European airlines: top 12 LCCs extended passenger lead vs non-LCCs in 2024

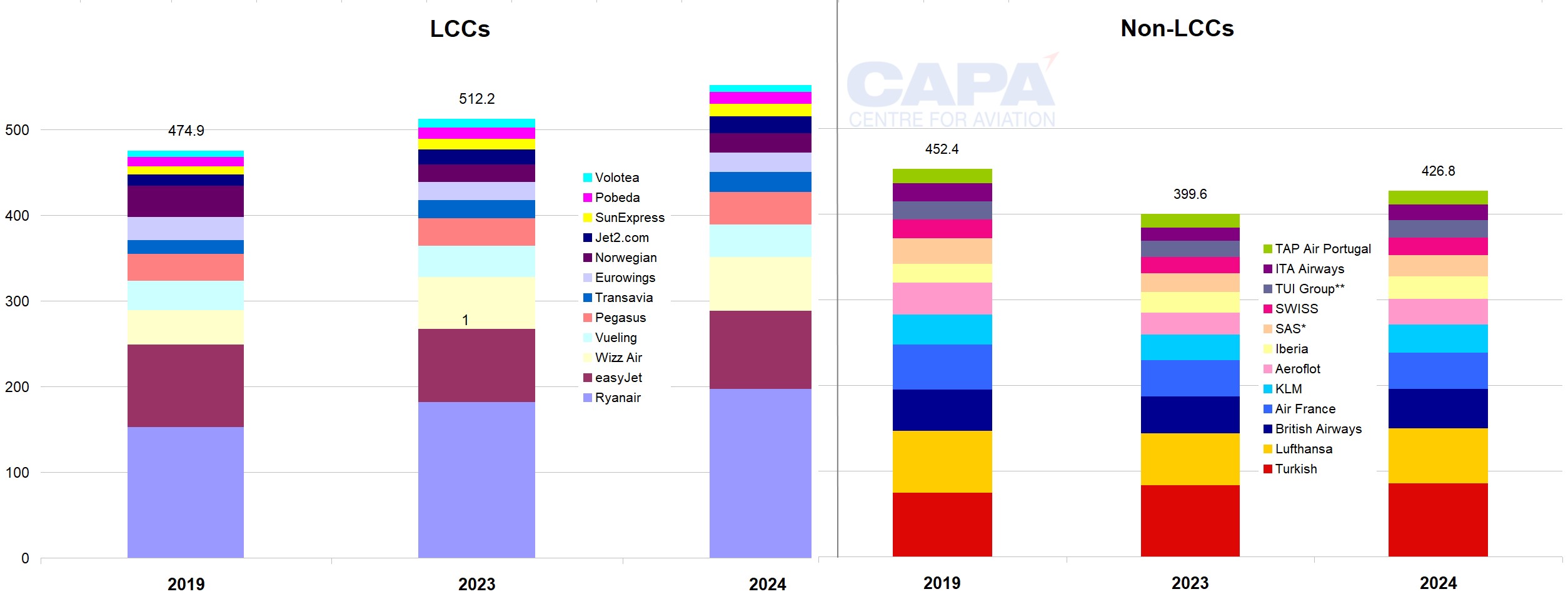

In 2024 Europe's top dozen low cost airline brands further increased the lead in their collective passenger numbers to 128 million, over the top 12 non-LCCs.

This compares with a lead of 113 million in 2023 (and only 23 million in 2019).

The top 12 LCCs collectively grew by 8.3% year-on-year in 2024, whereas the top 12 non-LCCs grew by just 6.8%. Compared with 2019, the LCCs were up by 17%, while the non-LCCs were still 6% short.

Ryanair, Europe's biggest LCC and biggest airline overall by passenger numbers in 2024, had more than double the traffic of the number two LCC, easyJet.

Both had more passengers than Turkish Airlines, the biggest non-LCC in Europe.

This report ranks the top 12 LCC and non-LCC airline brands in Europe by passenger numbers in 2024.

Summary

- Ryanair was again Europe's leading LCC in 2024, with well over double the passengers of the number two, easyJet.

- Vueling, the biggest low cost subsidiary of a legacy group, was just ahead of Pegasus in fourth.

- The top 12 LCCs carried 117% of 2019 passengers in aggregate in 2024. SunExpress had the fastest year-on-year growth.

- Turkish Airlines remained the leading non-LCC, with 32% more pax than Lufthansa.

- The top 12 non-LCCs carried 94% of 2019 passengers in aggregate in 2024. ITA Airways had the fastest year-on-year growth.

- The top 12 LCCs have increased their collective lead over the top 12 non-LCCs – from 23 million in 2019 to 128 million in 2024.

