Turkish Airlines & Pegasus Airlines: competitive equilibrium?

Among Europe's large aviation markets Türkiye has enjoyed the strongest recovery from the COVID-19 pandemic: its seat capacity in 2024 was 20% above its 2019 level, whereas capacity in Europe as a whole was flat on 2019.

The nation's two largest operators, the flag carrier Turkish Airlines and the ultra-low cost airline Pegasus Airlines, have also performed well. They occupy different market segments, and appear able to operate in a kind of competitive equilibrium.

Nevertheless, Pegasus has recovered capacity and traffic more rapidly, and with a higher load factor and superior operating margins.

Summary

- Türkiye’s capacity recovery from the COVID pandemic has outpaced Europe’s. Türkiye passengers grew by 8%, to a new high in 2024.

- Turkish Airlines’ passengers grew by 2%, and its load factor slipped fractionally from its peak.

- Pegasus Airlines' passenger numbers grew by 17%, and its load factor rose to just below its highest ever.

- Turkish Airlines and Pegasus Airlines have both increased seat share in Türkiye since 2019.

- Turkish Airlines' operating margin fell in 2023 and 2024. Pegasus Airlines achieved its second highest operating margin ever in 2024.

- Both follow a similar profit cycle, but Pegasus Airlines is now consistently more profitable than Turkish Airlines.

Türkiye's capacity recovery from the pandemic has outpaced Europe's

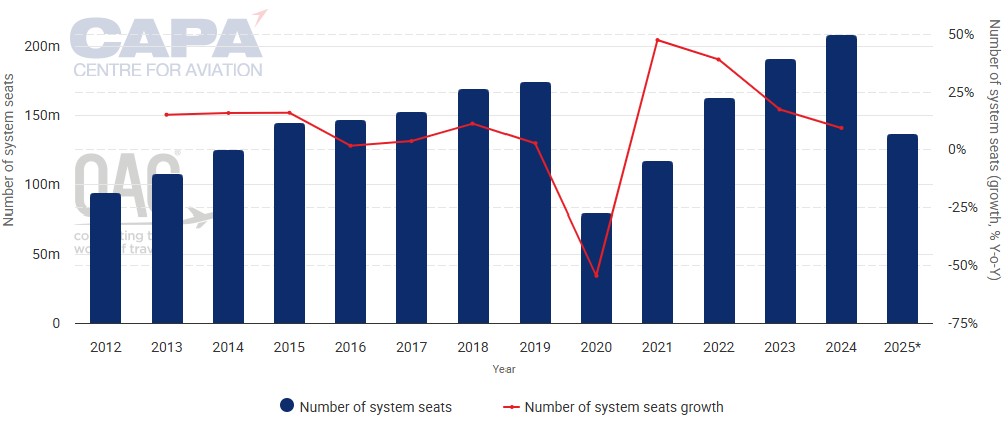

The Turkish aviation market increased total seat capacity by 9.4% in 2024, to 207.9 million, according to data from OAG.

This was 20% more than in 2019, confirming Türkiye's faster recovery from the pandemic compared with Europe as a whole, which was level with its 2019 seat capacity in 2024.

In 2024 international capacity outpaced the domestic market, with growth of 11.0%, compared with 5.1% growth in domestic seats.

International capacity was 30% above 2019, while domestic capacity was still 1% short of its 2019 level last year.

Turkey: annual airline seats/growth, 2012 to 2025*

* The values for this year are not complete and are at least partly predictive from 10-Mar-2025.

Source: CAPA - Centre for Aviation and OAG.

Türkiye passengers grew by 8% to a new high in 2024

Total passenger count through Türkiye's airports increased by 7.6% in 2024, to reach a new record high of 230.0 million passengers, according to the General Directorate of State Airports Authority (DHMI).

International passengers totalled 134.7 million, which was an increase of 9.2%, while the domestic passenger count grew by 5.4%, to 95.3 million.

