Airport finance, development and strategy in shadow of political turmoil - part one: North America

The annual GAD Americas global airport finance, development and strategy conference will take place in the Cayman Islands at the beginning of Apr-2025.

It will do so against a background of political unrest across the world, with violent changes of direction almost every day and no certainty about anything any longer.

In comparison, the airport sector is a haven of tranquillity.

But that will change in the US once the US president turns his attention to it, with the likelihood of an increasing role again for the private sector - if only because his Government Efficiency department will perceive private management to be, well, more efficient.

In Canada the situation there is complicated by a change of prime minister, and possibly a change of government there before long; while the present government has just decided to open up airport financing to its pension funds that are very active abroad.

Apart from these mainstays of conversation and debate, there are numerous other subjects that will inevitably be aired. Including how best to finance ATC in the future, and if it can be investable; how to marry airport, port and tourism development; how to integrate UAMs into the airport community and for what purpose; and how to provide for the myriad of propulsion systems that aircraft will require in the future at any single location.

This is part one of a two-part report.

Summary

- GAD Americas 2025 takes place amid a flurry of political activity and turmoil.

- In the US, President Trump’s preference for the private sector will become apparent again.

- Beauty is in the eye of the builder, as Transport Secretary Duffy will discover.

- Reforming ATC dominates the US agenda right now.

- The previous regime enacted government airport support on an impressive level, but that support cannot continue indefinitely.

- Two changes could improve the impact of the AIPP.

- Whole-airport leasing continues to decline in popularity, versus the infrastructure-specific P3.

- There are 962 known airport development projects in North America, valued at USD92 billion.

- But new airport projects are at an all-time low.

- Canada revises its policies on airport investment at last.

- Canada’s pension funds let off the leash in their own backyard, but will they take the bait?

- Canada even worse off than the US for new airport development.

GAD Americas 2025 takes place amid a flurry of political activity and turmoil

With the approach of the Global Airport Development (GAD) Americas event early in Apr-2025, this is an appropriate time to give consideration to some of the topics that might arise or be touched upon there, either formally or in ad-hoc discussions.

The event takes place amid political turmoil in the north and south of the Americas.

In the United States the country is getting to grips with Mr Trump's second term as president, which is moving at a whirlwind pace both domestically and internationally. At the time of writing, with a full schedule, neither he nor his Transportation Secretary, Sean Duffy, has made any significant move that affects airports.

In 2016 it was a different matter, the president having openly criticised in the run up to the election some US airports as being 'Third World' standard, including New York LaGuardia, which has (since then) been transformed into what is regarded as one of the country's leading gateways, by way of two separate public-private partnerships (P3s).

The US president's preference for the private sector will become apparent again

While 'private' was not quite the actual watchword in Mr Trump's first term, it is certainly the case that he favoured private sector involvement in airport financing and development. He encouraged it through measures such as removing completely the limit on the number of airports that could be leased, and their type, as specified by the Airport Investment Partnership programme (AIPP) (2018) the successor to the 1996 Airport Privatisation Pilot Programme (APPP).

He even floated the idea of privatising the two Washington commercial airports - Ronald Reagan National and Dulles - but that was never going to get 'security clearance.'

He also introduced an Infrastructure Incentives programme to spur additional dedicated funds from states, localities, and the private sector, on a matching funds basis.

He promised to try to make tax-exempt and private activity bond financing - a mainstay of the financing of airports - more attractive still, and to reduce or eliminate the power of airlines to veto a lease or P3 development deal, but ran out of time to see those measures through.

Beauty is in the eye of the builder

The current US president has previously said that, this time out, Mr Duffy will "prioritise Excellence, Competence, Competitiveness and Beauty when rebuilding America's highways, tunnels, bridges and airports".

Straight away it is to be recognised that not only does Mr Duffy have the entire phalanx of transportation needs to deal with, but also that his aviation budget may be limited in order to ensure that the US' crumbling road and bridge infrastructure is finally put to rights.

Reforming ATC dominates the US agenda right now

In the first two months of the regime Mr Duffy has had to devote much of his time to air traffic control (ATC) matters by, for example, streamlining hiring for air traffic controllers, including firing hundreds of them and upgrading aviation technology, following a series of recent air disasters (one of which was in the neighbourhood of the White House).