Ryanair was again Europe's leading LCC in 2024…

Ryanair retained its position as Europe's number one LCC brand by passenger numbers in 2024. It was also Europe's number one airline overall.

See related CAPA - Centre for Aviation report: Europe's top 20 airline groups by passengers 2024: Ryanair on top again

…with well over double the passengers of number two easyJet

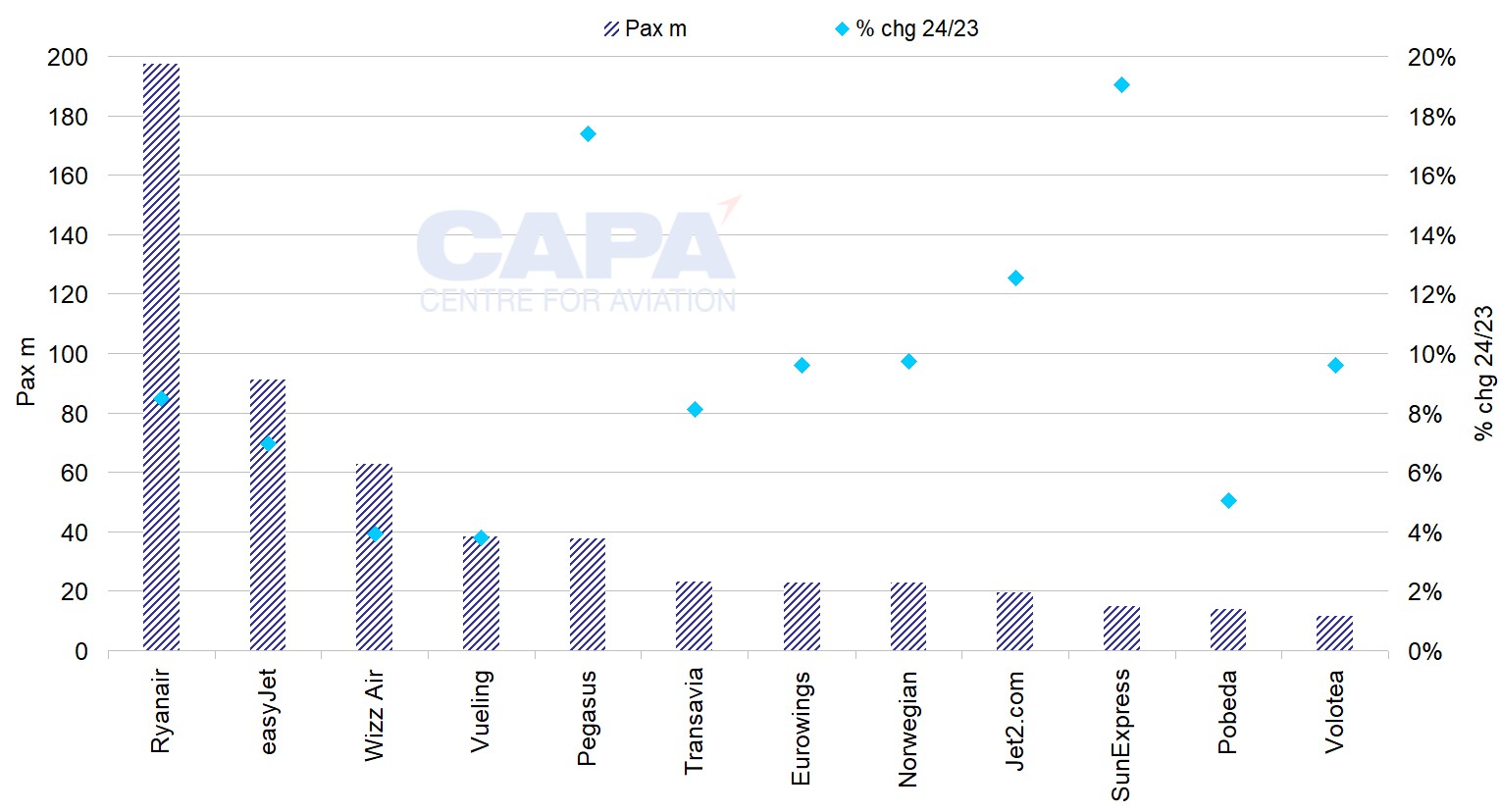

Ryanair's total of 197.2 million passengers in calendar 2024 was more than double number the total of the number two ranked LCC - easyJet's 91.1 million.

EasyJet, in turn, had almost 28 million more passengers than Wizz Air, which was the third largest LCC brand in 2024, with 62.7 million (less than one third of Ryanair's total).

Vueling, the biggest low cost subsidiary of a legacy group, was just ahead of Pegasus in fourth

IAG subsidiary Vueling, the biggest LCC brand in the leading legacy airline groups, was the number four low cost brand, with 38.2 million passengers.

