Delta and United see a favourable shift in transatlantic trends. Are the shifts permanent?

US global network airlines believe routes to Europe are becoming more de-seasonalised, and if the trend remains intact, the shift could eliminate a hurdle in achieving profits in those markets during the first quarter of 2025.

Delta Air Lines and United Airlines are particularly bullish on the shift, and see opportunities to build on the current momentum across the Atlantic.

Both airlines are predicting a strong performance on those routes for the first three months of 2025 and beyond.

Summary

- Delta Air Lines and United Airlines cite strong performances in transatlantic markets in 4Q2024.

- Both airlines believe the transatlantic has the potential to become de-seasonalised.

- Other factors are contributing to a shift in transatlantic trends.

- For now, transatlantic prospects continue to look promising.

Delta and United see momentum building in the transatlantic

Delta posted a 4% increase year-over-year in top-line revenue in its transatlantic markets in 4Q2024, and unit revenue and yields grew 6% and 3%, respectively, on a capacity decrease of 2%.

Offering an outlook for the first quarter of 2025, Delta President Glen Hauenstein told analysts and investors that transatlantic revenue was expected to "...lead[,] at up mid-single digits for the second quarter in a row. Demand across the Atlantic is benefiting from strong US point of sale and an extension of the season, with unprecedented off-peak results. We have good visibility into the spring and summer and expect another year of record profitability in our largest international entity".

United also logged a strong 4Q2024 performance on its routes to Europe, with top-line revenue growth of 9.5% and an increase in unit revenue of 7.1%.

Yield grew 4.9%, on capacity growth of 2.3%.

The company's Chief Commercial Officer Andrew Nocella recently declared: "From what we see today, we expect the first quarter [of 2025] to be our best Atlantic financial result in the company's first quarter history".

Both airlines believe the transatlantic market is shedding the winter doldrums

It's a bit unprecedented for a US airline executive to sound so bullish about first quarter performance in the transatlantic - given the weakness in demand for those markets during the winter months in the Northern Hemisphere.

Indeed, Mr Nocella concluded that "the polite way to say it", is typically that performance in European markets was "not so great", particularly "from January 15 through mid-March".

Now, Mr Nocella concluded, "...we are seeing a totally different result[,] where people are willing to go to Southern Europe on a vacation, and that's just great".

Delta has drawn a similar conclusion, as Mr Hauenstein noted that the IATA summer season is the peak, and winter in the Northern Hemisphere is off-peak: "Usually, we're not able to generate significant returns in the off-peak, many months in the off-peak", he said.

Mr Hauenstein explained that advanced bookings were not only strong, but "...close-in business travel going into the transatlantic has been incredibly strong".

One driver of the shift is strong US point of origin sales, given the strength of the USD against the EUR, with Mr Hauenstein saying that "Europe is an incredibly screaming buy", and "...people are finding that[,] particularly in Southern Europe, that the weather is actually pretty nice in the winter and the streets aren't as crowded".

This year Delta is launching new flights from New York JFK to Catania; Atlanta to Naples; Minneapolis to Rome; and Boston to Milan.

Mr Hauenstein said that there was is a "little confluence" of many things happening, "but all of those are favourable to our environment, and we're really capitalising on it".

Based on data from CAPA - Centre for Aviation and OAG as of late Jan-2025, United and Delta are among the larger airlines operating from the US to Western Europe, measured by two-way seat share.

United has an approximately 15% share, while Delta and American Airlines' (one-world JV partner British Airways) each has a 13% share.

American on its own has a 10% share, and United's joint venture partner Lufthansa has a 7.3% share.