Turkish Airlines' passengers grew by 2%…

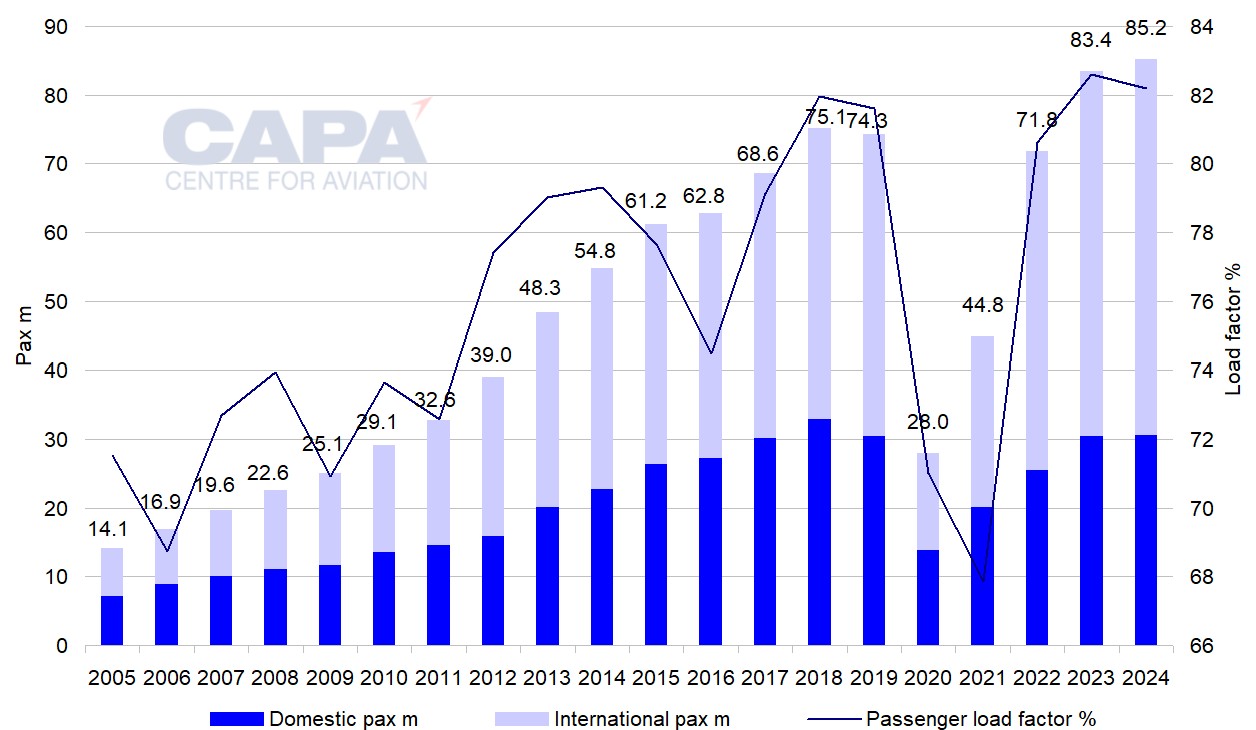

Passenger numbers for the country's biggest operator, Turkish Airlines, grew by 2.1%, to 85.2 million in 2024 (including its LCC subsidiary AJet).

This was 15% above its 2019 traffic, but its annual growth was much slower than the 16.1% that it achieved in 2023.

Turkish Airlines' international traffic grew by 2.9% to 54.6 million in 2024, and its domestic passenger count grew by 0.7% to 30.6 million.

Thus, it did not match market growth in either the international or the domestic segment.

…and its load factor slipped fractionally from its peak

Although passenger numbers grew by only 2.1% in 2024, RPKs grew by 7.7%, due to longer average trip lengths.

RPK growth was less than ASK growth of 8.2%, and in 2024 load factor slipped by 0.4ppts, to 82.2%.

This was still its second highest load factor ever (after 82.6% in 2023), although it was 1.3ppts below the global average of 83.5% reported by IATA.

