Outlook 2025: Europe – Europe's top 10 groups are outpacing wider European market, led by LCCsFeatured Analysis

Europe's airlines can look back on 2024 as the year when they finally completed the capacity recovery from the COVID-19 pandemic. Seat capacity is scheduled to be 100.0% of 2019 levels for 2024 as a whole, according to data from OAG and CAPA - Centre for Aviation.

LCCs are leading the way, and this seems likely to continue in 2025.

In 1Q2025 Europe's capacity is scheduled to be at 101.5%, confirming the recovery but with little further increase.

Aviation supply chain constraints and the ongoing (but slow) process of European airline consolidation are likely to contain capacity growth, and this may help to support yields in 2025.

The year 2025 will bring challenges in aircraft supply, recruitment, airspace capacity and the green transition - nevertheless, Europe's airlines are now beyond the COVID-19 recovery phase.

Summary

- Europe capacity in 1Q2025 is projected at 101.5% of 2019 levels, almost flat since 2Q2024. Intercontinental markets are leading the recovery.

- Europe's top 10 groups are outpacing the wider European market, led by LCCs.

- Wizz Air is out in front, while easyJet’s recovery is the slowest of the leading LCCs. Turkish Airlines Group is leading the legacy airlines’ recovery.

- European airline consolidation continues, albeit slowly, and will present opportunities in 2025.

