Is there another chapter in US consolidation featuring low cost airlines?

Many US low cost airlines believe that segment of the industry is ripe for consolidation, particularly as a new administration under the US president appears more inclined to approve potential mergers and acquisitions.

But after JetBlue's failed attempt to acquire Spirit Airlines, and Frontier Airlines' numerous overtures to purchase Spirit, the question remains - who will strike first to capitalise on the favourable conditions for consolidation?

Perhaps the bigger query is - who are the obvious candidates for the next round of consolidation in the country?

Summary

- Frontier Airlines remains bullish on consolidation, despite recent rebuffs by Spirit Airlines.

- Breeze Airways and Sun Country Airlines believe that M&A opportunities exist in the US low cost sector.

- Who are the obvious players in the next round of consolidation?

- Potential synergy calculations are likely occurring, even if no logical M&A tie-ups are emerging.

Frontier Airlines remains bullish on consolidation, despite rebuffs from Spirit

During the past couple of years JetBlue's two major initiatives - its Northeast Alliance with American Airlines and its pursuit of Spirit - were derailed by the US Department of Justice under the former president, after they were deemed largely anti-competitive.

More recently, Frontier and Spirit reignited their merger talks near the end of 2024 and earlier this year, but Spirit opted to pursue a stand-alone plan as it aims to emerge from Chapter 11 bankruptcy protection in the coming weeks.

See related CAPA - Centre for Aviation report: How will the latest chapter in the Frontier and Spirit saga end?

Despite being rebuffed by Spirit three times, Frontier remains bullish on consolidation. The airline's CEO Barry Biffle remarked during the recent Barclays Annual Industrial Select Conference that, "...obviously, we're open to M&A", adding that consolidation would benefit the industry overall.

He pointed to chatter regarding a potential interest by Southwest Airlines in JetBlue before the Dallas-based airline announced historic layoffs.

Mr Biffle concluded that everyone "other than maybe Delta. Or United, could buy JetBlue, right. I think Southwest could get away with it. American can get away with it, it solves a lot of problems internationally with [New York] JFK for American."

Simply put: Mr Biffle believes that if an airline aims to participate in M&A, "you've got a green light, you should do it now. Why would you take a risk a few years from now on another administration?"

Frontier still believes that combining with Spirit is logical, but "at the end, we wish them luck. I think they're going to end up being smaller. They [Spirit] almost have to be smaller in order to get their cash burn under control. And that could be good for us. Ironically, I think it's probably bad for them over time," Mr Biffle said.

After Mr Biffle drew those conclusions, Spirit posted an annual loss of USD1.2 billion in 2024, compared with losses of USD558.5 million in the year prior. The airline recorded a negative 22.5% operating margin in 2024.

Breeze and Sun Country also see room for consolidation in the US low cost airline sector

Other airlines occupying the ultra-low cost and lower cost base in the US appear to have drawn similar conclusions about consolidation among smaller airlines.

Breeze Airways CEO David Neeleman recently noted that two paths could be possible for Frontier and Spirit, according to Aviation Week Network.

After Spirit emerges from Chapter 11, a softening demand environment could force the airline to "make a deal sooner", or Frontier may decide "they don't have to buy them", given that Spirit could fail anyway, and leave space for the US' other large ULCC in the market.

Mr Neeleman concluded that there is a place for ULCCs, "but at what size[,] and in what markets? There is not enough room for everyone."

Sun Country Airlines, a niche carrier that flies under the radar but posts enviable financial results, is also "pro M&A," said the airline's CFO David Davis, also speaking at the Barclays conference.

"We think there are combinations that make sense with us as a part of them," he stated. But he added "the uniqueness of our model makes it a little more difficult for us", noting the 737-800F cargo aircraft that Sun Country operates on behalf of Amazon. This year (2025) Sun Country is increasing the number of freighters in operation for Amazon from 12 to 20.

See related CAPA - Centre for Aviation report: US airlines: Sun Country's model seems robust as other ULCCs struggle

Still, "...we think there are combinations with Sun Country that make a lot of sense, and continue to look at things," Mr Davis said.

However, "It's certainly not in our base plan, but I do believe the industry needs to consolidate on the low cost side".

It's tough to determine who are the logical candidates for further US consolidation

As chatter about additional consolidation in the US gains steam, aside from Frontier and Spirit it's not clear who would emerge as potential merger partners.

