Air Europa seeks investment. Latin America network is the main attraction

Air Europa is seeking funds to repay COVID-era government loans of EUR475 million.

It could do this by taking out new debt and/or by issuing new share capital. This process could lead to another airline investing in Air Europa, in which IAG has a 20% stake.

IAG was prevented from taking full control by the EU's competition regulator last year, but Air France-KLM, Lufthansa and Etihad Aviation Group are reported to be on the list of potential investors.

Air Europa's parent company, Globalia, and the Hidalgo family that controls it, plans to retain a majority holding, but a future airline investor would likely seek a closer commercial and operational relationship with the Spanish airline.

This report presents a snapshot of the Air Europa that investors will be considering.

Its Latin America network is likely to be the main attraction.

Summary

- Air Europa, on course to exceed 2019 capacity in 2025 – is Madrid’s number two airline by slots.

- It is number four on Europe-Latin America, where it is the leading ‘smaller airline’, fourth in domestic Spain, and only 16th on Spain-Europe.

- Air Europa has 22 long haul routes (20 to LatAm), 18 short/medium haul international routes, and 20 domestic routes.

- Its 49 aircraft have an average age of 9.6 years.

Air Europa is on course to exceed 2019 capacity in 2025

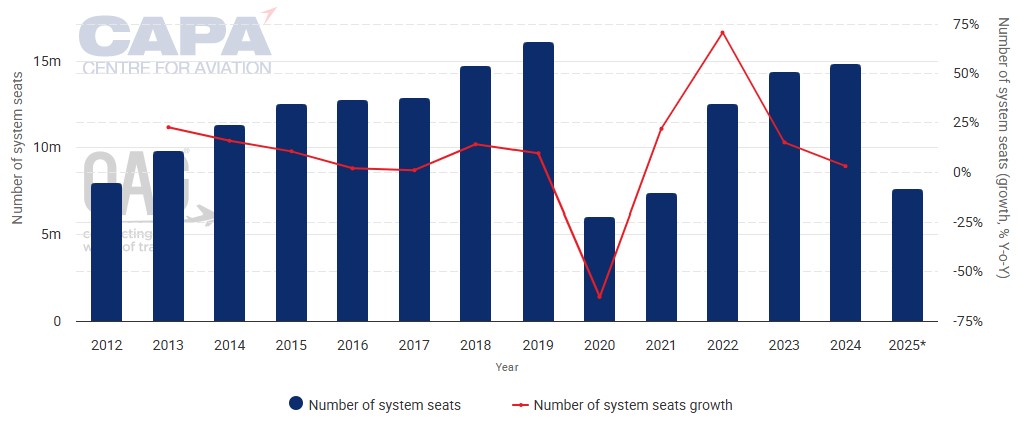

The most recent year for which Air Europa passenger numbers are available is 2023, when it carried 11.7 million. This was below its 2019 record high of 13.1 million.

According to data from CAPA - Centre for Aviation and OAG, Air Europa offered 14.8 million seats in 2024, an increase of 3.0% year-on-year, but still 7.9% below its 2019 capacity.

This suggests that passenger numbers may have reached around 12 million in 2024, still below its 2019 record.

Looking into 2025, Air Europa is scheduled to increase its seat capacity by 11% year-on-year in 1H2025: if this growth rate is maintained throughout the year, it will exceed its 2019 capacity by 2% in 2025.

Air Europa: annual seat capacity, 2012 to 2025*

*Data for 2025 are partly predictive up to six months and subject to change.

Source: CAPA - Centre for Aviation, OAG.

Air Europa is Madrid's number two airline by slots

Air Europa is the second largest airline at Madrid Barajas by slots.

Using schedules filed for the week of 30-Jun-2025 as the reference period, Air Europa has 15.3% of slots, compared with Iberia's 48.2% slot share.

Third-ranked Ryanair has 10.7% of slots, which is considerably ahead of fourth-placed easyJet's 1.6%.

Adding Vueling's 0.5%, British Airways' 0.7%, and Aer Lingus' 0.2% to Iberia's slots - IAG's total holding at Madrid is 49.6%.

