Norse Atlantic: wet lease could turn surplus capacity into an advantage

On 6-Feb-2025 the long haul LCC Norse Atlantic Airways announced an agreement to provide one wet lease aircraft to Indigo, the largest airline in India, on long haul routes from Mar-2025.

The six-month contract is extendable up to 18 months, and the two airlines are considering further collaboration, including the supply of additional aircraft.

This is an important milestone in Norse's strategic shift to place greater emphasis on third party flying, while reducing the importance of its scheduled network.

According to CAPA - Centre for Aviation/OAG, Norse Atlantic is scheduled to operate eight routes (from Oslo, Paris CDG, Rome FCO and Athens) in summer 2025, while its subsidiary Norse Atlantic UK will fly four routes (from London Gatwick).

Across the group, the network will be one route smaller than in northern summer 2024. This suggests a lack of profitable expansion opportunities for its own operations.

ACMI expansion could turn its surplus capacity into an advantage at a time when its fleet of young Boeing 787 widebodies are just what many growth airlines are seeking.

Summary

- Norse Atlantic’s summer 2025 network will have eight routes, a reduction from nine last summer, with significant competition on seven of them.

- Norse Atlantic UK’s summer 2025 network will have four routes, with significant competition on all of them.

- Norse’s total North Atlantic seat share will be 1.5% in Jul-2025 – down from 1.7% a year earlier – but it will remain the biggest LCC in this market.

- Its scheduled capacity is projected to fall in 1H2025, but ACMI capacity growth will continue to outpace its scheduled operations.

Norse Atlantic's summer 2025 network will have eight routes,…

Norse Atlantic is to launch a new four times weekly service between Athens and Los Angeles on 3-Jun-2025. The route will be the longest trans Atlantic service in its scheduled network, and will operate until 27-Sep-2025. According to OAG/CAPA - Centre for Aviation, no other airlines operate this route.

Athens to Los Angeles will be the second new route to be launched by Norse Atlantic in northern summer 2025, after Rome-Los Angeles (to start in Apr-2025).

This will bring its scheduled network to eight routes this summer 2025: Rome to New York JFK and Los Angeles; Paris CDG to New York and LA; Athens to New York and Los Angeles; Berlin to New York, and Oslo to New York (week of 14-Jul-2025, source: CAPA - Centre for Aviation/OAG).

…a reduction from nine last summer…

Norse Atlantic's summer 2025 route total is a net reduction of one compared with the nine operated a year earlier in 2024. While there are two new routes to be launched, there are three routes from Oslo that are scheduled to be suspended this summer - Bangkok, Miami and Los Angeles.

Norse Atlantic has operated Oslo-Bangkok since the end of Oct-2023, with between four and six weekly departures. It suspended the route in Apr/May-2024 and Sep/Oct-2024, resuming in both cases, but is scheduled to discontinue it from late Apr-2025. It was the sole operator until Thai Airways entered, with twice daily departures, in Jul-2024.

It has operated Oslo-Miami 2-4 times daily since Sep-2023, with brief interruptions in early summer 2024 and early winter 2024, but it is scheduled to discontinue from late Apr-2025.

Norse Atlantic launched Oslo-Los Angeles in Aug-2022, but suspended the service in Oct-2022 before restarting it in Mar-2023.

It then suspended it once more in Oct-2023, restarted in May-2024, but ceased to operate the route in Sep-2024.

…with significant competition on seven of them

While no other airline operates Athens to Los Angeles, Norse Atlantic faces significant competition on its seven other routes scheduled for this summer.

On Rome-New York JFK, it will operate twice daily in the summer 2025 schedule, competing with ITA Airways (six times daily) and Delta Air Lines (34 times weekly). In addition, United Airlines is scheduled to operate to New York Newark four times daily.

Norse Atlantic is scheduled to operate Rome-Los Angeles 10 times weekly this summer, competing with ITA Airways 12-14 times weekly service.

On Paris CDG-New York JFK, it will operate twice daily this summer, competing with Air France (76-84 times weekly), Delta Air Lines (42 times weekly) and JetBlue Airways (twice daily). In addition, United Airlines is scheduled to operate CDG to New York Newark four times daily and Air France to Newark twice daily.

Norse Atlantic's 12 times weekly Athens-New York service will compete with Delta Air Lines' four times daily service and American Airlines' twice daily departures. In addition, United Airlines will offer 20 weekly departures from Athens to Newark, an airport pair also operated by Emirates Airline twice daily.