Turkish Airlines' load factor has followed a broadly upward path over the past two decades, but with considerable volatility year to year.

Turkish Airlines: passenger numbers (million) and load factor (percentage), 2005 to 2024

Source: CAPA - Centre for Aviation, Turkish Airlines.

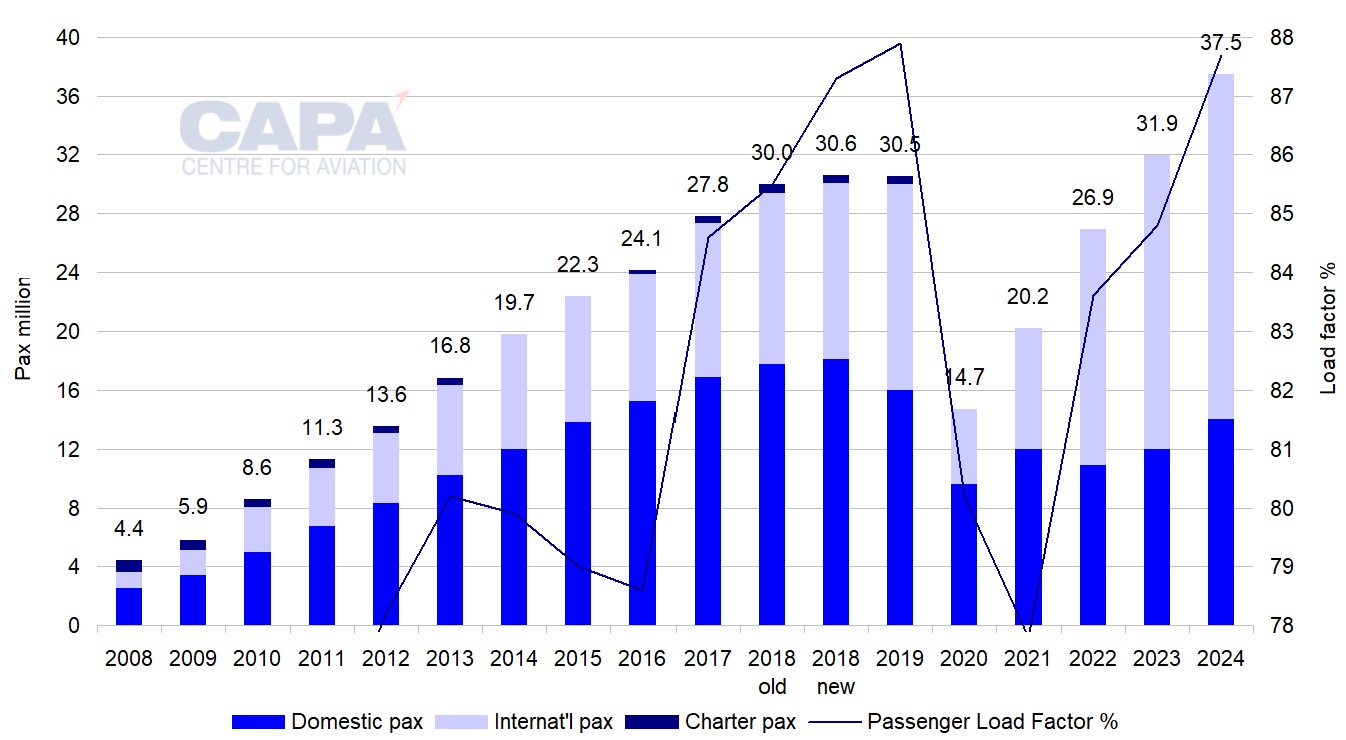

Pegasus Airlines' passenger numbers grew by 17%…

Pegasus Airlines' 2024 passenger numbers grew by 17.4% to 37.5 million, a new record for Türkiye's number two airline, maintaining a double digit growth rate for the fourth successive year. This was 23% higher than its 2019 traffic of 30.5 million passengers, a higher percentage than achieved by Turkish Airlines.