Madrid Barajas Airport: top 10 airlines ranked by departing frequencies, week of 30-Jun-2025

|

Rank |

Airline |

Total |

Slot share |

|---|---|---|---|

|

1 |

3,824 |

48.2% |

|

|

2 |

1,216 |

15.3% |

|

|

3 |

826 |

10.4% |

|

|

4 |

112 |

1.4% |

|

|

5 |

108 |

1.4% |

|

|

6 |

108 |

1.4% |

|

|

7 |

98 |

1.2% |

|

|

8 |

82 |

1.0% |

|

|

9 |

81 |

1.0% |

|

|

10 |

76 |

1.0% |

Source: CAPA - Centre for Aviation, OAG.

Air Europa is number four on Europe-Latin America…

On routes between Europe and Latin America, Iberia is the biggest airline by ASKs, with a share of 15.1%, ahead of Air France (10.8%) and LATAM (8.1%).

Air Europa is fourth, with 7.9% of ASKs, ahead of KLM (7.0%) and TAP Air Portugal (5.9%) (week of 30-Jun-2025, source: OAG/CAPA - Centre for Aviation).

As a group, IAG has 19.2% of Europe-Latin America ASKs (Iberia plus British Airways), putting it ahead of Air France-KLM's 17.8%.

Lufthansa Group has only 4.1%, which is far behind the other two leading European groups.

…where it is the leading 'smaller airline'

Air Europa is the leading 'smaller airline' on Europe-Latin America, while TAP Air Portugal, another such airline, is also a significant player in this market.

Both Air Europa and TAP are looking for investment and both have strength on routes to Latin America, which will be an important consideration for potential airline investors/partners.

If one of the leading European legacy airline groups invests in one or both, this could alter the groups' relative positions on Europe-Latin America (the combined ASK share of Air Europa and TAP is 13.7%).

Europe to Latin America: top 10 airlines ranked by ASKs, week of 30-Jun-2025

|

Rank |

Airline |

ASKs |

ASK share |

|---|---|---|---|

|

1 |

986,661,749 |

15.1% |

|

|

2 |

706,937,104 |

10.8% |

|

|

3 |

530,446,364 |

8.1% |

|

|

4 |

514,674,308 |

7.9% |

|

|

5 |

459,236,397 |

7.0% |

|

|

6 |

385,340,940 |

5.9% |

|

|

7 |

317,904,620 |

4.9% |

|

|

8 |

291,607,358 |

4.5% |

|

|

9 |

270,533,898 |

4.1% |

|

|

10 |

258,939,006 |

4.0% |

Source: CAPA - Centre for Aviation, OAG.

Air Europa is fourth in the Spanish domestic market

In the Spanish domestic market, Air Europa ranks fourth by ASKs (week of 30-Jun-2025, source: CAPA - Centre for Aviation/OAG).

It has a share of 9.9%, which is only fractionally ahead of Binter Canarias' 9.5% share.

The domestic market leader Vueling has 36.2% of ASKs, and second-placed Iberia has 23.2% (giving IAG 59.4%).

Ryanair is third, with a 17.9% share.

Domestic Spain: top 7 airlines ranked by ASKs, week of 30-Jun-2025

|

Rank |

Airline |

ASKs |

ASK share |

|---|---|---|---|

|

1 |

324,180,628 |

36.2% |

|

|

2 |

207,636,254 |

23.2% |

|

|

3 |

160,515,249 |

17.9% |

|

|

4 |

88,335,830 |

9.9% |

|

|

5 |

85,331,844 |

9.5% |

|

|

6 |

25,391,322 |

2.8% |

|

|

7 |

3,765,744 |

0.4% |

Source: CAPA - Centre for Aviation, OAG.

Air Europa is only 16th on Spain-Europe

On international routes between Spain and Europe, Air Europa is only 16th by ASK share, with just 1.3%.

The clear leader on Spain-Europe is Ryanair, with an ASK share of 24.6%, followed by easyJet (9.8%) and Jet2.com (8.0%).

The highest-ranked Spanish airline in this market is Vueling, in fourth, with 6.5% of ASKs, ahead of Iberia, with 4.9%.

IAG's overall share is 14.3%.

