Competitive dynamics are shifting for South Korean LCCs

The tragic crash of a Jeju Air 737-800 on 29-Dec-2024 has turned the spotlight on the South Korean LCC industry, a sector that is in the process of undergoing significant change.

It is yet to be determined what the ramifications of the crash will be for Jeju Air and other airlines.

However, even aside from that, the LCC market is in a state of flux as 2025 begins.

Jeju Air is the largest of the South Korean LCCs, although it will soon be overtaken when Korean Air's and Asiana's LCC subsidiaries are merged. And another independent LCC, T'Way, has also been boosted as a side-effect of the seismic Korean Air-Asiana deal.

Meanwhile, Eastar Jet is back on a growth track, with new ownership.

Summary

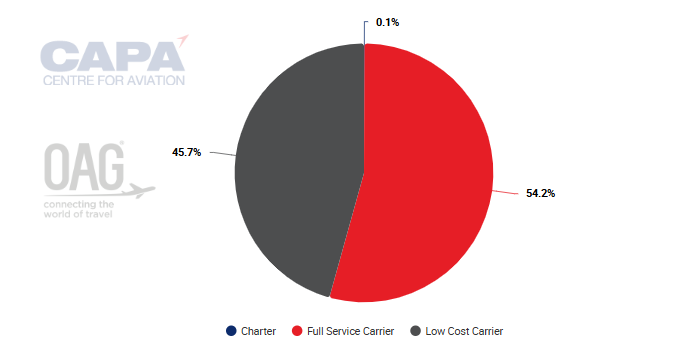

- Foreign and local LCCs operate 45.7% of South Korea’s system seat capacity.

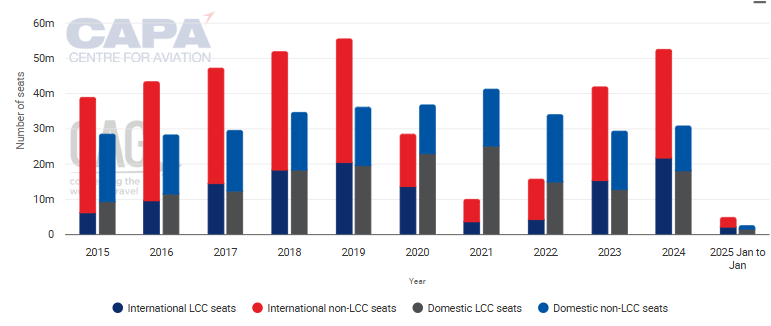

- LCCs have grown their international and domestic capacity shares by about 25 points since 2015.

- Jeju Air accounts for 11.1% of seats in South Korean market, and 15% on Korea-Japan routes.

- Jin Air, Air Busan and Air Seoul would have a combined share of 16.5% of Korean market.

- Seven local LCCs operate about 150 aircraft, with Boeing narrowbodies the dominant type.

LCCs have been increasing their share in the South Korean market, led by Jeju Air

South Korea has a very competitive LCC market. Overseas and local LCCs accounted for 45.7% of systemwide seats for the week of 6-Jan-2024, according to data from CAPA - Centre for Aviation and OAG.

This is significantly higher than the Asia Pacific average of 32.1%.

South Korea: departing seats by business model, for week of 6-Jan-2025

Source: CAPA - Centre for Aviation and OAG.

There are no less than 22 LCCs serving South Korea, of which seven are based in that country.

LCCs had a 41.1% share of South Korea's annual international seats in 2024, which was up from 36.5% in 2019, and was just 15.4% in 2015.

There has been similar robust growth in the domestic market, with LCCs representing 58.5% of seats in 2024, 54.3% in 2019, and 32.7% in 2015.

South Korea: annual seats by business model, international and domestic

Source: CAPA - Centre for Aviation and OAG.

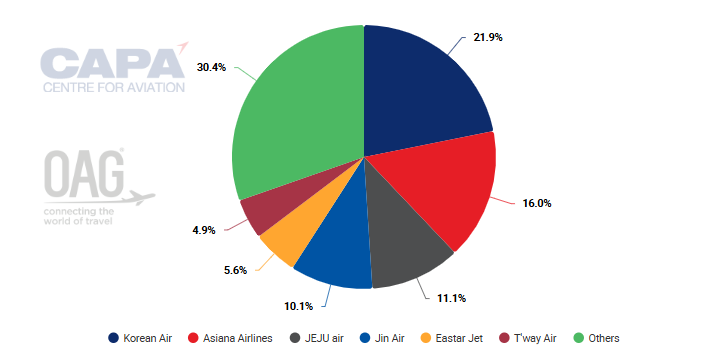

Jeju Air accounted for 11.1% of systemwide seats in the South Korean market for the week of 6-Jan-2024. This placed it third overall behind Korean Air and Asiana.

Jeju Air had a slightly higher share of 12.4% in the previous week, but it has reduced its capacity in the wake of the crash.