Both its international and its domestic passenger numbers grew at the same rate of 17.4% - stronger than the market.

Its international traffic was 67% higher than in 2019, whereas its domestic traffic was 22% lower.

Pegasus Airlines' growth outpaced that of Turkish Airlines and Türkiye as a whole in 2024.

…and its load factor rose to just below its highest ever

In 2025 Pegasus Airlines' passenger load factor gained 2.9ppts, to 87.7%, only 0.2ppts below its highest-ever level of 87.9%, achieved in 2019.

This was 5.5ppts higher than Turkish Airlines' load factor (but lower than the 90% plus load factors of Europe's two other ultra LCCs, Ryanair and Wizz Air).

Pegasus Airlines: passenger numbers (million) and load factor (percentage), 2008 to 2024

Note: charter passenger numbers not separately disclosed for 2014 and 2015 (included with international).

Passenger numbers are passengers flown until 2018, but include paid-for no-shows from '2018 new' onwards.

Source: CAPA - Centre for Aviation, Pegasus Airlines.

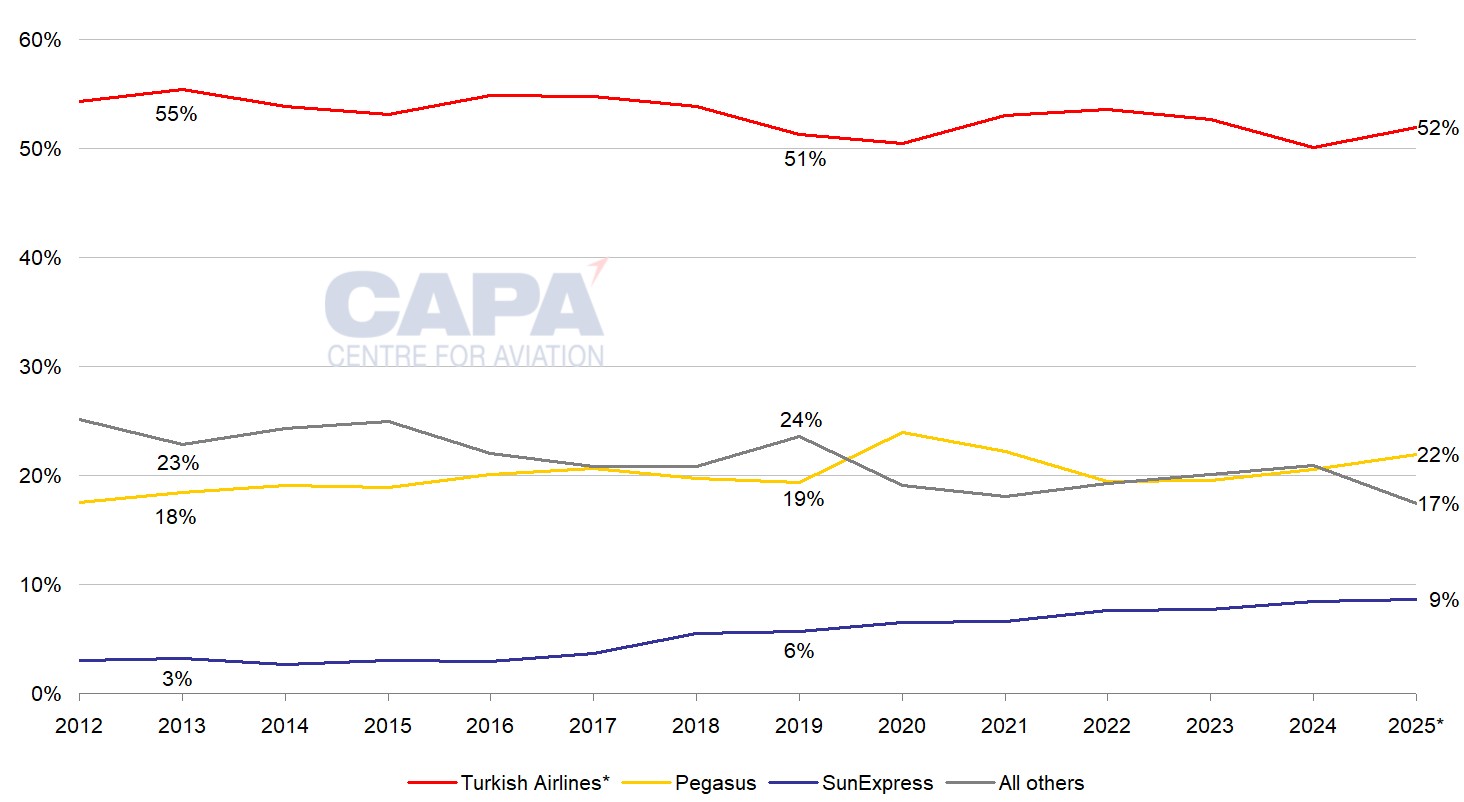

Turkish Airlines and Pegasus Airlines have both increased seat share in Türkiye since 2019

Both Turkish Airlines and Pegasus Airlines have achieved small increases in seat share in Türkiye since 2019.

Although Turkish Airlines' share fell from 55% to 51% in 2019, it has increased to a projected 52% in the first eight months of 2025.

Pegasus Airlines' seat share has risen from 18% in 2013 to 19% in 2019, and a projected 22% in the first eight months of 2025.

The seat share of Türkiye's number three airline, LCC SunExpress, has been on a longer term rising trend, increasing from 3% in 2013 to 6% in 2019 and a projected 9% in the first eight months of this year.

