Aircraft Interiors – industry development summary: Jan/Feb-2025

This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA - Centre for Aviation Aircraft Interiors Database and CAPA - Centre for Aviation News.

This edition covers Jan-2025 and Feb-2025 and features:

-

Starlink's rapid growth and the changing IFC market;

- Region Focus: North America;

-

Latest global interior updates.

Summary

- This regular CAPA - Centre for Aviation report provides a summary of major developments in the aircraft interiors sector, supported by data from the CAPA - Centre for Aviation Aircraft Interiors Database and CAPA - Centre for Aviation News.

- This edition covers Jan-2025 and Feb-2025.

- Starlink's rapid growth and the changing IFC market.

- Region Focus: North America.

- Latest global interior updates.

Starlink's rapid growth and the changing IFC market

Although Starlink's first airline installation only went live two years ago, the SpaceX subsidiary continues to win contracts at an unprecedented pace. There is little doubt that Starlink has impacted the satellite industry, as well as the IFC market.

SAS Scandinavian Airlines recently became the latest major airline to commit its entire fleet of approximately 100 aircraft to the Starlink network.

According to the CAPA - Centre for Aviation Aircraft Interiors Database, SAS' IFC service is currently powered by two vendors: older installations by Panasonic Avionics, whereas newer ones feature Viasat.

It should be noted that SAS' Viasat installation activities came to a halt post-COVID, as many of the airline's A320neos remain without any connectivity. This is expected to stop being the case with the new Starlink deal.

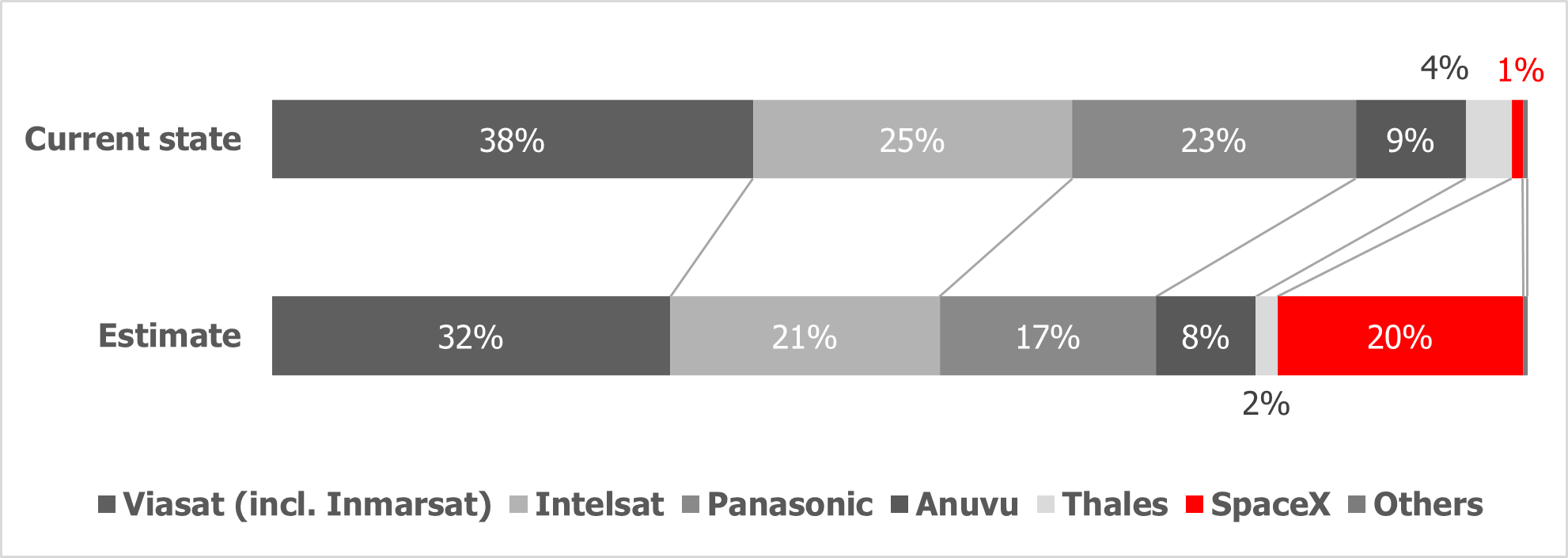

Based on the CAPA - Centre for Aviation Aircraft Interiors Database, an estimation of the global IFC landscape was conducted - should all publicly announced Starlink commitments come to fruition.

