Will US airlines’ hopeful stance for Trump policies fade with tariff turmoil?

After the election of the US president, Donald Trump, in Nov-2024, some of the country's airlines breathed a sigh of relief, betting that a change in administration would reverse policies aviation leaders had deemed onerous.

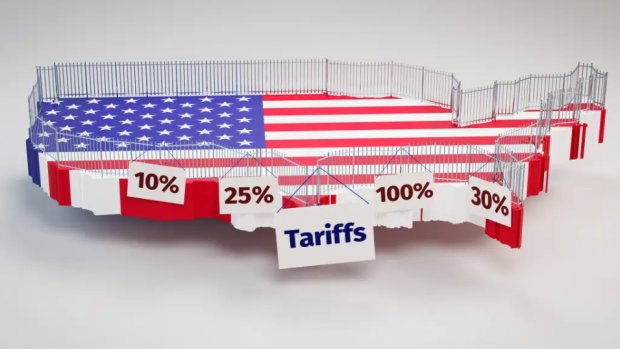

Nearly four months into Mr Trump's presidency, US airlines arguably find themselves stuck in a mental tug of war - they still remain optimistic that Mr Trump will initiate positive changes for the industry, but are also reeling from a whiplash of trade policies that are upending their financial forecasts.

The rapid changes beg one overarching question: are the benefits from favourable policy meaningful if profitability is wiped out?

Summary

- It is as yet unknown whether DOT Secretary Sean Duffy will successfully execute air traffic reforms.

- Airlines are in uncharted territory after tariff whiplash.

- Predictions that the Trump administration will be pro-antitrust could fail to materialise.

- Rapidly changing trade policy could result in fewer airlines to regulate.

Although viewed positively by airlines, Trump's aviation pledges have yet to materialise

Late in 2024 Delta CEO Ed Bastian declared that the then incoming Trump administration could be a "breath of fresh air," according to CNBC.

Mr Bastian told the news outlet that the industry had seen a "level of overreach" during the previous four years. Former Department of Transportation (DOT) secretary Pete Buttigieg had a particular focus on consumer protections that didn't sit well with many US airlines.

Even as Mr Trump announced sweeping tariffs on "Liberation Day" (2-Apr-2025), some US airlines remained bullish about pledges made by the current DOT Secretary Sean Duffy to supercharge the hiring of Air Traffic Controllers and raise salaries for that workforce.

"Quite frankly, we're thrilled that both the President of the United States and Secretary Duffy have come forward[,] and are developing a tens of billion of dollars air traffic control plan to completely revamp and modernise the air traffic control system", said Airlines For America SVP Legislative and Regulatory Policy Sharon Pinkerton on 3-Apr-2025 during the CAPA Airline Leader Americas Summit in Grand Cayman.

Airlines For America SVP Legislative and Regulatory Policy Sharon Pinkerton speaking at the CAPA Airline Leader Americas Summit in Grand Cayman on 3-Apr-2025

Source: CAPA - Centre for Aviation.

Noting in 2024 that the FAA netted 36 certified professional controllers, "Whatever we've done in the past…it's just not working," Ms Pinkerton said. Then adding, "we're thrilled" that Mr Duffy has acknowledged that the US has a shortage of approximately 3,000 air traffic controllers.

But it is yet to be revealed how of much of Mr Duffy's ambition to revamp the country's air traffic control system will become a reality.

Reuters has reported that Mr Duffy has said that he's still in talks with the administration about his plan to upgrade the US air traffic control system. The news outlet stated that Mr Duffy said he was working with the White House Office of Management (OMB) and Budget - and that office was reviewing his costs estimates. The "OMB is pressure-testing those numbers," he stated.

At the moment, the outcome of that pressure testing remains unknown and airlines, meanwhile, have turned their attention to navigating the Trump administration's rapidly changing trade policies.

Tariffs trigger US airlines to temper capacity and slash fares

US Airlines were faced with the onset of softening demand before "Liberation Day", and the walk back on some tariffs hasn't slowed the pressure that those operators face.

Both Frontier Airlines and Delta Air Lines have pulled their full-year financial guidance, as Delta's CEO Ed Bastian recently concluded that "broad economic uncertainty around global trade" has largely stalled growth.

Frontier, which previously expected to break-even in 1Q2025, now expects a pre-tax loss margin for that period. The ultra-low cost carrier also concluded that weakened demand was "resulting in fare discounting and promotions across the industry, amplified by the close-in nature of Frontier's bookings".

Both airlines have also opted to cut capacity, as Delta's supply will remain flat year-over-year in 2H2025 and Frontier's capacity is projected to fall in the low single digits for 2Q2025.

There's no doubt that other airlines will follow suit; but will those actions be enough to keep the industry afloat through an unpredictable period of tariff turmoil?

Canadian airlines have been working to ease the effects of tariffs for a bit longer - as tariffs were levied on Canada and Mexico earlier in 2025. Both Porter Airlines and the Canadian ultra-low cost carrier Flair Airlines have opted to move some capacity back into the domestic market.

But shifting capacity back into Canada "doesn't solve the issue, because everybody's doing the same", Flair CEO Maciej Wilk said at the CAPA Airline Leader Americas conference.

Flair CEO Maciej Wilk speaking at the CAPA Airline Leader Americas Summit in Grand Cayman on 3-Apr-2025

Source: CAPA - Centre for Aviation.

During Delta's 1Q earnings discussion, the company's president, Glen Hauenstein, explained that the company had seen a significant drop-off in Canadian bookings. Mexico, he said, is "kind of a mixed bag ... I think there's a lot of pressure on VFR [visiting friends and relatives] more than business traffic to Mexico right now".

He added that Delta "will be looking at Canada and Mexico as places that we probably want to reduce our capacity levels as we move forward".

For now, long haul demand appears to be holding up. Mr Hauenstein explained that Delta had "not seen yet a crack in the rest of the world to the United States, and we're mindful that could happen, but we haven't seen it yet". However, incoming passengers to the US only represent approximately 20% of Delta's international point of sale revenue, he said.

But even if US point of sale represents the bulk of Delta's long haul revenue, any dent in that 20% could still sting - the possibility of non-US travellers opting for other destinations continues to grow, as evidenced by Canadians trading US warm weather destinations for other markets in Mexico and the Caribbean. Weakening demand in any sector is headwind against a highly uncertain economic backdrop.

Perhaps Mr Wilk captured the current state of the industry most accurately at the CAPA Airline Leader Americas event: "The billion-dollar question is whether this is something that will continue for the next 3-4 years, or emotions will cool down and the summer of 2026 will be more or less back to normal".

It's a question no one can answer at the moment, and the 90-day reprieve on some tariffs issued by the Trump administration does little to quell continued uncertainty around air travel demand.

Will the outcome of a DOJ antitrust review could disappoint airlines?

After Mr Trump took office, most industry observers concluded that the new administration would be more favourable to alliances and mergers after the former president's Department of Justice succeeded in dismantling the JetBlue-American Airlines alliance and blocking the merger of JetBlue and Spirit.

While Ms Pinkerton noted that "I do think they're (the Trump administration) is going to be friendlier to this type of activity", she did state that the Department of Justice had formed a task force "to evaluate competition, and some of their language I think was unfavourable towards the idea of antitrust immunity".

Still, she believes that "we're going to have very fierce advocates for airlines in the administration".

Mr Trump's policies could result in smaller US airline industry

It's a safe bet to assume that airlines at the moment are not as concerned about transportation policy as they are about their profitability for 2025 and beyond.

There's an argument to be made that if the current tariff tumult stays the course, the Trump administration could have fewer airlines to regulate.