Cayman Islands looks to more direct nonstop flights from Europe and Latin America

The Cayman Islands, nestled in the Caribbean Sea and still a British Overseas Territory, are best known as a tax-free financial centre and as a vacation idyll for the financially well endowed.

But with a short runway, incapable of handling a fully laden long haul jet, the Caymans cannot reach their full touristic potential.

A long-established master plan that would see the runway extended and a new terminal built looks as if it will come to fruition during the next few years, enabling long haul flights to land and take off with full loads.

Currently the vast majority of visitors come from North America.

But with those new tourists from Europe, and possibly Latin America, would come demands for a more budget-oriented infrastructure that does not exist presently, but which is found in Jamaica and the Dominican Republic, for example.

The other matter to consider is whether now is the time to revisit the prospect of privatisation.

The halfway house that is the public-private partnership (PPP) seems to fit the demands of the Caribbean airport environment quite well, and there are examples of that not too far away.

Summary

- The Cayman Islands, a self-governing British Overseas Territory, is seeking to attract long haul connectivity to Europe, as well as more tourist arrivals from Latin America.

- The territory is a major offshore financial centre for international businesses and the rich - mainly due to the state charging no tax on income earned or stored.

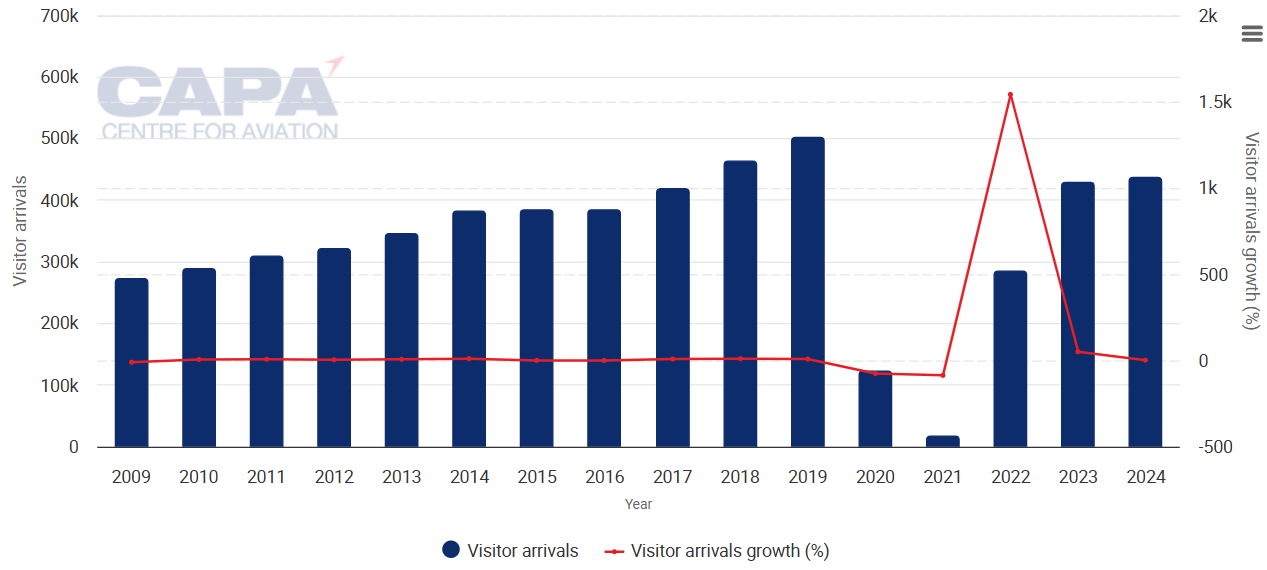

- Foreign visitor numbers increased in every year in the decade from 2010 to 2019

- The USA and Canada accounted for 89.2% of all visitors in 2024, which was an average increase of 3.35% over 2023.

- Europe connections are not always optimised for a rapid journey, compounded by a lack of alliance airline capacity and LCCs.