He has stated that he needs 18 months to "rebuild" air traffic control, and has expressed concerns about the Federal Aviation Administration (FAA)'s antiquated technology, He is pushing for a massive upgrade, which will require funding from the US congress.

That 'technology' currently still includes copper wire and floppy discs, straight out of the 1980s.

'Ground control to Major Elon…'

Mr Duffy has spoken with Elon Musk, a Trump advisor and leader in the Department of Government Efficiency (DOGE) about airspace reform issues, and it is noteworthy that on 05-Mar-2025 Mr Musk's company SpaceX denied that there is any "effort" on its part to take on any existing contract related to the FAA's modernisation of ATC systems.

The announcement followed the start of testing using Starlink systems in Alaska, Oklahoma City and Atlantic City. SpaceX added, "Starlink is a possible partial fix to an ageing system. There is no effort or intent for Starlink to 'take over' any existing contract".

Airlines cannot fly without modern, effective ATC control, and this is likely to be a big talking point at GAD Americas, along with the slow take up of remote tower technology in the US, something at which Europe comparatively excels.

Returning to airport finance - so there is every chance that Mr Duffy (or the president directly) will at length return to his philosophy of supporting private finance in modernising and refurbishing airports (as opposed to building new ones - see later).

The previous regime enacted government airport support on an impressive level

Under the previous President Biden regime, much airport financing has come from the Infrastructure Investment and Jobs Act - specifically the Airport Infrastructure Grant (AIG) programme, which was set up to provide USD14.5 billion in funding over five years, starting in FY2022.

On an annualised basis this includes up to USD2.39 billion for primary airports, and up to USD500 million for non-primary airports.

Within the administrative period 2022-2025, the total awarded in 2024 was USD3.9 billion, and USD516 million has so far been announced for 2025. Almost as a 'parting shot' from the Biden administration, on 08-Jan-2025, the FAA announced more than USD332 million for 171 grants across 32 states.

That leaves USD7.2 billion to be awarded before the end of 2027.

But that support cannot continue indefinitely

This has been hugely supportive financing, as the business sought to put the COVID-19 pandemic behind it, and goes some way towards satisfying the interminable investment demands made by the trade body ACI North America (ACI-NA), but it cannot continue indefinitely.

Acts of congress cannot just unravel, though.

So the 64,000 dollar question is whether the US president will just sit on a previous law that will run for three quarters of his presidency, or whether he will attempt to ally it to, say, a matched funding opportunity for the private sector as he has done previously.

Or, whether he will come up with something new altogether.

Two changes could improve the impact of the AIPP

According to Bob Poole, Director of Transportation Policy at the Reason Foundation, there is the potential for tax law changes that might encourage city, county and state airport owners to consider making better use of the AIPP via two changes.

One would be expanding the scope of the existing tax-exempt private activity bond (PAB) programme that applies only to public-private partnership (P3) highway and transit projects - i.e. expanding it to cover airports and seaports, as was previously suggested in the past decade by a bipartisan House P3 task force.

As mentioned previously, this was considered by Mr Trump in his first term.

The other change would be to enable an airport's existing tax-exempt revenue bonds to remain in force in the event of a long term lease being taken by a private concern (i.e. another example of engaging both public and private financing simultaneously). Currently they have to be paid off in the event of a significant change in control.

Whole-airport leasing continues to decline in popularity, versus the infrastructure-specific P3

And that also raises the question of how far P3s can go.

As CAPA - Centre for Aviation has often said, although whole-airport leasing in the US is not dead in the water, it is in intensive care, with only two small general aviation airports in Florida in the FAA's active programme right now (to become commercial flight facilities), and neither of them is exactly speeding towards a conclusion.

On the other hand, every other single lease application has been withdrawn since 2001 - apart from firstly, New York Stewart Airport, which was privately leased and operated for seven years between 2000 and 2007. But the lease was surrendered, and the Port Authority of New York and New Jersey now operates it. And secondly, the Luís Muñoz Marín International Airport in San Juan, Puerto Rico (2013).

The latter is the single success story in the bunch, with improvements across the board including airport-based ATC operations.

