Air Serbia: long haul expansion, record passengers and profit Analysis

Air Serbia received its fourth A330-200 on 11-Feb-2024, giving it a quartet of widebodies for the first time in its history.

The airline offers four long haul destinations (two in China and two in the USA) and is considering more, although its principal activity is providing connectivity between Serbia and European destinations.

Fleet and traffic growth took Air Serbia to its highest ever passenger numbers of 4.4 million in 2024. It expects traffic to grow by 6% in 2025 to a new high of 4.7 million, which would be 67% more than its 2019 total.

In the aftermath of the COVID-19 pandemic, Serbia's biggest operator has increased its seat share in the country, while low cost airline share has been eroded. Its record financial results for 2024 demonstrate that profitability is central to Air Serbia's expansion plans.

Summary

- Air Serbia passenger numbers grew at a CAGR of 10% pa in the period 2019-2024.

- Air Serbia is by far Serbia’s biggest airline; the biggest in the former Yugoslavia and fifth among airlines based in Central Europe, but only 51st among all airlines in Europe.

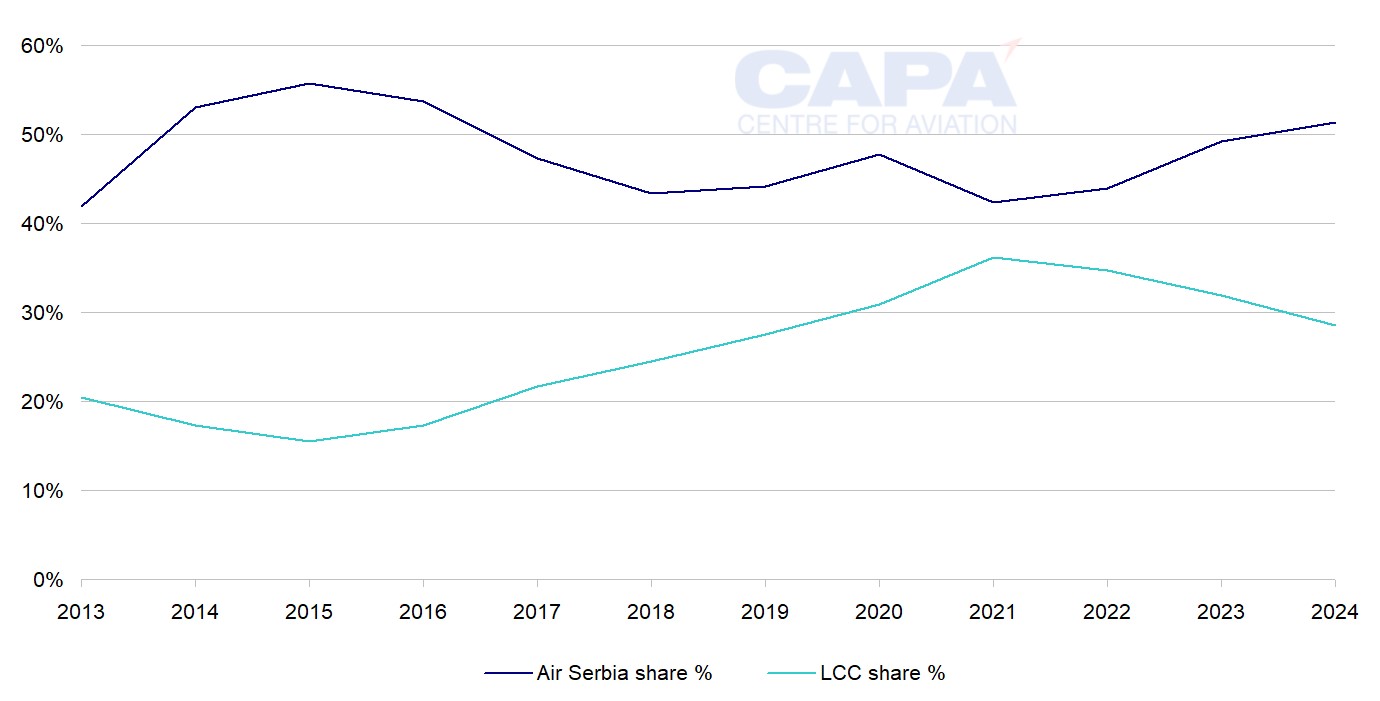

- Air Serbia’s seat share in Serbia has grown from 43% in 2018 to 52% in 2025. LCC share is also up versus 2018, but has fallen since 2021.