- The Cayman Islands, a self-governing British Overseas Territory, is seeking to attract long haul connectivity to Europe, as well as more tourist arrivals from Latin America.

- The territory is a major offshore financial centre for international businesses and the rich - mainly due to the state charging no tax on income earned or stored.

- Foreign visitor numbers increased in every year in the decade from 2010 to 2019

- The USA and Canada accounted for 89.2% of all visitors in 2024, which was an average increase of 3.35% over 2023.

- Europe connections are not always optimised for a rapid journey compounded by a lack of alliance airline capacity and LCCs.

- The Cayman Islands, a self-governing British Overseas Territory, is seeking to attract long haul connectivity to Europe, as well as more tourist arrivals from Latin America.

- The territory is a major offshore financial centre for international businesses and the rich - mainly due to the state charging no tax on income earned or stored.

- Foreign visitor numbers increased in every year in the decade from 2010 to 2019

- The USA and Canada accounted for 89.2% of all visitors in 2024, which was an average increase of 3.35% over 2023.

- Europe connections are not always optimised for a rapid journey compounded by a lack of alliance airline capacity and LCCs.

- CAPA and GAD conferences in the Cayman Islands in 2025 are well placed to consider local issues.

Cayman Islands seeking additional long haul connectivity from Europe and more tourists from Latin America

The Cayman Islands, the UK territory in the Caribbean Sea that is known as both a tourism resort and an offshore financial centre, announced around this time in 2024 that it was seeking to attract long haul connectivity to Europe, as well as more tourist arrivals from Latin America, in a bid to reduce its reliance on seasonal US travellers.

The Cayman Islands is a self-governing British Overseas Territory, and the largest by population (70,000).