Norse Atlantic will serve New York JFK from Berlin Brandenburg eight times weekly this summer, in competition with Delta Air Lines' twice daily service and United Airlines' twice daily departures between Berlin and Newark.

Norse Atlantic's six times weekly Oslo-New York JFK service will compete with SAS' twice daily departures (to be launched in Mar-2025). SAS also operates Oslo-Newark 12 times weekly.

Norse Atlantic UK's summer 2025 network will have four routes…

In addition to the Norse Atlantic network, its subsidiary Norse Atlantic UK is scheduled to operate four routes, all from London Gatwick, this summer (week of 14-Jul-2025).

These are to New York JFK, Miami, Orlando International and Los Angeles, the same routes that were operated a year earlier.

All are daily services, apart from London Gatwick-Los Angeles, which is six times weekly. London Gatwick-New York JFK's frequency is halved versus Jul-2024, while frequencies are unchanged on the other three routes.

…with significant competition on all of them

Norse's twice daily London Gatwick-New York JFK service will compete with Delta Air Lines and British Airways, both also twice daily.

JetBlue Airways discontinued this airport pair at the end of Oct-2024. However, the US carrier will operate four times weekly on London Heathrow-New York JFK, an airport pair also served by British Airways (112 times weekly), Virgin Atlantic (84 times), American Airlines (56 times), and Delta Air Lines (28 times).

The London-New York city pair also includes London Heathrow-New York Newark, served 98 times weekly by United Airlines and 28 times weekly by British Airways (week of 14-Jul-2025, source: CAPA - Centre for Aviation/OAG).

On London Gatwick-Miami, Norse Atlantic (twice daily) is the only operator, but London Heathrow-Miami will also be served by Virgin Atlantic, American Airlines (both four times daily), and British Airways (twice daily).

Norse Atlantic's twice daily London Gatwick-Orlando International service will compete with British Airways' four daily departures. In addition, London Heathrow-Orlando International will be served by Virgin Atlantic (34 times weekly).

Norse Atlantic is the sole operator on London Gatwick-Los Angeles, which it serves 12 times weekly. However, the city pair also includes London Heathrow-Los Angeles, served by Virgin Atlantic, British Airways (both six times daily), American Airlines (four times daily), and United Airlines (twice daily).

Norse Atlantic's London Gatwick to Cape Town service, launched in late Oct-2024 for the winter season, has been extended into Apr-2025, but is not scheduled for the rest of the summer 2025 season.

Norse Atlantic's total North Atlantic seat share will be 1.5% in Jul-2025 - down from 1.7% a year earlier…

The total seat capacity of the Norse Atlantic brand on the North Atlantic will give it a seat share of 1.5% in the week of 14-Jul-2025 (0.9% for Norse Atlantic and 0.6% for Norse Atlantic UK).

Its capacity will be 8.6% lower than in the equivalent week of 2024, driven by a 20.6% cut in Norse Atlantic UK seat numbers.

In that week of 2024 its seat share was 1.7% (0.9% for Norse Atlantic, and 0.8% for Norse Atlantic UK).

…but it will remain the biggest LCC in this market

In spite of its cut in capacity, Norse Atlantic will remain the biggest low cost airline by seats between Europe and North America in summer 2025.

Based on schedules for the week of 14-Jul-2025, its 1.5% seat share compared with WestJet's 1.1%, JetBlue's 1/0%, French Bee's 0.8%, PLAY's 0.3%, and HiSky (Romania)'s 0.1%.

Total LCC share will be down year-on-year…

Total LCC share on the North Atlantic will be 4.9% in the week of 14-Jul-2025, which is down from 5.2% a year earlier in 2024.

PLAY is also scheduled to cut capacity (by 20.6% year-on-year), whereas WestJet and JetBlue are broadly maintaining capacity at their Jul-2024 levels.

…while immunised JV share will be up this summer

Although LCC seat share on the North Atlantic will have fallen slightly year-on-year, the share held by immunised joint ventures is scheduled to grow to 79.8% in the week of 14-Jul-2025, from 79.4% a year earlier.

This mainly reflects an increase in the share of the Delta Air Lines/Air France/KLM/Virgin Atlantic JV within SkyTeam, from 24.5% to 25.1%.

The United Airlines/Air Canada/Lufthansa/SWISS/Austrian Airlines/Brussels Airlines JV within the Star Alliance will have the biggest seat share, 28.4% (versus 28.2% a year earlier).

The American Airlines/British Airways/Iberia/Aer Lingus JV within oneworld will have 21.4% (versus 21.5%).