- Air Serbia's network is scheduled to have 83 airports in summer 2025, up from 59 in summer 2019.

- Europe remains the main focus of its capacity.

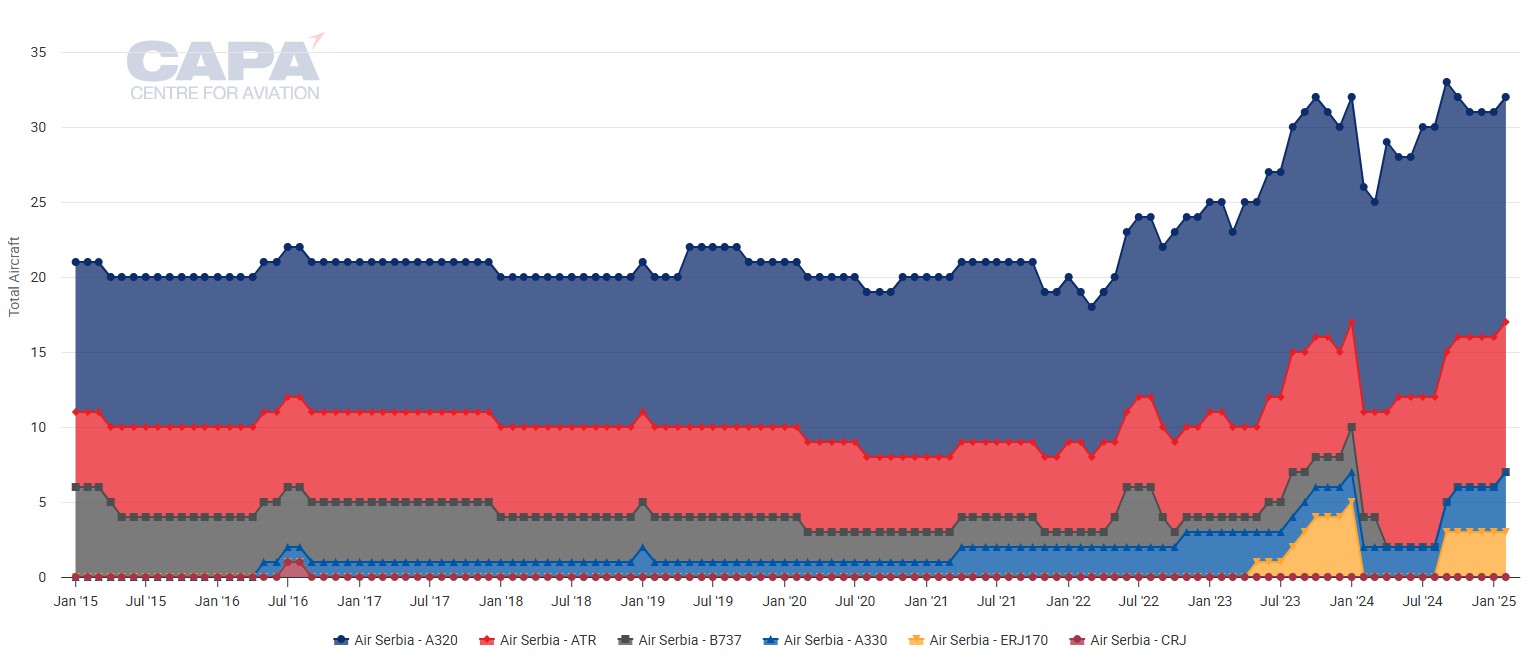

- Air Serbia's fleet has grown from 21 aircraft in 2019 to 32 in 2025.

- The airline reported record revenue and profits in 2023 and 2024.