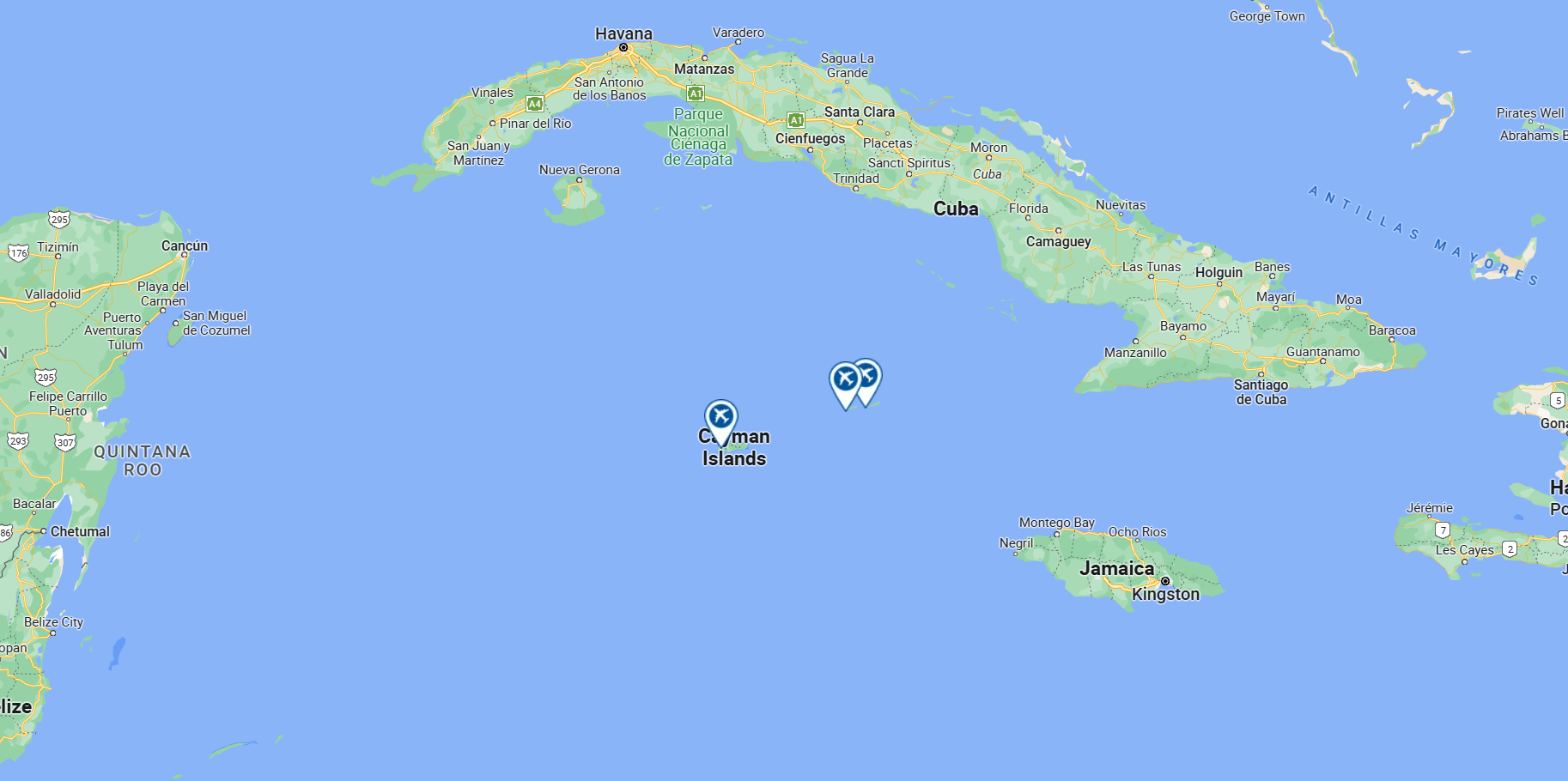

The 264sqkm (102 square mile) territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located south of Cuba and north-east of Honduras, between Jamaica and Mexico's Yucatán Peninsula.

The capital city is George Town on Grand Cayman, which is the most populous of the three islands.

Financial paradise - a major offshore centre for international business

The Cayman Islands is considered to be part of the geographic Western Caribbean zone, as well as the Greater Antilles. The territory is a major offshore financial centre for international businesses and the rich - mainly due to the state charging no tax on income earned or stored.

The main industries are financial services, tourism, and real estate sales and development.

With GDP per capita of USD84,500 (2024), and with USD88,500 expected in 2025 - and it has reached USD110,000 in the past - the Cayman Islands has the highest standard of living in the Caribbean, and one of the highest in the world. Immigrants from over 140 countries and territories reside there.

Where Latin America was concerned, the Tourism Department was focusing on Brazil, Argentina and Mexico, and had held discussions with airlines including Azul, GOL, LATAM Airlines and Copa Airlines regarding increasing connectivity.

High levels of tourist growth pre-pandemic are now getting back on track but there is still a gap to be bridged

Tourism to the Cayman Islands has followed a similar path to many other countries in recent years because of the COVID-19 pandemic, but before that episode visitor numbers increased in every year in the decade from 2010 to 2019 (with the exception of 2016, when numbers remained stable compared to the previous year).

Tourism is seasonal, with the highest visitor numbers recorded from November to March and the low point being in August and September. That period is in the rainy season, and also at the back end of the Hurricane Season, although the Cayman Islands are rarely badly affected (being southwest of the main channel).

Cayman Islands: annual tourism, visitor numbers/growth, from 2009 to 2024

Source: CAPA - Centre for Aviation and Cayman Islands Department of Tourism.

The two initial COVID-19 years saw a successive reduction in tourist numbers of -76% and -86%, leaving just 17,000 visitors in the whole of 2021 from a high of 503,000 in 2019, the last of three years on the run during which strong increases had been recorded.

Post-pandemic the numbers increased dramatically, with a gain of 1,540% in 2022, then a further gain of 51% in 2023, but then they bottomed out to just +2% in 2024, leaving a figure that was still 13% below that of 2019.