Turkish Airlines has a 50% equity stake in SunExpress (alongside Lufthansa). From Turkish Airlines' perspective, the increase in the LCC's share helps to mitigate the modest decline in its own seat share in Türkiye since 2013.

Türkiye: annual seat share of leading airlines*, 2012 to 2025**

*Turkish Airlines including its subsidiary AJet.

**8M2025.

Turkish Airlines' operating margin fell in 2023 and 2024

Turkish Airlines improved its 2024 net result by 17.5% to USD3,425 million, from USD2,915 million (although it is based in Türkiye, the group's financial reporting focuses on USD).

However, this was due to lower charges for tax and financial expenses.

Its operating profit fell by 15.6%, to USD2413 million, in spite of a revenue increase by 8.2%, to USD22,669 million.

Turkish Airlines' operating margin narrowed by 4.3ppts to 8.5% in 2024. This was its second successive decline in its operating margin, and was 6.3ppts lower than 2022's 14.7%.

Nevertheless, its 2024 operating margin was only bettered once in the decade leading up to the COVID pandemic (it reached 9.1% in 2018).

Pegasus Airlines achieved its second highest operating margin ever in 2024

In 2024 Pegasus Airlines' net profit fell by more than half, from EUR790 million in 2023 to EUR361 million.

However, its operating profit increased by 18.2% - from EUR489 million to EUR578 million, with revenue up by 17.1%, to EUR3,126 million.

Pegasus Airlines' operating margin increased modestly (by 0.2ppts) to 18.5%, which was its second highest level ever, after 18.9% in 2019.