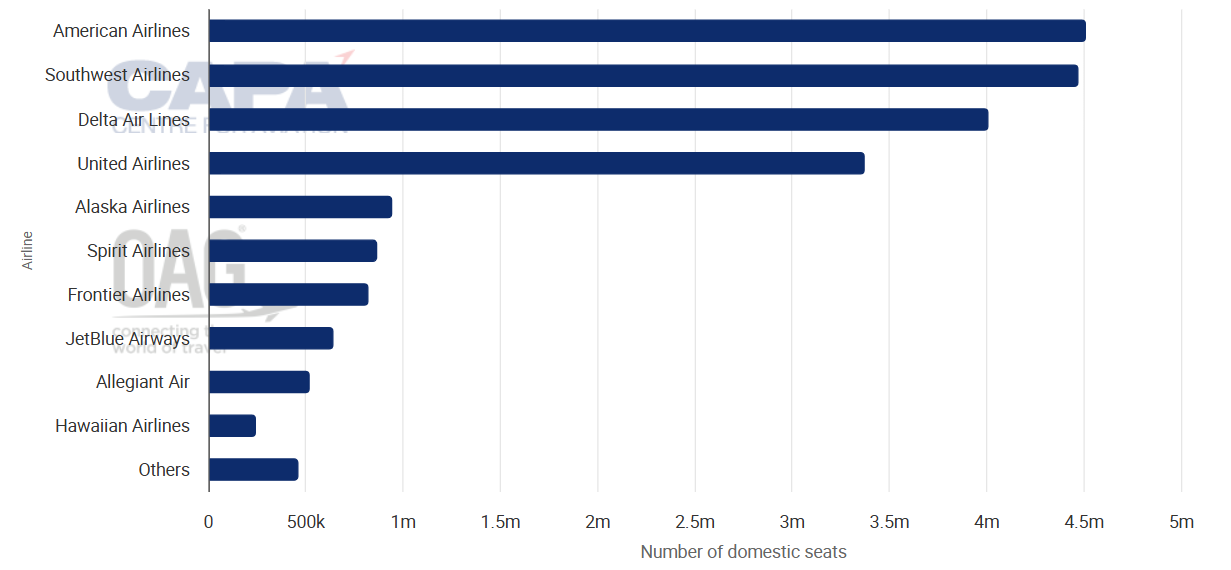

A look at US departing domestic seats, as of early Mar-2025, shows some consolidation at the end of the spectrum would allow airlines to build scale, but which combination would be viable?

US domestic departing seats: by airline, w/c 10-Mar-2025

Source: CAPA-Centre for Aviation and OAG.

Perhaps JetBlue gains momentum by being acquired by one the larger US airlines - but the airline is one of the few aviation operators that hasn't recently offered a view on future consolidation.

Combinations of any one of the smaller airlines could make sense again, purely to build scale, but niche airlines like Sun Country or Allegiant Air would not fit neatly into operations at other airlines.

United CEO Scott Kirby fielded a question regarding if further consolidation was necessary at the recent JP Morgan Industrials conference. "I don't know," Mr Kirby concluded. "I think it is less likely than others think," he added noting JetBlue was the "obvious candidate."

He said it's not necessary for United to forge a deal. "I think the ball is going to be in JetBlue's court. They're working hard, I have a lot of respect for them."

Mr Kirby also observed from a customer perspective JetBlue has "a lot of those sort of core DNA things that are expected." But "they're also competing another airline in JFK and Boston that has that too," he noted referring to Delta's dominance in New York and its strong position in Boston.

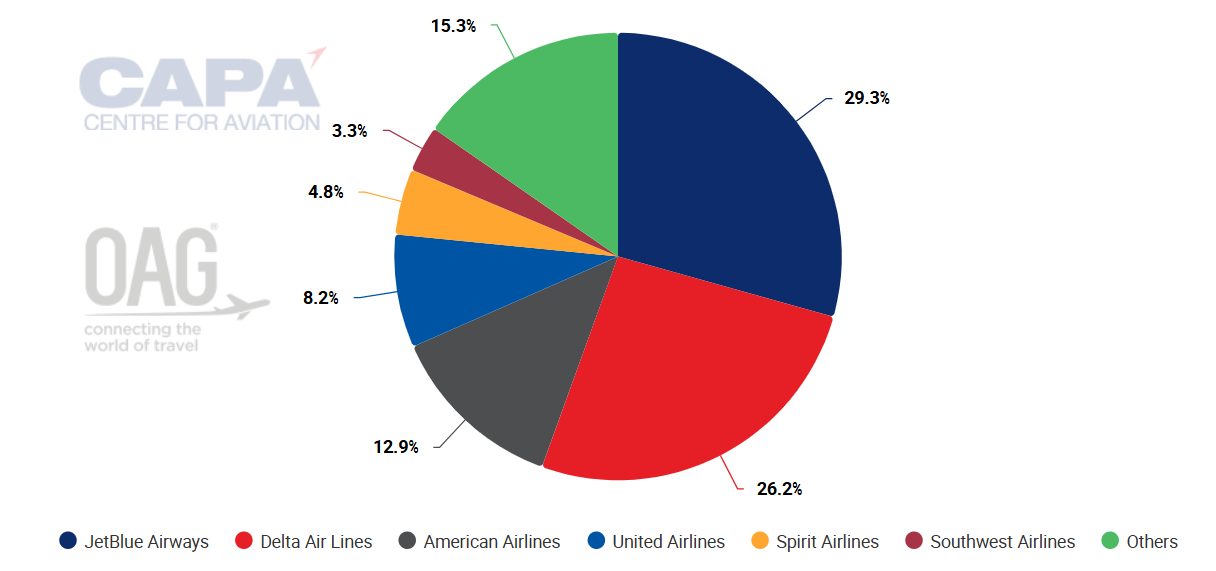

Boston Logan International Airport, system departing seats, w/c 10-Mar-2025

Source: CAPA - Centre for Aviation and OAG.

Data from CAPA - Centre for Aviation and OAG show as of early Mar-2025 JetBlue has a 29.3% share of Boston Logan's system departing seats followed by Delta's 26.2% share.

Noting it was a tough position to be in for JetBlue, United's CEO stated, "it's sort of their decision [JetBlue] on how to sort through that.."

Will merger speculation materialise into more consolidation in the US?

Despite a less than obvious ideal combination, it seems as if synergy number-crunching is occurring behind the scenes in the US low cost sector.

At the moment, it's anyone's wager on the outcome of further US consolidation - but some announcements could surface during the next couple of years.