Opportunities for aviation in Africa – is the door for development finally set to open?

Opportunities for aviation in Africa – is the door for development finally set to open?Analysis

The aviation industry in Africa presents both significant opportunities and challenges, with the potential for remarkable growth driven by economic development, rising demand for air travel, and the need for better connectivity across the continent.

In this report, we will examine the current state of aviation in Africa, identify the strongest and weakest markets, and explore opportunities for development using GDP and economic growth data.

Summary

- Africa’s aviation industry is poised for growth, due to a rising middle class, increasing international business, and tourism.

- Countries with higher GDPs, such as South Africa, Nigeria, Kenya, and Egypt, lead the aviation sector, supported by established infrastructure and growing demand for air travel.

- The African Continental Free Trade Area (AfCFTA) and the Single African Air Transport Market (SAATM) are key drivers for growth, facilitating easier trade and travel across borders, which could boost intra-Africa connectivity and economic integration.

- Modernising airport infrastructure across the continent, particularly in key cities like Addis Ababa, Nairobi, and Lagos, presents a significant opportunity.

- Infrastructure improvements could accommodate growing air traffic and could enhance connectivity, potentially attracting international investments and increasing capacity.

- Emerging markets with lower GDPs and underdeveloped aviation sectors represent growth potential.

- The rise of low cost carriers (LCCs) could make air travel more accessible to a broader population, expanding both domestic and international routes.

- Despite opportunities, the sector faces challenges – such as fragmented regulations, infrastructure gaps, and political instability.

- Addressing these issues through regulatory reforms, investment in airports and improved safety will be critical to unlocking the continent’s full aviation potential.

African aviation - the same old story

Africa, as a region, has experienced an increasing demand for air travel, driven by a rising middle class, growing international business relationships, and the increasing importance of tourism.

Despite these favourable factors, the aviation industry in Africa has faced numerous hurdles - these include insufficient infrastructure, safety concerns, regulatory inefficiencies, and fragmented air travel networks that often limit intra-Africa connectivity.

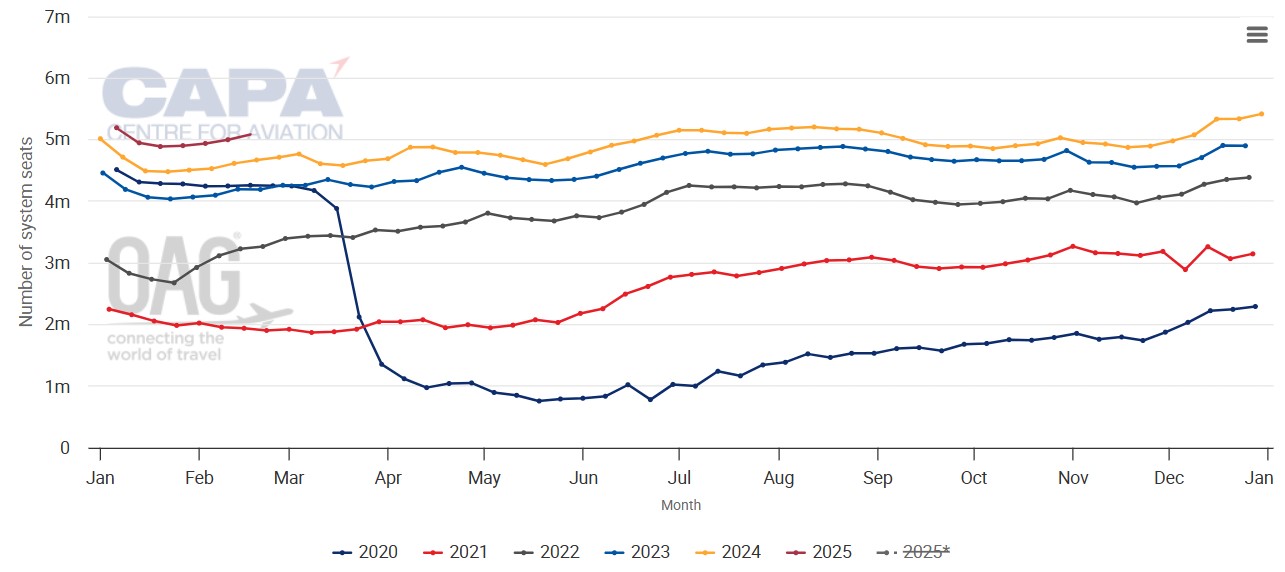

Africa has shown strong recovery from the COVID-19 pandemic, with seat capacity across the continent up year-on-year every week since late Mar-2021. Africa exceeded pre-pandemic numbers during 2023, and there has been continued growth during 2024.