Only one other LCC carried more than 30 million passengers: Pegasus Airlines, just behind Vueling with 37.5 million.

There is then a gap of more than 14 million to the other two low cost brands of legacy groups.

Air France-KLM's Transavia was sixth, with 23.2 million passengers, just ahead of Lufthansa Group's Eurowings, which had 22.8 million.

Very close behind them, in eighth among LCCs, was Norwegian, with 22.6 million passengers.

Jet2.com, in ninth place, carried 19.5 million passengers, while SunExpress completed the ranking of Europe's top 10 LCCs with 15.0 million.

Extending the list to a dozen, the Aeroflot subsidiary Pobeda carried 13.7 million passengers, and Volotea carried 11.4 million.

The only change of position in the top 12 compared with 2023 was SunExpress and Pobeda swapping places.

Europe's top 12 low cost airline brands by passenger numbers, calendar 2024

Source: CAPA - Centre for Aviation, airline company traffic reports.

The top 12 LCCs carried 117% of 2019 passengers in aggregate in 2024

In aggregate, the top 12 LCCs carried 555 million passengers in 2024 - which was 16.8% more than their 2019 total of 475 million, and 8.3% up on the 2022 figure of 512 million.

Only three of the top 12 LCCs were below their 2019 traffic level: easyJet (at 94%), Eurowings (85%), and Norwegian (62%).

The strongest growth versus 2019 was achieved by Wizz Air (158%), followed by Jet2.com (152%) and Volotea (150%).

SunExpress had the fastest year-on-year growth in the top 12 LCCs

The fastest growing LCC by year-on-year growth in 2024 was SunExpress, whose passenger numbers increased by 19.0%, followed by Pegasus (17.4%) and Jet2.com (12.6%).

The slowest growth was for Vueling (3.8%) and Wizz Air (3.9%).

Collectively, the top 12 LCCs grew by 8.3% year-on-year in 2024.

Turkish Airlines remained the leading non-LCC, with 32% more passengers than Lufthansa