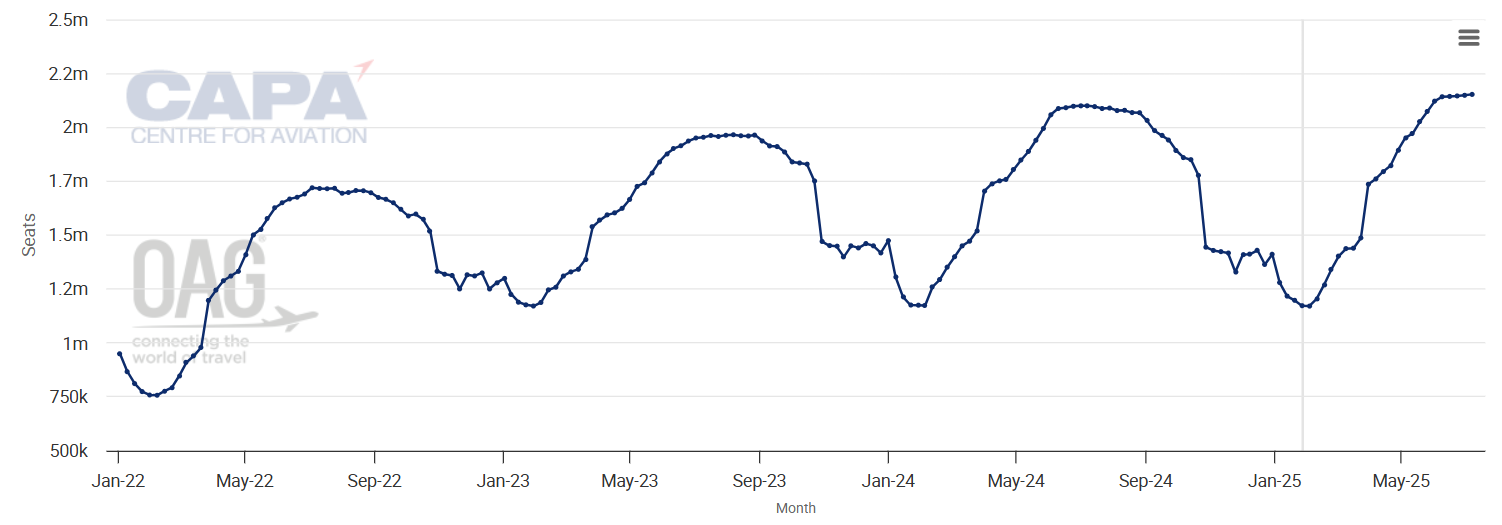

Although US airline executives see shifting trends in travel to Europe, for now the capacity patterns remain as they have been historically, with summer peaks and troughs in the winter.

Two-way total seats from the US to Western Europe, from Jan-2022 to early Jul-2025

Source: CAPA-Centre for Aviation and OAG.

*The values for this year are at least partly predictive for the 6 months from 27-Jan-2025 and may be subject to change.

Supply chain challenges could be boon for international markets

Other factors are also creating a sense of optimism among US airlines regarding prospects in long haul markets.

"The international environment…is going to be far stronger for longer because of the structural supply constraints that are going to last at least for the rest of this decade", United CEO Scott Kirby recently said, noting that widebody aircraft supply, both airframes and engines, is even more challenged than it is for narrowbodies.

He also explained that it was very hard to see the 15%-20% growth from US ultra-low cost airlines from 2012-2014 happening again - those factors are resulting in the industry evolving "into an equilibrium where each airline driven by economic necessity will be primarily focused on flying where they have a competitive advantage".