Spain to Europe: top 10 airlines ranked by international ASKs, week of 30-Jun-2025

|

Rank |

Airline |

ASKs |

ASK share |

|---|---|---|---|

|

1 |

1,971,816,573 |

24.6% |

|

|

2 |

787,564,071 |

9.8% |

|

|

3 |

638,021,912 |

8.0% |

|

|

4 |

519,587,904 |

6.5% |

|

|

5 |

388,921,566 |

4.9% |

|

|

6 |

339,571,736 |

4.2% |

|

|

7 |

278,885,886 |

3.5% |

|

|

8 |

251,342,880 |

3.1% |

|

|

9 |

212,217,436 |

2.7% |

|

|

10 |

199,763,630 |

2.5% |

|

|

… |

|||

|

16 |

1044,308,324 |

1.3% |

Source: CAPA - Centre for Aviation, OAG.

Air Europa has 22 long haul routes (20 to Latin America)…

Air Europa is scheduled to operate 22 long haul routes from Madrid in the week of 30-Jun-2025.

Of these, 20 are to Latin America and two are to North America (New York and Miami).

Air Europa is the only airline on five of these: to Asunción, Córdoba Pajas Blancas, Salvador Luís Eduardo Magalhães, San Pedro (Honduras) and Santiago Cibao (Dominican Republic).

There are also four on which the only other operator is Iberia: Panama City, Guayaquil, Quito and Montevideo.

Air Europa has a seat share of 49% or more on half of the 20 Latin American routes that it is scheduled to operate from Madrid in the week of 30-Jun-2025.

It competes with Iberia on 11 of its 20 Latin America routes, and on both of its North America routes.

Air Europa: long haul routes, ranked by its seat share on the route, week of 30-Jun-2025

|

Origin |

Destination |

Other competitors* |

||

|---|---|---|---|---|

|

Asunción |

100.0% |

0.0% |

||

|

Córdoba Pajas Blancas |

100.0% |

0.0% |

||

|

Salvador Luis E Magalhaes |

100.0% |

0.0% |

||

|

San Pedro (Honduras) |

100.0% |

0.0% |

||

|

Santiago Cibao |

100.0% |

0.0% |

||

|

Panama City |

64.7% |

35.3% |

||

|

64.1% |

0.0% |

|||

|

55.8% |

0.0% |

|||

|

49.8% |

50.2% |

|||

|

49.1% |

20.2% |

|||

|

Santo Domingo Las Americas |

43.2% |

44.4% |

||

|

37.3% |

62.7% |

|||

|

34.2% |

0.0% |

|||

|

31.7% |

30.5% |

|||

|

27.9% |

0.0% |

|||

|

26.6% |

73.4% |

|||

|

26.4% |

50.4% |

|||

|

New York JFK |

21.7% |

42.7% |

||

|

GRU Sao Paulo |

20.2% |

38.3% |

||

|

20.0% |

45.1% |

|||

|

Buenos Aires |

17.8% |

59.6% |

Aerolineas Argentinas |

|

|

11.9% |

41.9% |

*Bold indicates a codeshare partner of Air Europa.

Source: CAPA - Centre for Aviation, OAG.

…18 short/medium haul international routes…

Air Europa is scheduled to operate 18 short/medium haul international routes in the week of 30-Jun-2025.

Of these, 17 are from Madrid and one (to Paris Orly) is from Palma de Mallorca.

All but two of the 18 routes are to destinations in Europe, while one is in the Middle East (Tel Aviv), and one is in North Africa (Marrakech).

Its short/medium haul network is much more competitive than its long haul network.

Iberia is a competitor on 15 of the 18 routes and low cost airlines compete on 10 of the routes.

Air Europa faces at least two competitors on all but one route. The exception - Madrid to Istanbul, a new route launching in May-2025, has the codeshare partner Turkish Airlines as the only competitor.

Air Europa's highest seat share on any of its short/medium haul routes is 47% (Madrid to Porto).

On two routes, Madrid to Miami and Tel Aviv, the only other operator is a codeshare partner of Iberia.