Currently, Viasat leads the passenger aircraft IFC space, with 38% market share.

Viasat is followed by Intelsat, Panasonic Avionics Corporation and Anuvu.

Assuming all public Starlink commitments are completed today, CAPA - Centre for Aviation estimates that Starlink will occupy 20% of the market.

This easily elevates Starlink to the top three IFC providers worldwide.

Estimated IFC market share for current passenger aircraft, should all Starlink commitments get realised today

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Starlink is eager to seize this momentum by rapidly ramping up installation activities.

The Riga-based airline airBaltic successfully conducted a Starlink IFC-equipped test flight on its A220 aircraft recently. The airline is expected to install IFC on the rest of its aircraft, and become the first airline to offer Starlink Internet in Europe.

Turning over to the propeller space, ATR successfully carried out a Starlink IFC test flight, which led to EASA certifying Starlink for ATR 72-500 and -600 models.

Air New Zealand will be the first airline to offer Starlink IFC on an ATR. The airline expects to begin trials on its ATR 72-600 domestic services later this year 2025.

Qatar Airways' Starlink installation plan is ahead of schedule, recently passing the 30-aircraft mark.

In a news release the airline boasted a 9.5 hour installation time per aircraft - an impressive feat, considering the multi-day downtime for legacy solutions. After completing the 777 fleet, installation on the airline's A350 is expected to begin in northern summer 2025.

United Airlines' Starlink rollout plan is also moving forward.

The first Starlink-equipped Embraer E175 aircraft was originally scheduled to enter service by the end of 2025, but United recently accelerated this timeline to 2Q2025. Completion of all two-cabin regional aircraft is expected by late 2025, when the first Starlink-equipped mainline aircraft will also enter service.

To defend their market positions, legacy IFC providers are proactively expanding their offerings and tapping into new technologies.

For months, Viasat has been busy integrating its newly acquired Inmarsat network. Firm plans had been scarce about how exactly Viasat planned to allow its combined client list to tap into the merged network. A recent announcement finally offered some clarity.

In Feb-2025 Viasat announced that STARLUX Airlines would replace its legacy Inmarsat GX Aviation hardware with Viasat's GM-40. This confirms a Jul-2024 RunwayGirlNetwork report stating that Viasat had "no firm plans" to support GX Aviation clients requiring interoperability with the upcoming Viasat-3 services. For STARLUX to tap into both GX Aviation and Viasat's network, it will have to replace its GX Aviation hardware.

Over the coming months, we should expect other GX Aviation clients to make similar hardware replacement plans.

Intelsat is also taking action.

Intelsat's most popular IFC product, 2Ku, is run on GEO networks. The OEM is eager to unlock the potential of LEO.

To tap into the best of both worlds, Intelsat rolled out its Electronically Steered Array (ESA) solution. The steerable nature of the product means the system is multi-orbit, and capable of connecting with both GEO and LEO networks.

Various existing Intelsat customers have signed up for the new ESA solution: Alaska Airlines, Air Canada and American Airlines have selected it for their regional aircraft, and Japan Airlines has selected the solution to support its 737 MAX connectivity.

ESA entered service in 4Q2024. The CAPA - Centre for Aviation Aircraft Interiors Database currently tracks close to 40 CRJs and ERJs operated for Air Canada Express and American Eagle that have been upgraded to Intelsat ESA and re-entered service.

Intelsat's ESA installation is expected to pick up pace after obtaining STC for narrowbody and widebody aircraft types.

Anuvu is another legacy IFC player developing its multi-orbit strategy.

In Dec 2024 the IFC provider launched NuView-A and B - the first two of up to eight LEO satellites that will make up the 'Anuvu Constellation'. Anuvu has also been helping existing clients upgrade speed and bandwidth on current equipment with its "Dedicated Space" offering.

Anuvu has been successfully diversifying its customer base since 2022, when it lost its largest customer, Southwest Airlines, to Viasat for the LCC's linefit activities. Anuvu has since added its equipment to over 100 Turkish Airlines narrowbodies.

Including Air France and Norwegian, non-Southwest aircraft have doubled their share of the Anuvu fleet from around 15% to more than 30% in the past decade.

New entrants are also making inroads.