This has continued into 2025, according to latest data from CAPA - Centre for Aviation and OAG.

Africa: weekly total system seat capacity, from 2020

Source: CAPA - Centre for Aviation and OAG.

According to the International Air Transport Association (IATA), air transport supports over 7 million jobs across the African continent, and contributes around USD60 billion to Africa's GDP.

However, despite these contributions, Africa's aviation market remains underdeveloped compared to other regions such as Asia and Europe.

The African Union (AU) and various regional organisations have made strides to improve the situation.

For example, the implementation of the African Continental Free Trade Area (AfCFTA) and the Single African Air Transport Market (SAATM) are intended to open up the skies and promote cross-border travel and trade.

Yet, the full potential of these initiatives has yet to be realised.

Economic indicators across continent highlight market differences

The economic development of a country is one of the most critical drivers for the aviation sector, as a higher GDP typically correlates with greater disposable income, higher demand for air travel, and a more developed infrastructure to support aviation.

The strongest aviation markets in Africa are generally those with the highest GDP, and those that have taken steps to improve aviation infrastructure and connectivity.

The weakest markets highlight the vast differences across national borders.

Ethiopia a standout performer, thanks to its national airline

The African aviation landscape is never dull, and 2024 was no different, as the continent experienced an eclectic blend of highs and lows. But once again, it was in Ethiopia that stood out from the crowd, thanks to the continued strong performance of its national carrier Ethiopian Airlines.

The airline's network currently consists of 143 destinations, including 22 within Ethiopia and 67 across Africa, according to data from CAPA - Centre for Aviation and OAG for the week commencing 10-Feb-2025.

Ethiopian Airlines: network map for the week commencing 10-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

The airline's achievements during the year are too numerous to mention, but highlights include the signing of an MoU with Boeing for the purchase of up to 20 Boeing 777Xs; the signing of a sustainable aviation fuel production and acquisition agreement with Satarem; the entry of its first A350-1000 into service, and the announcement of plans to construct Africa's largest airport at Abusera.

In May-2024 Ethiopian Airlines CEO Mesfin Tasew called for the elimination of government interference in African airlines, stating: "Governments must remove their hands from the airlines if they want to see their airlines become successful, independent, self-sufficient in financing, and the like".

It might be an ambitious wish, but the success of Ethiopian Airlines in contrast to many of its regional competitors is proof that it is a goal worth striving for.

South Africa has a highly developed aviation sector

South Africa, as Africa's second largest economy, is home to major international airports like OR Tambo International Airport (Johannesburg) and Cape Town International Airport - but it has been put in the shadow because of Ethiopia's rise.

The country has a highly developed aviation sector, with significant capacity in both international and domestic air travel.

According to the World Bank, South Africa's GDP was $419 billion in 2023, and the country is a regional hub for air traffic.

Additionally, the airline industry benefits from global airlines and local operators like South African Airways.

With continued investment in airports and modern aircraft, South Africa remains the key leader in African aviation.

Nigeria is Africa's largest economy by GDP

Nigeria is Africa's largest economy by GDP, standing at approximately USD520 billion in 2023.

Nigeria's aviation sector is experiencing substantial growth, driven by its burgeoning population, expanding middle class, and a strong oil-based economy.

Lagos' Murtala Muhammed International Airport is a key hub, and there is potential for increased connectivity within the continent.

However, infrastructure issues, fuel supply challenges, and regulatory inefficiencies remain significant barriers to growth.

Kenya hopes for regional trade and tourism growth

Kenya, with a GDP of around USD120 billion, has experienced steady growth in air traffic.