Air Europa: short/medium haul international routes, ranked by its seat share on the route, week of 30-Jun-2025

|

Origin |

Destination |

Other competitors* |

||

|---|---|---|---|---|

|

47.2% |

29.1% |

|||

|

40.8% |

39.3% |

|||

|

Tunis Carthage |

39.0% |

0.0% |

||

|

33.2% |

57.3% |

|||

|

29.7% |

30.5% |

|||

|

29.5% |

40.5% |

|||

|

26.8% |

25.1% |

|||

|

26.7% |

23.8% |

|||

|

26.4% |

54.9% |

|||

|

Istanbul |

24.5% |

0.0% |

||

|

24.2% |

38.1% |

|||

|

23.9% |

26.5% |

|||

|

22.6% |

55.9% |

|||

|

22.1% |

33.4% |

|||

|

15.0% |

49.7% |

Aegean, World2Fly |

||

|

12.8% |

40.5% |

|||

|

10.9% |

0.0% |

|||

|

9.6% |

32.4% |

*Bold indicates a codeshare partner of Air Europa.

Source: CAPA - Centre for Aviation, OAG.

…and 20 domestic routes

Air Europa is scheduled to operate 20 domestic routes in the week of 30-Jun-2025.

On 10 of these, the only other operators currently are IAG's Iberia or Vueling, with Air Europa having the majority of seats on five.

Low cost airlines compete with Air Europa on its 10 other domestic routes (Ryanair on nine of these).

Air Europa: domestic routes, ranked by its seat share on the route, week of 30-Jun-2025

|

Origin |

Destination |

Other competitors |

|||

|---|---|---|---|---|---|

|

71.9% |

28.1% |

0.0% |

|||

|

59.8% |

40.2% |

0.0% |

|||

|

57.6% |

42.4% |

0.0% |

|||

|

56.1% |

43.9% |

0.0% |

|||

|

56.0% |

44.0% |

0.0% |

|||

|

48.6% |

0.0% |

13.1% |

|||

|

45.1% |

54.9% |

0.0% |

|||

|

34.5% |

0.0% |

65.5% |

|||

|

32.8% |

36.8% |

0.0% |

|||

|

32.5% |

12.2% |

8.8% |

|||

|

32.0% |

0.0% |

68.0% |

|||

|

29.5% |

0.0% |

63.5% |

|||

|

29.2% |

36.9% |

0.0% |

|||

|

28.2% |

0.0% |

71.8% |

|||

|

26.3% |

47.1% |

0.0% |

|||

|

Barcelona-El Prat |

22.8% |

0.0% |

53.3% |

||

|

Barcelona-El Prat |

22.1% |

77.9% |

0.0% |

||

|

20.6% |

52.2% |

0.0% |

|||

|

14.4% |

0.0% |

51.4% |

|||

|

10.5% |

52.7% |

0.0% |

Source: CAPA - Centre for Aviation, OAG.

The airline's 49 aircraft have an average age of 9.6 years

According to the CAPA - Centre for Aviation Fleet Database, Air Europa's current fleet of 49 aircraft comprises two ATR turboprops, one Airbus A320-200, 21 Boeing 737-800s, 10 Boeing 787-8s and 15 787-9s.

The average age of the fleet is 9.6 years - lower than the European average of 13.7 years.

Its youngest sub-fleet, its Boeing 787s, have an average age of 6.8 years.

It has orders for six Boeing 787-9s, for delivery in 2025 and 2026, and 30 Boeing 737 MAX 8s, for delivery from 2025 until 2031.

Air Europa's Latin America network is the main attraction for investors

Air Europa is reported to be enjoying healthy trading conditions, although financial results have not been disclosed for a number of years, but its government loan is a burden.

The airline has engaged advisers PJT Partners to help with raising funds to repay the debt to the Spanish state.

It is approaching the end of its widebody delivery programme, and about to begin receiving new narrowbodies. It typically leases its fleet, but the financing of its Boeing 737 MAX deliveries is likely to be a consideration for any potential investor.

Air Europa, a well established brand with 39 years of operations, is Spain's largest independent airline and the third largest overall, behind IAG's Iberia and Vueling.

Its membership of SkyTeam and existing codeshares may provide a more obvious fit with Air France-KLM, but alliance membership is not fixed in stone.

SAS, with whom Air Europa has recently signed a new codeshare agreement, left Star Alliance to join SkyTeam after Air France-KLM took an equity stake in it. This precedent could be followed in reverse if Lufthansa were to invest in Air Europa.

Air Europa's attractions to any strategic airline investor will include its Madrid slots and, most particularly, its Latin America network.