Aviation and the Trump tariffs: clouds are darkening

Donald Trump's 90 day suspension of additional tariffs has prompted a stock market rally, but it does not dispel the uncertainty unleashed by his so-called "liberation day" announcement on 2-Apr-2025.

Moreover, most of the world's nations still face a base level tariff of 10% on their exports to the US, unprecedented in modern times. The average rate imposed by the US was 2.5% in 2024 and had not been double digit for eight decades.

Meanwhile, a full-blown trade war between the world's two largest economies is escalating. Mr Trump increased the tariff on China to 125%, while China has levied 84% on the US (update: now 125%, 11-Apr-2025).

For aviation, the outlook is deteriorating. Tariffs and trade wars do not boost economic growth. Risks of an economic slowdown, possibly a recession, are growing. Inflationary pressures and higher borrowing costs add to the uncertainties.

These economic concerns are likely to mean lower demand for air travel. Flag carriers/network airlines are likely to be hit harder, due to exposure to North America, premium cabins and cargo.

Summary

- Financial markets tumbled in response to the US tariff announcements and remain below 2025 peaks in spite of a bounce.

- US tariffs jumped to the highest rates since 1909. The 90 day suspension of the higher tariffs leaves the 10% rate, the highest in eight decades.

- The future is more unpredictable, over a much wider range of possible outcomes.

- Aviation production costs, and delivery delays, will increase. Boeing is likely to be worse affected than Airbus.

- Airlines will see lower demand as a result of weaker GDP growth.

- Flag carriers/network airlines are likely to be hit harder, due to exposure to North America, premium cabins and cargo, but low cost airlines less so.

Financial markets tumbled…

The reaction in the financial markets to the US tariff announcements on 2-Apr-2025 was very negative.

For example, the US S&P 500 index, Japan's Nikkei 225 and the EUROSTOXX 50 all fell by 12%-13% in the first few days.

The sell-off was exacerbated by margin calls, which increase the liquidity needs of market participants and force them to sell assets.

…and remain below 2025 peaks in spite of a bounce

The rally in stock markets prompted by the 90 day suspension of tariffs above the 10% blanket rate still left these indices below their 2-Apr-2025 levels on 10-Apr-2025.

Moreover, all three are 11%-14% below their 2025 peaks.

Even the safe haven of gold suffered a fall in price of around 5% after the tariff announcements, although it recovered much of this.

The value of the US dollar and commodities, including crude oil, also fell.

More worryingly, US treasuries, another investment usually regarded as a safe haven in troubled times, suffered a sell-off, driving up the effective cost of government borrowing.

US tariffs jumped to the highest average rate since 1909

The turmoil in financial markets illustrates how they dislike uncertainty.

The Trump administration had clearly signalled its intention to impose tariffs on many of its trade partners, but markets were surprised by three factors.

First, the level of tariffs imposed on imports into the US was higher than expected, across more countries than expected.

The average tariff rate imposed by the US catapulted from 2.5% in 2024 to 24% in Apr-2025, according to Harvard Professor Jason Furman (source: Financial Times, 8-Apr-2025).

The rate had been below 5% for five decades and below 10% for eight decades. The new rate is the highest since 1909.

Trump appeared to be sticking to them

Second, many had seen the signalling of forthcoming tariffs as just a negotiating tactic by the US President. It quickly became clear it was not.

Third, Mr Trump did not appear willing to adjust his policy in order to calm markets, as many might have hoped.

His 9-Apr-2025 partial retreat only partly alters that.

Many observers have suggested that the president was happy to ignore the stock market reaction to his tariffs, but the sell-off in government bonds prompted his pull-back on the higher rates.

Moreover, the 90 days suspension still leaves open the possibility of a return to the higher rates.

The future is more unpredictable…

Overarching these three factors is that the world trade system and the global economy now faces much more uncertainty than before the tariff announcements.

Nobody can predict the next steps. After the 90 day suspension is over, tariffs could go up or down, depending on how each nation responds.

"This is not a negotiation", wrote Peter Navarro, the president's trade adviser in the Financial Times on 8-Apr-2025.

However, it clearly is a negotiation. Mr Trump wrote on social media on 9-Apr-2025 that "more than 75 Countries have called… to negotiate a solution".

Adding to the uncertainty, it is not clear exactly what the US administration is seeking in return for any lowering of its tariffs. Its demands in these negotiations will not all be purely tariff-related.

The White House is targeting a "barrage of non-tariff weapons foreign companies use to strangle American exports", according to Mr Navarro (a man described by another member of Trump's administration, Elon Musk, as "a moron" and "dumber than a sack of bricks").

If the US successfully negotiates with more than 75 countries in 90 days, the across-the-board tariff of 10% is set to remain, a much higher level than has been seen for decades.

If negotiations break down or are not concluded in the 90 day window, will the previously announced higher rates resume, or will there be a further suspension?