China Electronics Technology Group is among the latest to roll out a Ka-band solution.

The COMAC C909 (formerly named ARJ21) is now capable of offering this Chinese-made IFC solution. The CAPA - Centre for Aviation Aircraft Interiors Database currently shows around one dozen Air China C909 linefitted with the system.

Meanwhile, Hughes Network Systems recently expanded its deal with Delta Air Lines (in the next section CAPA will be deep-diving into Delta's shifting IFC strategy as part of its region focus).

Region Focus: North America

In this issue of the CAPA - Centre for Aviation Aircraft Interiors report CAPA would like to check in on the progress of various major interior programmes undertaken by US airlines over recent years.

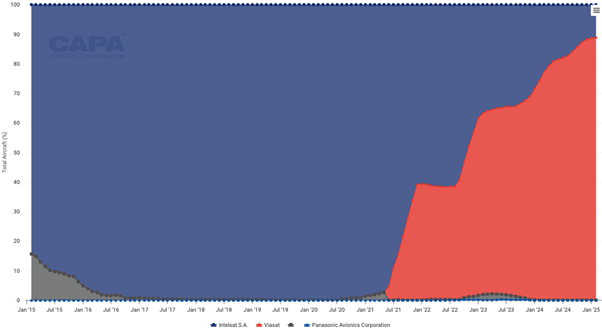

It has been four years since Delta Air Lines pivoted from its longtime IFC provider Intelsat and made a deal with Viasat. This agreement was followed by further announcements, the most notable of which saw Delta introduce free WiFi for all signed-in guests, regardless of travel class.

Fast track to today, around 90% of Delta mainline aircraft now provide Viasat's IFC system. This monumental rip-and-replace effort involved over 860 aircraft. Aside from the Boeing 717, the CAPA - Centre for Aviation Aircraft Interiors Database shows only a handful of A220s, A350s and 757s, pending Viasat transitions.

This programme has just seen its latest twist.

Hughes Network Systems disclosed in late Feb-2025 that it had secured a linefit contract for future Delta A350 and A321neos.

This is a major expansion to the existing deal covering Delta's 717 and regional jets. It has not been disclosed whether Hughes will be directly interfacing with Delta or acting as a Managed Service Provider for the Airbus HBCplus programme.

More unclear is Delta's master plan for IFC vendor split, as Hughes was assumed to be Delta's regional IFC provider while Viasat handled mainline. The latest news appends that balance.

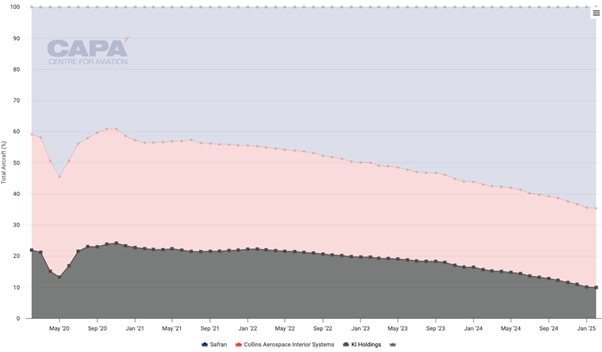

Delta Air Lines: aircraft in service, IFC provider share, from 2015

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Regardless, Delta's continuous investment to support free Wifi, alongside Starlink's entry, has evidently ignited a domino effect in the airline industry, influencing internet pricing decisions across the world.

United Airlines hopped on the bandwagon when it committed its entire fleet to Starlink's WiFi and decided to follow Starlink's requirement in allowing free access.

Delta and United are also leading the US airline industry in seat-retrofit activities.

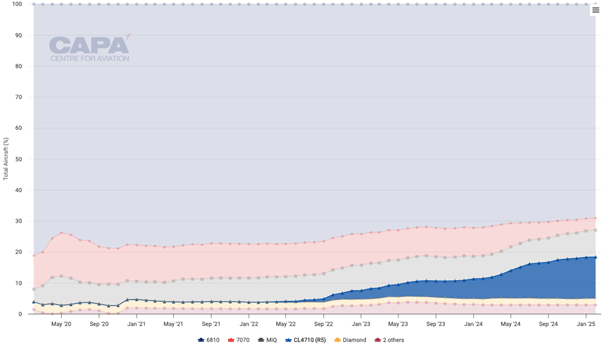

In 2022 Delta debuted new first class seating on its first A321neo. The RECARO R5 seats, heavily customised by Factorydesign, feature privacy wings and a 13" IFE screen.