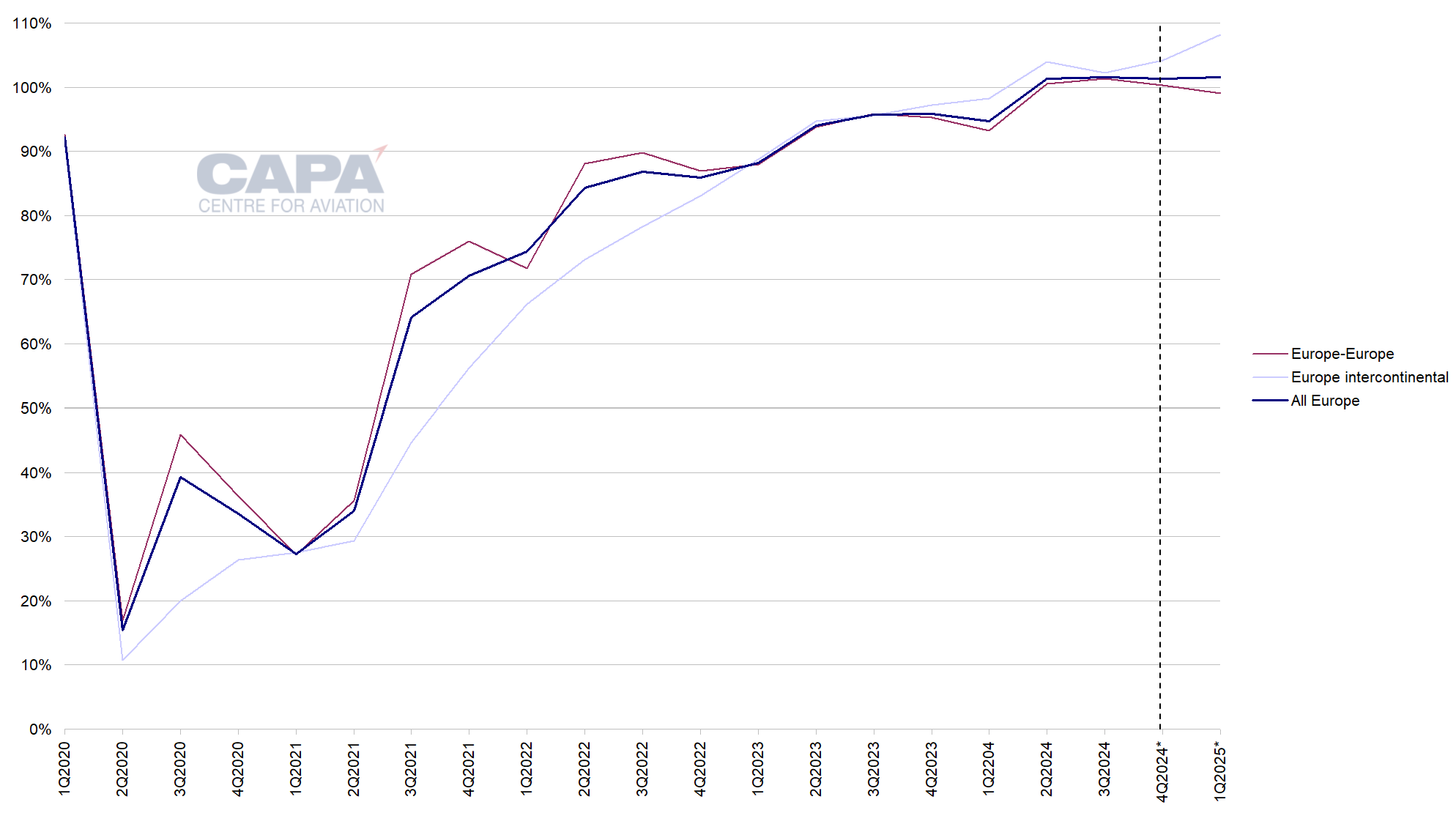

Europe capacity in 1Q2025 is projected at 101.5% of 2019 levels - almost flat since 2Q2024

Based on data from OAG schedules and CAPA - Centre for Aviation seat configurations as of 2-Dec-2024, Europe's total seat capacity for 4Q2024 is scheduled to be at 101.4% of its 4Q2019 level.

Capacity as a percentage of the equivalent quarter of 2019 will have improved by 6.9ppts between 4Q2023 (when it was at 97.2%) and 4Q2024.

However, the big step up was from 1Q2024 to 2Q2024, and the 4Q projection is virtually unchanged from the figure of 101.5% reached in 3Q2024, and 2Q2024's 101.3%.

This outlook for 4Q2024 has been modestly trimmed from 101.7% just before the start of the quarter, in late Sep-2024.

The outlook for 1Q2025 is more or less flat, with seat capacity scheduled at 101.5%.

Intercontinental markets are leading the capacity recovery…

Intercontinental markets have been outpacing intra-Europe since the start of 2023, and the gap is widening in 4Q2024.

Intercontinental capacity is at 104.1% of 2019 levels, compared with 100.3% for intra-Europe in 4Q.

The outlook for 1Q2025 is for the intercontinental capacity to move further ahead, reaching 108.1%, while intra-Europe is scheduled to ease down to 99.0%.

This reflects a reduction in short haul business traffic and a growing trend of government policy and regulation in favour of substituting short haul air travel with rail.

Europe: quarterly seat capacity as a percentage of the equivalent period of 2019, 1Q2020 to 1Q2025*

*Includes projected data as at 2-Dec-2024.

Source: CAPA - Centre for Aviation, OAG.

