China-India aviation market back in the spotlight as flights resumption beckons

Direct flights between India and mainland China may be allowed to resume soon, thanks to an agreement between their respective governments, although the market has changed dramatically since such flights were last operated five years ago.

India and China are the two most populous nations on the planet, but there were relatively few direct flights between them before the COVID-19 pandemic - even though interest had been picking up with the entry of IndiGo into this market.

The state of competition before these flights were suspended gives some insight into how airlines will respond when the market is reopened.

However, demand patterns are quite different now - the Chinese international market is weaker, whereas the Indian international market is much stronger. And some of the airlines are in very different growth phases now.

Summary

- An agreement in principle has been reached, although the details are yet to be decided.

- China Southern and China Eastern were the market leaders before flights were suspended.

- IndiGo joined Air India in the India-China market in 2019, and captured a 16.8% seat share.

- India-China passenger market ranked only 303rd in the world in weekly seats in Jan-2020.

- India’s international market has recovered faster than China’s, and Indian carriers are targeting international growth.

While timing is yet to be confirmed, India and China have agreed that flights can finally restart

Passenger flights between the two countries stopped in 2020 when the COVID-19 pandemic began, as they did in many international markets.

Both governments were relatively slow to relax COVID-19-related border restrictions, and the situation was complicated by extreme political tension between India and China related to border clashes.

So there have been essentially no scheduled services between India and mainland China since early 2020 - although flights between India and the Special Administrative Region of Hong Kong have resumed. Direct cargo flights have also been operating.

Relations between the respective governments appear to be improving, and on 27-Jan-2025 they signalled that an agreement in principle had been reached to resume flights.

The announcement from the Indian government came following a visit by India's foreign minister to China. Despite the agreement in principle, there are no details yet on timing.

"The relevant technical authorities on the two sides will meet and negotiate an updated framework for this purpose at an early date," according to an Indian government statement.

Chinese airlines dominated this market, although a second Indian airline entered the picture in 2019

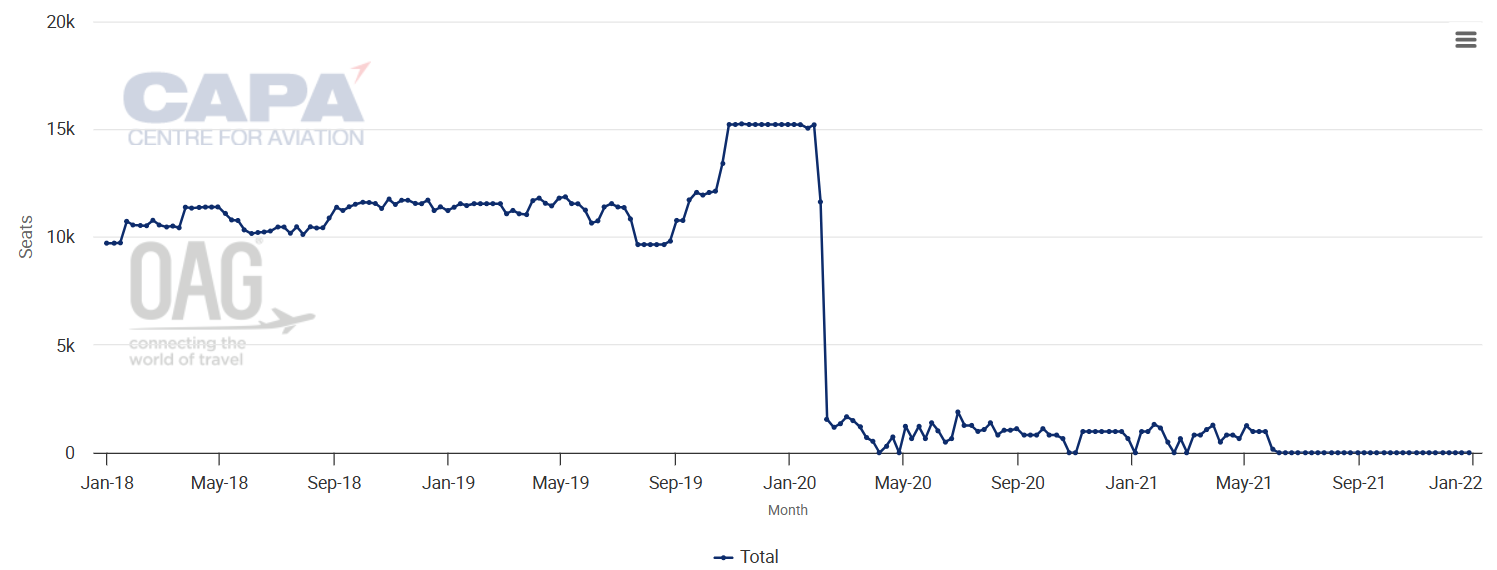

The chart below illustrates the India-mainland China market before the pandemic.

Capacity remained fairly stable through 2018 and most of 2019, until a spike in Nov-2019 coinciding with the entry of IndiGo in the market.

There were 80-90 roundtrips per week for most of 2019, peaking at 103 in Nov-2019.

Capacity dropped precipitously from mid-Feb-2020, then there were sporadic flights for a few months, then essentially nothing from Jul-2021.

Capacity between mainland China and India 2018-2021, as measured in weekly one-way seats

Source: CAPA - Centre for Aviation and OAG.

