Codeshare deals boost Australia-India aviation market, and there's strong potential for more service

A new codeshare deal between Air India and Virgin Australia highlights the rising interest in the small - but growing - market between these two countries, Australia and India.

The unilateral codeshare does not directly boost capacity in this market, but it does add another important layer to existing services that should help increase demand, at least in one direction.

The India-Australia nonstop market is far less developed than others. However, it is on an upward trajectory, and has surpassed pre-pandemic levels.

It is also a safe bet that there is plenty more potential for growth in this market, and it is likely to factor into Indian airline expansion plans.

Summary

- Codeshare agreement gives Air India connections to 16 Australasian destinations.

- Virgin Australia will still rely on Singapore Airlines for access to Indian market.

- Air India has a 61.2% share of nonstop capacity in India-Australia market.

- Qantas and IndiGo have progressively expanded their code share arrangement.

- Connecting traffic on SIA and other airlines is a major factor in this market.

Codeshare gives Air India expanded access to the Australian market via Melbourne and Sydney

The codeshare agreement announced on 17-Feb-2025 allows Air India to put its code on Virgin Australia flights to 15 points in Australia and one in New Zealand.

Travellers can connect to the Virgin Australia routes from Air India's daily flights from Delhi to Melbourne, and Delhi to Sydney, using Boeing 787s. Air India does not mention its Mumbai-Melbourne route in the codeshare announcement - presumably as it will be suspended soon, after the codeshare begins (see below).

Virgin Australia does not have any flights to India (or any widebody or long haul flights at all, for that matter).

Australian destinations covered under the codeshare are a mix of major cities and tourist destinations. They include Adelaide, Ballina/Byron Bay, Brisbane, Cairns, Canberra, Darwin, Gold Coast, Hamilton Island, Hobart, Launceston, Melbourne, Newcastle, Perth, Sunshine Coast and Sydney.

Queenstown is the sole New Zealand destination covered by the codeshare, as that is the only New Zealand service offered by Virgin Australia.

Virgin Australia is reliant on SIA interline for India market, but this may be expanded to codesharing

Because the agreement is unilateral, Virgin Australia cannot put its code on the Air India flights between Australia and India.

Virgin Australia does sell interline tickets to eight destinations in India via another partner: Singapore Airlines. However, these must be booked through the Australian airline's contact centre or a travel agent, and are not available online.

Virgin Australia says it is working with Indian authorities to be able to put its code on Singapore Airlines flights to India.

Air India still has a greater share of Australia-India nonstop capacity than Qantas

India's international market has been booming since COVID-19 pandemic-era restrictions were lifted, and Australian and Indian airlines are looking to tap into the high demand.

There are only two airlines flying nonstop between Australia and India - Air India and Qantas.

Qantas offers flights between Melbourne and Delhi, and between Sydney and Bengaluru. So the airlines overlap on the Melbourne-Delhi nonstop route.

In addition to its two Delhi routes, Air India also offers a Mumbai-Melbourne route, which began in Dec-2023. However, it is suspending the three weekly flights between 30-Mar-2025 and 13-Sep-2025 - primarily due to aircraft availability, related to its widebody retrofit programme.