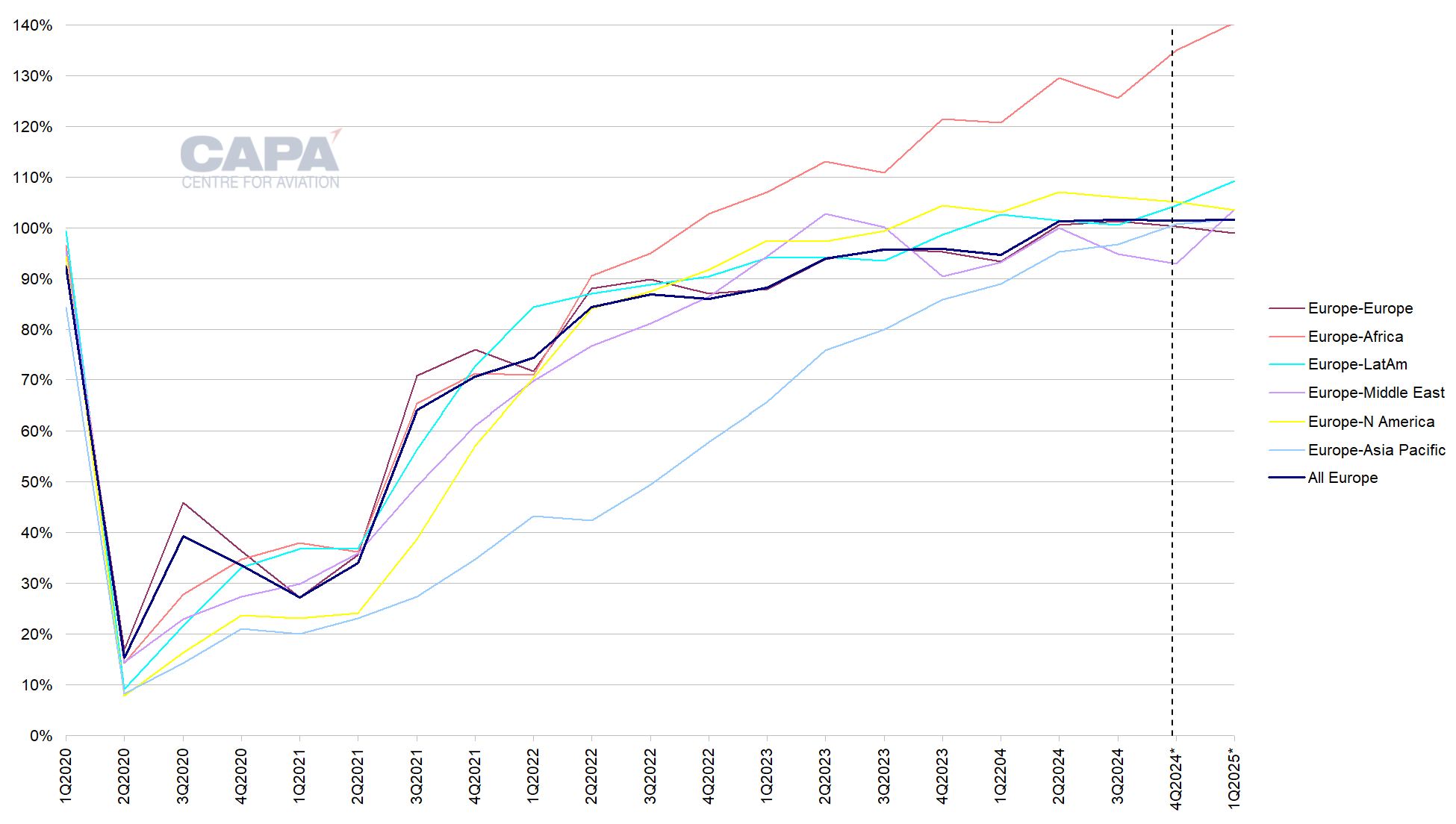

…with all intercontinental regions above 100% in 1Q2025

All intercontinental markets to/from Europe are scheduled to be ahead of their 1Q2019 capacity in 1Q2025.

At the top of the recovery ranking from Europe in 1Q2025 is Europe-Africa: projected at 140.4%, up from 135.0% in 4Q2024.

Europe-Latin America is projected at 109.3%, which is an improvement from 104.3% in 4Q2024.

Europe-Middle East is scheduled to reach 103.7%, up from 92.9% in 4Q2024. However, this route region has been subdued in recent quarters as a result of geopolitical events and projections based on current schedules could be subject to downward revisions.

North Atlantic seat capacity is projected at 103.4% in 1Q2025, down from 105.2% in 4Q2024.

Europe-Asia Pacific continues to lag other markets, but is above 100% for the first time in 4Q2024 (projected at 100.7%) and is scheduled to reach 101.8% in 1Q2025.

Europe to main world regions: quarterly seat capacity as a percentage of the equivalent period of 2019, 1Q2020 to 1Q2025*

*Includes projected data as at 2-Dec-2024.

Source: CAPA - Centre for Aviation, OAG.

