Macau International Airport rolls the dice as it looks to further expansion to 15mppa

Macau International Airport rolls the dice as it looks to further expansion to 15mppaAnalysis

Macau, a special administrative region of China situated in the Greater Bay economic region (and close to both Hong Kong and the Chinese mainland), would probably have a bigger regional airport hub were it not for the presence of Hong Kong, to which it is connected by a bridge.

But Macau offers what is the probably the world's biggest draw to visitors in the form of its gambling facilities - it is the largest venue, as measured by gambling revenues.

While the Chinese continue to travel in droves (and they are now doing again, after the COVID-19 pandemic), Macau's single-sector economy will continue to thrive, and despite the improving offers being made by the Philippines and Indonesia.

In the longer term its future is tied up with the progression of the Greater Bay area, the world's largest economic region, and how Macau fits into the vision for its further development.

Summary

- Macau is the most densely urbanised and populated region in the world.

- It is a UNESCO World Heritage site that is also the leading gambling centre globally.

- It is an innate part of the economy, and the Chinese are the biggest gamblers.

- A single sector economy is not a good idea.

- Tourist numbers growing before the pandemic... and has picked up the reins again as the chief driver of air transport business.

- There are 8.5 million air passengers anticipated in 2025.

- Hub operation only partially developed ... with a local operator having small fleet and no long haul aircraft.

- Total seat capacity back on track, but with limited low cost and alliance airline flights.

- Reclamation of land has begun to expand the airport.

- Future prospects will also be determined by where the airport fits in the greater scheme of things.

The most densely urbanised and populated region in the world

In this, the third in an occasional series that focuses on airports that rarely make the news but have something to say for themselves (the previous two were Punta del Este in Uruguay and Casablanca in Morocco), attention turns to Macau. Like Hong Kong, it is a 'Special Administrative Region' (SAR) of the Peoples Republic of China, having previously been a Portuguese colony.

With a population of more than 700,000 people and a land area of 32.9sqkm (12.7sqmi), it is the most densely urbanised and populated region in the world, and two thirds of the total land area is built on land reclaimed from the sea.

Following the handover from Portugal to China in 1999, Macau became an SAR, maintaining separate governing and economic systems from those of mainland China under the principle of "one country, two systems".

A UNESCO World Heritage site that is also the leading gambling centre globally

At one and the same time, the unique blend of Portuguese and Chinese architecture in the city's historic centre has conferred upon Macau its designation as a 'UNESCO World Heritage Site', and its gambling industry is seven times larger than that of Las Vegas. The city has one of the highest GDPs per capita, (USD69,400), and GDPs per capita by purchasing power parity, in the world.

It has a high Human Development Index (HDI) of 0.925, as calculated by the Government of Macau, placing it in the 23rd rank in the world (Hong Kong is fourth). Just behind Austria and Slovenia, and ahead of Japan. The HDI is a statistical composite index of life expectancy, education, and per capita income indicators.

Macau's economy - worth USD54 billion in 2024 - leans heavily on casino gaming and tourism.

It is the world's 83rd-largest economy, but while Macau has one of the highest per capita GDPs, the territory also has a high level of wealth disparity, which is offset by handouts from the gambling business.

Although Macau has other tourist attractions, like golf courses and theme parks, that gambling industry is the largest in the world, generating over USD24 billion in annual revenues. Taxes from gambling revenues, which can be over 60% of GDP, fund a robust welfare system, and an annual cash payment to Macau's citizens.

The regional economy is heavily reliant on casino gaming, and the vast majority of government funding (79.6% of total tax revenue) comes from gaming. Local taxes on personal income, residential property, and retail sales range from non-existent to negligible.

