IndiGo is primed for higher growth this year, as groundings diminish and long haul plans beckon

IndiGo has done an impressive job of maintaining its international growth, despite a daunting number of narrowbody groundings, and it is now looking to boost its overseas expansion by accelerating plans to introduce new widebody types.

The airline has been one of the hardest hit by the Pratt & Whitney engine issues that have caused a maintenance backlog and a chronic shortage of engines for many operators of Airbus A320neo-family aircraft.

IndiGo has still managed to increase its international capacity, however, with new deliveries and additional leased aircraft more than offsetting the groundings. Now, the number of grounded aircraft is steadily decreasing, raising the prospect of an even higher growth rate.

International expansion is a priority for IndiGo, and the next stage will involve adding more long-range aircraft.

The airline has signalled the importance of this step by attempting to bring in widebodies sooner than planned, via wet leases, as it eyes the India-Europe market.

Summary

- Grounded A320neo-family aircraft reached 75 in Jun-2024, and are now down to 61.

- The parked total is forecast to decline into 40s and below later this year 2025.

- System weekly seats are now up 27.3% year-on-year, with international up by 34.9%.

- IndiGo is due to receive 70 A321XLRs starting this year 2025 and 30 A350-900s from 2027.

- The airline is considering more wet-leased 787s from Norse Atlantic.

IndiGo expects a significant drop in the number of parked Neos, which will be a major factor in capacity growth

The number of IndiGo's grounded Airbus A320neo-family aircraft peaked in the 70s last year, which was a significant proportion of the Neos in its fleet. The airline has a total of 389 jet aircraft, all but two of which are narrowbodies.

However, IndiGo has moved "past the peak of [narrowbody] groundings and the groundings are on a downward trajectory", said CFO Gaurav Negi during IndiGo's recent earnings call for the Dec-2024 quarter.

Mr. Negi said the grounded aircraft total is now in the 60s, and CAPA fleet data confirms that there were 61 A320neos and A321neos listed as inactive as of 27-Jan-2025.

