North Atlantic drives Europe’s legacy airline profits, but geopolitics could intervene

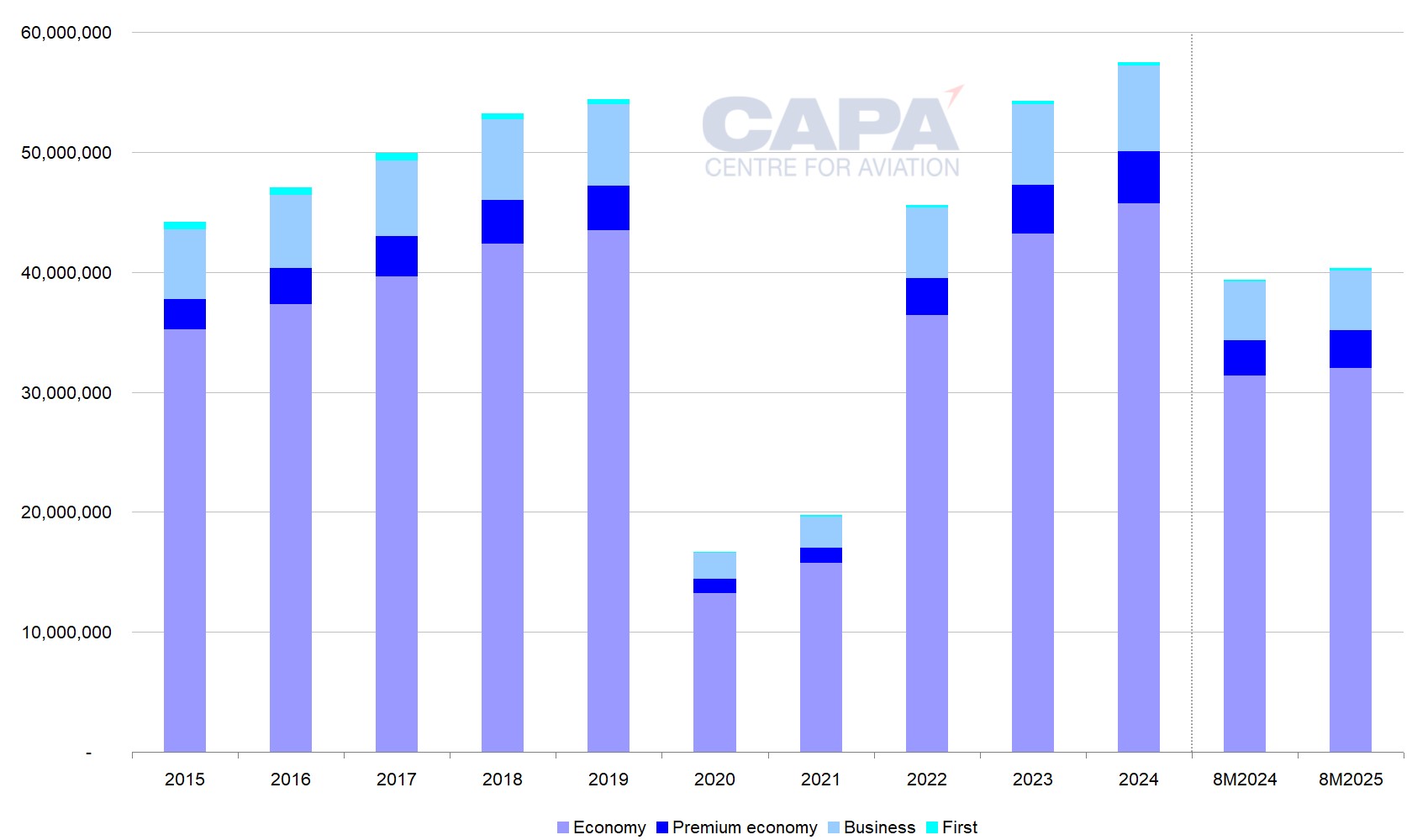

The North Atlantic has recovered from the COVID-19 pandemic faster than the total market for aviation to/from/within Europe. Capacity in the premium economy cabin has bounced back the strongest, whereas first class capacity on the North Atlantic has shrunk since 2019.

Capacity growth between Europe and North America is set to slow from 5.9% in 2024 to 2.4% in the first eight months of 2025. Premium economy is scheduled to outpace this, but is projected to slow from 8.0% in 2024 to 4.3%.

Europe's big three legacy airline groups - Lufthansa Group, IAG and Air France-KLM - currently see a positive outlook on the North Atlantic, supported by their immunised JVs and the strength of the premium cabins. Premium leisure travellers have offset the impact of a more sluggish recovery in business travel.

The North Atlantic should remain a driver of profits for the big three in 2025, but macroeconomic and geopolitical uncertainties should not be ignored.

Summary

- In 2024 North Atlantic capacity grew by 5.9%, led by premium economy – up 8.0%. In 8M2025 growth is set to slow to 2.4%, with premium economy up 4.3%.

- The North Atlantic has recovered from the COVID-19 pandemic faster than Europe overall. Premium economy’s recovery is the strongest, whereas first class has shrunk since 2019.