Any retaliatory increases in tariffs on US imports will lead to higher tariffs imposed on the nation concerned.

…over a much wider range of possible outcomes

For those attempting to plan for the future, the range of possibilities is much higher than in the past.

When average tariffs were low and changes - when they happened - were only minimal, businesses could plan within a more predictable range of possibilities.

That kind of world is now in the past.

Business must now attempt scenario planning for an unprecedented range of future tariff outcomes.

These outcomes could be positive as well as negative, but the key point is the much wider range of uncertainty makes planning for the future very taxing.

An obvious consequence is that investment decisions will be delayed or even cancelled permanently.

Aviation production costs, and delivery delays, will increase

For aerospace manufacturers, the imposition of increased tariffs will lead to higher costs of production. This will ultimately feed through to higher fares.

Aviation supply chains are complex and global, with components supplied from contractors all over the world, regardless of the location of final assembly.

Raised prices and a consequent reconfiguring of global aviation supply chains are likely to lead to even more delivery delays and capacity constraints for airlines.

Boeing is likely to be worse affected than Airbus

Tariffs on parts imported to the US will raise costs for Boeing and this is likely to raise the prices it charges for its completed aircraft.

There may be some mitigating effect from exchange rate movements if USD continues to weaken.

This will make Boeing less competitive outside the US, even more so if other nations impose retaliatory tariff increases on exports from the US.

The impact on Airbus will be less damaging.

The European airframer may lose sales into the US if tariffs raise the price of its products, but this will not affect its sales in the rest of the world.

It may also face some increases in production costs if retaliatory tariffs are imposed on components exported from US suppliers to its European production lines.

Airlines will see lower demand as a result of weaker GDP growth

Aviation supply chain challenges will also affect airlines.

However, a more fundamental impact is likely to be felt by airlines in the form of weaker demand, both in passenger and cargo traffic.

Passenger demand is linked to GDP growth and the outlook for the global economy has deteriorated since the Trump tariff announcements.

This reflects a number of factors that feed through to likely weaker economic growth.

These include reduced trade flows, the impact of falling stock markets on individual wealth, increased bond yields signalling higher government borrowing costs and concerns about rising inflation.

Flag carriers to be hit harder…

The consequences for flag carrier/long haul airlines are likely to be more challenging than for low cost airlines or those with less exposure to the US and cargo.

Leading US airlines had already warned in Mar-2025 on weaker domestic demand, both corporate and consumer, due to growing economic uncertainty.

On 9-Apr-2025 Delta Air Lines withdrew guidance for record profits in 2025, citing a lack of economic clarity over the impact of the Trump tariffs.

…due to exposure to long haul North America and premium cabins…

Airlines exposed to the North Atlantic face particular demand uncertainty. The Trump trade war cannot be positive for sentiment.

According to a poll on travel media website ttgmedia, travel agents answered 66% 'Yes' to the question of whether the US president's actions and rhetoric are putting clients off booking travel to the US (as at 9-Apr-2025).

Premium cabins drive long haul profitability, especially on the North Atlantic, but filling them could become more difficult.

Reduced trade flows lead to lower business traffic and falling demand for business class, which anyway has not fully recovered from the COVID-19 crisis.

Demand for premium cabins from private leisure travellers has helped to make up for lower business traffic in the recovery from the pandemic.

However this demand is vulnerable to the falling net worth of individuals resulting from stock market declines.

This also typically has a negative impact on consumer spending.