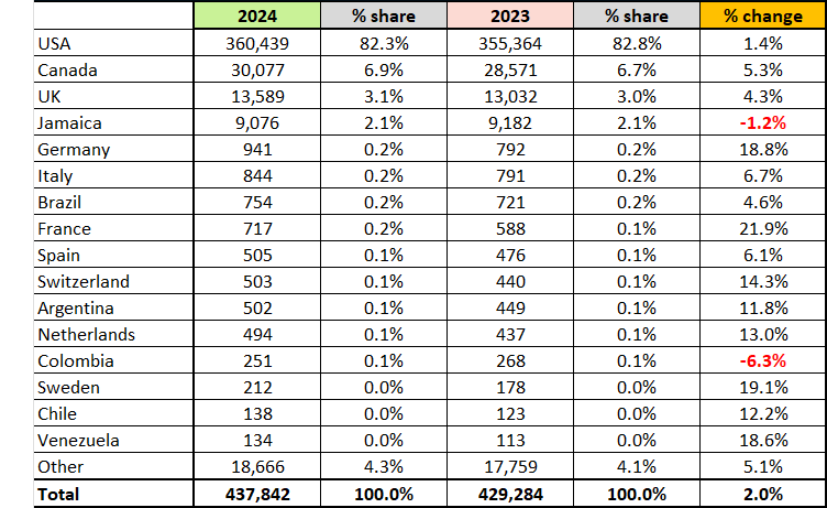

Bridging that gap, and more, is now the Tourism department's aim. And there are gaps within gaps, so to speak, as the statistics are heavily skewed towards North America, as the below table shows.

Cayman Islands: visitor numbers by country market 2024 (vs. 2023)

Source: Cayman Islands Tourist Board.

USA and Canada provide almost 90% of all tourists...

The USA and Canada accounted for 89.2% of all visitors in 2024, which was an average increase of 3.35% over 2023.

That increase was small compared to several other countries, but those two countries between them are clearly dominant.

Apart from accessing the islands by air, there is also a substantial cruise business supplying tourists. The cruise ship terminal is situated close to Owen Roberts International Airport as well as downtown, the main beach and the financial centre, which offers opportunities further to develop fly-cruise options from an expanded international and intercontinental air network.

