Europe to India aviation: IndiGo could help to unlock vast potential

IndiGo has applied for slots at Amsterdam Schiphol Airport in order to launch daily connections with Delhi and Mumbai. It is also thought to be considering other major Western European destinations, such as London and Paris, although Manchester has been confirmed alongside Amsterdam for its initial services.

A new widebody wet lease contract with Norse Atlantic Airways could accelerate the low cost airline's long haul expansion ahead of the 2027 delivery of its own Airbus A350s.

Europe-India capacity has recovered well from the COVID-19 pandemic, with 2024 seat capacity reaching a record high and growth scheduled to continue in 2025.

However, the market has significant untapped potential.

If IndiGo is successful in launching its first services to Western Europe, this could help to stimulate further growth in this under-served market.

Summary

- IndiGo currently has no Western Europe destinations, and only two (damp-leased) widebodies, but a wet lease contract could accelerate its long haul expansion.

- IndiGo will not be the only operator on Amsterdam to Delhi and Mumbai.

- Europe-India capacity has recovered well from the COVID-19 pandemic. The 2024 seat capacity was at a record high, and growth is scheduled to continue in 2025.

- There are 16 airlines operating between Europe and India in the northern summer 2025 – led by Air India, Lufthansa and British Airways.

- There are 27 airports, led by London Heathrow in Europe and Delhi in India. There are 41 routes led by London Heathrow-Delhi and London Heathrow-Mumbai.

IndiGo currently has no Western Europe destinations…

IndiGo currently has three destinations in Europe, all in Eastern Europe: Baku (Azerbaijan), Tbilisi (Georgia) and Istanbul (Türkiye). If the low cost airline is successful in launching Amsterdam services from Delhi and Mumbai, these will be its first in Western Europe.

…and only two (damp-leased) widebodies…

It currently has only two widebody aircraft (Boeing 777-300ERs, according to the CAPA - Centre for Aviation Fleet Database), operating Delhi and Mumbai to Istanbul under a damp lease from Turkish Airlines.

The first of its order for 30 Airbus A350-900s is not due until 2027.

…but a wet lease contract could accelerate its long haul expansion

However, it has recently agreed a wet lease contract with Norse Atlantic Airways for one 787-9, and this could extend to up to six aircraft. This deal could accelerate its long haul expansion plans.

IndiGo's expansion into Western Europe was confirmed in early Mar-2025 with confirmation of Amsterdam and Manchester as its first destinations. The airline plans to commence three times weekly services to each destination in Jul-2025, subject to regulatory approval.

IndiGo CEO Pieter Elbers stated: "India has strong ties both with the United Kingdom and the Netherlands for business and tourism; and there is a large Indian diaspora who live in these countries".

IndiGo will not be the only operator on Amsterdam to Delhi and Mumbai...

It will face competition from full service airlines on both its routes from Amsterdam.

However, it has a codeshare agreement with KLM, which is the most significant operator between Amsterdam and India.

According to schedules filed with OAG, both Air India and KLM operate twice daily between Amsterdam and Delhi.

Air India only entered in Jun-2023, while KLM has served Delhi for many years.

In addition KLM operates twice daily between Amsterdam and Mumbai, which is a route also served four times weekly by China Airlines and once a week by Cathay Pacific.

... but will offer the only direct route from India to the north of the UK

Former Indian carrier Jet Airways had previously operated direct flights between India and Manchester between Nov-2018 and Mar-2019.

The new route reflects the strong cultural ties between the North of England and India, with more than 500,000 people of Indian heritage reported to be living within two hours of Manchester Airport.

Europe-India capacity has recovered well from the COVID-19 pandemic

The market between Europe and India has enjoyed a robust recovery from the depths of the COVID-19 pandemic.

Capacity has grown back above levels last seen before the collapse of Jet Airways in Apr-2019, which had been a significant stimulant to growth in this market in 2017 and 2018.

