latin America than any of the three Gulf airlines. However, its network has fewer destinations in Asia Pacific than either of Emirates or Qatar Airways (see also weaknesses below).

Moreover, THY benefits from a large domestic market, unlike any of the Gulf three.

Turkish Airlines, Emirates Airline, Qatar Airways, Etihad Airways: number of non-stop destinations by region, week of 2-Dec-2024

|

Region |

Qatar Airways |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Own aircraft |

By codeshare |

Own aircraft |

By codeshare |

Own aircraft |

By codeshare |

Own aircraft |

By codeshare |

|

|

46 |

25 |

22 |

46 |

25 |

86 |

4 |

31 |

|

|

41 |

87 |

45 |

101 |

54 |

120 |

30 |

117 |

|

|

86 |

69 |

40 |

91 |

45 |

134 |

22 |

106 |

|

|

8 |

46 |

5 |

41 |

1 |

112 |

0 |

14 |

|

|

23 |

9 |

11 |

25 |

24 |

6 |

10 |

22 |

|

|

17 |

60 |

14 |

162 |

12 |

227 |

5 |

44 |

|

|

International total |

221 |

296 |

137 |

466 |

161 |

685 |

71 |

334 |

|

Domestic |

46 |

6 |

1 |

1 |

1 |

1 |

1 |

1 |

|

Total |

267 |

302 |

138 |

467 |

162 |

686 |

72 |

335 |

Source: CAPA - Centre for Aviation, OAG.