In addition to linefitting the seats on factory-new A321neo, Delta has also been busy retrofitting the new seats on existing 737s.

According to the CAPA - Centre for Aviation Aircraft Interiors Database, within just two years the seat is now featured on more than 100 aircraft. This number will increase with the seat's introduction on the Boeing 757 and remaining Boeing 737s.

Delta Air Lines: narrowbody business class seat model share in service, from 2020

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

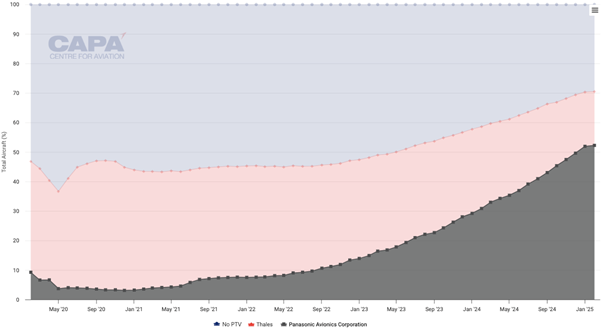

United has also been busy with its narrowbody retrofit programme: 'United Next'.

Since 2021 the airline has received new aircraft with seats featuring seatback screens, additional PED features, and improved design. The airline has been retrofitting next generation screens to existing narrowbodies while replacing seats for some, to offer a consistent experience.

United has made significant progress since the plan started. According to the CAPA - Centre for Aviation Aircraft Interiors Database, over 70% of United narrowbodies in service now offer seatback screens - up from less than 50% pre-COVID.

Moreover, around half of all United narrowbodies offer the latest Panasonic IFE solution.

United Airlines: narrowbody IFE manufacturer share in service, from 2020

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

United Next was also paired with plans to upgrade Thales IFC to Viasat systems. However, with the more recent Starlink announcements, the Viasat upgrade plans are all but certain to end soon. Recent Viasat upgrades are expected to return to hangar and undergo retrofits again.

Lastly, the United Next program allows the airline to rid itself of the infamous Koito (now KI Industries) seats. Share of United narrowbodies with Koito seats has now fallen from above 20% pre-COVID to around 10%. This figure is expected to further decline as United Next progresses.

United Airlines in-service narrowbody business class seat model share

Source: CAPA - Centre for Aviation Aircraft Interiors Database.

Not to let United and Delta steal all the thunder - other US airlines have been busy making their own seating announcements.

In Dec-2024 JetBlue Airways finally confirmed plans to add 2-2 domestic first class seats to its monoclass aircraft, which make up around 80% of the JetBlue fleet in service. The seat product will take up cabin space currently occupied by its 'Even More' extra legroom seats.

JetBlue joins a list of US low cost and ultra-low cost carriers aiming to capture the premium travel trend.

As previously covered by CAPA - Centre for Aviation, Frontier Airlines is planning to introduce a domestic first class seat in late 2025.

Meanwhile, Spirit Airlines has revamped its 'Big Front Seat' from simply a seat selection option to 'Go Big' - a dedicated fare type with all the benefits of first class. Both ULCCs also rolled out fare types allowing blocked middle seats.

Southwest Airlines also shocked the industry when it abandoned a decades-long signature open seating policy, and pivoted to allocated seating. The airline will also add an extra legroom product while introducing the new Recaro R2 seats.

Other latest global interior news

OEM

- AVIC delivers first shipment of widebody economy seats

North America

- Aeromexico to retrofit 787 with Viasat IFC.

- Air Canada Express and American Eagle begin installation of Intelsat ESA IFC.

- Delta to add Thales FlytEDGE for select future deliveries from 2026.

- United Airlines accelerates Starlink rollout plan.

Asia Pacific

- EVA Air unveils new premium economy seat on its latest 787-9.

- Qantas Airways to upgrade cabins for 42 Boeing 737-800s.

Europe and Middle East

- Emirates Airline plans 'doored' business suites for its Boeing 777X.

- Jazeera Airways to shift to 180-seat Airbus A320 fleet configuration by 3Q2025.

- KLM Cityhopper firms plans to densify Embraer E2 fleet.

- Lufthansa to offer free messaging on long haul flights.

- SAS taps Starlink to power IFC for entire fleet from late 2025.