Georgia: fast-growing Eastern European aviation market hits record passengers in 2024

Georgia's airports handled more passengers in 2024 than at any time in their history.

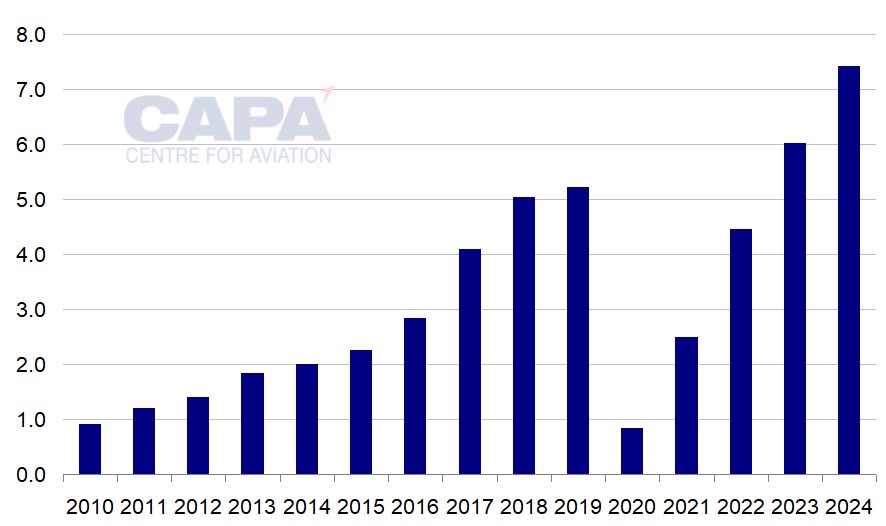

The former Soviet republic's aviation market is small (7.4 million passengers last year 2024), but is growing rapidly (growth of 24% year-on-year).

It has enjoyed a faster recovery from the COVID-19 pandemic than Eastern/Central Europe as a whole.

The government of Georgia has been active in seeking new airline services, attracting 13 new routes and three new airlines in 2024: the entry last year of Austrian Airlines, Transavia and Air China is due to be followed in summer 2025 by the entry of British Airways, easyJet, Transavia France and Edelweiss Air. The government is also seeking more direct services to/from China.

Wizz Air is the biggest airline by seats and passengers in Georgia, where low cost airline seat share has grown over the past 15 years.

However, LCC share has plateaued, and even fallen slightly, in the past two years.

Summary

- Georgia’s airports handled a record number of passengers in 2024. Its capacity recovery from the pandemic has outpaced Europe’s.

- Georgian Airways has lost seat share since 2019, but regained some of the lost share in 2023 and 2024.

- LCC share of international seats has grown over the past 15 years, but is below its 2022 peak. Wizz Air is the biggest airline in Georgia.

- easyJet, British Airways, Transavia France and Edelweiss Air will enter Georgia in 2025.

Georgia's airports handled a record number of passengers in 2024

In 2025 Georgia's airports handled 7.4 million passengers - a new record high.

This was an increase of 23.4% year-on-year, and 44% above 2019 traffic.

Georgian airport traffic had reached 6.0 million passengers in 2023, already above the 2019 level of 5.2 million (which itself had been a record).

Passenger numbers grew at a compound average rate of 21% p.a. from 2010 until 2019, after which this rapid growth was interrupted by the COVID-19 pandemic.

Strong double digit growth has resumed since the depths of the crisis in 2020, but the CAGR since 2019 works out at 7.5% p.a.

Georgia: annual airport passenger numbers (million), 2010 to 2024

Source: CAPA - Centre for Aviation and GCAA.

Georgia's capacity recovery from the pandemic has outpaced Europe's

In terms of seat capacity, Georgia's recovery from the pandemic has significantly outpaced the wider European recovery.

According to data from CAPA - Centre for Aviation/OAG, Georgia's 2024 capacity was 37% above 2019 levels, whereas Eastern/Central Europe was up by 6%, and Western Europe by just 2%.