South Korea: share of system departing seats, by airline, for week of 6-Jan-2025

Source: CAPA - Centre for Aviation and OAG.

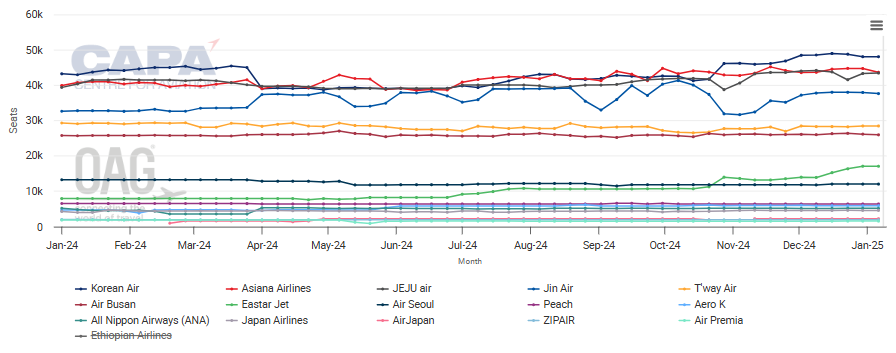

Jeju Air is particularly strong in the important South Korea-Japan market.

It accounts for about 15% of weekly seats in that market, about the same percentage as Asiana and only slightly behind Korean Air.

Japan is Jeju Air's largest international market by a wide margin.

Capacity from South Korea to Japan, as measured in weekly seats, from Jan-2024

Source: CAPA - Centre for Aviation and OAG.

The next highest-ranked LCC in the South Korean market is Jin Air, with 10.1% of seats for the week of 6-Jan-2025.

Jin Air is a subsidiary of Korean Air, and the parent plans to merge Asiana's LCC subsidiaries Air Busan and Air Seoul into Jin Air.

Air Busan operates 4.6% of Korea's weekly seats, and Air Seoul 1.8%, so the enlarged Jin Air would have 16.5% of overall seats, lifting it above Jeju Air.

South Korea's top 10 airlines by share of system departing seats for week of 6-Jan-2025

Source: CAPA - Centre for Aviation and OAG.

Adding Europe routes and widebodies has helped T'Way expand its operation

The LCC T'Way is also benefiting from the Korean Air-Asiana merger. To address competition concerns stemming from the Asiana takeover, Korean Air agreed to support T'Way's entry onto four important European routes in the second half of 2024.

This included Korean leasing five Airbus A330s to T'Way, which primarily operates narrowbodies.

These additions helped T'Way boost its international seats by 9.1% year-on-year for the week of 6-Jan-2025.

Because the new routes operated are longer-range than the rest of its network, the airline's ASKs are up by nearly 32% year-on-year, and it has a 4.9% share of South Korea's system seat capacity.

Eastar Jet has revived and remained independent

Another major consolidation step almost occurred in 2020. Jeju Air reached an agreement to take over LCC Eastar Jet, but Jeju Air pulled out of this deal in Jul-2020 as the COVID-19 crisis deepened.

Eastar Jet shut down its operations in early 2020 and attempted to restructure. It eventually gained new investors and relaunched operations in early 2023. It has steadily rebuilt its fleet and network, and now accounts for 5.6% of weekly seats.

The seventh - and smallest - Korean LCC is Aero K, which launched operations in 2021 after a long gestation period. It has a 1.2% share of seats in the South Korean market.

Air Premia also launched in 2021, but it is classified as a hybrid airline rather than an LCC.

Korea's LCCs have primarily used Boeing narrowbodies, and are set to grow further

There are about 150 aircraft operated by the seven LCCs, including 108 Boeing narrowbodies, 33 Airbus narrowbodies, four Boeing 777s, and eight A330s.

The LCCs have 47 Boeing narrowbodies on order, mainly consisting of 38 orders from Jeju Air.

The order total does not include Jin Air, Air Busan or Air Seoul, which are covered by substantial parent group orders. Korean Air has both Boeing and Airbus narrowbodies on order.

South Korea's LCC sector is generally in a stronger condition than before the pandemic

For the Asiana subsidiaries, merging with Jin Air and being part of the Korean Air group means more backing and a better growth platform. The combination will also be more of a competitive force with larger scale.

There was probably a need for consolidation in the South Korean airline industry before 2019 - particularly in the LCC sector.

The Korean Air-Asiana merger goes a long way towards addressing this, although further consolidation moves are not out of the question.

For T'Way, the Korean Air-Asiana merger has been something of a windfall, as it has gained a widebody long haul operation that should prove successful.

And Eastar Jet appears to have the backing to provide much greater financial stability than it had previously, and it is targeting growth again.

However, the outlook for Jeju Air is obviously uncertain due to the recent tragedy. There will be brand damage at the very least, and the airline has already signalled that it will reduce capacity in the short term.

The ongoing investigations will determine what other legal and regulatory consequences there will be for the airline.

From a competitive perspective, it also faces much more robust rivals.