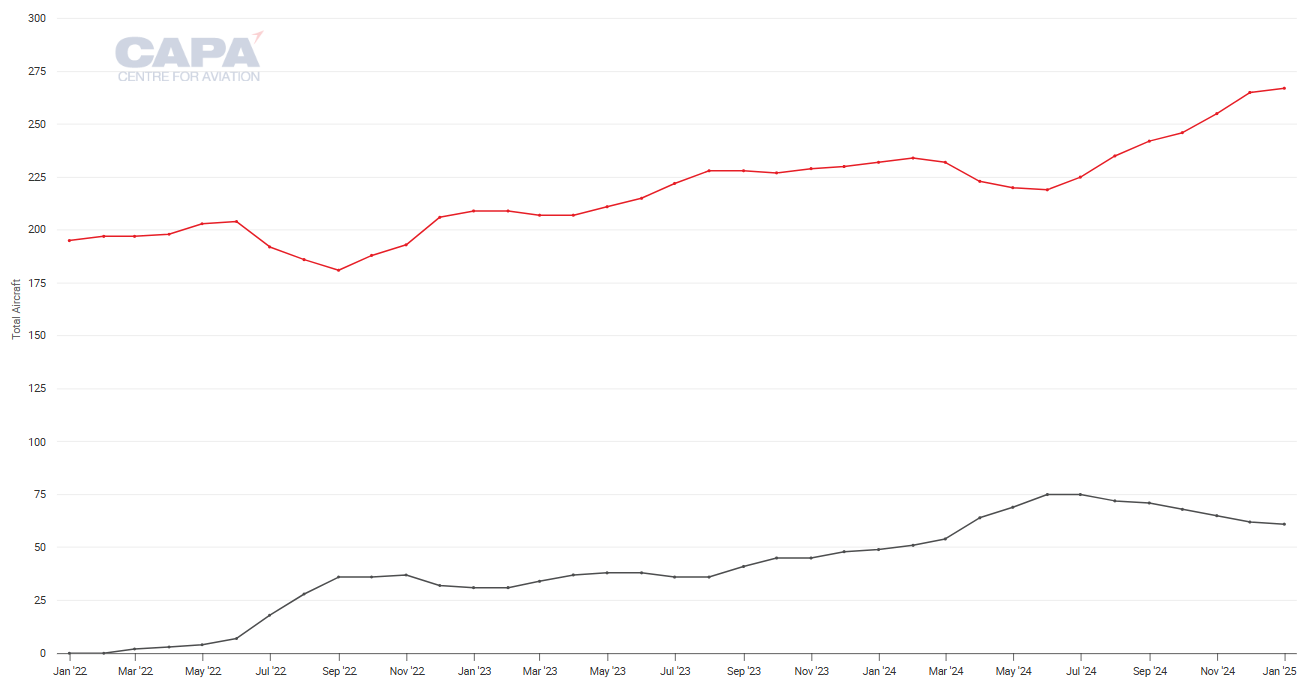

The chart below shows the number of A320neo-family aircraft in service (top line) and inactive (bottom line) since early 2022, when the aircraft availability issues began to ramp up.

It indicates that the number of inactive aircraft topped out at 75 in Jun-2024 and Jul-2024, and has been declining since.

The total in service has meanwhile been increasing at a faster rate than the decline in parked aircraft since mid-2024, accounting for the aircraft reactivations, as well as new deliveries.

IndiGo's combined A320neo and A321neo fleet status, in service (top line) vs inactive, since Jan-2022

Source: CAPA fleet database.

Based on the latest guidance from OEMs, IndiGo expects to begin its next financial year (which starts on 1-Apr-2025) with the grounded total in the 40s, and the total is predicted to drop further as the year progresses.

IndiGo inducted 33 aircraft into its fleet in the quarter ending 31-Dec-2024. Of these, 23 were from its original order book, and 10 were secured via damp leases or secondary leases.

The airline's massive delivery pipeline has certainly been helpful, as IndiGo is receiving one new Airbus narrowbody per week on average.

CEO Pieter Elbers noted that IndiGo had also demonstrated its effectiveness in "leveraging secondary market capacity" (i.e. securing more leased aircraft) during the supply chain-related disruptions of the past few years.

Because of this, the airline has been able to maintain its overall growth rate goals - it targeted an annual capacity growth rate in the "early double digits" for its fiscal year ending 31-Mar-2025, and Mr. Negi said the airline was on track to achieve this.

It should be noted that Cebu Pacific is another large Asia-Pacific LCC that has been able to obtain enough extra aircraft to maintain growth, despite the engine availability issue.

Year-on-year capacity gains have progressively strengthened, particularly in the international sector

IndiGo reported 12% year-over-year system ASK growth for the three months through 31-Dec-2024, the airline's fiscal third quarter.

IndiGo's numbers do not include scheduled operations.

Data from CAPA and OAG shows that for the week of 27-Jan-2025 system ASKs were up by 23.7% year-over-year, reflecting a significant increase that occurred through the fiscal third quarter.

Bearing in mind that the year-over-year increase was much smaller in the early part of 2024, IndiGo appears to be comfortably on course for its estimate for the full fiscal year.

The chart below highlights that international ASKs have grown more quickly than system ASKs (and therefore much more quickly than domestic ASKs).

International ASKs were up by 34.9% year-over-year for the week of 27-Jan-2025 - although the full fiscal year increase will be lower than that because the rate of growth has trended upwards through the year.

The increase was particularly sharp in the fiscal third quarter (the three months through 31-Dec-2024).

IndiGo: international capacity, as measured in weekly ASKs, from 2020

IndiGo recognises that there are more expansion opportunities in India's international market than domestic, hence its focus on the international sector.

The next chart shows that IndiGo has been steadily increasing its annual international capacity, with the increases stepping up significantly since 2016.

IndiGo: international capacity, as measured in annual ASKs, from 2012

This growth has helped IndiGo maintain its position as India's leading international airline, despite the resurgence of Air India.

IndiGo wants to advance its long haul plans, to take advantage of India's surging international demand

Until now, almost all of IndiGo's international operations have been conducted with its large fleet of narrowbodies.

The only exceptions are two Boeing 777-300ERs damp-leased from Turkish Airlines, which are used specifically for flights to Istanbul.

