Addis Ababa’s Abusera International Airport will put Africa firmly on the global aviation map

Airports, typically, take many years from concept to completion, except within China and Türkiye.

But the decision on the location alone of the new airport to serve Addis Ababa, the capital of Ethiopia, took seven years.

It isn't that the existing airport, Bole, is ramshackle. It could continue to be patched up and moderately expanded, perhaps to last for another 10 years.

But courtesy of the success of Ethiopian Airlines, which is widely regarded as the premier airline on the African continent, ambitions are big. And the projected Abusera Airport, which should be open in its first phase in 2029, envisages total annual throughput eventually amounting to 110mppa, making it one of the biggest airports in the world, by today's standards.

It is a project, though, that might not have been feasible without the attachment of an airport city - one that will cost more than the airport.

The African Development Bank will probably provide loans, possibly syndicated ones, but the opportunity may still remain for the private sector investment fraternity to commit finally to a major African project such as this; one that is built on solid commercial acumen, with the state airline a major player.

Summary

- For too long, while being home to Africa’s leading airline, Ethiopia seemed incapable of building a new airport to house it in the capital.

- A new Addis Ababa airport will now be built at Abusera, situated 70km from the existing one.

- There is the potential for 110 million passengers annually, which would put it in new territory for Africa.

- A roll-call of international designers and project managers are on the job.

- The airport might not have been viable without its economic and social spin offs, such as an airport city.

- The state airline is driving this and other infrastructure projects.

- Abusera ties in with Ethiopian Airlines’ own 2035 growth strategy.

- There will come a time when Abusera must take the lead, but the existing Bole Airport should not be written off.

- The African Development Bank aims to please, but could Abusera be the project that is the tipping point for the airport investment fraternity to change its view of Africa?

For too long, while home to Africa's leading airline, Ethiopia seemed incapable of building a new airport to house it

In Nov-2022 CAPA - Centre for Aviation published a report which pointed out that during the previous three years several major new airports had opened across the world, including Istanbul, Beijing Daxing and Berlin-Brandenburg - although the latter had taken an eternity. And while another, at Mexico City, had fallen by the wayside altogether and had been cancelled, despite early works on it.

Moreover, all that had happened since 2014, when a master plan was first rolled out for a new airport in Addis Ababa, the economic powerhouse of East Africa, and home to Ethiopian Airlines - the continent's most impressive airline on the world stage, and arguably one of its most successful financially.

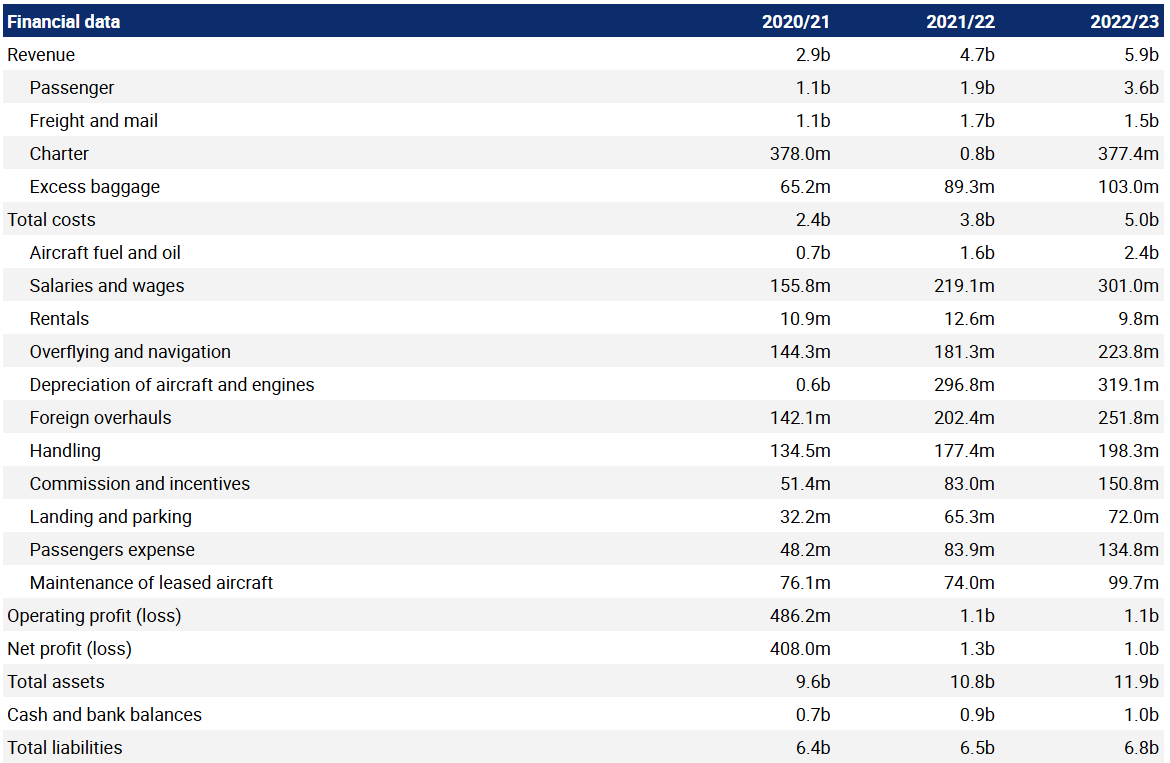

Ethiopian Airlines, which is increasingly active globally in fifth and sixth freedom markets, was able to report both operating and net profit in excess of USD1 billion in two of the three COVID-19 pandemic years, and between USD400 and USD500 million even during 2020/21.