Air Serbia passenger numbers grew at a CAGR of 10% pa in the period 2019-2024

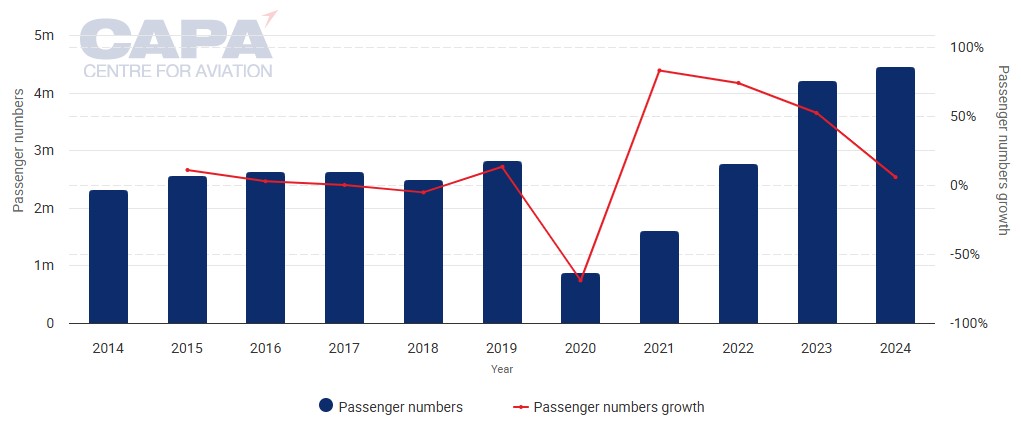

Between 2014 and 2019 Air Serbia's passenger numbers increased from 2.3 million to 2.8 million, which was then its record high. The compound average growth rate over the five years was 4.0% pa.

Between 2019 and 2024 - notwithstanding the negative impact of the COVID-19 pandemic - its growth rate more than doubled, as traffic grew at a CAGR of 9.6% pa.

According to data from CAPA - Centre for Aviation/OAG, Air Serbia is scheduled to offer 2.0% more seats in the first seven months of 2025, compared to the same period of 2024.

This is below its planned passenger growth of 6% for the full year, although that also includes charter traffic.

Air Serbia: annual passenger numbers/growth, 2014 to 2024

Source: CAPA - Centre for Aviation, Air Serbia reports.

It is by far Serbia's biggest airline…

Based on data from CAPA - Centre for Aviation and OAG on schedules planned for the week of 14-Jul-2025, Air Serbia is comfortably the country's leading airline, with a seat share of 55.8%.

This is more than three times the share of second-ranked Wizz Air's 13.8% (including Wizz Air UK and Wizz Air Dubai).

Serbia: top 10 airlines ranked by seats scheduled, for the week of 14-Jul-2025

|

Rank |

Airline |

Seats |

Seat share |

|---|---|---|---|

|

1 |

136,516 |

55.8% |

|

|

2 |

27,838 |

13.8% |

|

|

3 |

13,202 |

5.4% |

|

|

4 |

8,584 |

3.5% |

|

|

5 |

6,664 |

2.7% |

|

|

6 |

5,908 |

2.4% |

|

|

7 |

5,110 |

2.1% |

|

|

8 |

4,760 |

1.9% |

|

|

9 |

4,104 |

1.7% |

|

|

10 |

3,720 |

1.5% |

*Wizz Air including Wizz Air UK and Wizz Air Dubai.

Source: CAPA - Centre for Aviation, OAG.