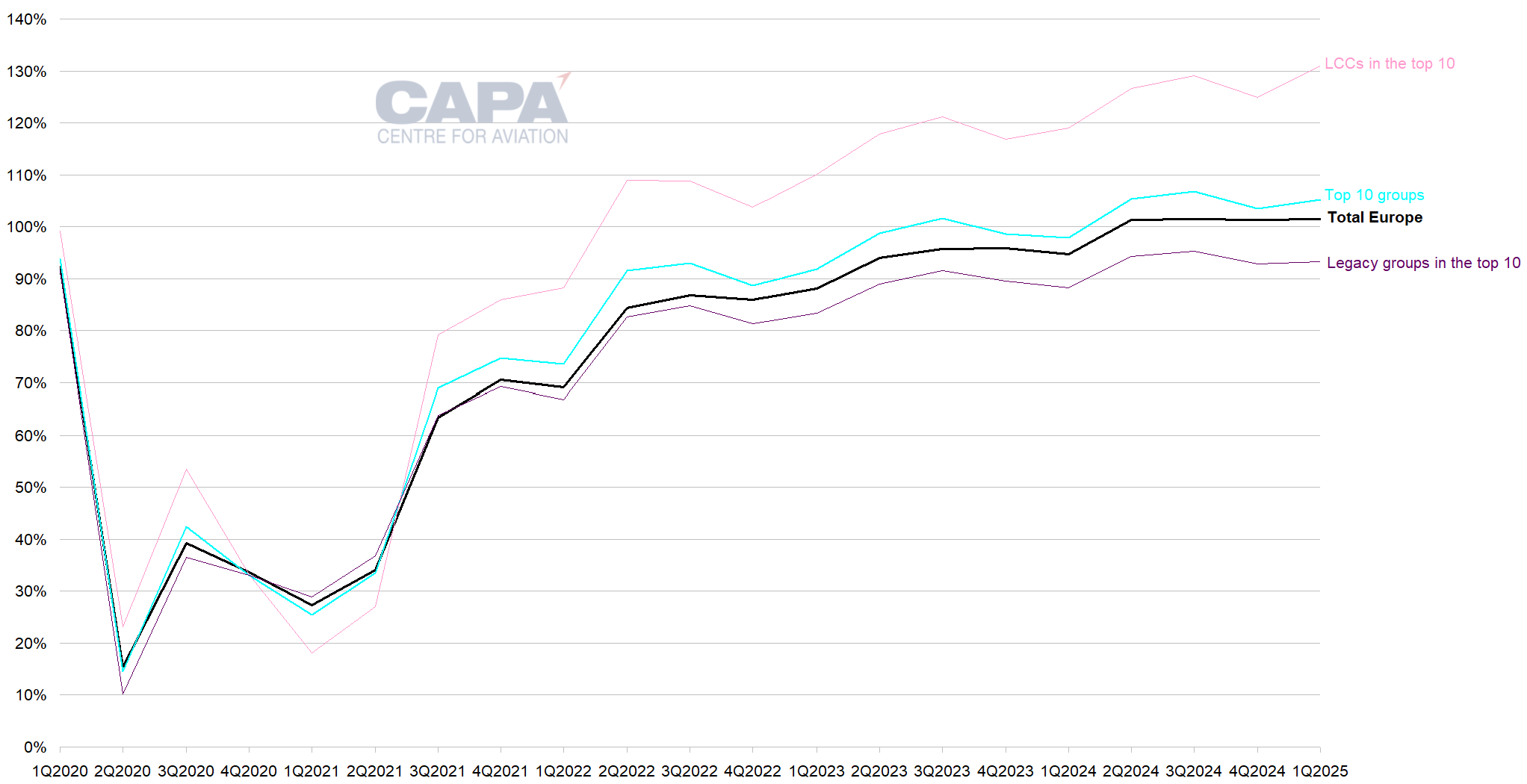

Europe's top 10 groups are outpacing the wider European market recovery…

Europe's top 10 airline groups by seats have outperformed the capacity recovery of the wider European market.

In aggregate, the top 10 are scheduled to be at 103.5% of 4Q2019 capacity in 4Q2024 (versus all Europe at 101.4%), and at 105.2% in 1Q2025 (Europe 101.5%).

…led by LCCs…

Within the top 10 groups, LCCs are collectively outpacing legacy airline groups, and the gap is widening.