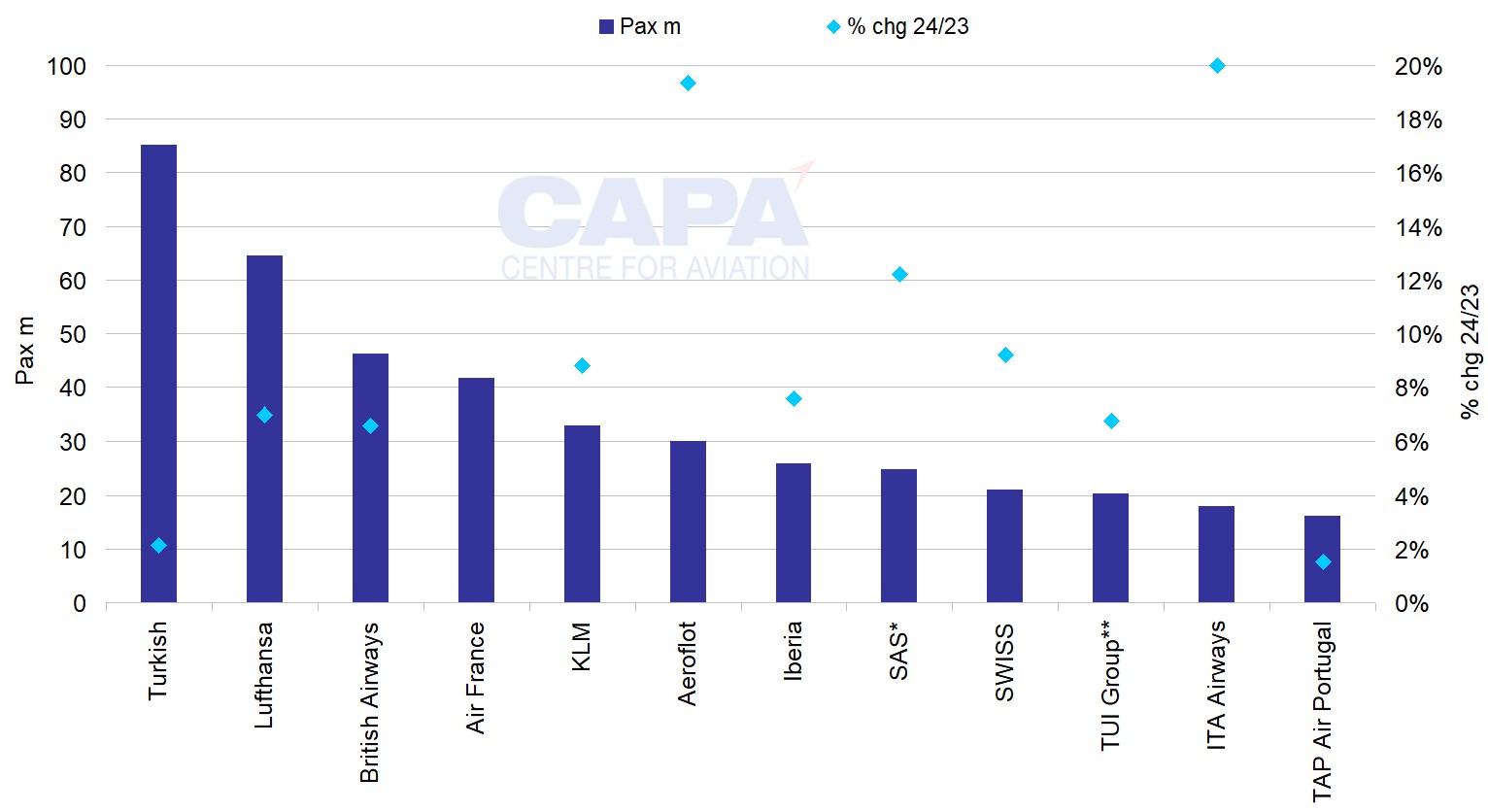

The chart below ranks the top dozen non-LCC airline brands by passenger numbers in 2024.

Turkish Airlines was again at the top of the list, with 85.2 million.

This is 5.9 million fewer than the second biggest LCC's 91.1 million (easyJet). However, it is 20.7 million more than the second ranked non-LCC.

The national airlines of four western European countries occupied ranks two to five: Lufthansa (64.5 million), British Airways (46.2 million), Air France (41.7 million) and KLM (33.0 million).

Russia's Aeroflot was sixth, with 30.1 million passengers, just ahead of Iberia, with 25.9 million, and SAS, with 24.8 million.

Ninth placed SWISS, with 21.1 million passengers, was just ahead of 10th ranked TUI's 20.3 million (year to Sep-2024).

The top dozen non-LCC brands was completed by ITA Airways (18.0 million) and TAP Air Portugal (16.1 million).

The only change from the 2023 ranking was ITA Airways replacing S7 Airlines at number 11.

Europe's top 12 non-LCC airline brands by passenger numbers, calendar 2024

* SAS figure for 12 months to Jul-2024 (since when no figures have been reported).

** TUI Group figure is reported number of customers for its Markets & Airlines division for 12 months to Sep-2024; CAPA estimates.

Source: CAPA - Centre for Aviation, airline company traffic reports.

The top 12 non-LCCs carried 94% of 2019 passengers in aggregate in 2024

In aggregate, the top 12 non-LCCs carried 427 million passengers in 2024, which was still only 94% of their 2019 total of 452 million.

Only two of the top 12 non-LCCs carried more passengers than in 2019: Iberia and Turkish Airlines (both on 115% of 2019).

Behind them, the closest were SWISS (98%), British Airways and TUI Group (both on 97%).

The lowest percentages of 2019 passenger numbers in 2024 were recorded by Air France (79%) and Aeroflot (81%).

ITA Airways was the fastest growing top 12 non-LCC

The fastest growing non-LCC by year-on-year growth in 2024 was ITA Airways, with a 20.0% increase, followed by Aeroflot (19.3%).

SAS also achieved double digit growth (12.2%).

The slowest growth was for Air France (-0.1%) and TAP Air Portugal (1.5%).

Collectively, the top 12 non-LCCs grew by 6.8% year-on-year in 2024, which was slower than the LCCs.

The top 12 LCCs increased their collective lead over the top 12 non-LCCs

The leading dozen LCCs further widened the margin of superiority over their non-LCC counterparts in passenger numbers in 2024.

In 2024 the top 12 LCCs carried 555 million passengers, which was 128 million more than the non-LCCs' 427 million, increasing the gap from 113 million in 2023.

In 2019 the top 12 LCC total of 475 million was only 23 million more than the top 12 non-LCC total of 452 million.

Europe's top 12 LCCs and non-LCCs: passenger numbers (million) 2019, 2023, and 2024

* SAS figure for 12 months to Jul-2024 (since when no figures have been reported).

** TUI Group figure is reported number of customers for its Markets & Airlines division for 12 months to Sep-2024.

Source: CAPA - Centre for Aviation, airline company traffic reports

LCCs' superior growth is set to continue

These statistics are a further reminder of the superior recovery of Europe's low cost airlines from the COVID-19 pandemic, and of their continued stronger growth.

Even if current global macroeconomic and geopolitical uncertainties lead to a weakening of the economy and demand for air travel, LCCs are likely to continue to outperform compared with their non-LCC rivals.