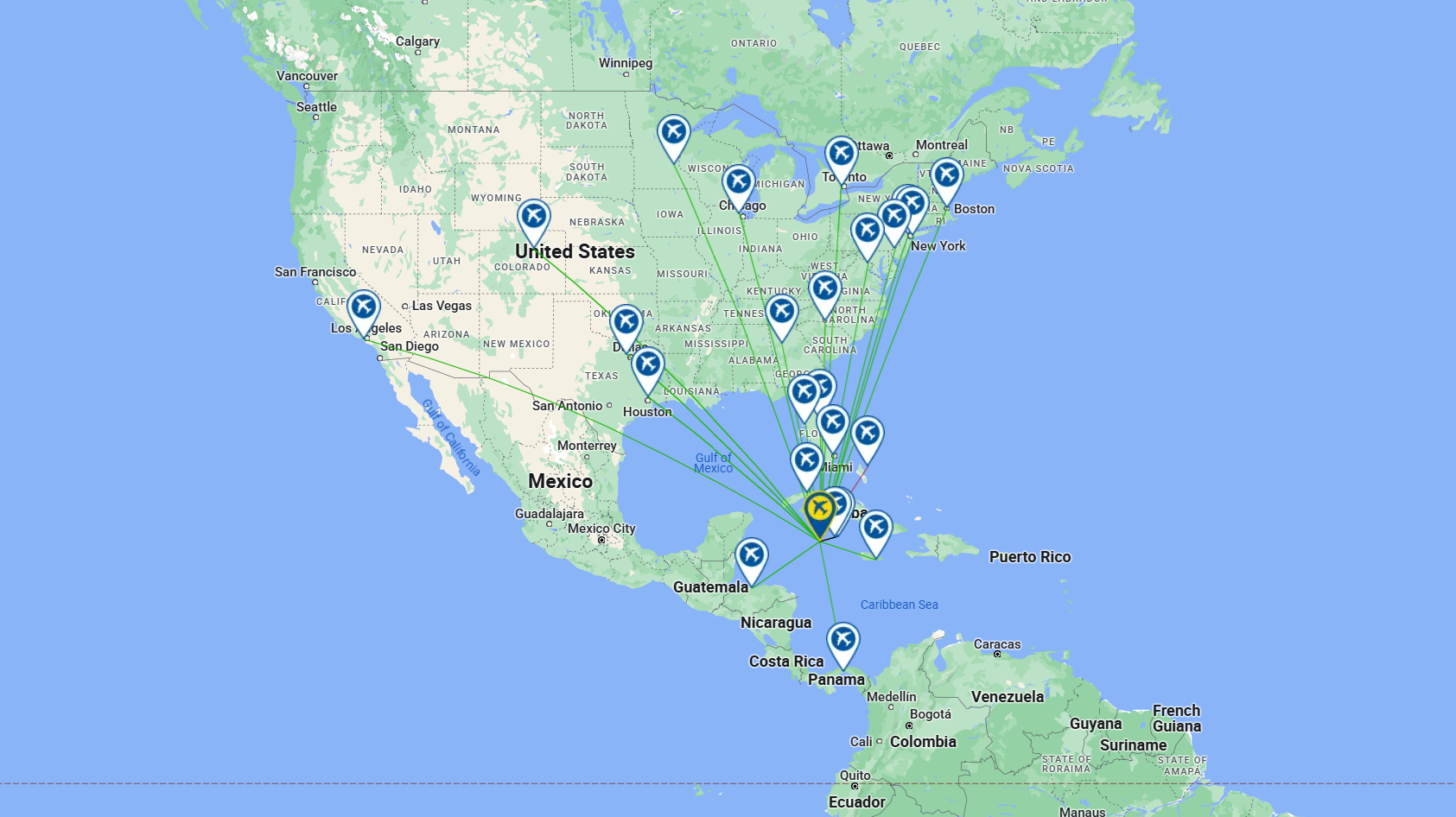

And that US/Canadian dominance is evident from the route network map for the major airport, Owen Roberts International, for the week commencing 10-Feb-2024.

Grand Cayman Island Owen Roberts International Airport: network map for the week commencing 10-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

Owen Roberts is connected to many of the US' main hubs, enabling it to be accessible from most of the US directly, or with one change, as well as being directly connected to Toronto, Canada.

…but other markets have much higher growth rates

On the other hand, the 2024 tourist table above shows that while high levels of growth cannot be expected from mature US and Canadian routes, they have been evident in other markets: notably Germany, France, Switzerland, Sweden and the Netherlands in Europe, and Argentina, Chile and Venezuela in Latin America.

So it is hardly surprising that the Tourist Board should be focusing attention on Europe and South America in particular.

There are no direct European services at present, even from the UK, with the British Airways link from London connecting via Nassau. The flight from Heathrow is a major source of both business and leisure tourism.

Five Latin American airports do offer services presently, including Panama City - which is the principal acknowledged hub for the region - by way of Copa Airlines services.

Short runway problem to be rectified

One problem that the Owen Roberts airport faces is a short runway of only 2,140m x 45m, which means that it cannot host large aircraft with full loads. Otherwise, it requires a change of gauge at a nearby airport, such as Nassau in the Bahamas.

In 2014 the Airport Authority unveiled a new plan to perform major renovations as part of a master plan to renovate and redevelop all three Cayman Islands airports. At Owen Roberts International this meant expanding the current terminal building and parking areas, extending the runway (and in the middle to long term) the construction of a second terminal building and a parallel taxiway.

Such expansion would allow passenger airlines to fly newer and larger aircraft.

British Airways currently serves the airport with the Boeing 777-200, and other aircraft able to use it are the Airbus A330, Airbus A340, Boeing 747-400 and the Boeing 787-9.