The four independent LCC groups in the top 10 (Ryanair, easyJet, Wizz Air and Pegasus Airlines) are jointly projected at 124.9% in 4Q2024 and 130.9% in 1Q2025.

The six legacy groups are scheduled to be at 92.8% in 4Q2024 and 93.3% in 1Q2025.

Note that the legacy groups include Aeroflot Group, whose international network is restricted by western sanctions on Russia, and this has a negative impact on their collective capacity.

However, the legacy groups still lag the LCCs: their 1Q2025 capacity would be 96.9% if Aeroflot is excluded from the calculation.

Europe's top 10 airline groups: aggregate quarterly seat capacity as a percentage of the equivalent period of 2019, 1Q2020 to 1Q2025*

*Includes projected data as at 2-Dec-2024.

Source: CAPA - Centre for Aviation, OAG.

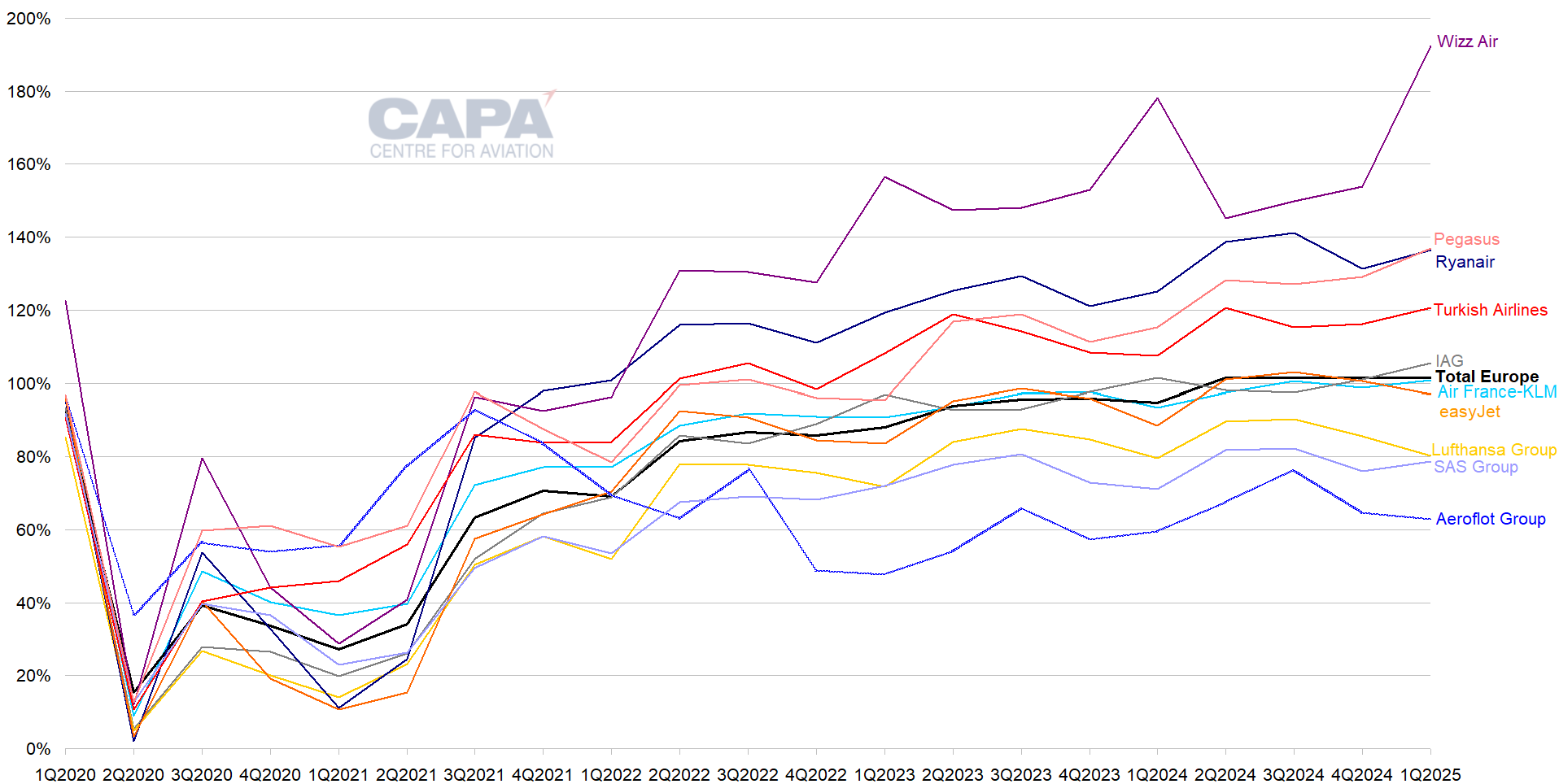

…with Wizz Air out in front, and easyJet the slowest of the LCCs

Leading the recovery in terms of capacity as a percentage of 2019 levels is Wizz Air Group, currently scheduled to reach 192.5% in 1Q2025.

Wizz Air's capacity recovery has been in the region of 140%-150% for the past three quarters, and would have been higher were it not for supply chain issues concerning GTF engines for its Airbus aircraft.

Although, in absolute terms, its 1Q2025 capacity is slightly lower than its 4Q2024 capacity, due to seasonality, it works out as a higher percentage of 2019 levels than in the northern summer quarters.

Wizz Air is still comfortably ahead of all other top 10 groups, and higher than the projected Pegasus' 136.8% and Ryanair's 136.4% in 1Q2025.

Ryanair could also have been at a higher level, were it not for delays in its 737MAX deliveries from Boeing.

Among the four LCCs, easyJet's capacity recovery has been the slowest - it returned back above its 2019 capacity levels only in 2Q2024.

It is projected at 100.6% in 4Q2024, but is scheduled to slip back to 97.0% in 1Q2025.

Turkish Airlines Group is leading the legacy airlines' recovery

Among the legacy airline groups, Turkish Airlines Group's capacity recovery has progressed furthest.

It is scheduled to be at 116.3% in 4Q2024 and 120.6% in 1Q2025.