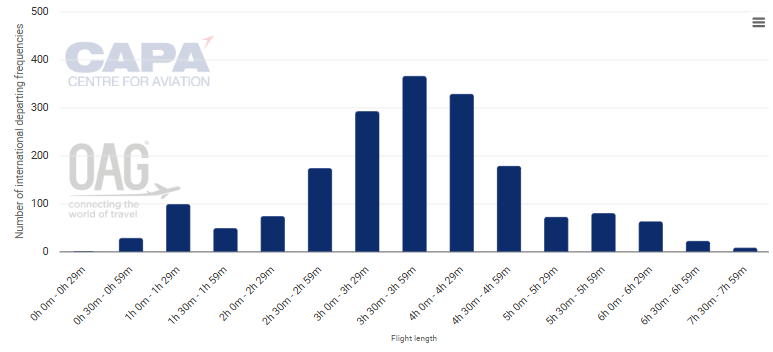

Because of its narrowbody reliance, the vast majority of the airline's international flights are less than five hours, as the chart below shows.

IndiGo's current international departing frequencies, by length of flight

This mix is likely to change in the future, as IndiGo pursues its strategy of introducing many more longer-range aircraft, both narrowbodies and widebodies.

The airline has 70 Airbus A321XLRs on order, with deliveries due to begin this year, and 30 Airbus A350-900s which are scheduled to start arriving in 2027.

Such is the allure of long haul markets, however, that IndiGo is considering how it can bring forward the introduction of additional widebodies.

"Subject to regulatory approvals[,] we are exploring interim solutions for earlier induction of long-range aircraft to our fleet through wet leases", Mr. Elbers said. He added that the airline was examining route and network opportunities for these aircraft.

In a separate statement, IndiGo also signalled that global supply chain challenges that are slowing aircraft deliveries were another reason to seek an "interim solution" for adding widebodies.

Leasing 787s would allow IndiGo to start to fulfil its European ambitions

The airline is believed to have signed a letter-of-intent to wet lease six Boeing 787-9s from Norse Atlantic. The two airlines have so far confirmed a damp lease deal for one 787, which is due to enter service in March, and said they are in discussions regarding additional contracts.

IndiGo has given no official word of which long haul routes it is pursuing. However, it is generally accepted that it has its sights set on Europe. The airline currently has no Western European destinations.

Some clues have emerged, with the airline reportedly advertising for senior staff in London, Paris and Amsterdam, and applying for slots at Amsterdam Schiphol International Airport.

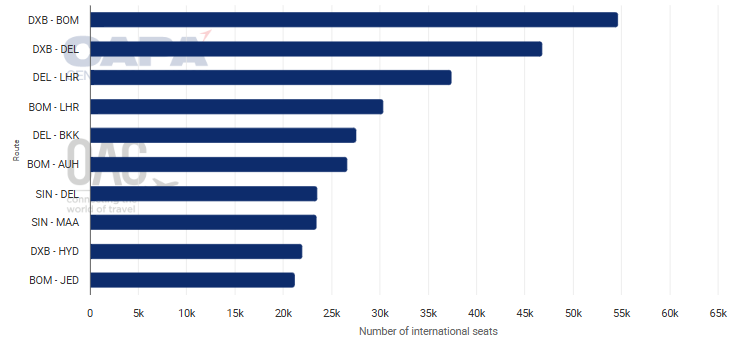

The heavily contested London market will no doubt be a top target for IndiGo. The chart below shows that routes between London and Mumbai and Delhi are the third and fourth busiest of India's international routes.

India's top 10 international routes, as measured in two-way seats for the week of 27-Jan-2025

IndiGo will face strong competition on European routes to destinations such as London and Paris, but it would still be bullish about its prospects against the full service legacy airlines already flying in that market.

All signs point to IndiGo achieving higher growth rates this year, with international again the priority

IndiGo appears primed for much higher capacity growth for its next fiscal year, which begins 1-Apr-2025.

Its fleet will be boosted by new deliveries, as well as the return of more parked aircraft. Although the supply chain and engine availability problems will persist, IndiGo appears to be past the worst of the groundings.

International capacity is likely to continue to increase at a higher rate than domestic. The addition of long haul aircraft will help, although at least for next year their numbers may not be enough to make a dramatic difference to capacity.

However, widebodies would have a much greater effect from a strategic perspective, allowing IndiGo to enter new competitive arenas.

More information may emerge soon about widebody routes and cabin products if the Norse Atlantic wet lease deal has indeed been finalised.

Despite the widebody additions, it will still be IndiGo's massive narrowbody fleet that will drive its international volume.

The airline often cites its estimate that 65% of the world's population is within a six-hour flight from an Indian airport, so there is still plenty of scope in the medium haul market.