The Chinese are the biggest gamblers

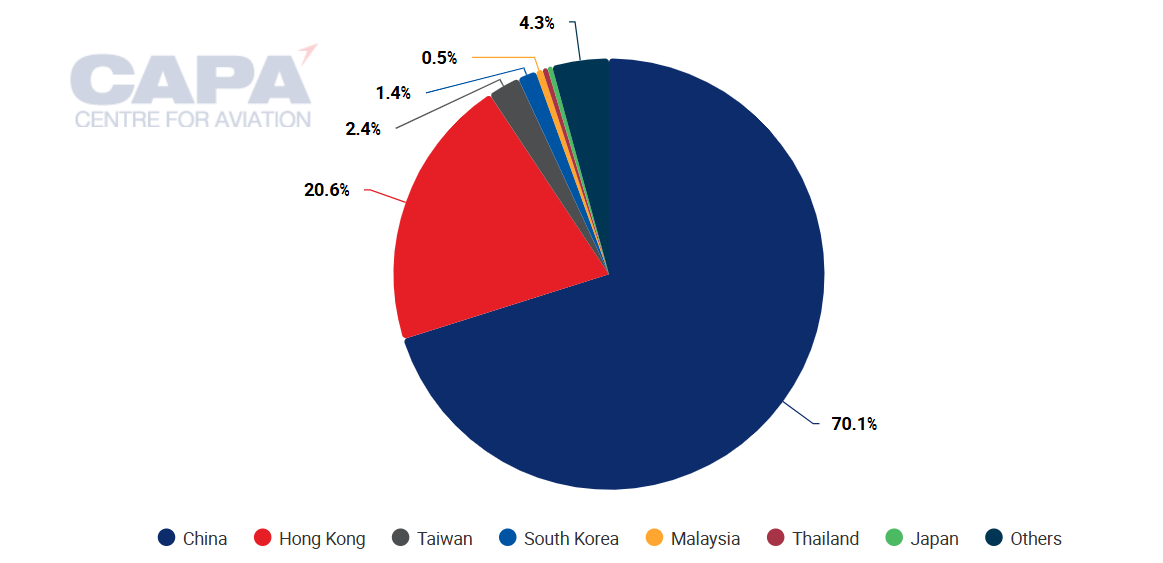

The largest number of casino patrons by far is tourists from mainland China - making up 70% of all visitors.

Macau visitor arrivals by country, 2024

Source: CAPA - Centre for Aviation and DSEC.

Casino gaming is illegal in both the Chinese mainland and Hong Kong, granting Macau a legal monopoly on the industry in China.

But revenue from Chinese 'high rollers' has been falling, and by as much as 10% further in 2019, even before the COVID-19 pandemic, prompted by economic uncertainty, and by alternative sources (such as the Philippines with its 'City of Dreams' casino in Manila).

A single sector economy is not a good idea

That must be of concern to the authorities, because export-oriented manufacturing, which previously contributed to a much larger share of economic output - as much as 36.9% of GDP in 1985 - had fallen to less than 1% by 2017.

Macau's shift to an economic model entirely dependent on gaming caused concern over its overexposure to a single sector, prompting the regional government to attempt rediversifying its economy in recent years (having previously had a non-interventionist role in the economy).

Due to a lack of available land for farming, agriculture is not significant in the economy. Food is exclusively imported to Macau, and almost all foreign goods are transshipped through Hong Kong. That makes it an expensive place to visit in its own right - a Southeast Asian version of Norway and Iceland.