IAG is scheduled at 100.9% in 4Q2024 and to reach 105.4% in 1Q2025, while Air France-KLM is projected at 100.8% in 1Q2025.

Lufthansa Group remains the laggard of the big three legacy groups, and is projected at only 80.3% in 1Q2025 (only 0.7ppts above the same period a year earlier).

SAS Group is set to be at only 78.7% - well below its 20% shareholder Air France-KLM - while Aeroflot Group is scheduled at just 62.9% in 1Q2025.

Europe's top 10 airline groups: quarterly seat capacity as a percentage of the equivalent period of 2019, 1Q2020 to 1Q2025*

*Includes projected data as at 2-Dec-2024.

Source: CAPA - Centre for Aviation, OAG.

European airline consolidation continues, albeit slowly

As illustrated, Europe's top 10 groups are following a wide range of different capacity recovery paths.

Nevertheless, their collective capacity has outpaced the recovery of the European market overall, reflecting the benefits of scale and the forces of consolidation.

European airline consolidation progressed in 2024, albeit in small incremental steps. Air France-KLM completed the acquisition of a 19.9% stake in SAS, while Lufthansa's purchase of 41% of ITA Airways received final approval from the European Commission.

Neither of these deals involved a full takeover, and neither target has a seat share in Europe of more than approximately 2%.

IAG's planned acquisition of Air Europa did not proceed after the regulatory remedies demanded were deemed by IAG too burdensome to justify the deal.

Consolidation is likely to continue in 2025, but again only in small incremental steps, and also provided regulators do not intervene too heavily.

Specific opportunities in 2025 are likely to include the sale of Air Europa, or at least of a minority stake. Air France-KLM has reportedly been considering taking 20% of the Spanish airline.

The likely privatisation in TAP Air Portugal, involving the sale of 51% or more, will be of interest to Air France-KLM, Lufthansa and IAG.

Both Air Europa and TAP offer strength on Europe-Latin America routes.

A long-planned IPO by airBaltic could also involve the sale of a minority stake to a strategic shareholder, a role in which Lufthansa is reportedly interested.

