Outlook 2025: Asia Pacific – familiar challenges persist

The Asia Pacific airline industry is set to continue its international capacity growth in 2025 and finally move past the pre-pandemic benchmark, although the growth rate will be hindered by aircraft availability issues.

Airlines in this region are collectively already close to 2019 capacity levels in the international market; so it is likely that they will exceed that mark early in the new year.

Aside from a few key international markets, the factors inhibiting capacity growth are no longer demand-related. Airlines want to grow faster, but are frustrated by engine issues, delivery delays and supply chain bottlenecks.

Aircraft orders by Asia Pacific airlines have soared over the past few years as airlines look to rebuild their fleets. This trend will continue in 2025, with some key deals looming, although possibly to a lesser extent than in 2023 and 2024.

Constrained capacity will help to keep yields and revenue relatively high, although they may moderate somewhat in 2025.

Collective profits in the region are expected to rise slightly, although financial fortunes will be mixed.

Factors such as elevated costs and geopolitical tensions will continue to put financial pressure on Asia Pacific airlines.

Summary

- Asia Pacific airlines are at 96% of 2019 international capacity, and may reach 100% in Jan-2025.

- Several airlines have already signalled that they are likely to place aircraft orders in 2025.

- Engine issues, supply chain bottlenecks and delivery delays will continue to be a headache.

- IATA forecasts that the region’s airline profits will rise to USD3.26 billion – up from USD3.2 billion in 2024.

- Reopening Russian overflights would be a major boost for Japanese and South Korean airlines.

Asia Pacific airlines are poised to finally reach the region's 2019 international capacity level

Pre-pandemic comparisons are becoming less relevant now as the worldwide COVID-19 crisis fades further into the past.

However, passing the 2019 capacity level is still a symbolic milestone, and illustrates how many years the industry's growth was set back.

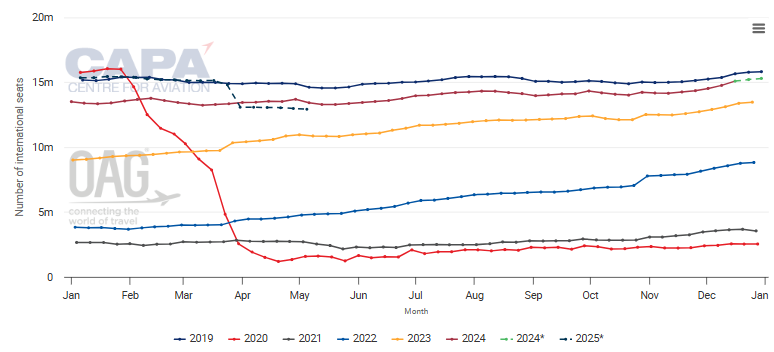

The chart below shows that although the rate of international capacity growth in the Asia Pacific region remains slow, weekly international seats have reached 96% of 2019 levels.

While long term schedule data becomes less useful the further out we look, it does indicate that weekly seat capacity will reach 2019 levels in Jan-2025.

However, it will still be below the few months in 2020 before the COVID-19 pandemic hit. So whether it will have fully recovered depends on which pre-pandemic year is used as the baseline.

Asia Pacific: international capacity, as measured in weekly seats, including forward schedules, from 2019

* These values are at least partly predictive up to six months from 09-Dec-2024 and may be subject to change.

Source: CAPA - Centre for Aviation and OAG.

This report in Nov-2024 highlighted the fact that while the Asia Pacific region is close to full recovery in terms of international capacity, it is still lagging the other major regions, which are all above 100% recovery.

The two Asia Pacific markets that remain slowest to recover are outbound leisure traffic from Japan and mainland China.

There is likely to be some improvement in 2025, but any increase will be gradual. This analysis looks more closely at trends in the Japan market, and why the dynamics may not shift much in the near term.

Several airlines have discussed plans for orders in 2025, and there will be others working behind the scenes

After cutting many less efficient and older aircraft during the COVID-19 crisis, many Asia Pacific airlines are now looking to rebuild their fleets with aircraft suited to their revised business plans.

This resulted in a surge in aircraft orders from the region's airlines in 2023, and to a lesser extent in 2024. The wave of order activity means medium-term delivery slots are becoming scarce.

There are still some airlines looking to fill out their fleet plans with additional aircraft orders, which will result in some significant deals announced in 2025.