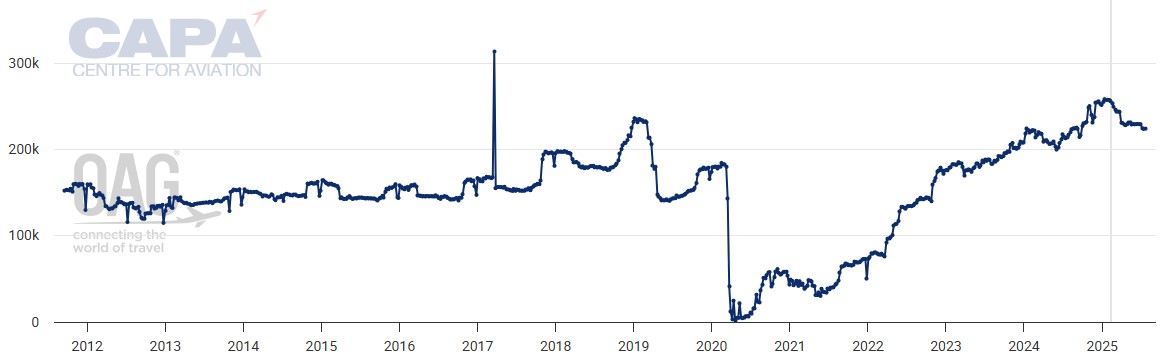

The Europe-India market is counter-cyclical, in that it peaks in the northern winter season.

In the week of 13-Jan-2025, seat capacity reached a new high. It was up by 15% year-on-year, and 10% above the previous peak in the equivalent week of 2019.

Europe to India: total weekly seats, Sep-2011 to Jul-2025*

*Includes projected data after the week of 10-Feb-2025.

Source: CAPA - Centre for Aviation, OAG.