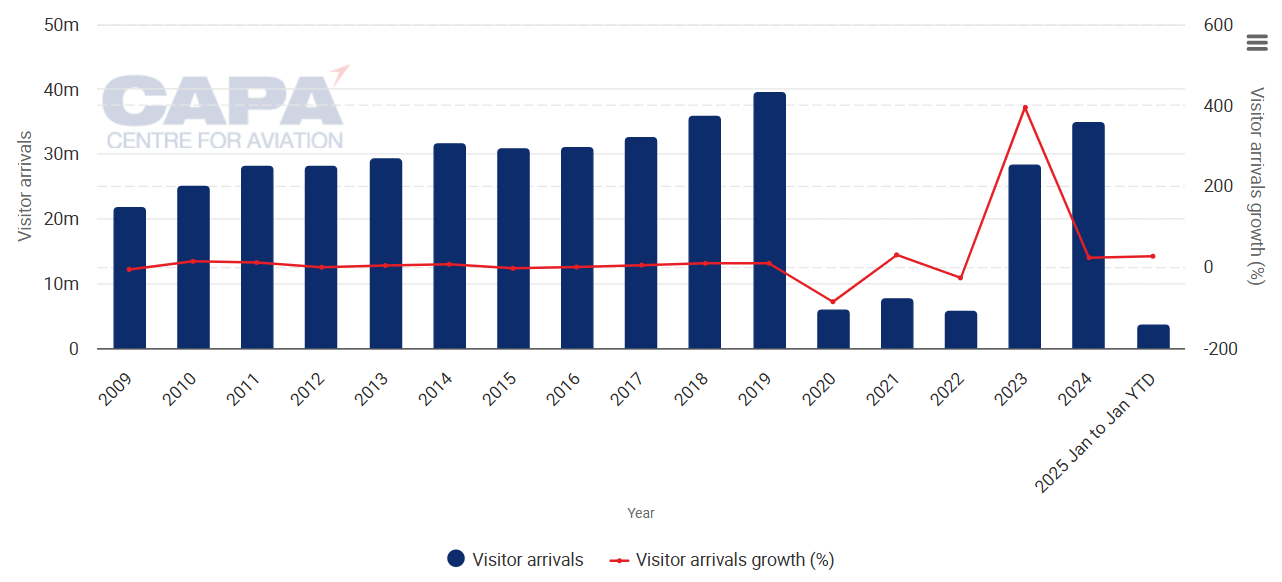

Tourist numbers growing before the COVID-19 pandemic

Despite that, tourist numbers rose almost year-on-year in the decade to 2019, with a blip in 2015, and had increased by over 10% in 2019.

Macau: annual tourism - visitor numbers and arrivals growth, from 2009 to 2025

Source: CAPA - Centre for Aviation and DSEC.

Following the three bad years of 2020-2022 there has been a strong recovery in those numbers, and it is possible that the 2019 figure of 39.4 million can be reached again in 2025, with a 27.4% growth figure achieved in Jan-2025.

Chinese tourists have returned in big numbers. In 2024 the ratio of Chinese tourists was the same as it was in 2019, at 70%-71%.

However, looking at the statistics in more detail, the ratio of Chinese tourists had been growing year-on-year until 2019, when it fell by a couple of percentage points compared to 2018.

Throughout the COVID-19 pandemic that ratio was as high as 91.4% though - quite the opposite to most other Southeast Asian nations and territories, where Chinese visitor numbers plummeted.

An innate part of the economy

So it seems that Chinese gamblers are an innate part of the Macau economy now, and if they were to disappear for any reason that economy would be in serious trouble.

Having said that, Macau's Statistics and Census Service reported that in Jan-2025 while tourist arrivals from mainland China had increased by 33.8%, compared to the previous year. The largest increases (42.2% and 54.6%) came from the Philippines and Indonesia respectively, even if the actual totals were far smaller than that of China.