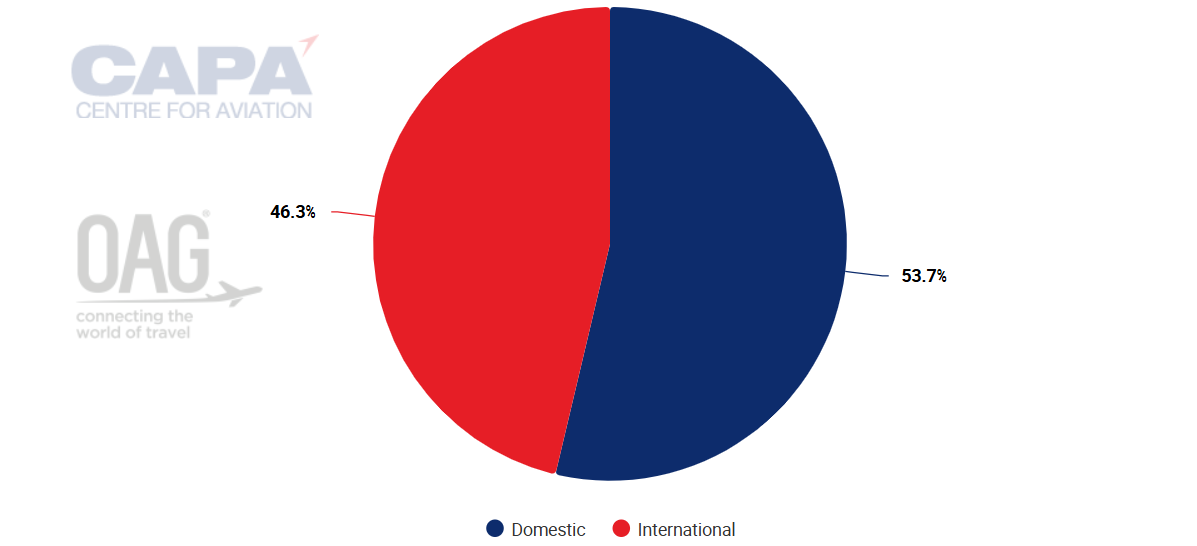

Mr Nocella explained that United's international margins had outpaced the airline's domestic performance in 2024, noting that the airline's plan during the COVID pandemic "was to double down on international flying, and it has proven to be the right move".

As of late Jan-2025, 46% of United Airlines Holdings' available seat miles were deployed into international markets.

United Airlines Holdings: ASM split between international and domestic, as of late Jan-2025

Source: CAPA - Centre for Aviation and OAG.

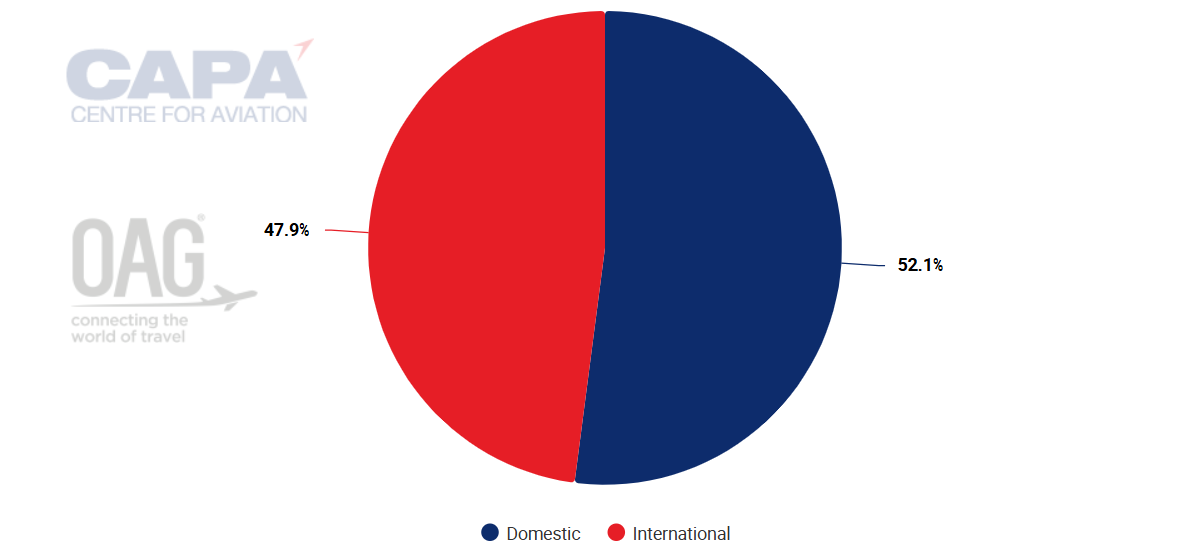

Delta Air Lines Group's ASM split is nearly 48% international and 52% domestic.

Delta Air Lines Group: ASM split between international and domestic as of late Jan-2025

Source: CAPA Centre for Aviation and OAG.

Optimism over favourable transatlantic shifts shows little sign of waning at Delta and United

Many factors could ultimately affect travel trends to Europe, since economic and geopolitical uncertainty remain as an overhang.

But for now, prospects look promising for transatlantic travel year-round.