Nairobi's Jomo Kenyatta International Airport is one of Africa's busiest airports, with an expanding role as a regional hub for both passengers and cargo.

Kenya Airways, the national carrier, plays a pivotal role in connecting East Africa to the rest of the world.

The rise in regional trade and tourism is expected to continue driving the growth of Kenya's aviation sector.

Egypt has one of the most robust aviation sectors

Egypt, with a GDP of USD400 billion in 2023, has one of the most robust aviation sectors in North Africa.

Cairo International Airport is a major regional hub, with strong demand from the tourism sector, as well as international trade.

The expansion of EgyptAir's network and investment in infrastructure projects, like the new terminal at Cairo Airport, indicate that the country has the potential to expand its aviation market significantly.

Chad is one of Africa's smallest economies

Chad is one of Africa's smallest economies, with a GDP of approximately USD12 billion in 2023.

The aviation sector here is underdeveloped, largely due to limited infrastructure, political instability, and a lack of investment.

Although the country is geographically important for regional connectivity, it has not experienced the level of growth in air travel, compared to its larger neighbours.

Mozambique faces significant challenges in its aviation sector

With a GDP of around USD20 billion, Mozambique faces significant challenges in its aviation sector.

The country's airports are limited in capacity, and air travel is constrained by underdeveloped domestic infrastructure and a reliance on a few international flights.

While there is potential for growth in the tourism and cargo sectors, investments in infrastructure and regional connectivity in Mozambique are crucial.

Sierra Leone impacted by political instability and the absence of a national airline

Sierra Leone is among the smaller economies in Africa, with a GDP of approximately USD5 billion in 2023.

The country's aviation sector is underdeveloped, with limited domestic services and minimal regional connectivity.

Political instability, underdeveloped airports, and the absence of a national airline contribute to the challenges.

There are key opportunities for growth, if there is appetite for change

The African Continental Free Trade Area (AfCFTA), which came into force in 2021, is one of the most significant drivers for the growth of aviation across the continent. This agreement aims to reduce trade barriers and promote the free movement of goods and services within Africa.

As trade between African nations increases, the demand for efficient transportation - particularly air travel - will grow. Airlines operating in Africa stand to benefit greatly from a more integrated and unified market.

A critical opportunity for the development of aviation in Africa also lies in the modernisation and expansion of airport infrastructure.

Major cities like Addis Ababa, Nairobi, Johannesburg, Cairo, and Lagos are seeing airport expansions, but many other regions remain underserved.

According to the African Development Bank, several countries are investing in infrastructure development under the African Infrastructure Investment Plan (AIIP), which could lead to improved connectivity and the growth of the aviation sector.

Low cost Carriers (LCCs) have generally struggled to succeed across Africa, but a small number have proven that low cost travel is viable in the African context - given the large and growing middle class across Africa, there is an increasing appetite for affordable air travel.

By expanding low cost carrier services and increasing competition, the aviation market in Africa could experience a rapid expansion of both domestic and international routes. LCCs are likely to open up new routes and make air travel more accessible.