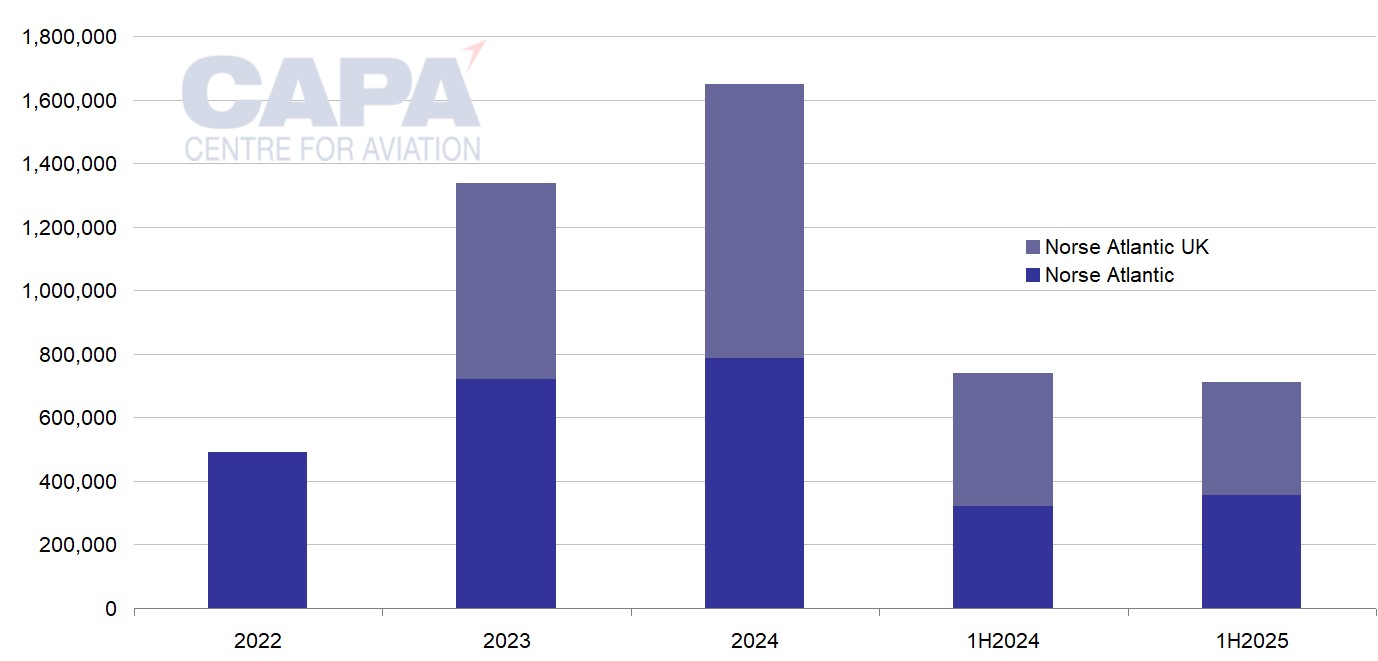

Norse Atlantic Group scheduled seat capacity grew by 21.7% in 2024

In 2024 total scheduled capacity for the Norse Atlantic Group capacity grew by 21.7% versus 2023. There was a 37.7% increase at Norse UK, while the Norwegian airline increased its seat count by 8.0% (source: CAPA - Centre for Aviation/OAG).

…but is projected to fall by 3.7% in 1H2025

In 1H2025 the group's scheduled capacity is projected to fall by 3.7% year-on-year, with a 14.2% cut at Norse UK and a growth of 9.9% by the parent airline.

Norse Atlantic Group: annual seat capacity 2022 to 2024; and 1H2024 and 1H2025

Source: CAPA - Centre for Aviation, OAG.

Total ASKs grew faster than on scheduled operations in 2024, boosted by ACMI services…

However, scheduled capacity is only part of the picture.

Norse Atlantic has been expanding its wet lease/ACMI operations for third-party airlines, which is growing more rapidly than scheduled traffic.

The group reported a 42.1% increase in ASKs in 2024 across all operations, aggregating its scheduled network and ACMI services. This was faster than ASK growth in its scheduled operations of 32.8%, according to data from CAPA - Centre for Aviation/OAG.

Across all operations, it carried 49% more passengers in 2024 than in 2023.