In Nov-2019 a draft project for a 265m runway extension was approved, followed in May-2023 by a broader USD91 million redevelopment plan, including runway extension, air traffic control system modernisation and construction of a new terminal.

The initiative will be funded via a USD5 terminal fee and USD15 development fee, to be included in airfares during the construction period, which is expected to last until 2029.

Full direct service aircraft from Europe possible for the first time

As a direct result, the Tourism Department was able to seek to attract enhanced long haul connectivity to Europe, including nonstop services.

As things stand, the airport is mainly an international one, with 92% capacity in that domain. The other 8% are on services to the other two airports, Little Cayman and Cayman Brac, which are about 100km distant, to the northeast.

(N.B. Cayman Brac's Sir Captain Charles Kirkconnell International Airport, formerly known as Gerrard-Smith International Airport, also has international service, as its name suggests, presently to and from Miami).

Cayman Islands and airports' location

Source: CAPA - Centre for Aviation and OAG.

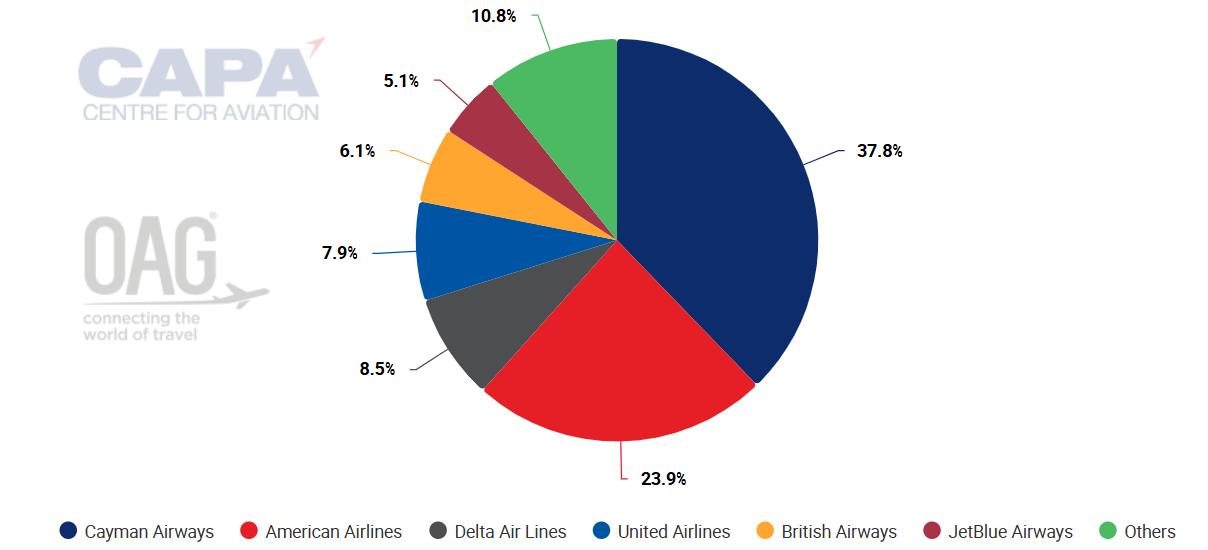

Cayman Airways has the largest share of the seat capacity, at 37.8%, followed by a succession of US airlines, interspersed by British Airways on 6% of capacity.

Of all the capacity operated, 75% is to/from the United States.

Cayman Islands: system two way seat capacity in the week commencing 10-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

The main feeder airports are big US hubs, each with a spider's web of spokes

Individually, Miami is the international airport with the largest seat capacity portfolio, followed by Atlanta, Nassau, and New York JFK.

A powerful indication of how easy it can be to access the main airport from the US, including a welter of airports there that are connected to those hubs.

Europe connections are not always optimised for a rapid journey, compounded by a lack of alliance airline capacity and LCCs

Having said that, a long journey from Europe, for example, can involve layovers in some of those cities with no same-day connection, and a total journey time of well over 24 hours, especially if a budget level fare is sought.