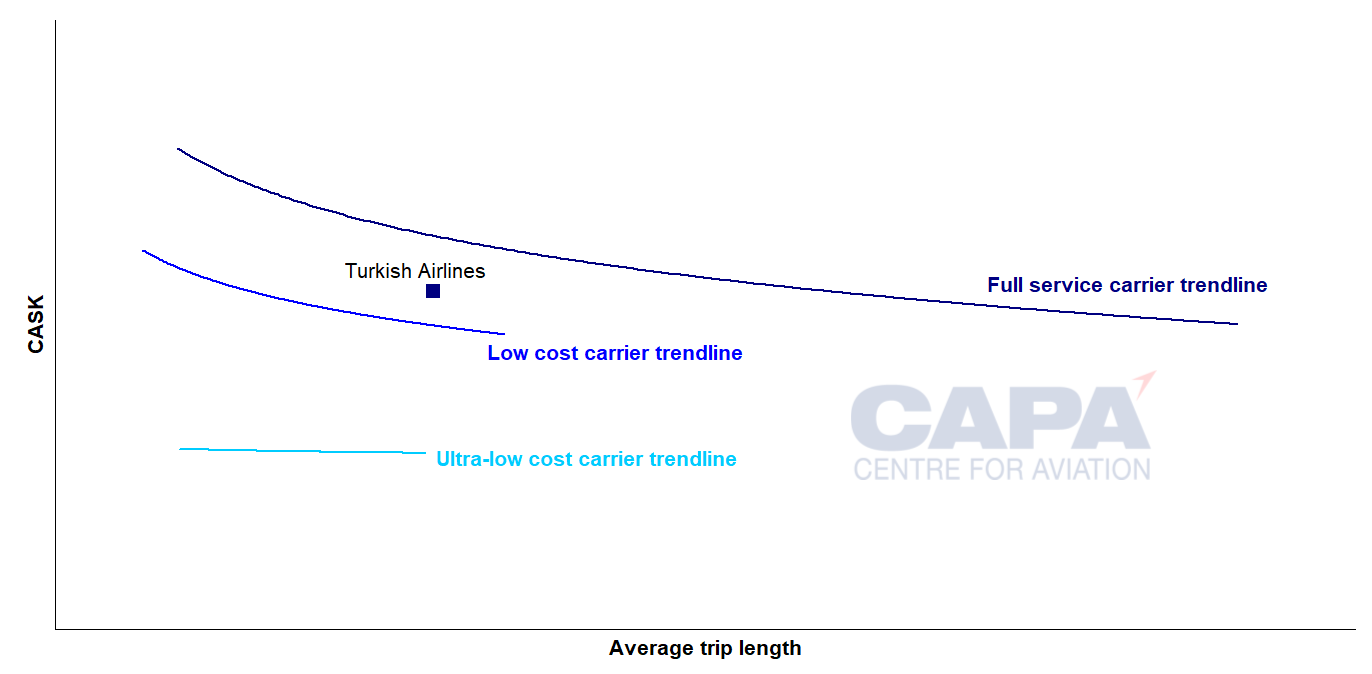

5. THY has an efficient level of unit cost

THY has a very efficient cost structure by comparison with most full service carriers, particularly its European competitors.

Its unit cost, expressed as cost per available seat kilometre (CASK), is below the trend line for European FSCs on a scatter plot of CASK against average trip length.

This (in addition to its hub location) gives it a further advantage against the European network airlines in competing for global traffic flows.

Moreover, THY's trip length-adjusted CASK is broadly comparable to those of Emirates and Etihad, two of the Gulf-based super connectors.

Cost per available seat kilometre (CASK), versus average trip length for Turkish Airlines (and trend lines for different business models in Europe), 2023

Source: CAPA - Centre for Aviation, airline company accounts.

6. THY has a relatively young fleet

THY's average fleet age is 9.4 years at 2-Dec-2024, compared with an average of 13.7 years for all European airlines, 13.2 years for Middle East airlines, 12.4 years for Asia Pacific airlines, and 17.9 years for North American airlines (source: CAPA - Centre for Aviation Fleet Database).

The airline's relatively young fleet by comparison with those in its main regions of activity gives it an advantage in terms of fuel efficiency and customer appeal.