- Premium cabins are more important on the North Atlantic than in other major regions.

- Europe’s big three legacy airline groups currently see a positive outlook on the North Atlantic, supported by their immunised JVs.

- The North Atlantic is very important to profit for Europe’s big three, due to its overall size and the size of its premium segment.

In 2024 North Atlantic capacity grew by 5.9%, led by premium economy - up by 8.0%

In 2024 total seat capacity between Europe and North America grew by 5.9% year-on-year.

The fastest growing cabin on the North Atlantic last year was premium economy, where capacity increased by 8.0%, which is more than 2ppts faster than total capacity.

Economy capacity grew by 5.8%, while both business and first class grew by 5.6%.

Europe to North America: annual seats by cabin, 2015 to 2024 and 8M2024 & 8M2025

Source: CAPA - Centre for Aviation, OAG.

In 8M2025 growth is set to slow to 2.4%, with premium economy up by 4.3%

In the first eight months of 2025 total North Atlantic capacity growth is scheduled to slow to 2.4%.

However, premium economy is again projected to be the fastest growing cabin, with an increase of 4.3%.

Economy is scheduled to grow by only 2.1%, with business class seats up by 3.7% and first class by 3.2% in 8M2025.

The North Atlantic has recovered from the COVID-19 pandemic faster than Europe overall

Relative to the first eight months of 2019, total capacity on the North Atlantic is scheduled to be 8.4% higher in 8M2025.

This highlights the North Atlantic's more robust recovery from the pandemic, compared with total capacity to/from/within Europe, which is projected to be only 3.5% above its 8M2019 level in 8M2025.

Premium economy's recovery is the strongest, whereas first class has shrunk since 2019

Economy capacity is projected to be up by 7.6% versus 8M2019 - and premium economy is set to be up by 22.3%.

Business class is scheduled to be up by 8.6%, but first class is projected to be down by 40.9% in 8M2025, compared with 8M2019.

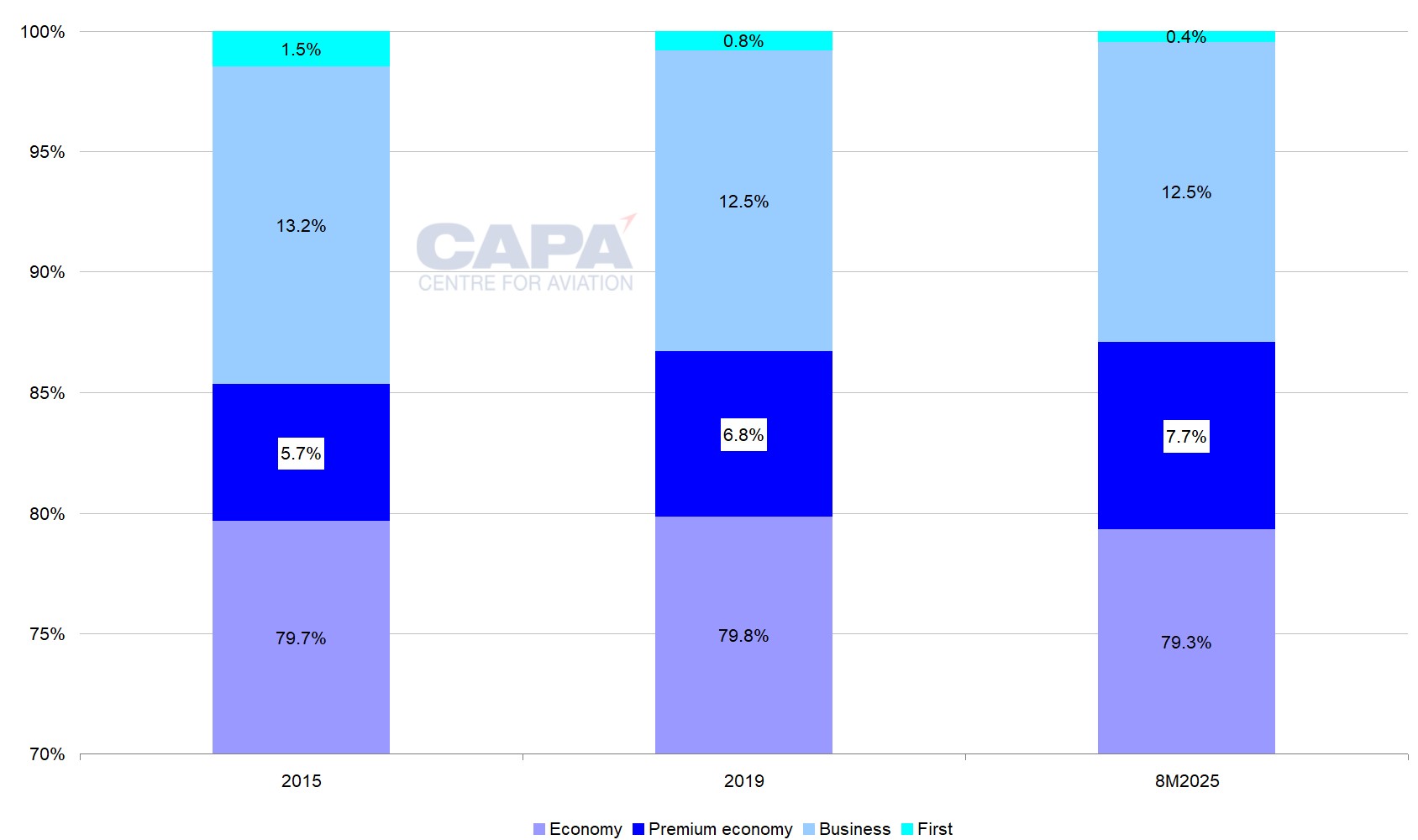

Economy seats continue to account for a large majority of total North Atlantic capacity.