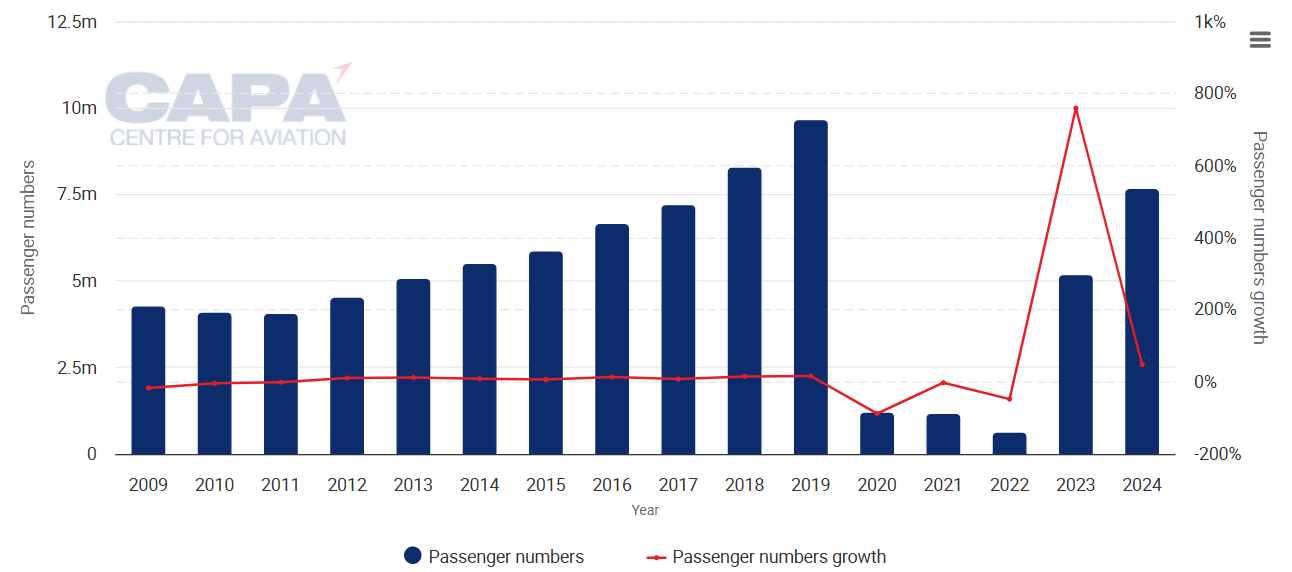

Turning to the passenger traffic statistics, belatedly recovering from COVID-19 (after a problematic three years, during which passenger traffic numbers fell from 9.6 million in 2019 to 600,000 in 2022), Macau then experienced passenger traffic growth of +759.7% in 2023; but then down to 48.3% in 2024, and a total that is -20.5% down on the 2019 figure (which was a record).

So, passenger numbers grew back at almost twice the rate of tourist numbers in 2023, but then slipped below the 2023 increase in tourists in 2024.

Tourism has picked up the reins again as the chief driver of air transport business

The only logical explanation is that the passenger total increase in 2023 was driven by post pandemic VFR (visiting friends and relatives) needs, and immediately dropped away in 2024, leaving tourism again as the principal driver.

Hong Kong witnessed the reverse of that situation, with the tourism increase hugely outstripping that of passenger numbers (albeit from an almost zero base in the case of tourism in Hong Kong).

Macau International Airport: annual traffic, passenger numbers/growth, 2009-2024

Source: CAPA - Centre for Aviation and Macau International Airport reports.

There are 8.5 million passengers anticipated in 2025

Macau International Airport expects now to handle 8.5 million passengers in 2025, which is an 11.8% projected year-on-year increase.

It also expects to handle 113,000 tonnes of cargo in 2025, up 4.5%, and 65,000 aircraft movements, up 8.4%.

The all-time high total is 9.6 million in 2019, and that was close to its design limit of 10 million per year, with a processing capacity of up to 2,300 passengers per hour.

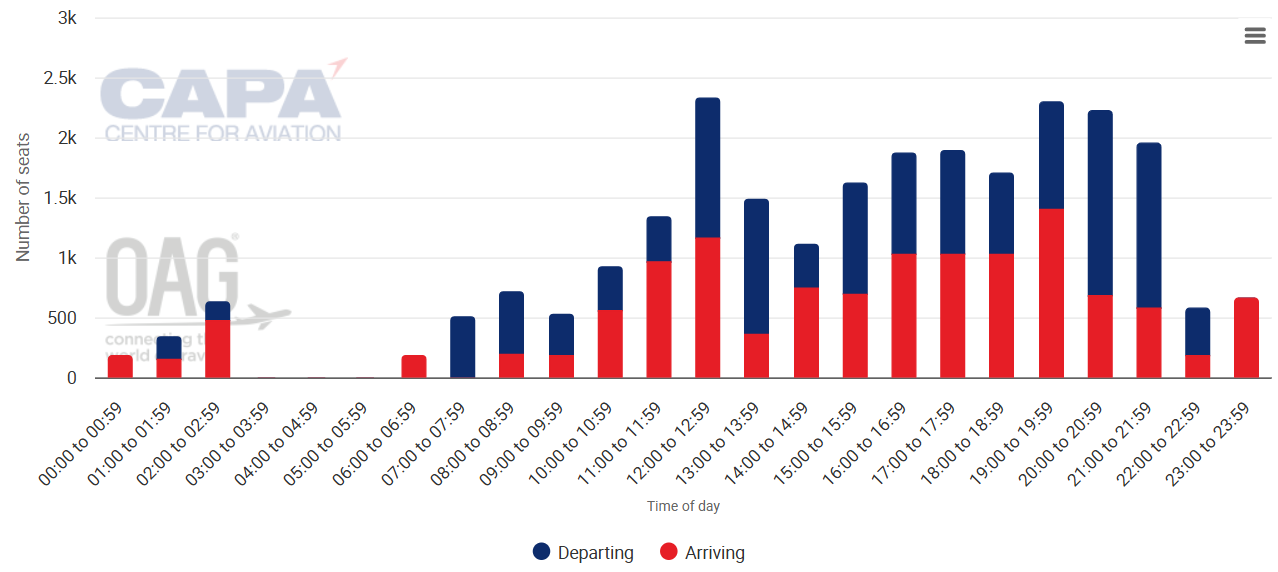

There is no formal night curfew, but there appears to be a voluntary agreement not to operate in or out between the hours of 0300 and 0600.