…and cargo

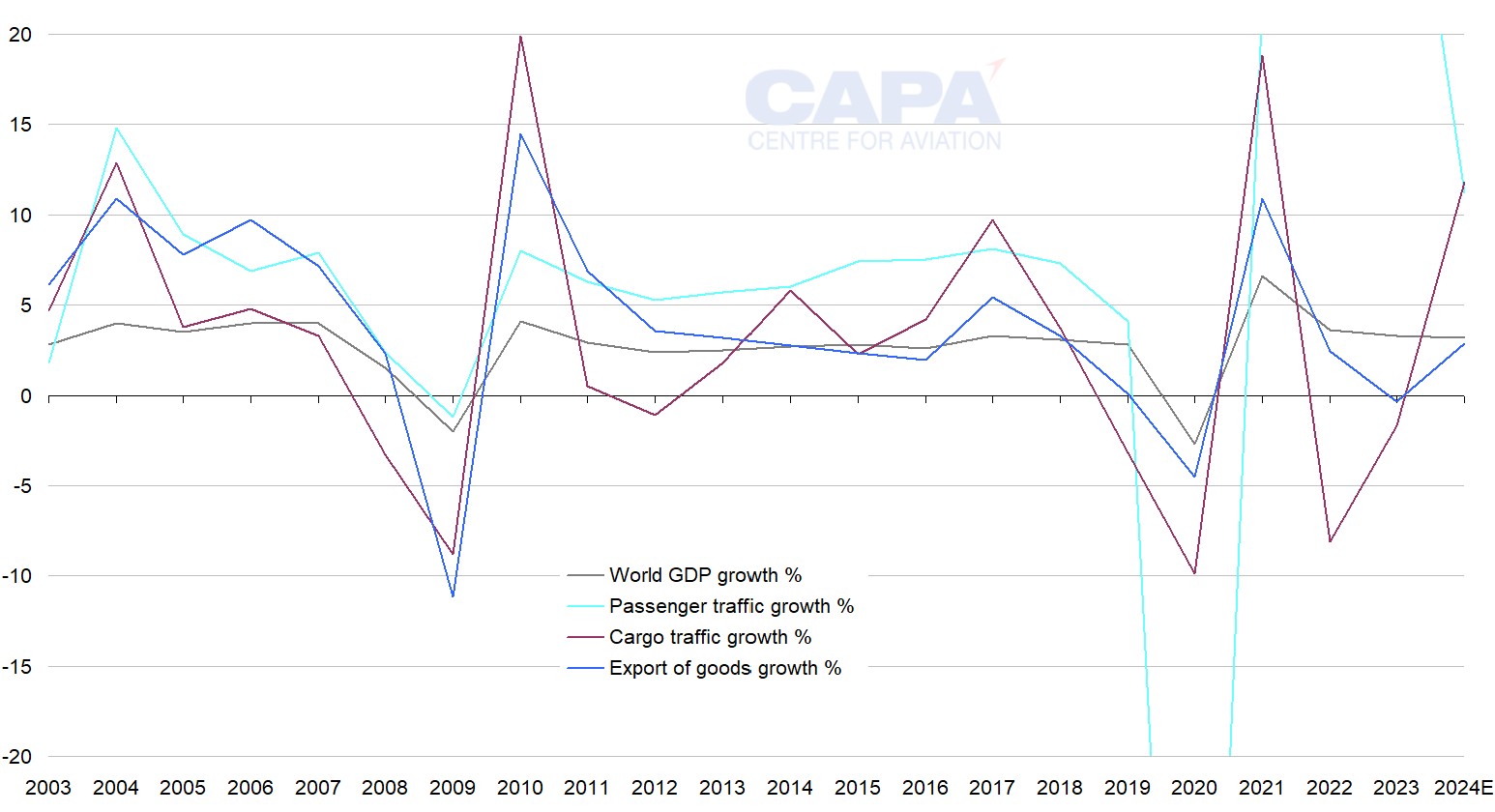

Air cargo traffic growth, closely linked to trade flows, is also correlated to GDP growth.

According to IATA data, cargo's share of world airline revenue grew from 12.0% in 2019 to 15.4% in 2024. This is an important element of many carriers' business models.

A trade war is bad news for air cargo demand and for airlines with significant cargo operations.

According to IATA, global air cargo traffic fell by 0.1% in Feb-2025, the first decline since mid 2023. The Trump tariffs, even at 10%, will add to the downward pressure on demand.

Growth in world GDP, passenger traffic, cargo traffic and export of goods, 2003 to 2024

Source: CAPA - Centre for Aviation, IATA, IMF.

Low cost airlines may be less badly affected

Low cost airlines, which tend to be more focused on short/medium haul, on the economy cabin and on passenger traffic, are better placed than flag carriers.

Nevertheless, a softer economic outlook is not welcome for any airline.

Weaker USD and oil prices may provide some relief

There are two factors that may provide some relief to airlines, particularly those outside the US.

One is a weaker dollar, which will lower the cost to non-US airlines of USD-denominated costs, the most significant being aircraft and oil. However, airlines with significant US-originated sales will suffer from a negative revenue impact in their own currency.

The second positive factor is the recent fall in oil prices, which feeds through into lower jet fuel prices.

Brent crude has fallen from USD82 in the week before President Trump's inauguration in Jan-2025 to just below USD64 at the time of writing on 10-Apr-2025, having dipped below USD60 on 9-Apr-2025 (it was USD75 as recently as 2-Apr-2025).

For non-US airlines, the fall in USD further lowers the cost of jet fuel in their own local currency.

However, the fall in crude oil prices is itself a signal of a weaker global economic outlook.

Trump 2 is looking bad for aviation

There was a hope among some in the airline industry that the second Trump term could be positive for aviation, as the president is expected to reduce regulation.

In fact, senior airline executives and other US aviation leaders revealed at the CAPA Airline Leader Summit Americas in Grand Cayman in early Apr-2025 that dialogue between the industry and government officials had already significantly improved under the new leadership.

However, it is now looking more likely that the negative impact of the protectionist Trump trade war and the consequent effect on economic growth and demand for air travel will outweigh any benefits of deregulation.