Europe's airlines are beyond the COVID-19 recovery phase

Supply chain constraints - aircraft, labour and airspace - and the costs of the green transition will be the challenges of 2025 and beyond.

These factors are likely to contain capacity increases in 2025, which may be beneficial for airline yields.

Nevertheless, the strong growth in fares of the initial post-pandemic period is unlikely to recur as demand reverts more to being driven by GDP growth.

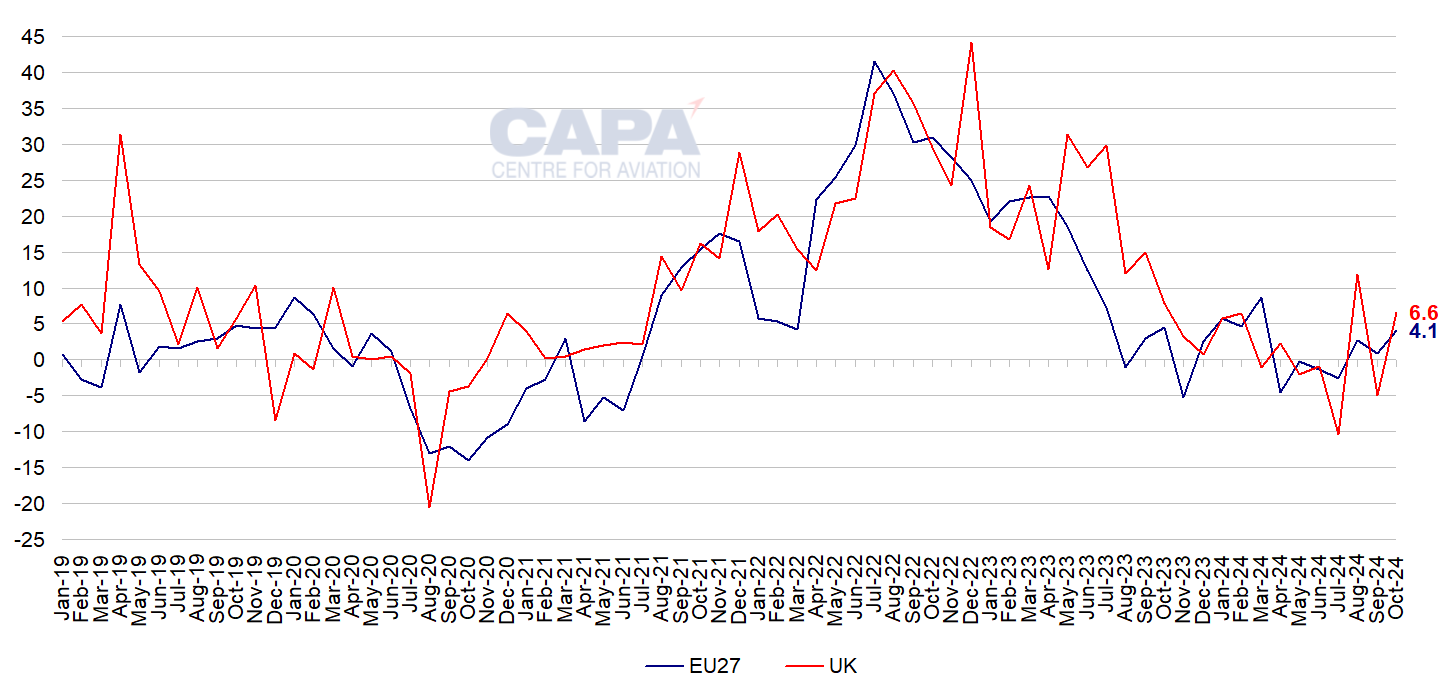

Inflation in passenger air travel (year-on-year growth in prices), Jan-2019 to Oct-2024

Source: Eurostat, Office for National Statistics, CAPA - Centre for Aviation.

Most economic forecasters expect GDP growth in 2025 to be a little higher than in 2024, but still below long term trend rates.

Europe's airlines have now moved beyond the COVID-19 recovery phase, having demonstrated their resilience and resourcefulness over the past five years.

They can look to the many challenges of 2025 with cautious optimism.