The chart below is of departing and arriving seat capacity for Tuesday 04-Mar-2025.

Each day has a similar profile.

Macau International Airport: total system seats per hour, for 15-Feb-2024

Source: CAPA - Centre for Aviation and OAG.

Hub operation only partially developed

That profile, and the evident equilibrium between arriving and departing seats, also suggest that a major hub operation could be in play. And there are two long runways, each of over 3,000m x 45m to support such an operation.

But that is not the case, at least to nothing like the same degree as at Hong Kong.

Both the airport and the flag carrier airline, Air Macau - which has 45.7% of total seat capacity in week commencing 03-Mar-2025 - exist primarily to support critical commerce and tourism to Macau, and to facilitate domestic and foreign journeys for residents.

The main exception to that rule is that - since opening, the airport has been a common transfer point for people travelling between mainland China and Taiwan, as well as a passenger hub for destinations in mainland China.

Some comparison could be made with Copa Airlines at Panama and Icelandair at Reykjavik in Europe. In both cases, those airlines have built extensive hub operations out of smaller O&D demands.

Small fleet and no long haul aircraft

But Air Macau's fleet is a small one, one of 21 Airbus A320 and A321 models, and contains no long haul aircraft.

In comparison Cathay Pacific, based at Hong Kong, has 176 aircraft in total, including 107 long haul types and another 51 of them on order.

The vast majority of flights (87%) are in the category of up to four hours.

And neither Panama City nor Reykjavik has anything like the giant Hong Kong hub in their own backyard.

So, while Macau can, and does, offer mid-sized regional hub functionality within a prescribed area (as seen in the route map below), that is all that it is likely to do in the immediate future.