And that prospect is not helped by a low degree of penetration by low cost carriers (LCCs), which have only 13.6% of capacity.

Not only that - a large slug of that capacity is on unaligned airlines (51.4%), so that alliance-agreed through-fares may not be as accessible as they are to other destinations.

No demand for low cost options just now but it would come with European services

What that adds up to is what could be a problem for the Tourist Board.

To put matters into perspective, there is absolutely no imperative to chase budget vacationers. The economic system of the country is set up to service high wealth individuals, whether they live there or are in temporary residence, for business or leisure services, or just visiting for a vacation.

But an increase in direct flights from Europe that is afforded by the runway extension and additional terminal capacity - be it manifested in additional British Airways services or direct flights from, say, Paris, Amsterdam and Frankfurt - would open the door to demand from the same budget tourists that frequent low budget destinations like the Dominican Republic and Jamaica.

Charter flight operators would want to get in on the act, too.

To a lesser degree that would also apply to direct flights from South America.

Failure to provide for that new level of demand might render some potential services unviable

It might well turn out that the only reasonable option is to provide the inexpensive accommodation and leisure facilities that those vacationers seek or risk half empty planes, and that certainly would not last for long.

In some ways this conundrum mirrors that of Cape Verde, the small island nation off the west (Atlantic) coast of Africa, which went from a backpackers' destination to an abundance of three-four star hotels to five-star establishments - on islands where there was nothing else to do other than lie on a beach - and then back to a demand for budget accommodation, when the problem of how larger aircraft could land on what were restricted runways on most of the islands was solved.

It will not be the case that such a series of developments takes place in the Cayman Islands, because it has top-end tourism already but long and direct flights will change the nature of the demand, for sure.

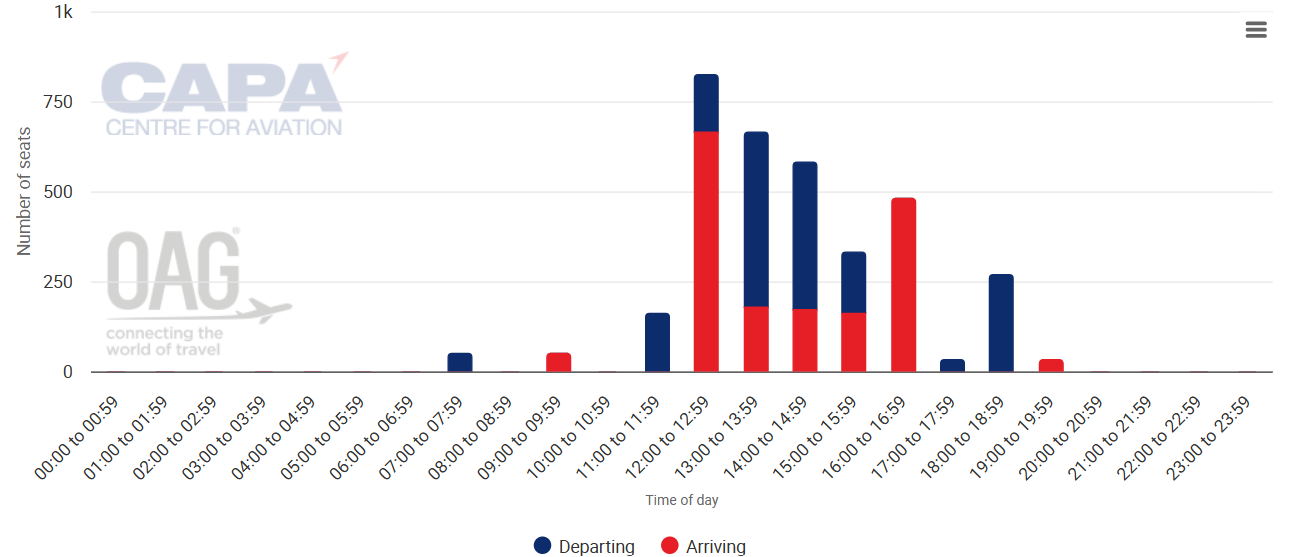

Many flights compacted into one short timespan

Utilisation at Owen Roberts does leave a little room for enhancement.