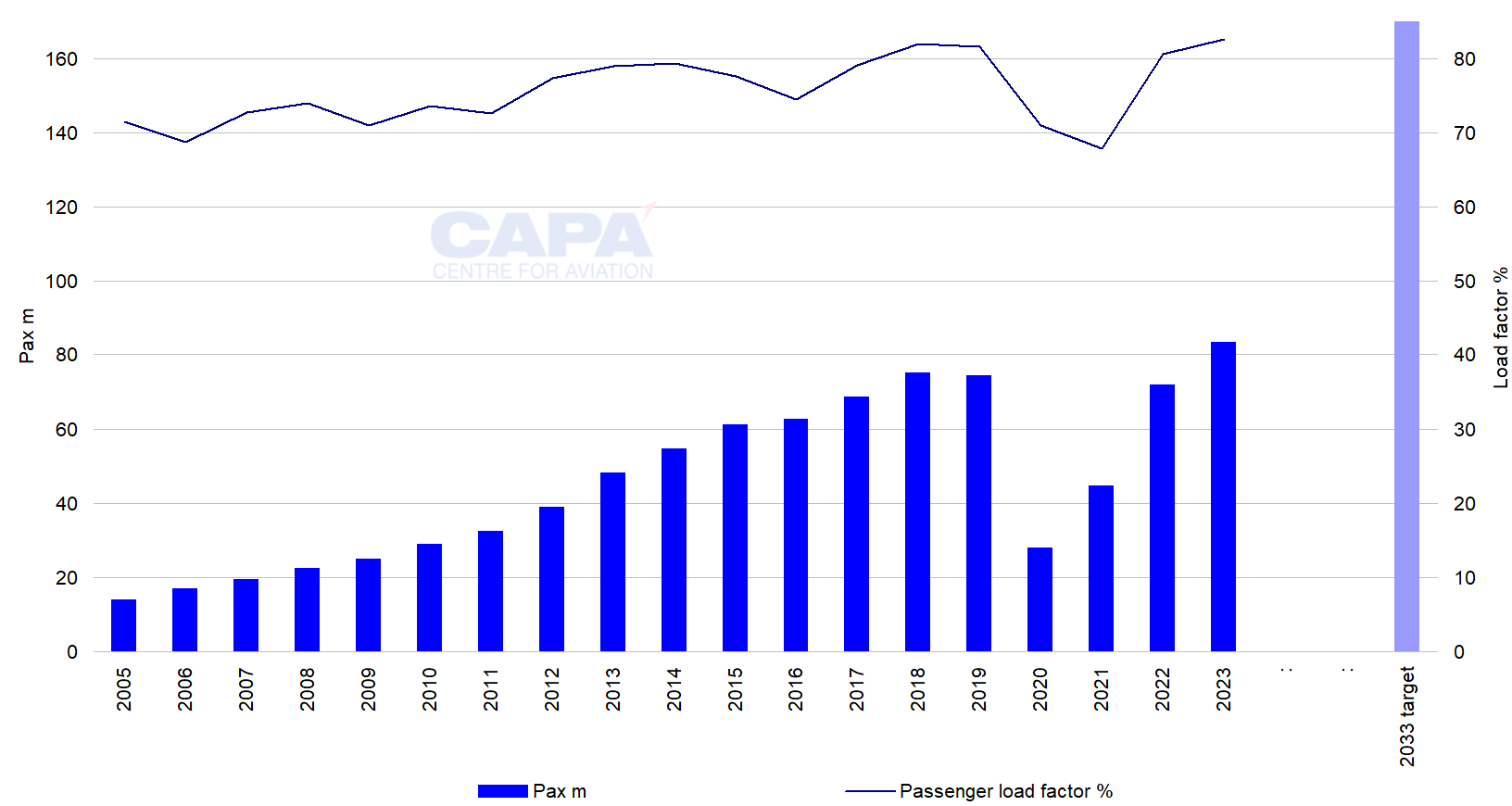

7. THY's growth remains robust

In the 10 years from 2009 to 2019 the group achieved a near tripling of annual passenger numbers, from 25.1 million to 74.3 million, at a compound average annual growth rate of 11.5% pa.

Its 2023 it carried 83.4 million passengers, which was growth of 16.1% year-on-year.

Its target for 2033 is to more than double its 2023 level, to more than 170 million passengers.

This implies a CAGR of 7.4% or more from 2023 to 2033; a lower rate than in the past, but still stronger than likely global airline industry growth.

Turkish Airlines Group: passenger numbers, 2005 to 2023 and target for 2033

Source: CAPA - Centre for Aviation, Turkish Airlines.

8. Turkish Airlines Group has a good record of profitability

In spite of its strong growth, Turkish Airlines Group has a creditable record of profitability.

In the past two decades it has reported a net loss only twice: 2016 and 2020 (the latter during the COVID-19 pandemic).

In 2023 it achieved an operating margin of 12.8%, ranking it fourth among 16 of Europe's leading airline groups. Only the ultra-LCCs Pegasus Airlines and Ryanair and Aegean Airlines Group (a full service airline with LCC unit costs) ranked above it.

THY's 2023 operating margin was higher than those of Europe's big three legacy groups IAG, Lufthansa Group and Air France-KLM, and also beat LCCs, such as Norwegian, Wizz Air and easyJet.

See related CAPA - Centre for Aviation report: European airline margins 2023: ultra LCCs Pegasus and Ryanair at the top