The P3 however - providing specific infrastructure like a passenger or cargo terminal, a consolidated car rental building or an inter-terminal people mover, has continued to grow in number and preference across the country.

So discussions are likely to be focused on potential new P3 projects; how far this method can go (what can and can't it be applied to?); who should be responsible for what; and on any new and innovative financing systems to go with them.

Although there has been little or no movement on airport privatisation, there has been among the city, county and state owners of the country's major airports on construction activities - and many of them are very large projects.

There are 962 known airport development projects in North America, valued at USD92 billion

At the moment, according to the CAPA - Centre for Aviation Airport Construction database, there are 962 known airport development projects in North America. The vast majority of them are in the US, and they have a total value of USD91.6 billion.

That is 300 more than the nearest continental challenger (Asia Pacific), but only half the amount of investment in Asia Pacific where there are huge projects in China and Southeast Asia.

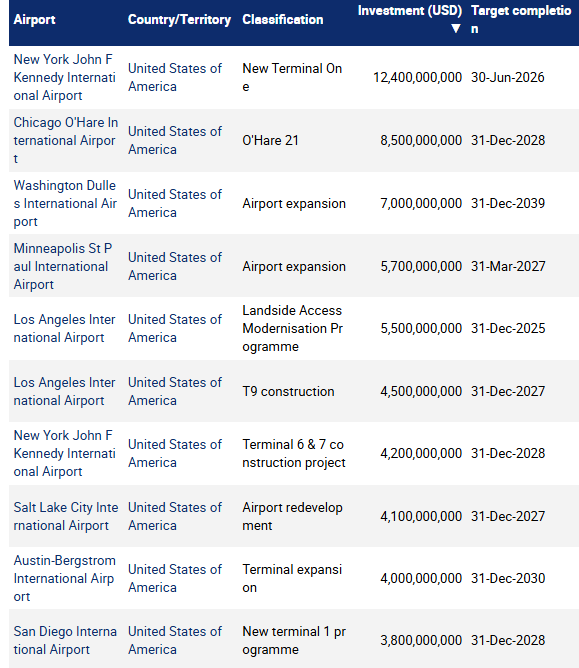

The Top 10 projects in the US by investment are detailed in the table below.

Top 10 projects in the US by investment

Source: CAPA Airport Construction Database.

The questions that are likely to arise include:

- How long will COVID-era government financing continue? Will it be wound up after 2027?

- What, if anything, will it be replaced with (will there be a similar 'national' scheme that embraces major hubs, primary and secondary level airports)?

- Will ACI-NA's financing demands ever be met?

- To what degree can the private sector fill the gap?

- Which airports, if any, should be prioritised?

- Would an alternative system like Canada's not-for-profit stakeholder arrangement be suitable? (That has apparently been aired as a suggestion, but coincidentally, Canada may be about to consider an alternative approach itself, see later in this report).

But new airport projects are at an all-time low

Although there is construction at major US gateways (there are 30 known projects, with investment totalling over USD1 billion each), the same cannot be said about new airport projects. In total, there are only three of those in the whole of North America.

And all three are in the US.

One is a mainly cargo airport in Illinois, which has edged closer to spades in the ground, but is still very much a work in progress while another - again intended for cargo - is a conversion of a general aviation airport in Florida that has been in process for 15 years this year.

Why is the US so reluctant to build new airports? The last one of any substance (Denver) opened 30 years ago.

That reluctance seems to be prompted by several factors, including community opposition, environmental impact, land availability, cost, and time. It is a major undertaking requiring time and airport owner's staff resources, not to mention that the litigation risk is high.

But old airports cannot keep being rebuilt forever.

Cities, and their demographic, are in constant flux. Perhaps the time has come for a government policy to be determined.

Canada revises its policies on airport investment, at last

Turning to Canada, that country is going through a process of change right now, with a new prime minister, a forthcoming election this year, and the (remote) possibility that some or even all of it could become the 51st US State.

The stakeholder system of ownership of the major airports managed by not-for-profit boards, principally from the public sector, has been embedded there since the 1990s, but some or other form of privatisation was mooted in 2017; a study took place, but it was quietly dropped.