However, whereas economy's share of seats grew fractionally from 79.7% in 2015 to 79.8% in 2019, that share is projected to fall to 79.3% in 8M2025.

Premium economy's share increased from 5.7% in 2015 to 6.8% in 2019, and is scheduled to be 7.7% in 8M2025.

The share of seats held by business class dropped from 13.2% in 2015 to 12.5% in 2019, and is expected to be at this same level in 8M2025.

For first class, seat share fell from 1.5% in 2015 to 0.8% in 2019, and a projected 0.4% in 8M2025.

Europe to North America: seat share by cabin, 2015, 2019 and 8M2025

Source: CAPA - Centre for Aviation, OAG.

Premium cabins are more important on the North Atlantic than in other major regions

Premium cabins (business and first class) accounted for 12.8% of total scheduled capacity on the North Atlantic in 2024 - this is higher than in any other major route region in the world.

Premium cabins had around 11% of seats on Europe-Asia Pacific - the other big long haul region for European airlines - while the global average share of seats taken by premium cabins was less than 5% in 2024.

North Atlantic is the key region for Europe's big three, who see positive conditions currently…

For each of IAG, Lufthansa Group and Air France-KLM, the North Atlantic is the leading long haul region in their networks by ASKs (in the case of IAG, it is the leading region of all by ASKs).

In their recent 2024 year end-results reports, the three leading European legacy airline groups all reported strong 4Q performance and a positive outlook for their North Atlantic businesses.

In this respect, Lufthansa Group, Air France-KLM and IAG echoed commentary from their US counterparts - United Airlines, Delta Air Lines and American Airlines.

The North Atlantic accounted for 30% of IAG's ASK capacity in 2024, and achieved a 6.2% increase in passenger unit revenue.

This was its best-performing region on unit revenue last year, at twice the 3.1% increase for IAG's total passenger network. In 4Q2024 its North Atlantic unit revenue grew at an astonishing rate, of 14.1%.

Lufthansa Group describes the North Atlantic as its "core profit pool and thus our top priority". Its North American RASK grew by 4.6% in 4Q2024, which was a stronger unit revenue performance than any other route region.

For Air France-KLM, the North Atlantic accounted for 24% of its total group ASKs last year. North America was its best-performing region for yield growth in 4Q2024, with an increase of 3.0%.

…supported by their immunised JVs

Moreover, Europe's leading legacy airline groups are all part of immunised North Atlantic joint ventures that help to limit competition.

The three JVs controlled 77% of seats between Europe and North America in 2024, compared with 74% in 2019.

Although SAS (in which Air France-KLM has a 19.9% stake) and ITA Airways (40% owned by Lufthansa Group) are not part of these immunised JVs, their capacity would take JV share to 80% of seats on the North Atlantic.

The North Atlantic is very important to profit for Europe's big three…

Lufthansa Group, Air France-KLM and IAG do not break down financial performance by region.

However, the significance of the North Atlantic to their ASK capacity gives a fairly good indication of how important it is to their revenue and profit.

…due to its overall size…

This partly reflects the overall size of the market, which links two of the world's leading aviation markets and benefits from an open skies agreement between much of Europe and much of North America.

…and the size of its premium segment

It also reflects the size of the premium segment of the North Atlantic market, which attracts high yield passengers, whether travelling for business or leisure purposes.

The recovery of corporate and business-motivated traffic has been relatively weak. However, the negative impact on demand for premium cabins has been more than offset in the aftermath of the pandemic by higher-spending leisure travellers.

Moreover, premium leisure traffic is likely to be less economically sensitive than business traffic if macro conditions weaken.

The North Atlantic should remain a driver of profits for the big three in 2025…

Recent profit warnings from US airlines focused on softer domestic demand, and there are currently no concerns from operators either side of the Atlantic about the outlook for Europe-North America traffic.

The capacity growth outlook on the North Atlantic into summer 2025 is fairly disciplined, which should be supportive to unit revenue.

The North Atlantic is likely to remain the main engine of profitability for Europe's leading legacy airline groups in 2025.

…but concerns could mount

And yet - downturns are rarely visible until it is too late.

Gathering global geopolitical and economic concerns may possibly start to have an adverse effect on demand on the North Atlantic.

Tariffs and recent rhetoric from Washington do not appear designed to harmonise US-Europe relations, nor to quicken the flow of traffic between the two.