Cathay Pacific intends to begin negotiating more long haul widebody aircraft orders in 2025, as it looks ahead to the next phase of its Boeing 777 replacement, as this analysis describes.

Japan Airlines is considering placing regional jet orders in 2025, while All Nippon Airways is studying its fleet needs before deciding whether to order more widebodies and narrowbodies.

Malaysia Airlines is believed to be close to making a decision on a follow-up narrowbody order for at least 25 aircraft.

Vietnam Airlines intends to place orders for 50 narrowbody aircraft in 2025, and the LCC AirAsia is also believed to be focusing on another narrowbody order to boost its already extensive order book.

Philippine Airlines has signalled that it is planning a major aircraft order soon.

Fleet availability frustrations are likely to remain with airlines for some time yet

While these moves are aimed at Asia Pacific airlines' long-term needs, airlines are facing many challenges in their near-term fleet planning.

Severe logjams in maintenance for certain types of aircraft engines are forcing many airlines around the world to ground aircraft due to lack of engine availability.

This issue is compelling several airlines to adjust their networks and growth plans. The engine availability problem is likely to continue through 2025 at least.

In addition, supply chain bottlenecks are slowing parts repair and replacement for airlines, which is affecting aircraft down time.

Aircraft delivery delays are the third part of the fleet planning problem that airlines are facing.

Many Asia Pacific airlines are seeing delivery timetables shift by multiple months, with little certainty about the revised targets.

For example, first delivery of the Boeing 777-9 model has been delayed from 2025 to 2026, which will affect airlines such as Cathay Pacific and ANA.

Airlines are turning to the lease market to try to secure short-term capacity to make up for aircraft shortages, or are extending leases on aircraft they had planned to replace. This means availability is tight and lease prices higher.

The Asia Pacific airline industry's run of solid financial returns is forecast to continue, although other regions are stronger

Despite the fleet challenges, Asia Pacific airlines generally achieved healthy financial results in 2024.

Many posted record revenues. However, higher costs offset much of these gains.

Constrained capacity and strong demand kept yields high, although yields moderated from unsustainably high levels in 2023.

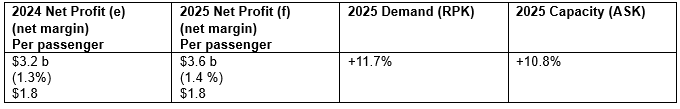

IATA predicts that Asia Pacific airlines will collectively post a USD3.6 billion net profit in 2025 - up from an estimated USD3.2 billion in 2024.

Almost all the other global regions are expected to see higher collective profits than Asia Pacific, despite the fact that the Asia Pacific region is the largest in terms of RPKs.

The only region expected to have a lower profit margin than Asia Pacific in 2025 is Africa.

However, Asia Pacific traffic and capacity are forecast to have the highest growth of any region in 2025.

All of these factors - the lower profitability and higher growth - are consistent with the later start to post-pandemic recovery in the Asia Pacific region. The effects of this are still evident in the 2025 forecasts.

IATA's Asia-Pacific airline industry financial forecasts

Source: IATA.

A key question is: when Russian overflights can be resumed

Political tensions and conflicts will continue to cause challenges for Asia Pacific airlines in 2025.

One of the major factors is the need to avoid Russian airspace, which is forcing Japanese and South Korean airlines, in particular, to take lengthy detours on their routes to Western Europe.

Chinese airlines are able to overfly Russian airspace, giving them an advantage over European airlines on Europe-China routes.

While peace talks in the Ukraine war are being floated, it is still difficult to predict when the conflict may end. So the airspace issues will likely continue for the short term at least.

Meanwhile, Chinese airlines face lingering capacity restrictions in the US market, as bilateral air services are capped at 50 flights per week for each country. This is just one third of the frequencies allowed before the pandemic.

There is still more work to be done in the major airline mergers in India and South Korea

Airline consolidation was an important theme in 2024, and its repercussions will continue to be felt in 2025.

Air India's takeover of Vistara and Korean Air's acquisition of Asiana were completed in Nov/Dec-2024.

However, much work still remains for the new owners to fully absorb Vistara and Asiana, so these two brands will still be seen in 2025.

The mergers in India and South Korea will change the competitive landscape, and could spur further consolidation in both markets.