…the biggest in the former Yugoslavia…

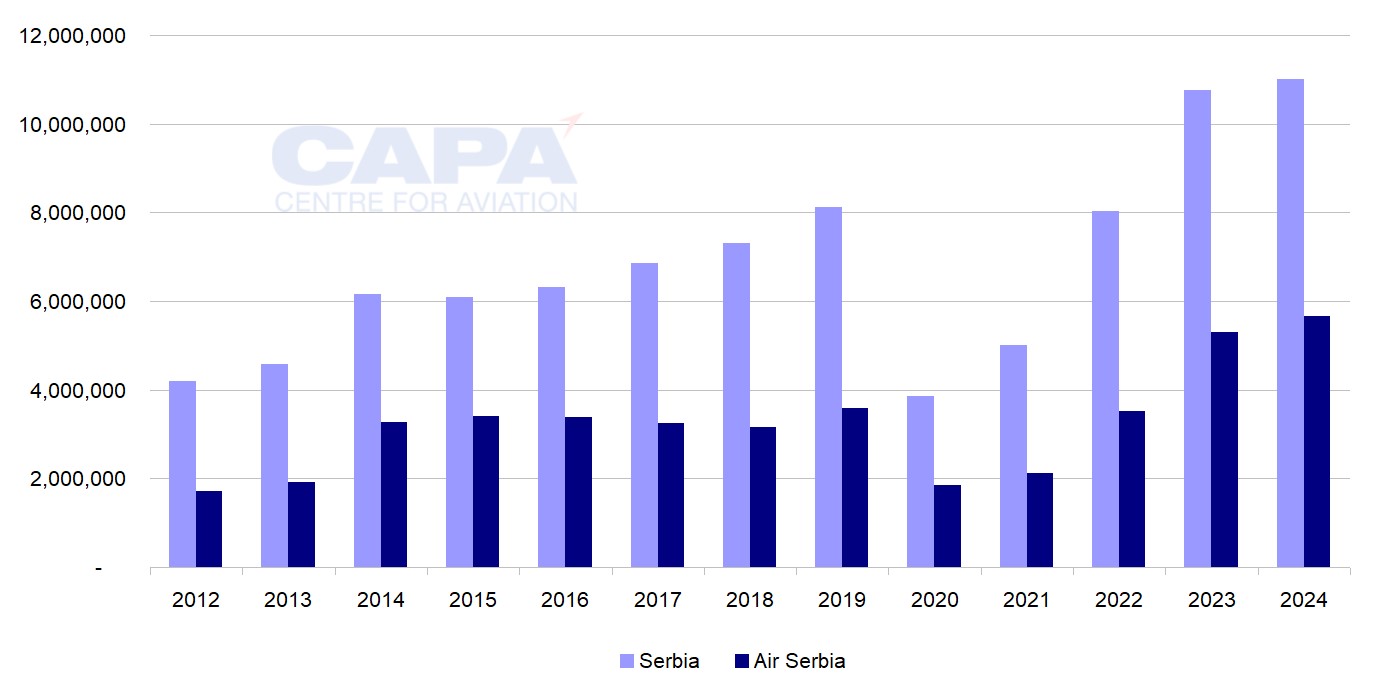

Air Serbia is the largest operator by seats among airlines based in the former Yugoslavia, even though Serbia is only the second largest market in this region (Croatia, the largest market, had 43% more seats than Serbia in 2024).

It has two thirds more seat capacity scheduled than Croatia Airlines for the week of 14-Jul-2025.

…and fifth among airlines based in Central Europe…

Air Serbia ranks fifth among airlines that are based in Central Europe (after Wizz Air, LOT Polish Airlines, SmartWings and airBaltic).

Its seat capacity is 7% less than airBaltic's and 28% less than SmartWings'.

…but only 51st among all airlines in Europe

Based on schedules for the week of 14-Jul-2025, during the peak summer period, Air Serbia is only the 51st largest airline by seats in Europe.

Air Serbia's seat share in Serbia has grown from 43% in 2018 to 52% in 2025

For the calendar year 2024, Air Serbia's share of all scheduled seats in Serbia was 51.4%, its highest since 2016, when it had 53.7%.

For the first seven months of 2025, it is projected to have 52.0% of scheduled seats.

From 2018 - when the airline's seat share in Serbia hit a low of 43.3% - to 2024, Air Serbia's capacity grew by 79%, whereas capacity in the country as a whole grew by 51%.

Air Serbia and total Serbia market: annual seat capacity, 2012 to 2025*

*2025: first seven months only, partly based on projected data as at 17-Feb-2025.

Source: CAPA - Centre for Aviation, OAG.

LCC share is also up versus 2018, but has fallen since 2021

Air Serbia's seat share gains since the COVID-19 pandemic have gone a long way to reversing the decline it suffered from 2015 to 2018, when low cost carriers grew their share in Serbia.

LCC share grew from 17.3% of scheduled seats in 2015 to 27.5% in 2019. During the pandemic this increased further, reaching 36.2% in 2021, as other operators made deeper cuts.

However, LCC share has declined since 2021 - to 28.5% in 2024. For the first seven months of 2025, this is projected to fall to 24.4%.

Air Serbia's ability to grow its share at the expense of LCCs since 2021 reflects the appeal of its offer.

Serbia: seat share of Air Serbia and of LCCs, 2013 to 2025*

*2025: first seven months only, partly based on projected data as at 17-Feb-2025.

Source: CAPA - Centre for Aviation, OAG.

Europe remains the main focus of Air Serbia's capacity

Air Serbia's capacity growth from 2019 levels has mainly been driven by growth in its short/medium haul network, particularly in Europe.

The airline has also grown its long haul network, but Europe still accounts for 95% of its scheduled seat capacity in 2025.

Its European growth has focused mainly, but not exclusively, on southern European sun destinations.

Although it has suspended its flights to Kyiv (following the Russian invasion of Ukraine), it serves four destinations in Russia (Moscow, St Petersburg, Kazan and Sochi).

Air Serbia's network is scheduled to have 83 airports in summer 2025, up from 59 in summer 2019

Taking the reference point as the week beginning 14-Jul-2025, Air Serbia is scheduled to serve 83 airports this summer.