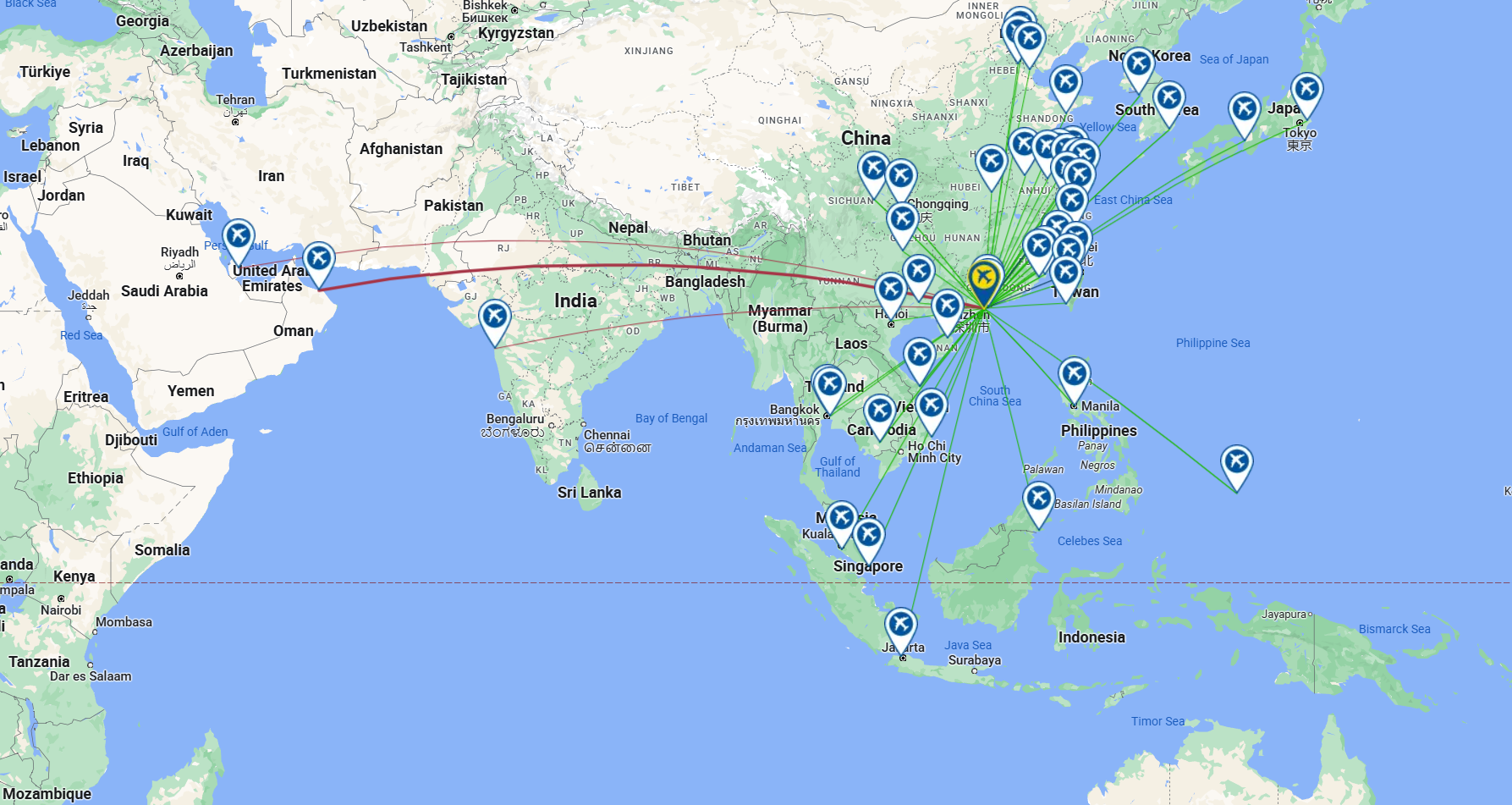

Macau International Airport: network map for the week commencing 24-Feb-2025

Source: CAPA - Centre for Aviation and OAG.

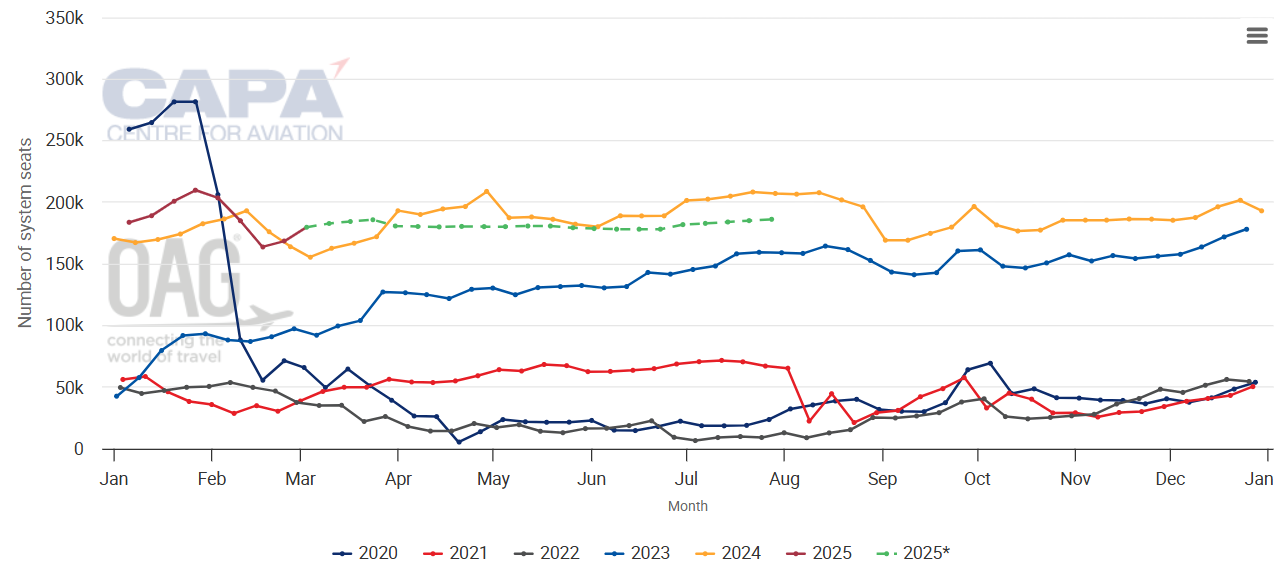

Total seat capacity back on track

As of the week commencing 03-Mar-2025, Macau's total seat capacity is marginally ahead of where it was in 2024, thus putting it at the highest level since 2019.