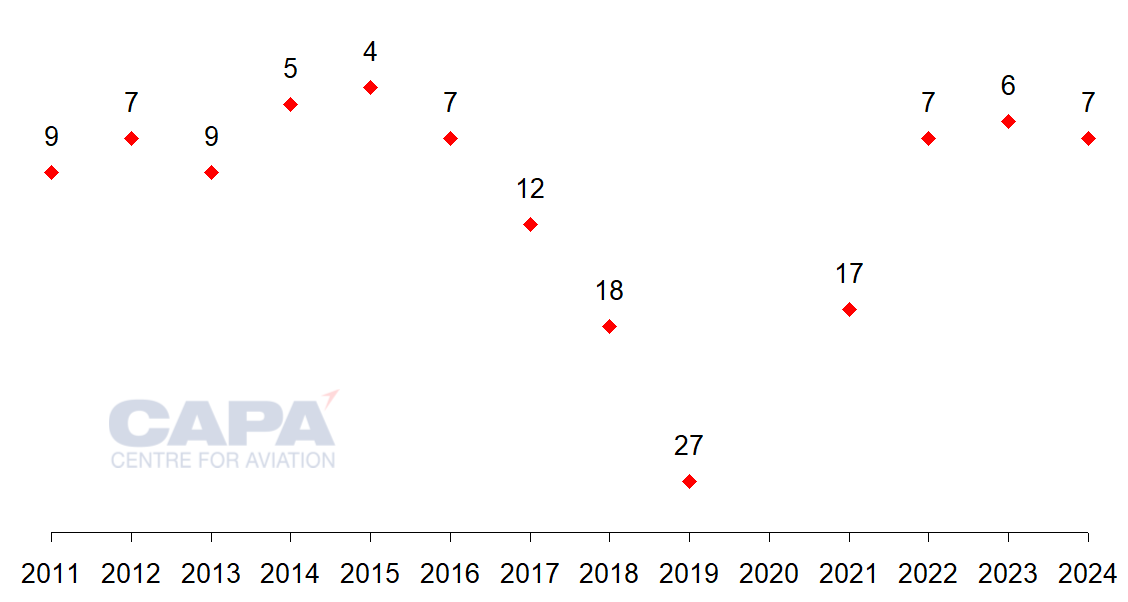

9. Turkish Airlines is a strong brand

Turkish Airlines was judged the best airline in Europe in the 2024 Skytrax awards.

It competes globally with airlines from all regions, not only in Europe, and its brand is also strong on a worldwide level.

It was ranked the seventh best airline in the world by Skytrax in 2024: consistently in the global top 10 in 2011-2016, it had fallen to 12th in 2017 and as low as 27th in 2019.

Although its 2024 world ranking was one place down from 2023, it consolidated the return to the top 10 that it had achieved in 2022.

Turkish Airlines' ranking in Skytrax world airline awards, 2011 to 2024

Source: Skytrax, CAPA - Centre for Aviation.

TURKISH AIRLINES GROUP WEAKNESSES

1. THY's Asia Pacific network is small vs the major Gulf airlines

THY's Asia Pacific network has fewer destinations than the two largest Gulf-based super connectors: Emirates and Qatar Airways.

It has 41 Asia Pacific destinations in the week of 2-Dec-2024, compared with 45 for Emirates and 54 for Qatar Airways.

THY's Asia Pacific network has grown in recent years, and the region provides further opportunity (see below).

2. THY's passenger load factor is below the European average

Turkish Airlines Group's passenger load factor was 82.6% in 2023, below the European airline average of 84.4% reported by IATA.

In the first nine months of 2024 THY's load factor slipped to 82.3% from 83.1% for the equivalent period of 2023. This was below the European airline average of 84.5% (as reported by IATA).

Its load factor has improved considerably from levels well below 80% more than a decade ago, but it has plateaued over the past 10 years.

TURKISH AIRLINES OPPORTUNITIES

1. THY could improve its aircraft utilisation

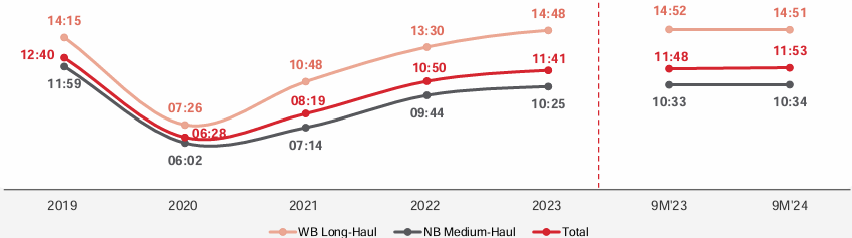

THY's daily aircraft utilisation rate improved slightly from 11:48 hrs in 9M2023 to 11:53 hrs in 9M2024.