This compares with 59 in the equivalent week of 2019.

Air Serbia: number of airports served by region, week of 29-Jul-2019, week of 31-Jul-2023 and week of 14-Jul-2025

|

29-Jul-19 |

31-Jul-23 |

14-Jul-25 |

|

|---|---|---|---|

|

29 |

38 |

40 |

|

|

Eastern & Central Europe |

26 |

37 |

39 |

|

1 |

2 |

2 |

|

|

1 |

1 |

0 |

|

|

Asia |

0 |

1 |

2 |

|

2 |

1 |

0 |

|

|

Total |

59 |

80 |

83 |

Source: CAPA - Centre for Aviation, OAG.

The airline's network in Western Europe will have increased from 29 airports in Jul-2019 to 40 in Jul-2025, while its Eastern and Central Europe airport count will be up from 26 to 39.

Air Serbia's North America network comprised only New York JFK in 2019, but now also includes Chicago O'Hare (launched in May-2023).

In Asia it now serves Shanghai Pudong (launched Jan-2025) and Guangzhou (Oct-2024), whereas it had no Asian destinations in summer 2019. It launched Tianjin Binhai in Dec-2022, but suspended this service in Nov-2024.

Its Africa network has fallen from one airport in 2019, Cairo, to zero. The route was restarted after the COVID-19 pandemic in May-2023, but withdrawn in early 2024.

Its Middle East network consisted of two airports in 2019 (Tel Aviv and Beirut), but none in 2025.

It withdrew from Beirut at the start of the pandemic, but did not restart it in the aftermath, and suspended Tel Aviv following the Hamas attacks in Oct-2023.

Air Serbia's fleet has grown from 21 aircraft in 2019 to 32 in 2025

Air Serbia's fleet comprises a total of 32 aircraft in service as at 17-Feb-2025, according to the CAPA - Centre for Aviation Fleet Database. The fleet has an average age of 14.3 years.

This consists of four Airbus A330-200 widebodies, 15 Airbus A320 family aircraft (classics, not neos), three Embraer regional jets, and 10 ATR 72-600 turboprops.

The total today is 11 more than its fleet of 21 aircraft in Dec-2019, which included just one Airbus widebody, 11 Airbus narrowbodies, three Boeing narrowbodies and six ATR turboprops.

Air Serbia: fleet at month end, Jan-2015 to Feb-2025*

*Feb-2025 data as at 17-Feb-2025.

Source: CAPA - Centre for Aviation Fleet Database.

The airline reported record revenue and profits in 2023 and 2024

Air Serbia's expansion in the aftermath of COVID-19 has not been at the expense of profitability. It returned to profit in 2022 after the losses of the COVID-19 years, and made successive record profits in 2023 and 2024.

For 2024, it generated revenue of EUR700 million and a net profit of EUR41.3 million - both historic high figures for the airline.

Its improved financial performance reflects a strong rebound in demand, coupled with greater cost efficiency and employee productivity.

Air Serbia CEO Jiri Marek told the CAPA Airline Leader Summit World & Awards for Excellence in Nov-2024 that it was carrying 50% more traffic than in 2019, with the same number of employees as 2019.

Profitability is central to Air Serbia's expansion plans

The growth in the widebody fleet from one aircraft in 2019 to four today reflects the expansion of its long haul network from one route to four over that period.

CEO Jiri Marek foresees further growth potential on long haul routes in the medium and long term, but the immediate focus is the development of existing routes through increased frequencies.

It has only recently launched its two China routes - Guangzhou in Oct-2024 and Shanghai Pudong in Jan-2025 - and will consider additional frequencies on those routes, on which it recently signed a codeshare with China Southern Airlines.

Next, it may add two more destinations in North America and then consider new destinations in Korea or Japan.

The approach to long haul expansion, as with all operations, is driven by profitability.

At CAPA's Airline Leader Summit World & Awards for Excellence Mr Marek said: "We need to understand who we are. We are a regional airline, so we don't want to make any kind of decision that can potentially jeopardise our profitability."

WATCH... CAPA TV interview with Air Serbia CEO Jiri Marek

Air Serbia, CEO, Jiri Marek sat down on stage for a keynote Airline Leader Interview with CAPA - Centre for Aviation, Head of Analysis, Rich Maslen At CAPA's Airline Leader Summit World & Awards for Excellence in Belgrade in Nov-2024.