The projection is that it will continue to increase throughout the forthcoming months, and at the very least keep par with 2024.

Macau International Airport: weekly total system seat capacity, from 2020

Source: CAPA - Centre for Aviation and OAG.

* The 2025 values are at least partly predictive up to 6 months from 03-Mar-2025 and may be subject to change.

The Macau International Airport Company (MIAC) expects twice weekly service connecting Macau International Airport to Cheongju to commence in Apr-2025, followed by the launch of a service connecting the airport to Ho Chi Minh City in Jul-2025. Air Macau last operated the Macau-Cheongju route in Jul/Aug-2016.

Furthermore, MIAC representatives are engaged in discussions with AirAsia, Qatar Airways, Emirates Airline and Turkish Airlines regarding plans to launch services connecting Macau International Airport to new destinations. At present, the airport is served by 27 airlines, operating to 41 destinations.

Limited low cost and alliance airline flights

Macau has a similarly low profile as Hong Kong where low cost carriers (LCCs) are concerned. They account for only 17.8% of seat capacity, compared to 21.1% at Hong Kong.

So, one way that Macau might differentiate itself from Hong Kong is by increasing that LCC ratio.

But then, to what end?

Las Vegas' Harry Reid airport's LCC capacity ratio right now is 66.7%, which is considerably higher than many of its peers in the US, but that domestic market, oriented especially towards cheap 'in and out' flights from the west coast in particular, is quite different from that of Macau. High rollers in that part of the world may well prefer their aerial comforts.

So while Macau's chief attraction remains gambling, there may be no need for additional budget services.

If a lack of budget airline services is not a weakness, then a low presence by alliance airlines is more of one, since gamblers alone can come from anywhere in the world.

Presently, 74% of capacity is on unaligned airlines and the oneworld alliance has no presence at all.

Reclamation of land has begun to expand the airport

The airport was constructed on reclaimed land, and (according to the CAPA - Centre for Aviation Airport Construction Database in Nov-2024) works to reclaim 129.6ha for its expansion have begun.

Reclaimed land will be used to expand the apron area, install additional aircraft parking stands, and establish a rapid exit taxiway, supporting efforts to increase its capacity to up to 15 million passengers per annum by 2040. Reclamation works are expected to be completed by 2030.

Future prospects will also be determined by where the airport fits in the greater scheme of things

Macau Airport's future prospects are not solely based on its own performance and that of the SAR.

Hong Kong, Macau, and the Guangdong province are collectively known as the Greater Bay Economic Region. All are connected by a bridge - the Hong Kong-Zhuhai-Macau Bridge, which is the world's longest.

It is the largest and most populated urban area in the world, with a total population of approximately 86 million people, which is more than the population of Germany.

This megalopolis consists of nine cities and the two special administrative regions. It is envisaged by Chinese government planners as an integrated economic area, aimed at taking a leading role globally by 2035.

How much of a part Macau will play in all this is uncertain. It could conceivably become the region's 'playground', as for example Lebanon was in the Middle East and Punta del Este aspires to be for South America.

But in 2022 CAPA - Centre for Aviation highlighted how Zhuhai Airport, in which the Hong Kong Airport Authority (HKAA) is a shareholder, was gaining in importance as a domestic feeder airport to Hong Kong, which itself has a USD13 billion plan to turn its airport into a sprawling city-within-a-city.

It was even suggested that Zhuhai could become the domestic terminal for the Hong Kong Airport, thus sidelining some of Macau's importance and influence.

Zhuhai's Airport did not recover from the COVID-19 pandemic as quickly as did Macau's, but it did not fall as far and as fast in 2020-2022. It handled some 12 million passengers in 2024 - approximately the same as it did in 2019.

While HKAA is a shareholder (and its holding is now 90% of the equity), preference will naturally be shown to working with the Zhuhai airport. Assessing to what degree that influences Macau Airport's prospects is much the same as rolling a dice or playing the one-armed bandits at the casino.