Both follow a similar profit cycle…

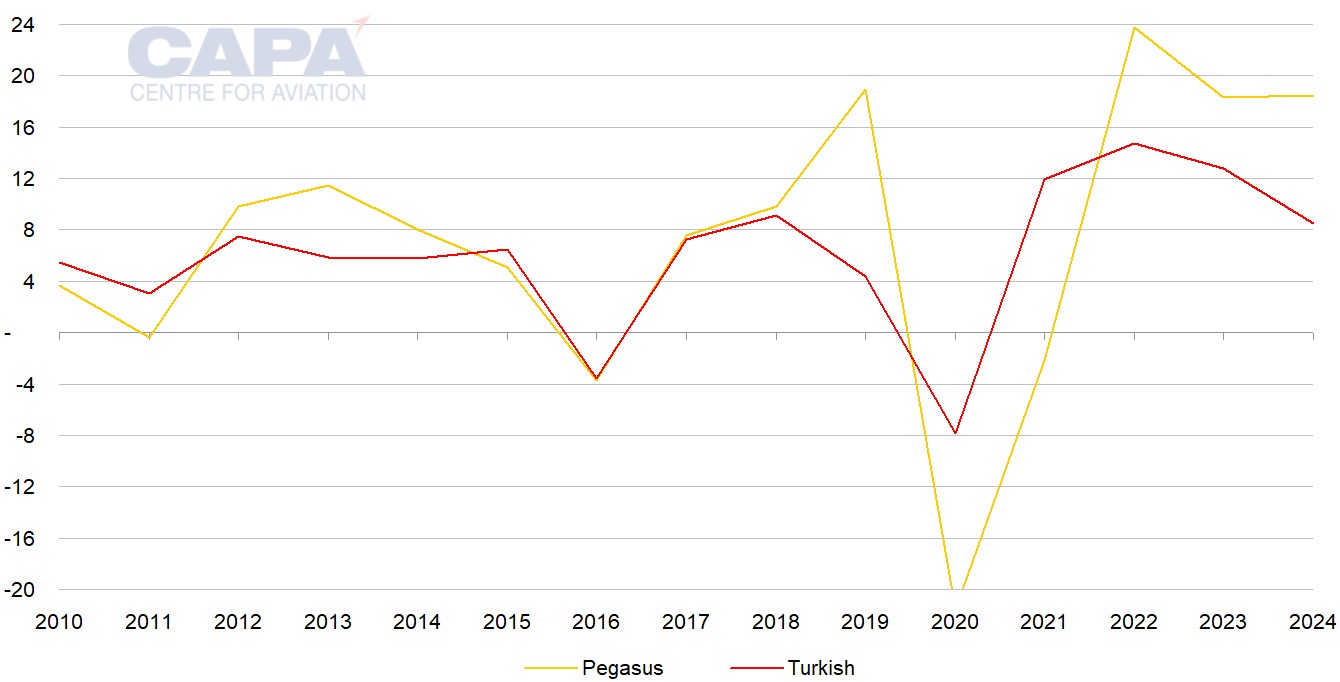

Pegasus Airlines and Turkish Airlines follow broadly the same cycle of profitability, whereby their operating margins typically move up and down together.

Pegasus Airlines and Turkish Airlines: operating margin (percentage), 2010 to 2024

Source: CAPA - Centre for Aviation, Pegasus Airlines, Turkish Airlines.

…but Pegasus Airlines is now consistently more profitable than Turkish Airlines

However, Pegasus Airlines has consistently reported higher margins in recent years.

This pattern began in 2019, when Turkish Airlines' operating margin halved, but Pegasus Airlines' operating margin almost doubled.

The pattern was interrupted by the COVID-19 pandemic, when Pegasus Airlines suffered a bigger drop in its margin for 2020.

Nevertheless, Pegasus Airlines' profitability has recovered more strongly since then, and it has achieved higher margins than Turkish Airlines in every year since 2022.

The equilibrium may be tipping

Both airlines have different business models: Turkish Airlines, a full service, network airline with a global network and hub connections; and Pegasus Airlines, an ultra-LCC with a short/medium haul focus on domestic Türkiye and Türkiye to Europe.

Pegasus Airlines has a significant unit cost advantage over Turkish Airlines.

However, since they each essentially occupy different market segments, the unit cost performance of each versus other competitors in each segment is more important.

Both airlines have a unit cost advantage over other competitors in their own market segment. This is what has preserved the competitive equilibrium between them.

However, Pegasus Airlines' superior margins in recent years suggest its ultra-low unit cost may give it greater resilience to challenging market conditions.

Perhaps the competitive equilibrium is starting to tip in Pegasus Airlines' favour.