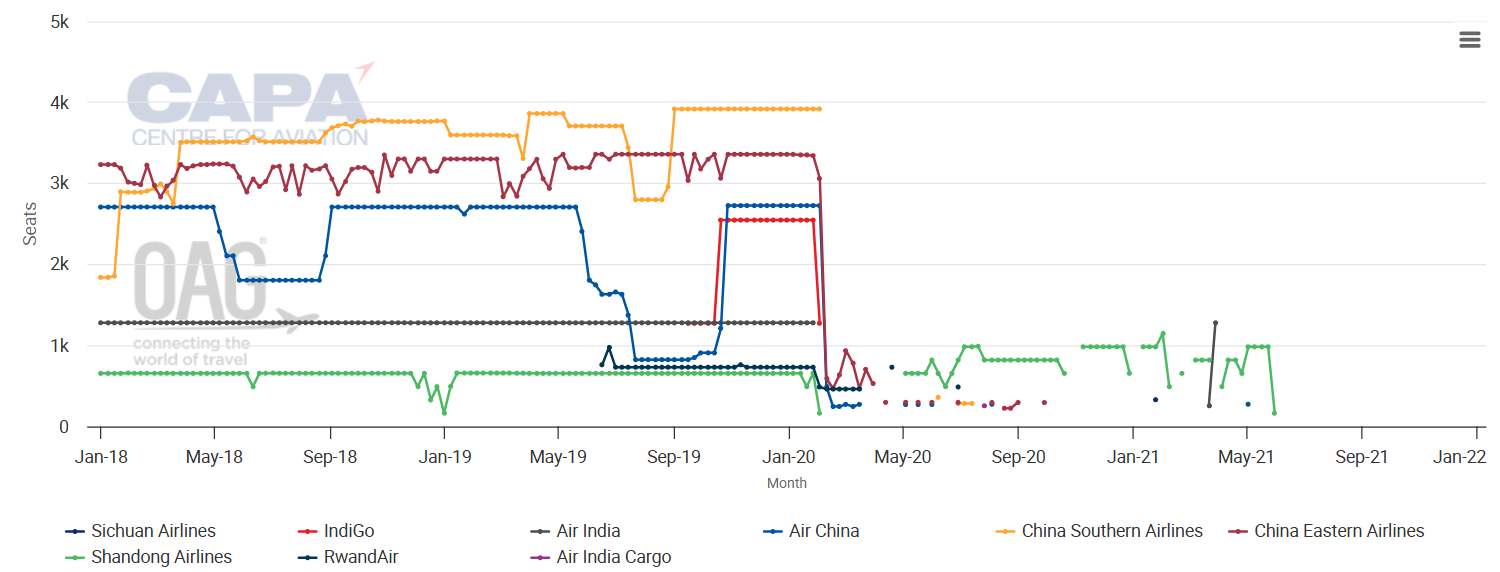

The next chart shows the breakdown by airline.

For the week of 28-Jan-2019 China Southern was the market leader, with 31.1% of weekly seats. China Eastern was next, with 28.6%, followed by Air China, with 23.5%, Air India with 11.1%, and Shandong Airlines with 5.7%.

The picture had changed somewhat a year later, just before the pandemic hit.

IndiGo began flights to China in Sep-2019, with a Delhi-Chengdu route, followed by Kolkata-Guangzhou in Oct-2019.

So for the week of 27-Jan-2020, the incumbents' share of seats all shrank versus the same week in 2019, and the newcomer IndiGo accounted for 16.8%.

Capacity between mainland China and India 2018-2021, by operator, as measured in weekly one-way seats

Source: CAPA - Centre for Aviation and OAG.

Traffic flows between India and China were relatively underdeveloped

Direct airline capacity in this market was low before the pandemic, compared to other international markets.

Data from CAPA - Centre for Aviation and OAG shows that the India-mainland China market was ranked 303rd in terms of weekly seats between countries for the week of 27-Jan-2020.

However, this was significantly better than the same week in 2019, when it ranked 374th.

Obviously there was also indirect traffic between India and China, which is not captured in the capacity data.

This indirect traffic would have been amplified in the absence of direct flights since the pandemic. And it will likely continue to grow, as many third-country airlines are prioritising both the Indian and Chinese markets.

The balance between inbound and outbound demand will likely shift when direct flights resume between India and mainland China.

Chinese outbound traffic was a leading source of visitors for many countries before the pandemic, but it has remained slow to recover.

On the other hand, the Indian international market has surged past pre-pandemic levels, and outbound flows from India have been strong.

Indian carriers are poised to play a larger role in the India-China market in the future

Given the sheer size of both markets, it is hard to imagine that there is not plenty of scope for more service - particularly when China outbound recovers more.

As with many of India's international markets, these routes have been dominated by foreign airlines in the past. But there may well be a greater shift towards Indian carriers as they expand.

A resurgent Air India has placed hundreds of aircraft orders and plans to grow its international network, and these plans will undoubtedly include mainland China.

IndiGo also has a massive order book, and is prioritising international growth. The arrival of longer-range narrowbodies and widebodies will give it more options in markets like mainland China.

The stronger recovery in Indian versus Chinese outbound traffic is also likely to favour the Indian carriers.

But even if the Indian carriers do increase their percentage, Chinese airlines will no doubt still have the dominant market share, due to the much higher number of Chinese airlines with international networks.