However, it remains well below its 2019 level of 12:40 hrs - a level it regularly achieved a decade ago.

THY's relatively high proportion of short and medium haul routes is, to some extent, a limiting factor, but it has an opportunity to drive further improvements in aircraft utilisation.

Turkish Airlines: average daily aircraft utilisation (hours) 2019 to 2023, and 9M2023 & 9M2024

748" height="209" />

748" height="209" />

Source: Turkish Airlines.

2. AJet offers improved network and unit cost potential

The group's low cost brand AJet (formerly AnadoluJet) was incorporated as a separate subsidiary in 2023, and began independent operations in Apr-2024.

This project aims to refocus the brand, renew its fleet and restructure its costs and revenues.

This should attract price-sensitive customers in high growth leisure markets and expand the group's network.

3. THY's ongoing fleet improvements should enhance its network and lower unit cost

THY has firm orders for 91 new widebodies and 240 new narrowbodies to join its passenger fleet between now and 2037 (source: CAPA - Centre for Aviation Fleet Database, 2-Dec-2024).

The narrowbody orders consist of 205 Airbus A321neos and 35 Boeing 737MAX-8s.

The widebody orders are for 15 Airbus A350-1000s, 66 Airbus A350-900s and 10 Boeing 787-9s.

These new-generation aircraft have advantages of range and unit cost compared with the older aircraft in THY's existing fleet.

They should help it to open up new markets in regions such as South West Pacific and Latin America, and increase its gauge flexibility in existing markets.

4. Asia Pacific provides further growth potential

Turkish Airlines Group has increased the balance of its capacity between the three major global aviation regions, namely Europe, Asia Pacific and North America, since 2019.

In 10M2024 Europe accounted for 24.8% of group ASKs, Asia Pacific for 25.0%, and North America for 18.4%.

In the equivalent period of 2019, these shares were 28.5%, 24.1%, and 13.2% respectively.

However, as noted above, THY has fewer destinations in Asia Pacific than either of Emirates or Qatar Airways.

The launch of one-stop services to Sydney and Melbourne are examples of realising the potential for expansion in the region.

The delivery of A350-1000s will allow THY to operate nonstops to Australia.

Turkish Airlines Group: share of ASKs by region, 10M2019 and 10M2024

|

Region |

10M2019 (percentage) |

10M2024 (percentage) |

2024 vs 2019 (percentage) |

|---|---|---|---|

|

Domestic |

12.3% |

10.0% |

110% |

|

28.5% |

24.8% |

118% |

|

|

9.4% |

7.3% |

106% |

|

|

Far East |

24.1% |

25.0% |

140% |

|

9.8% |

8.7% |

120% |

|

|

13.2% |

18.4% |

189% |

|

|

Central & South America |

2.9% |

5.8% |

275% |

|

Total |

100.0% |

100.0% |

135% |

Source: Turkish Airlines, CAPA - Centre for Aviation.

5. The airline could achieve further growth in cargo revenue

THY has a fleet of 18 dedicated freighter aircraft (10 Airbus A330-200Fs and eight Boeing 777-220Fs).

It also wet leases five freighters (as at 30-Sep-2024) and makes use of belly freight in its passenger aircraft.

This is a sizeable cargo operation. However, its cargo revenue fell by 30.5% in 2023 to account for 12% of group revenue - down from 20% in 2022.

