Canadian and Mexican airlines brace for the latest round of US tariff threats

During the past few weeks, looming threats by the US of tariffs on goods in two of the country's most important air travel markets - Canada and Mexico - have already resulted in some airlines working to de-risk their operations from the potential economic unrest.

Now the administration of President Trump has once again delivered a firm date of 4-Mar-2025 for tariffs to begin.

It is yet to be revealed whether charges will ultimately take effect, or remain a negotiating tactic by the US, but either outcome could impact air travel demand in those key markets.

Summary

- Air Canada makes some capacity adjustments, even before the latest round of tariff threats from the US, while WestJet sees a drop-off in transborder travel.

- Volaris believes that some hesitancy it is seeing in transborder travel is temporary.

- Could fallout from the tariff overhang eventually affect consumer sentiment for air travel?

- Will geopolitics create significant headwinds for airlines as 2025 unfolds?

Air Canada and WestJet are poised to adjust if tariffs shift demand patterns

Earlier in 2025 the US also declared its intention to impose 25% tariffs on Canada and Mexico, only to decide to give the countries a reprieve after they agreed to address the administration's concerns about border security and drug trafficking.

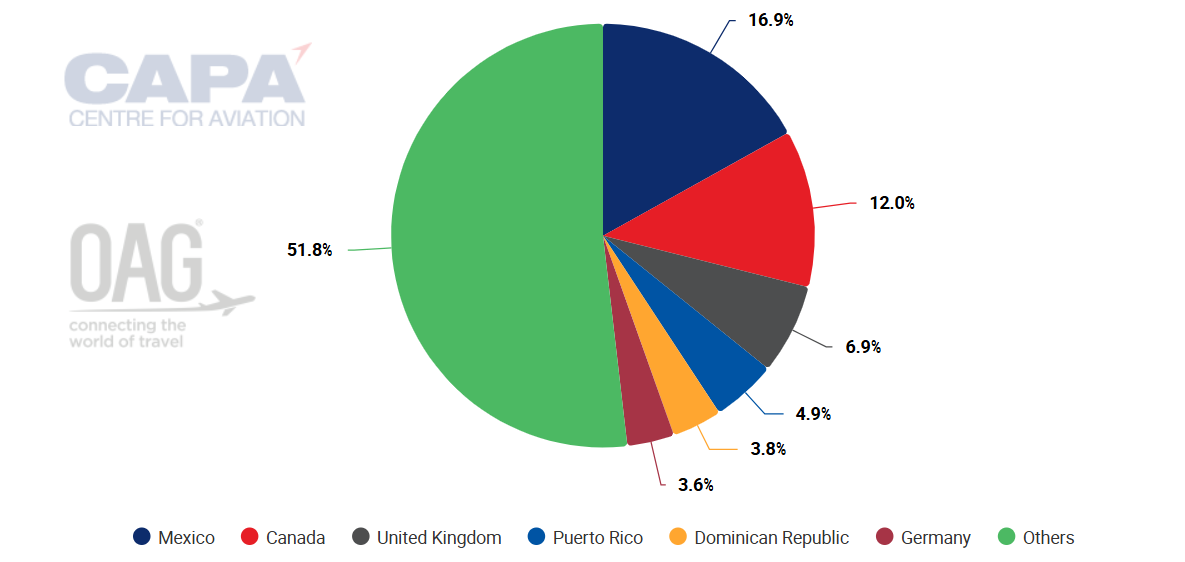

The Canadian and Mexican transborder air travel markets are two of the most important in the world, representing nearly 30% of departing seats from the US, as of early Mar-2025.

US: departing seats by country, as of early Mar-2025

Source: CAPA - Centre for Aviation and OAG.

During that pause some of the largest airlines in those markets either took steps to mitigate continuing fallout over the threats, or noted some softness as a result of the US' negotiating tactics.

During a recent earnings discussion before the 04-Mar-2025 deadline, Air Canada Executive Vice President, Revenue & Network Planning Mark Galardo concluded that it was premature to discuss the impact of potential or actual tariffs, or possible retaliations.

But Air Canada is making some proactive moves in Mar-2025, pulling back some capacity in selected US leisure markets, including Florida, Las Vegas and Arizona.

In early Feb-2025 the Canadian Prime Minister, Justin Trudeau, encouraged his country's citizens to "choose Canada", even if that meant changing their summer vacation plans to travel domestically instead.

The US is an extremely important market for Air Canada. Data from CAPA - Centre for Aviation and OAG for early Mar-2025 show the airline has a 42% share of two-way seats between the two countries.

Top airlines operating between the US and Canada, measured by two-way seat share, as of early Mar-2025

| Rank | Airline | Seat Share |

| 1 | Air Canada | 41.5% |

| 2 | WestJet | 17.0% |

| 3 | United Airlines | 11.2% |

| 4 | Porter Airlines | 9.2% |

| 5 | Delta Air Lines | 6.8% |

| 6 | American Airlines | 6.8% |

Source: CAPA - Centre for Aviation and OAG.

Mr Galardo remarked Air Canada was still seeing encouraging signs regarding demand in the airline's US sixth freedom markets.

That traffic is a strategic element in Air Canada's long haul strategy, as it funnels US passengers from smaller markets through its hubs to its long haul destinations.

See the related CAPA - Centre for Aviation report: Air Canada remains steadfast in the strength of its sixth freedom potential

WestJet CEO Alexis von Hoensbroech told Canadian news outlet CTV News on 13-Feb-2025 that the airline had seen a drop off of Canadians travelling to the US since the tariff announcements, on an order of magnitude of approximately 25%, and the decrease "has stayed on that level since then".