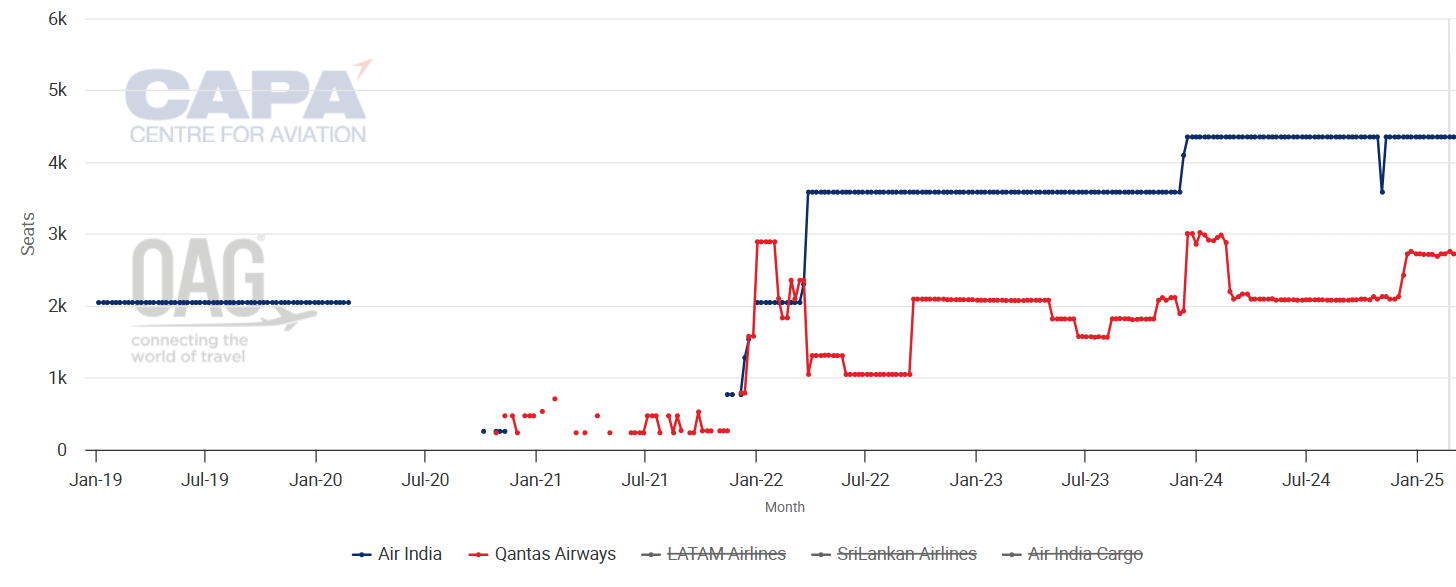

The chart below shows that Air India has a 61.2% share of capacity for the week of 24-Feb-2025, versus 38.8% for Qantas.

The Air India share will slip a little after the Mumbai-Melbourne suspension, but it will still be comfortably ahead of Qantas in this market.

India-Australia one-way capacity by airline, as measured in weekly seats, from 2019

Source: CAPA - Centre for Aviation and OAG.

Qantas, meanwhile, codeshares with the other major Indian airline, IndiGo. The airlines began this relationship in 2022, and have progressively strengthened it - most recently in May-2024.

The relationship is different from the Virgin Australia/Air India partnership.

Qantas customers can connect to IndiGo's domestic network via its Indian gateways, and the two airlines also connect in Singapore, which both airlines serve.

Qantas has often talked about the potential it sees for growth in India, and this was one of the markets that benefitted from Qantas pulling out of the mainland China market in Jul-2024.

The nonstop traffic between Australia and India is overshadowed by connecting traffic in this market

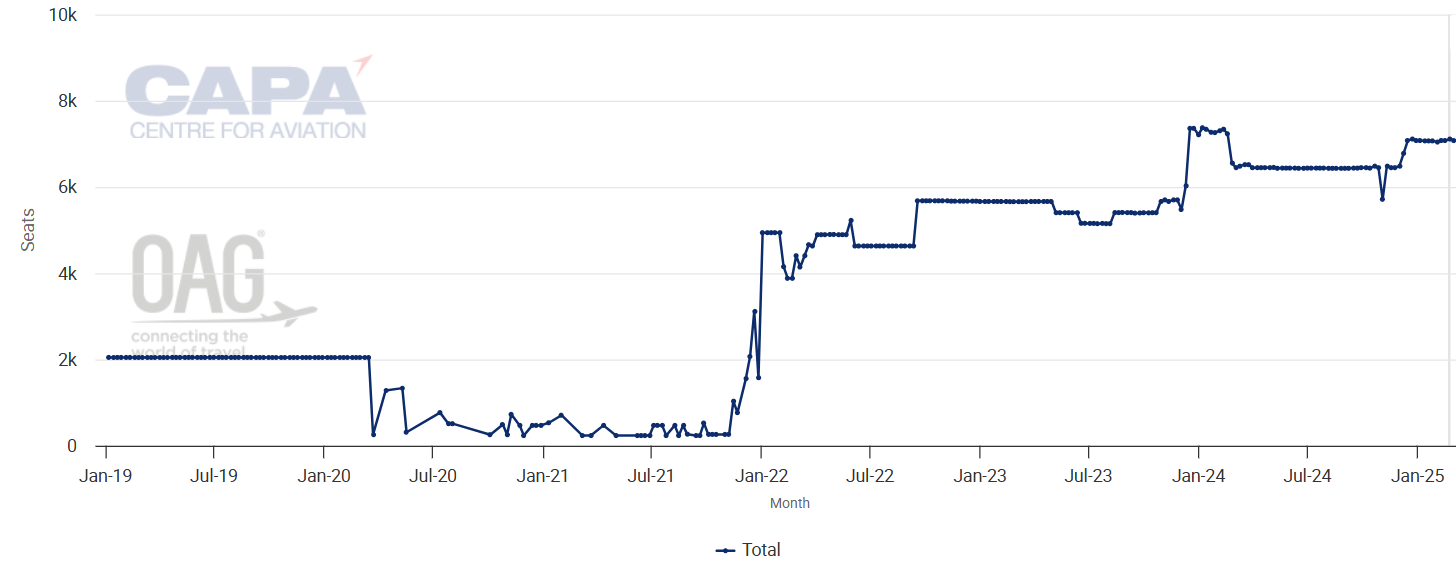

The chart below shows how overall nonstop seat capacity in the Australia-India market quickly rose above pre-pandemic levels in late 2021, helped by Qantas entering this market in Nov-2021 after an absence of nearly a decade.