…which are set for further growth

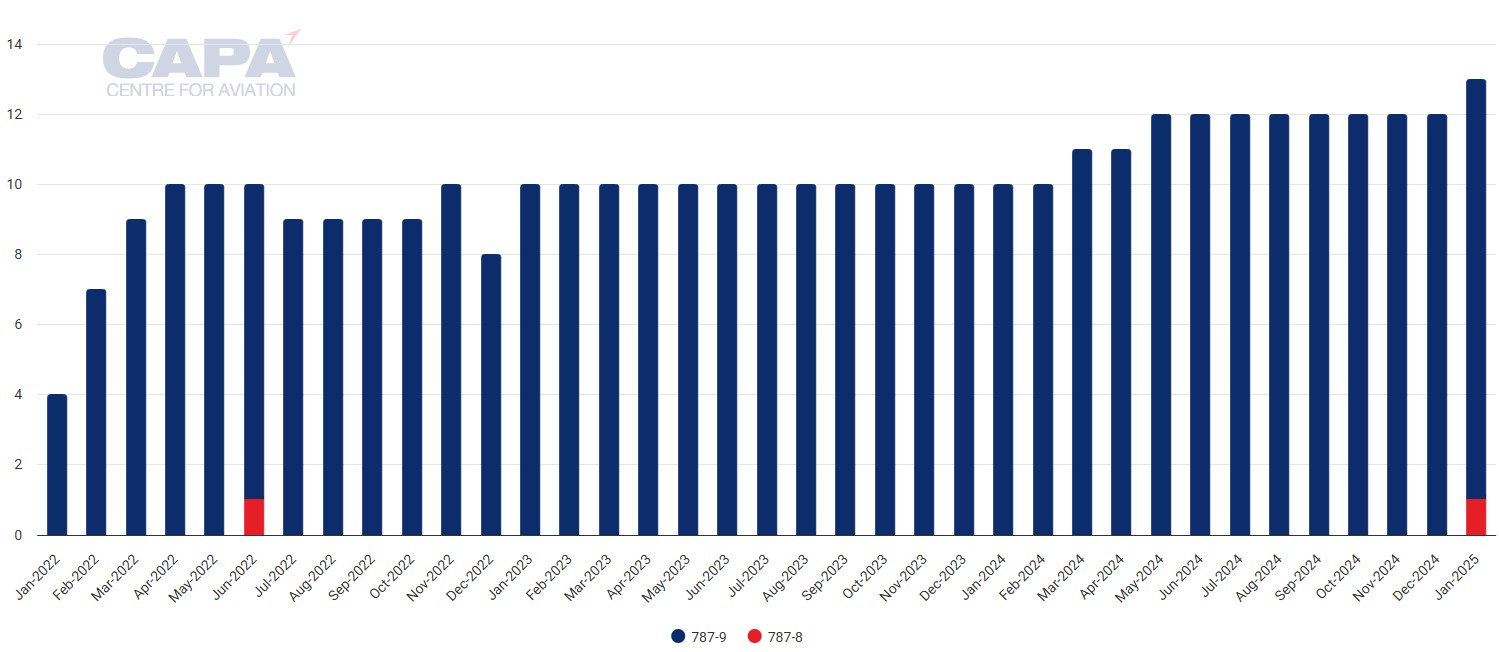

Norse Atlantic is undergoing a strategic shift to grow its third-party flying further.

In 2025, it targets four or five aircraft to be used for ACMI operations, with seven or eight on its own network.

For 2026, it plans to increase the number of ACMI aircraft to six or seven, with five or six on its own network.

The firm wet lease agreement with IndiGo has strong potential beyond the one aircraft initially contracted. In Nov-2024 Norse Atlantic announced an LOI with a 'reputable international airline' for the wet lease of six aircraft.

Norse Atlantic Airways Group: fleet numbers at month end, Jan-2022 to Jan-2025

Source: CAPA - Centre for Aviation Fleet Database.

ACMI expansion could turn surplus capacity into an advantage

Norse Atlantic's strategic shift follows a period of losses and financial challenge for the airline.

This reflects a struggle to generate sufficient demand to fill all of its aircraft through its scheduled network - particularly in the northern winter season.

It has started to improve its commercial performance and cost efficiency, but the expansion in its ACMI work goes further to improve the utilisation of its fleet, while also decreasing its revenue risk.

Moreover, ambitious third-party airlines are anxious to meet their capacity needs at a time when supply chain challenges are delaying the supply of new aircraft from the OEMs.

Norse Atlantic has a young fleet (average age 6.6 years) of sought-after Boeing 787 widebodies.

Against this backdrop, Norse Atlantic's ACMI expansion offers a route to turn its surplus capacity into an asset with significant potential.