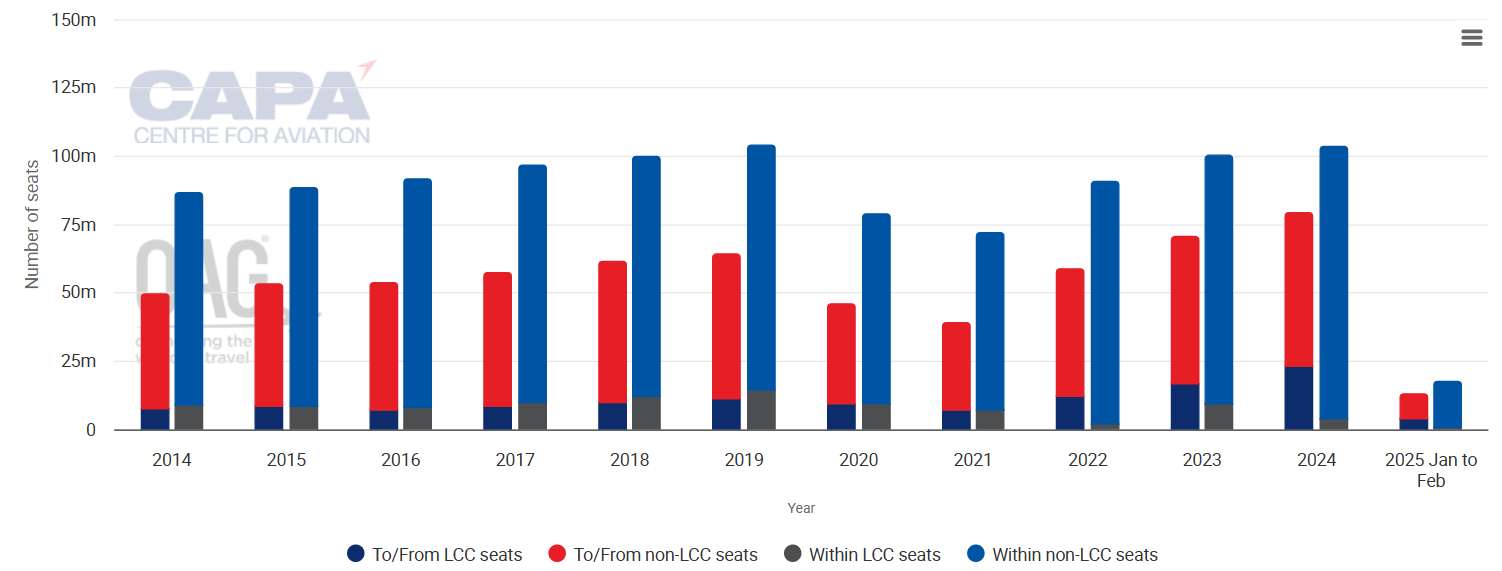

The LCC share of capacity to/from Africa rose to 29.3% in 2024, up from 23.4% in 2023, according to data from CAPA - Centre for Aviation and OAG.

This was mainly due to growth among LCCs serving markets in North Africa from Europe. The share of LCC capacity within Africa fell over the same period, from 9.5% in 2023 to 3.9% in 2024.

Africa: LCC/non-LCC annual capacity share, from 2014

Source: CAPA - Centre for Aviation and OAG.

The tourism sector is another key opportunity for aviation growth.

Africa has a rich natural heritage, offering tourists access to national parks, beaches, and historical sites. As the global middle class grows, more international tourists will visit Africa, increasing demand for both international flights and regional connectivity.

The global shift toward sustainability is also an opportunity for Africa.

As international regulations around environmental sustainability tighten, Africa has an opportunity to leapfrog some of the older, polluting aviation practices and adopt new, greener technologies and sustainable aviation fuels (SAF). Sustainable aviation projects, such as the introduction of electric aircraft and better waste management practices at airports, could position African countries as leaders in sustainable aviation.

To reach potential there are challenges to overcome

Despite the clear opportunities, several challenges remain for Africa's aviation sector.

Aviation regulations vary widely across African nations, making it difficult to establish a seamless, integrated aviation network. The African Union and regional organisations like the African Civil Aviation Commission (AFCAC) have taken steps to standardise regulations, but implementation remains slow.

Many African airports and airlines lack the modern infrastructure required to handle growing air traffic. Investment in better runways, terminals, and air traffic control systems is essential to handle expected increases in demand.

Some African countries face political instability, terrorism threats, and safety concerns that can deter foreign investment and reduce tourism. These security concerns hinder the growth of air travel and discourage international airlines from serving certain markets.

Will Africa embrace the opportunity to grow?

The aviation sector in Africa holds immense potential for growth, fuelled by economic development, increasing demand for air travel, and initiatives like the AfCFTA.

While there are opportunities for development, especially in stronger markets like South Africa, Nigeria, and Kenya, challenges remain in many parts of the continent.

Investments in infrastructure, regulatory reform, and the expansion of low cost carrier networks will be critical to unlocking the full potential of Africa's aviation sector.

As the African economy continues to grow and integrate, aviation will certainly play an increasingly important role in fostering economic development and improving connectivity across the continent. How big a role will remain dependent on how the industry embraces its need to change,