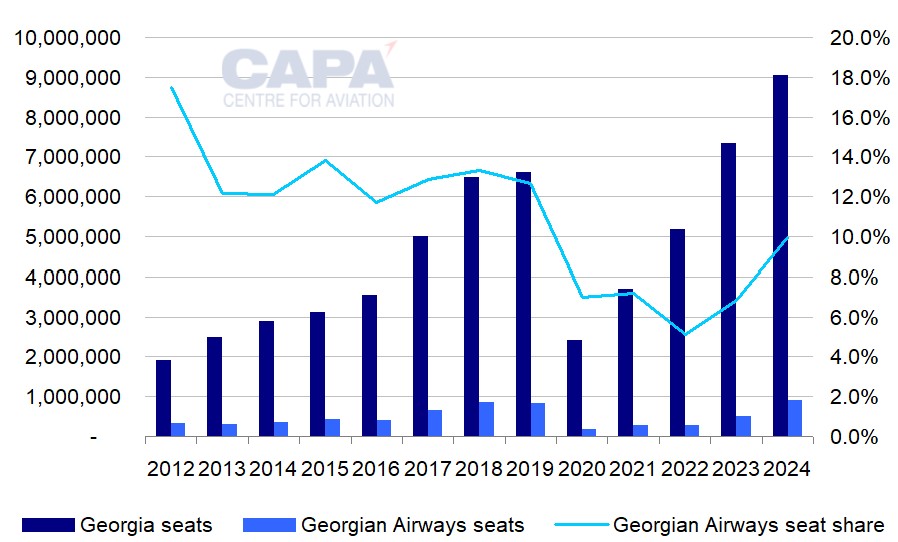

Georgian Airways has lost seat share since 2019…

Georgian Airways, the national flag carrier, has not kept pace with the recovery in capacity for the country as a whole.

The airline was only 7% above its 2019 seat capacity in 2024, when its seat share was 9.9%, below its 2019 share of 12.7% (and even further below its 2012 share of 17.5%, source: CAPA - Centre for Aviation/OAG).

According to the Georgian Civil Aviation Authority, Georgian Airways' share of passengers was only 7%, lower than its seat share in 2024.

Wizz Air, the leading airline in Georgia, had 17% of passengers in 2024.

…but regained some of the lost share in 2023 and 2024

However, although Georgian Airways' 2024 seat share was down versus 2019, it was up compared with 2022 and 2023.

Georgia: annual seat capacity and Georgian Airways seat share, 2012 to 2024

Source: CAPA - Centre for Aviation, OAG.

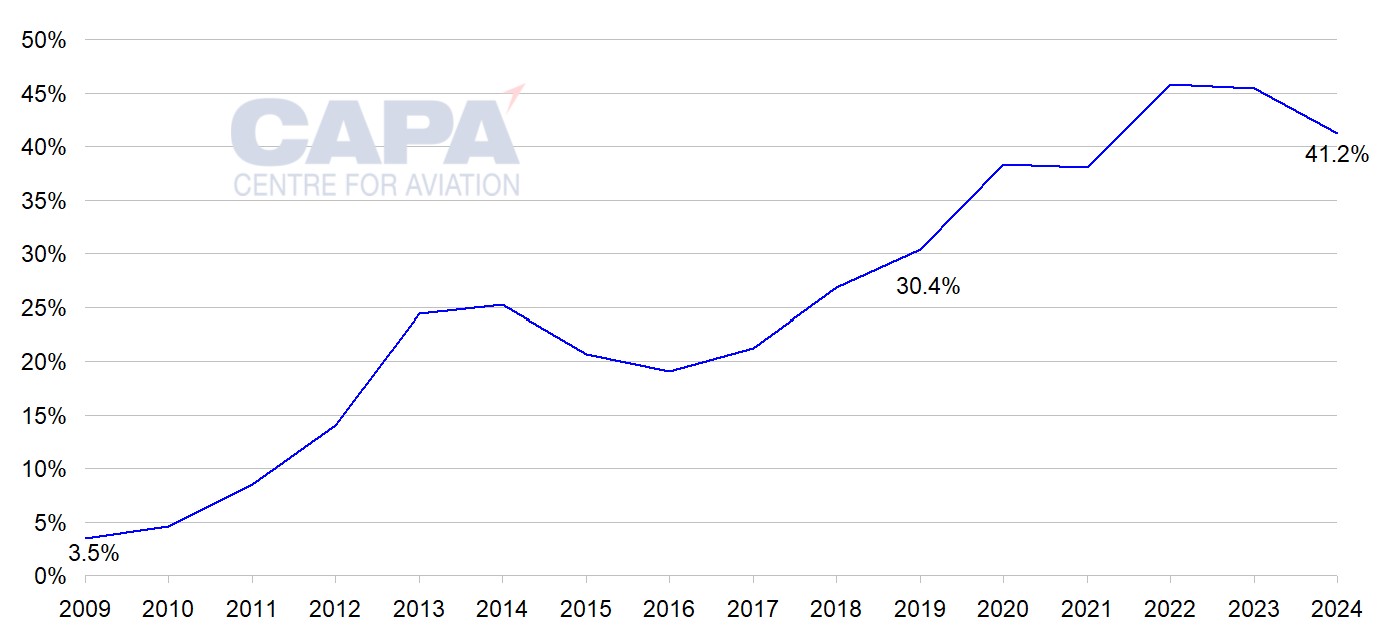

LCC share of international seats has grown over the past 15 years…

Low cost airlines have increased their international seat share in Georgia over the past 15 years, growing it from 3.5% in 2009 to 41.2% in 2024. This 2024 figure was 10.8ppts higher than in 2019.