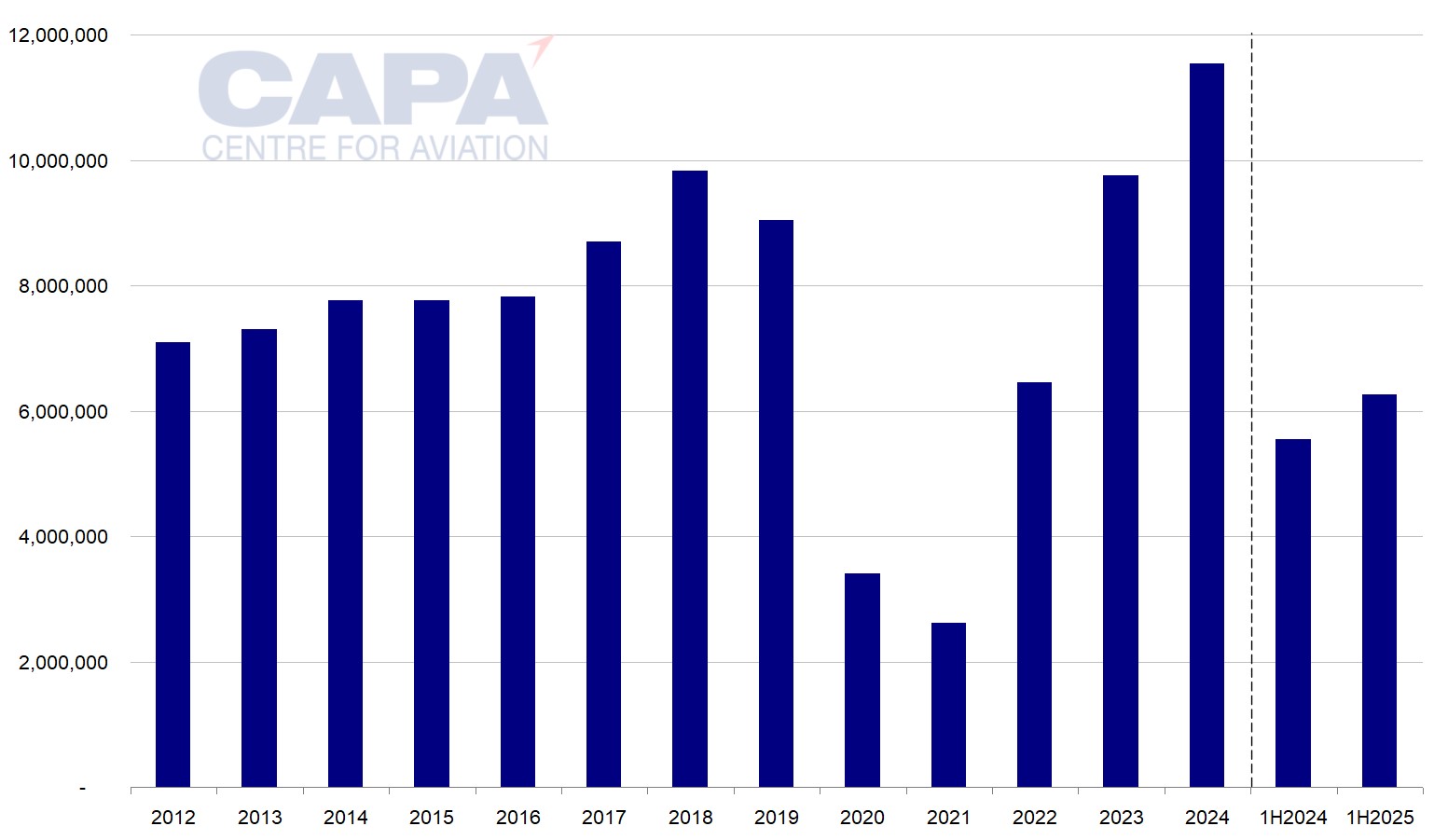

2024 seat capacity was at a record high…

Annual seat capacity between Europe and India grew by 18% year-on-year in 2024 to a record level of 11.5 million seats.

This was 17% more than the market capacity of 2018, which was the previous peak year.

Europe to India: annual seats, 2012 to 2024; and 1H2024 and 1H2025*

*Includes projected data after the week of 10-Feb-2025.

Source: CAPA - Centre for Aviation, OAG.

…and growth is scheduled to continue in 2025

Based on schedules filed with OAG and seat capacity data from the CAPA - Centre for Aviation Fleet Database, growth is expected to continue at double digit rates this year.

Seat numbers in 1H2025 are projected to be up by 13% year-on-year, and 28% above market capacity in the equivalent period of 2018.

There are 16 airlines operating between Europe and India in summer 2025…

Based on schedules for the week of 30-Jun-2025, there will be 16 airlines flying between Europe and India in the northern summer 2025.

This is down from 18 a year earlier (following the withdrawal of Vistara, merged with Air India, and World Ticket Ltd.), but an increase from the 14 operators in the market in the equivalent week of 2018.

…led by Air India, Lufthansa and British Airways

Air India is the biggest airline by seats between Europe and India, with a projected seat share of 30.2% in the week of 30-Jun-2025.

Two other airlines also have a double digit seat share: Lufthansa, with 14.3%, and British Airways, with 12.4%.

Air India's share has grown from 22.1% a year earlier, following its merger with Vistara (which had 9.6% in the equivalent week of 2024), while Lufthansa and British Airways have a broadly similar share to 2024.

IndiGo, in fourth place, has a seat share of 8.8%, which is up from 7.7% a year earlier. Fifth ranked Virgin Atlantic has also grown its share, to 8.6% from 7.4% a year earlier.

The two Indian airlines, Air India and IndiGo, jointly hold a seat share of 38.9%.

Europe-India: airlines ranked by seats scheduled for the week of 30-Jun-2025

|

Rank |

Airline |

Seats |

Seat share |

|---|---|---|---|

|

1 |

69,192 |

30.2% |

|

|

2 |

32,804 |

14.3% |

|

|

3 |

28,388 |

12.4% |

|

|

4 |

20,076 |

8.8% |

|

|

5 |

19,838 |

8.6% |

|

|

6 |

12,824 |

5.6% |

|

|

7 |

11,028 |

4.8% |

|

|

8 |

10,024 |

4.4% |

|

|

9 |

6,608 |

2.9% |

|

|

10 |

4,026 |

1.8% |

|

|

11 |

3,906 |

1.7% |

|

|

12 |

3,528 |

1.5% |

|

|

13 |

2,744 |

1.2% |

|

|

14 |

2,604 |

1.1% |

|

|

15 |

1,436 |

0.6% |

|

|

16 |

325 |

0.1% |

Source: CAPA - Centre for Aviation, OAG.

There are 27 airports…

The total number of airports in the Europe-India market is scheduled to be 27 in the week of 30-Jun-2025.

This is down by two from a year earlier in 2024, but is two more than in the equivalent week of 2018.

There are 19 European airports (20 a year earlier, 18 in 2018) and eight in India (nine a year earlier, seven in 2018).

…led by London Heathrow in Europe…

London Heathrow remains the largest European airport by seats in the market to India, with a seat share of 33.2% in the week of 30-Jun-2025 - up from 30.1% a year earlier, and almost back to its 2018 level of 33.8%.

Two other European airports also have a double digit seat share: Frankfurt (12.6%, versus 14.2% last year) and Istanbul (10.9%, versus 10.6%).

Paris CDG's share has slipped to 8.7%, from 10.5% a year earlier.

Fifth is Amsterdam Schiphol, with 6.5% of seats, almost the same as last year's 6.5%, but a drop from 10.8% in 2018.