Overall capacity between Australia and India, as measured in one-way weekly seats, from 2019

Source: CAPA - Centre for Aviation and OAG.

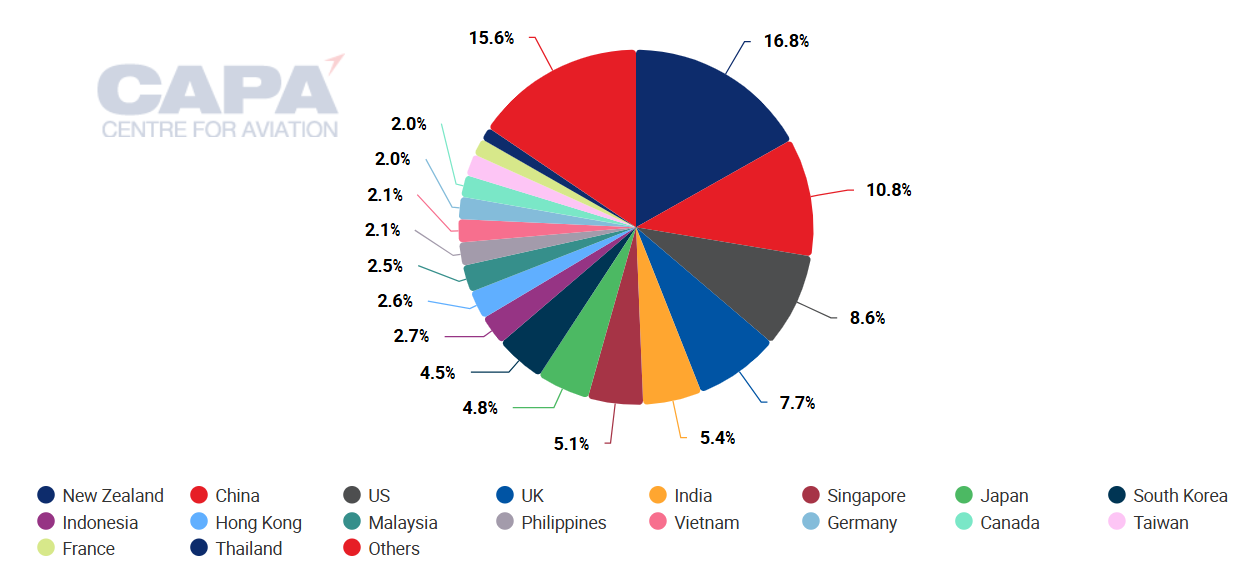

The next chart below depicts Australia's visitor numbers by market in 2024.

India is ranked fifth, with a 5.4% share of total visitors. This was about the same as in 2023, but down from 8.2% in 2022 when some major markets, such as mainland China, were very low.

The post-pandemic share is higher than the 4.2% in 2019, when India was the seventh-largest visitor market for Australia.

Australia's visitor arrivals by market in 2024

CAPA and Australian Bureau of Statistics.

The previous chart covers all arrivals, so it includes connecting traffic between Australia and India.

In contrast, the next chart below compares Australia's overseas markets based on nonstop seat capacity. India is ranked 16th on this chart - much lower than on the overall visitors chart above.

The difference in rankings between the charts reflects the very large volume of one-stop traffic between these countries.

Australia's main markets, as ranked by nonstop departing seat capacity for the week of 17-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

Singapore Airlines is very active in this connecting market, as is Malaysia Airlines, and other Asian airlines (to a lesser extent).

Some airlines like VietJet Air are looking to boost their networks in both Australia and India, and will increasingly be players in connecting traffic.

Air India, IndiGo widebody expansion plans will probably include Australia at some point

The sheer size of the Indian market, as well as growing international demand, make it an enticing destination for many overseas-based airlines.

Indian airlines are aiming to capture a larger share of India's international market, which has historically been dominated by foreign airlines.

Both Air India and IndiGo have massive order books, and Australia is likely to be part of their network expansion plans as they grow their widebody fleets.

Even if nonstop services increase markedly, partnerships will still be needed for Australian and Indian airlines, as Australia and India have extensive domestic networks beyond the main gateways.

Virgin Australia in particular is heavily reliant on its partners to access markets like India, as it has no widebodies of its own. It plans to wet lease widebodies from Qatar Airways, but these are earmarked for routes to Doha.

This makes it important for Virgin Australia to gain code share authority on Singapore Airlines flights to India.

Although the nonstop market between Australia and India is relatively small at the moment, it is likely to grow in the future - with Indian airlines probably maintaining a higher share.

Qantas also has widebody orders in the pipeline, but Virgin Australia is further away from being able to add its own India flights.