Georgia: LCC seat share, 2009 to 2024

Source: CAPA - Centre for Aviation, OAG.

…but is below its 2022 peak

However, LCC share of international seats has come down from a peak of 45.8% in 2022.

This is partly because flydubai and Air Arabia have cut their capacity to Georgia over the past two years, and also because Georgian Airways' growth outpaced the market in 2023 and 2024.

Wizz Air is the biggest airline in Georgia

Looking ahead to summer 2025, based on schedules for the week of 23-Jun-2025, Wizz Air is the biggest airline by seats in Georgia, with a share of 18.7% (including 1.6% for Wizz Air Dubai).

Georgian Airways ranks second, with 9.5% of seats. Its share has fallen from 13.0% in the equivalent week of 2019, when it was the leading operator in the country. At that time, Wizz Air was second, with 11.4% of seats (including 0.5% for Wizz Air UK).

Turkish Airlines is third, with 7.8% of seats (down from 9.3% in the equivalent week of 2019, when it also ranked at number three).

Pegasus Airlines is fourth, just behind Turkish Airlines, with 7.3%. It has risen from 16th in Jun-2019, when it had just 2.3% of seats.

Georgia: top 10 airlines, week of 23-Jun-2025

|

Rank |

Airline |

Seats |

Seat share |

|---|---|---|---|

|

1 |

37,920 |

18.7% |

|

|

2 |

19,188 |

9.5% |

|

|

3 |

15,756 |

7.8% |

|

|

4 |

14,686 |

7.3% |

|

|

5 |

13,780 |

6.8% |

|

|

6 |

8,904 |

4.4% |

|

|

7 |

8,868 |

4.4% |

|

|

8 |

7,048 |

3.5% |

|

|

9 |

6,960 |

3.4% |

|

|

10 |

6,840 |

3.4% |

*Share includes Wizz Air Dubai, which has 1.6% of seats.

Source: CAPA - Centre for Aviation, OAG.

LCC seat share is scheduled to be 46.1% in the week of 23-Jun-2025 - up from 33.5% in the equivalent week of 2019.

However, this is very slightly below the 46.9% seat share held by LCCs in the same week of 2024, adding evidence that their share is no longer increasing.

Tbilisi is the leading airport

Tbilisi International is Georgia's leading airport, serving the capital city and acting as Georgian Airways' main hub.

It handled 4.8 million passengers in 2024, which was almost three times the traffic of the country's number two airport, Kutaisi, and almost five times that of third ranked Batumi.

Kutaisi is located between Tbilisi and the Black Sea, while Batumi is on the Black Sea coast.

Tbilisi's passenger numbers grew by 29% in 2024, which was faster than the 24% growth of the country as whole.

Kutaisi's passenger traffic grew by only 3% to 1.7 million in 2024, whereas Batumi's leapt by 53%, to just under 1.0 million.

Georgia: leading airports ranked by passenger numbers, 2024

|

Rank |

Airport |

Pax million |

|---|---|---|

|

1 |

4.8 |

|

|

2 |

1.7 |

|

|

3 |

1.0 |

Source: CAPA - Centre for Aviation and GCAA.

easyJet, British Airways, Transavia France and Edelweiss Air will enter Georgia in 2025

easyJet will launch services to Tbilisi from Geneva, London Luton and Milan Malpensa from the end of Mar-2025/start of Apr-2025.

British Airways is to re-enter Heathrow to Tbilisi at the same time (it last served the route in 2013).

Transavia France will launch Paris Orly-Tbilisi flights from 9-Apr-2025, almost one year after its sister airline Transavia launched Amsterdam-Tbilisi services in Apr-2024.

Edelweiss Air, the leisure subsidiary of SWISS (part of Lufthansa Group), will launch Zurich-Tbilisi in Apr-2025.

Ryanair operated to Tbilisi from Milan Bergamo and to Kutaisi from Bologna and Marseille in 2019 and 2020. It also planned to launch Cologne-Tbilisi in Apr-2020, but COVID-19 stopped this and the routes it had already launched, and it has not restarted Georgia flights post-pandemic.

Georgia's government is actively supporting aviation growth

The government of Georgia is implementing marketing campaigns in the UK, Switzerland, and Italy to attract more tourists to Georgia in support of the new airlines services planned for summer 2025.

Mariam Kvrivishvili, Georgia's Deputy Economy Minister, said last year:

"We are sure we will already see increased tourist flows... Aviation is a complex sector, and our team has been working with partners on this topic for quite some time".

The government is also talking to Hainan Airlines, Beijing Capital Airlines and Sichuan Airlines to add more Georgia-China services following Air China's entry into Urumqi-Tbilisi flights in competition with China Southern Airlines in Dec-2024.

This follows the relaxation last year of visa controls between the two nations.