"If we see this materialise as a trend that stays[,] then we will probably start to think of potentially reducing some capacity to the US[,] but we have not reached this point", noting at that time that it was broadly two-to-three weeks from the initial tariff announcement. "But we will react if the demand pattern of our guests actually changes."

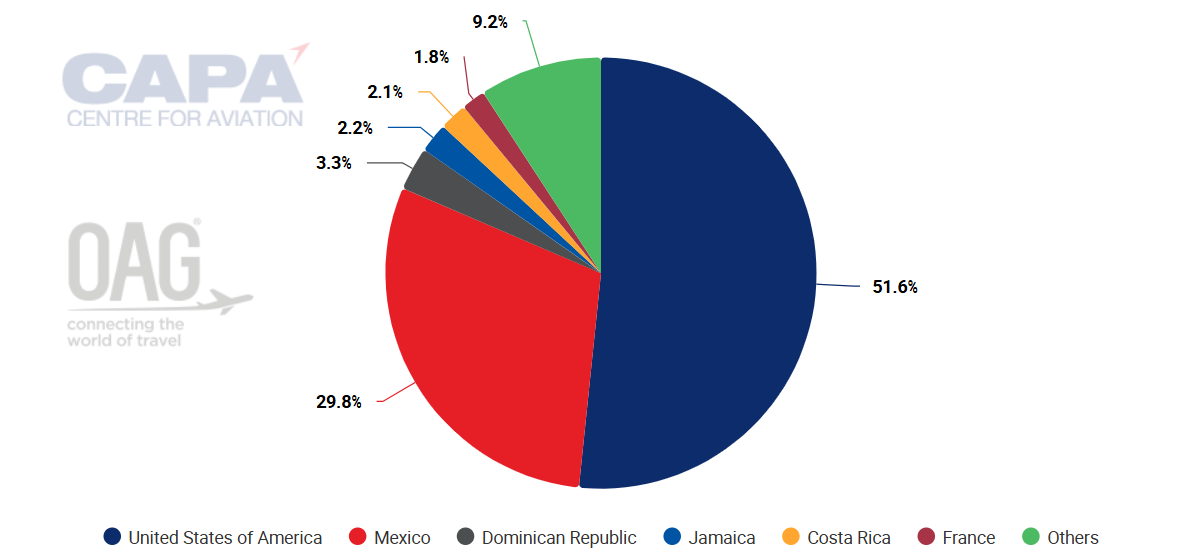

The US represents 52% of WestJet's international departing seats, according to CAPA - Centre for Aviation and OAG.

WestJet: international departing seats by country market, as of early Mar-2025

Source: CAPA - Centre for Aviation and OAG.

Volaris implements some measures to combat a certain level of travel hesitancy in transborder markets

The Mexican ultra-low cost carrier Volaris is monitoring the situation on the US border, and its executives are seeing a "certain hesitancy" for travel in the transborder market since the Nov-2024 presidential election in the US, but the airline expects that trend to stabilise in the near term.

As with its importance to Air Canada, the US transborder plays a major role in Volaris' overall strategy, and the airline is the third largest airline in the market, measured by two-way seats.

Top airlines operating between the US and Mexico, measured by two-way seat share, as of early Mar-2025

| Rank | Airline | Seat Share |

| 1 | American Airlines | 19.8% |

| 2 | United Airlines | 16.2% |

| 3 | Volaris | 14.1% |

| 4 | Delta Air Lines | 12.5% |

| 5 | Aeromexico | 9.3% |

| 6 | Viva | 6.0% |

| 7 | Southwest Airlines | 6.0% |

| 8 | Alaska Airlines | 5.8% |

| 9 | JetBlue Airways | 3.2% |

| 10 | Spirit Airlines | 2.5% |

Source: CAPA - Centre for Aviation and OAG.

Volaris has been working to expand its transborder market presence since the US restored Mexico's safety rating in Sep-2023, after a two-year downgrade under which Mexican airlines were prohibited from adding new routes, changing aircraft gauge, or adding new frequencies.

To mitigate some of the hesitancy of the visiting friends and relatives (VFR) traffic that Volaris targets on its transborder routes, Volaris has adjusted its 1Q2025 capacity and modulated base fares to sustain load factors.

The airline's executives noted that the skittishness in transborder travel applies to the low season, highlighting robust bookings for holiday periods.

"We expect that this is a temporary market condition, and we will continue monitoring demand patterns closely[,] just as we did at the start of the first Trump Administration", said Holger Blankenstein, Volaris' EVP Commercial & Operations.

Backlash to tariffs will ensue, which could affect consumer appetite for air travel

According to The Washington Post, Mr Trudeau has vowed to impose retaliatory tariffs on up to USD107 billion worth of US goods, and Mexican officials have also developed plans to strike back against tariffs if they materialise.

Aside from direct impacts, the ongoing threats of tariffs entail knock-on effects that could also trickle down to air travel as consumer sentiment drops due to the uncertainty over the potential fallout from the continued tariff overhang, and spending potentially stalling.

Given air travel's discretionary nature, hesitation to book flights could ensue.

Will the ripple effects of tariff threats spread beyond the Americas?

While supply chain issues continue to create headwinds for airlines as they work to balance capacity deployment with demand, geopolitical and economic forces could also coalesce to possibly add another uncertainty as the year 2025 unfolds.

Canadian and Mexican airlines are already testing the waters to determine how to mitigate potential fallout from tariff threats.

Is there a possibility other airlines will need to follow suit?