Although cargo's 2023 share of revenue was similar to pre-COVID levels, there is an opportunity to grow this. Indeed, in 9M2024 this grew to 15% from 11% in the same period of 2023, driven by strong demand from the Far East.

6. THY could increase the number of codeshare destinations

By comparison with the Gulf three, THY has fewer codeshare destinations to extend its network reach (partly because it already has more international destinations using its own aircraft).

THY has more codeshare partners - 57 - compared with 32 for Emirates and Qatar Airways, and 38 for Etihad. However, THY's 296 international codeshare destinations are significantly fewer than Emirates' 466, Qatar Airways' 685, and Etihad's 334.

This suggests that THY could make greater use of its codeshare partners to extend the number of destinations that it could offer its passengers.

TURKISH AIRLINES THREATS

1. THY is exposed to Türkiye's economic/geopolitical context

Airlines operating in Türkiye are exposed to economic and geopolitical risks to a greater degree than elsewhere in Europe.

2. Airlines are vulnerable to external events

As with all airlines, THY is vulnerable to the risk of possible accidents, in addition to strikes and other events that could disrupt its service, as well as adversely affecting its reputation and demand for its services.

In addition to geopolitical risk (already mentioned) these could include natural phenomena, such as earthquakes and volcanic ash disruption.

3. Costs are exposed to fluctuations in jet fuel prices

Jet fuel prices are subject to sometimes sharp and often unpredictable moves both up and down.

Rising jet fuel prices will place an additional burden on THY's cost base.

According to its 9M2024 results presentation, it has hedged 54% of its FY2024 fuel requirements, leaving it exposed for 46%.

Its policy is to hedge a maximum of 60% for the following month, leaving exposure for at least 40%.

4. Competition is growing from Pegasus/LCCs

According to data from OAG and CAPA - Centre for Aviation, LCCs' share of international seats in Türkiye grew from 25.3% in 2019 to 34.0% in 2024.

LCC share in the smaller domestic market fell from 35.2% to 32.8% over the same time frame.

The ultra-LCC Pegasus Airlines' share of international passenger traffic in Türkiye grew from 13.6% in 2019 to 16.2% in 2023, according to data from Pegasus and Türkiye's General Directorate of State Airports Authority. In 1H2024 it was 18.3%, up from 17.0% in 1H2023.

Pegasus' share of domestic passenger numbers fell from 32.2% in 2019 to 26.4% in 2023. However, it grew to 29.0% in 1H2024 (versus 25.7% in 1H2023).

5. Gulf competition remains strong

THY faces continued competition from the Gulf-based airlines, which also use their hubs to attract global transfer traffic flows, although THY has enjoyed a stronger recovery from the COVID-19 pandemic.

It is scheduled to reach 117% of its 2019 seat capacity in 2024, while Emirates and Etihad are not yet back to their 2019 levels, and Qatar Airways is only 13% above its 2019 capacity.

The Gulf Three have a geographic advantage in attracting connecting passengers to/from Southern Asia and Australasia, and have also been successful in developing high-quality service and strong brands.

6. The green transition is an existential threat to all airlines

The transition to net zero carbon emissions, a global commitment by the world's airlines, is a necessary condition for aviation's continued long term existence.

The development of new propulsion technology will be needed to guarantee this, something that is largely out of the control of THY (or any airline).

The interim need to operate with sustainable aviation fuels is also largely out of any airline's control.

Conclusion: THY's profitable growth to continue

THY's robust recovery from the COVID-19 pandemic demonstrates the success of its strategy to build on Türkiye's large aviation market and Istanbul's geographic advantages as a global connecting hub.

The continued success of both THY and the ultra-LCC rival Pegasus Airlines suggests that they occupy different market segments, in which they each have a unit cost advantage over other competitors.

However, AJet's new focus should improve Turkish Airlines Group's position in the more price-sensitive market segments.

This SWOT analysis leans clearly towards strengths and opportunities.

Turkish Airlines' track record of profitable growth looks set to continue.