Although KLM has grown its capacity and Air India has entered, the gap left by Jet Airways' exit has not been fully filled at Amsterdam.

IndiGo's entry may help to fill that gap.

Europe-India: European airports ranked by seats scheduled for the week of 30-Jun-2025

|

Rank |

Airport |

Seats |

Seat share |

|---|---|---|---|

|

1 |

76,054 |

33.2% |

|

|

2 |

28,874 |

12.6% |

|

|

3 |

24,892 |

10.9% |

|

|

4 |

19,992 |

8.7% |

|

|

5 |

14,612 |

6.4% |

|

|

6 |

14,062 |

6.1% |

|

|

7 |

9,168 |

4.0% |

|

|

8 |

6,144 |

2.7% |

|

|

9 |

5,208 |

2.3% |

|

|

10 |

4,661 |

2.0% |

|

|

11 |

4,385 |

1.9% |

|

|

12 |

3,906 |

1.7% |

|

|

13 |

3,584 |

1.6% |

|

|

14 |

3,528 |

1.5% |

|

|

15 |

2,744 |

1.2% |

|

|

16 |

2,604 |

1.1% |

|

|

17 |

2,560 |

1.1% |

|

|

18 |

2,048 |

0.9% |

|

|

19 |

325 |

0.1% |

Source: CAPA - Centre for Aviation, OAG.

…and Delhi in India

On the Indian side of the market, airports are more concentrated.

Delhi is scheduled to have 50.9% of seats in the week of 30-Jun-2025 (51.2% a year earlier). Mumbai's share is 28.2% (29.4% a year earlier).

Delhi and Mumbai, collectively, have 79.1% of seats (80.6% a year earlier).

This is down from 82.7% in 2018, because Mumbai's share has fallen from 33.0%, whereas Delhi's seat share is up from 49.7%.

Europe-India: Indian airports ranked by seats scheduled for the week of 30-Jun-2025

| Rank | Airport | Seats | Seat share |

|---|---|---|---|

| 1 | Delhi Indira Gandhi International Airport | 116,679 | 50.9% |

| 2 | Mumbai Chhatrapati Shivaji Maharaj International Airport | 64,636 | 28.2% |

| 3 | Bengaluru Kempegowda International Airport | 25,930 | 11.3% |

| 4 | Hyderabad Rajiv Gandhi International Airport | 6,720 | 2.9% |

| 5 | Chennai International Airport | 5,758 | 2.5% |

| 6 | Amritsar Sri Guru Ram Dass Jee Airport | 5,532 | 2.4% |

| 7 | Ahmedabad Sardar Vallabhbhai Patel International Airport | 2,560 | 1.1% |

| 8 | Goa Manohar International Airport | 1,536 | 0.7% |

Source: CAPA - Centre for Aviation, OAG.

There are 41 routes, led by London Heathrow-Delhi and London Heathrow-Mumbai

There are scheduled to be 41 routes between Europe and India in the week of 30-Jun-2025, which is a reduction of three compared with 44 a year earlier, but six more than the 35 available in the equivalent week of 2018.

The two biggest routes by seats are London Heathrow-Delhi (13.6% of seats) and London Heathrow-Mumbai (11.7%), the same top two as a year earlier, since when both have increased capacity.

Seven years ago, in 2018, these were also the two biggest routes, but London Heathrow-Mumbai was first, with 14.1% of seats, and London Heathrow-Delhi was second, with 13.2%.

IndiGo could be a catalyst to unlocking Europe-India's vast potential

According to data from CAPA - Centre for Aviation/OAG, total capacity between Europe and India is scheduled to be 229,000 seats in the week of 30-Jun-2025 - this makes India the fourth largest long haul market to/from Europe, after the USA, Canada and China.

Nevertheless, although India and China both have around 1.4 billion people, Europe-India capacity is only 53% of Europe-China's 429,000 seats.

A significant proportion of Europe-India O&D traffic connects via the Gulf airlines' Middle East hubs and, to a lesser extent, via Turkish Airlines' hub at Istanbul.

Capacity between Europe and India is enjoying faster growth than the other leading long haul markets to/from Europe, but it remains underserved by direct routes.

When IndiGo starts to serve Amsterdam and Manchester, it will be the only low cost operator between India and Western Europe.

The entry of such a large and successful LCC could be a catalyst to unlocking the vast potential of Europe-India aviation.

A shortened version of this analysis first appeared in the March/April 2025 edition of Air Transport World

|

|