Then, last year, a working group was set up to study investments into its airports as part of the 2024 federal budget. A large part of the study was to consider whether Canada's many public pension schemes should be incentivised to invest in its airports (currently they are not), as well as (or in lieu of) the investments into foreign airports, mainly in Europe.

Six pension funds are doing that, and one of them, OTPP, advised at the turn of the year 2025 that it would divest those European interests.

One potential outcome might be the elimination or at least reduction of the punitive ground rents that the airports have to pay the government.

But all this requires a monumental effort of will among disparate parties to overcome the comfortable inertia that has set in where domestic airport ownership is concerned.

Canada's pension funds let off the leash in their own backyard but will they take the bait?

At the beginning of Mar-2025 the government announced (two days before the change in prime minister) a policy statement that seems to offer flexibility of funding sources available to airport authorities, such as private institutional investors; specifically pension funds.

Pension funds will be able to enter commercial subleases to invest in and develop airport lands, with the not-for-profit airport authorities that operate 22 major facilities, including Toronto's Pearson International Airport, the busiest.

Airport authorities can also create subsidiaries to encourage pension investment on airport lands - from terminals to hotels and shopping centres. The for-profit share-capital subsidiaries would allow private investors to buy, or be issued, shares, so long as the airport authority maintains a controlling interest.

Private investors and airport authority subsidiaries can also undertake joint investment projects that will support the development of new airport facilities, like terminal buildings.

With ministerial approval, airport authorities could also sublease terminal facilities and operations to a pension fund or other investors, even where formal partnerships or joint ventures are not permitted under existing ground leases.

These are still early days. There is already stiff trade union opposition growing, while at the other end of the spectrum other fund operators (infrastructure, private equity etc.) may reasonably question why they have not been favoured to the same degree.

What's more, the funds will not be able to take a controlling stake, which some (not all) of them are used to in their foreign investments, even if they typically take a hands-off approach to management. In their own country, they might expect a little more.

Canada even worse off than the US for new airport development

There was no provision in the announcement for pension fund investment into new airports, and Canada is even worse off for those than is the US. There is none of any consequence.

CAPA - Centre for Aviation used to consider the second Toronto airport scheme at Pickering, to the east of Canada's largest city, as a viable project; one that began in 1972!

But in 2025 it was declared dead by the federal government. Perhaps there might be an opportunity to revive it, and others, if pension funds were permitted to invest in brand new facilities under the auspices of Transport for Canada. But then again, they don't usually do that, which would be taking a risk with members' money.

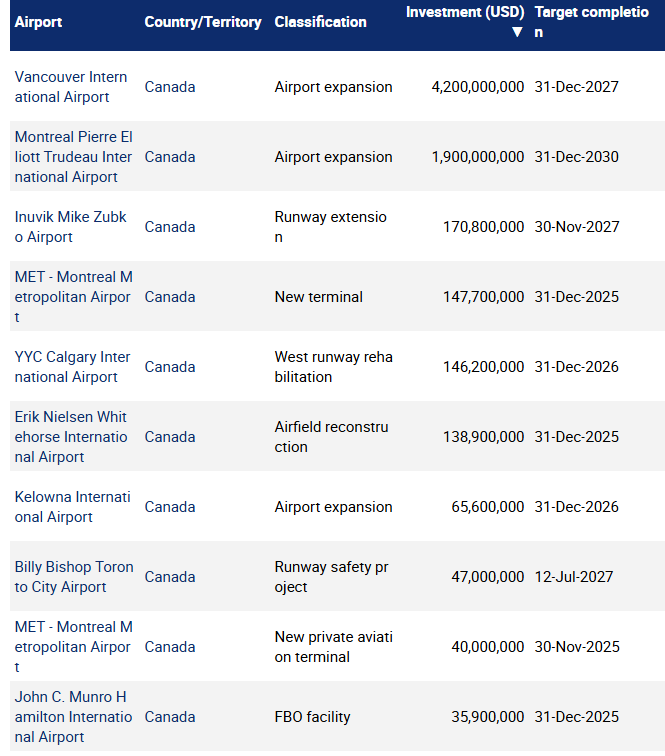

The table below is of the Top 10 construction projects in Canada, which are modest in comparison to US standards with the exception of Vancouver and Montreal.

Top 10 construction projects in Canada

Source: CAPA Airport Construction Database