Most of the scheduled commercial activity is geared towards departures and arrivals during a window between 1200 and 1700, and requiring staffing needs for comparatively little of it outside that window.

The best example of that is Tuesday, which has the least overall activity, as shown by the chart below of arriving and departing seat capacity for Tuesday 11-Feb-2025.

Grand Cayman Island Owen Roberts International Airport: system seats per hour for 11-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

It should be noted that there is considerable private aircraft traffic at the airport also, supported by a general aviation terminal managed by a Fixed Base Operator, but those aircraft movements are, of course, random.

Privatisation was discussed and dismissed 15 years ago; time for a revisit?

It is typical of the Caribbean region as a whole for its airports to be in public ownership, usually by way of an Airports Authority, which also has responsibility for air traffic control.

And that is the case in the Cayman Islands, where The Cayman Islands Airports Authority (CIAA) is the statutory authority under the Ministry of Tourism & Ports.

The CIAA owns and operates Cayman's airport facilities: its mission is 'Connecting Cayman to the world with an innovative and sustainable travel experience'.

Could that be done better by a private enterprise? There have been discussions about the relative benefits of privatisation in the past, notably the Miller Commission Report which argued in favour of the privatisation of the Owen Roberts airport and that, in addition to whatever the government realised from the sale, it would save an additional CI8.7 million (USD10.4 million) that it provides as an annual subsidy payment.

The CIAA argued that payment was not a subsidy, and was rather "monies collected by the Authority as rent, utilities, parking and landing fees and passenger fees from various Government entities[,] including the Department of Immigration, the Customs Department and Cayman Airways". It added, "Obviously, privatisation of the airport would not eliminate the need for those Government entities to pay these fees".

The Miller Report was published in 2010 and times have changed since then, with numerous airports in the locality privatised, such as Kingston and Montego Bay in Jamaica, and Grantley Adams Airport in Barbados also operated under a PPP.

The US Virgin Islands' PPP points to another possible way forward

More to the point, there has been a transaction in the past 12 months, with two airports in the US Virgin Islands now being operated under a PPP by VIports Partners, a consortium led by Toronto-based Aecon Group.

Such an arrangement could help steer the Owen Roberts airport at least towards more rapid construction of the facilities that might kick start the additional air services that the government craves, and without forsaking its ownership.

CAPA and GAD conferences in the Cayman Islands in 2025 are well placed to consider these issues

The development of the airport and the potential for privatisation are subjects likely to come under consideration at two Aviation Week Network conferences that are being concurrently held in the Cayman Islands in early Apr-2025 - The Global Airport Development (GAD) conference Americas and the CAPA Airline Leader Summit Americas.

GAD Americas - The leading conference for airport strategy and finance, is a unique conference and networking event dedicated to best practice and innovation in airport finance, management and infrastructure development. Bringing together public and private airport operators, investors, financiers, regulators, government and industry experts from around the world, GAD provides an opportunity to identify new investment opportunities, partners and business prospects.

The lead-off event in CAPA - Centre for Aviation's 2025 Airline Leader Summit series, the CAPA Airline Leader Summit Americas gathering will bring global and regional aviation leaders to analyse the key trends in aviation across North and South America, as well as diving deep into the developing regional outlook.

The event will examine the rapid changes that are rippling throughout aviation markets in the wake of the second Trump administration and what the shifts in US policy mean for airlines. Within the broader conversations around change management and shifting regional priorities, the summit will examine topics including:

- Disruptive impacts and opportunities for traditional aviation models generated by new technologies.

- How the industry can respond to and moderate the impact of supply chain disruptions.

- The diverging outlooks for the low cost & ultra low cost airline models in different parts of the Americas.

- How airlines are addressing the 'Say-Do Gap' when it comes to sustainability.

- What changes in US policy could mean for international travel demand and regional tourism flows.