Ethiopian Airlines financial data 2020/21 - 2022/23

Source: CAPA - Centre for Aviation and Ethiopian Airlines reports.

Ethiopian Airlines financial year ends in June.

Values shown are in USD.

While full accounts are not yet available, it is known that in the last fiscal year, ending on 30-Jun-2024 2023/24), the airline reported record revenues of USD7.02 billion, reflecting a 14% year-on-year increase. It transported 17.1 million passengers - with 13.4 million on international routes and 3.7 million domestically.

Despite added infrastructure, the existing airport (Bole International) wasn't considered to be up to the job for much longer; but little progress had been made in eight years, even to firm up a site for the new airport, let alone to start building it.

If the government wanted the airline to hold on to its status, it needed to get on with it, and quickly. And Africa as a whole needed to understand that lethargy and inertia like this was what puts off many potential foreign investors in the continent's transport infrastructure.

New airport now to be situated 70km from the existing one

At last there has been a breakthrough, and it directly involves the state airline in the airport project.

On 14-Mar-2025 Ethiopian Airlines and the African Development Bank signed a Letter of Intent (LoI) to collaborate towards the USD7.8 billion Abusera International Airport development project, which will include an 'airport city' featuring hotels, shopping malls, office buildings and apartments. That name has only been applied since an actual location was identified.

The airport will be located 67km (42 miles) south from the existing Bole International Airport (ADD), close to Bishoftu City - a resort town that is also the primary airbase of the Ethiopian Air Force, and which sits at an elevation of 1,920 metres (6,300ft).

Location of Addis Ababa, the Bole International Airport, Bishoftu and Abusera

Source: Google Maps.

Such elevations are not uncommon in Ethiopia, even though they can influence the maximum load permissible for take-off. Bole Airport's elevation is 2,334 metres.

Potential for 110 million passengers annually would put it in new territory for Africa

The airport will be capable of accommodating up to 200 aircraft simultaneously.

Ultimately, passenger capacity will rise to 110 million passengers per annum, which is more than four times the capacity of Addis Ababa's existing air gateway. It will include a 1.1 million sqm terminal, 126,190sqm of airline support facilities, over 100,000sqm of cargo and airport support facilities, and two Code 4E parallel runways. The first phase of construction is scheduled for completion in 2029, with passenger-handling capacity at that stage of 60 mppa upon completion of the phase.

That definitive level of capacity is 230% greater than the actual passenger numbers at Africa's busiest airport, Cairo International, in 2023 (2024 statistics are not yet official for many countries there).

It puts the new facility easily in the Top 5 in the world for projected new capacity.

There is considerable scope for enhancement of its hub capacity, as well as point-to-point. It is believed that up to 50% of Bole's passengers are in transit, domestically and/or internationally.

The new airport will be served by an express railway line running from the centre of Addis Ababa.

A roll call of international designers and project managers

The design for both the airport and airport city is by Zaha Hadid Architects, a practice known for its energy efficiency considerations, so it will be pertinent to expect a heavy emphasis on environmental matters in that design.

Several other companies are involved in the consortium that has been awarded a technical advisory, engineering, project management and construction supervision contract for the airport. They include Pascall+Watson Architects, the aviation specialists Landrum & Brown, and the engineers TY Lin.

The project has faced consistent challenges over the last decade including the resettlement of local communities, financing arrangements (which is presumably why the African Development Bank stepped in) and the geopolitical dynamics in Ethiopia and the wider region.

The limited construction activities to date are reported to have come with some significant challenges as farmers demanded compensation and appropriate resettlement, which is not unusual with greenfield airports in rural or semi-rural areas (as has often been the case in India).

City project planned as hub for aviation, trade, and economic development

Abusera Airport will be part of the broader Abusera City project, which is intended to be a hub for aviation, trade, and economic development, stimulating regional economic growth.

It is not known how much of the funding will be directed towards the airport and how much for the commercial development to go with it, but initial estimates produced years ago projected the airport city construction cost at USD5 billion, with current assessments indicating a potential increase in that level of expenditure.

Meanwhile, the original budget for a new airport was set at around USD2.5 billion, which tallies with the overall figure now.

The airport might not have been viable without its economic and social spin offs

One way of interpreting this is that the only way the airport could be justified - and hence the lengthy delay in starting work on one - would be in conjunction with attendant commercial developments that would be of specific and targeted economic benefit to a region.

Ethiopian Airlines Group has already secured the designated land from the Oromia regional government for the ambitious project and relocation of residents has begun, paving the way for the start of construction.

The airport city project encompasses an expansive area of 38 to 40 square kilometres. Construction is expected to begin promptly following the Group's assumption of control over the secured land.

The completion of the airport city is anticipated within a five-year timeframe. It will be also be connected to the Bole International Airport through an express train, with its design currently in progress.

The state airline is driving this and other projects

The existing Bole Airport, along with 22 others, is managed by Ethiopian Airports Enterprise (EAE), a government-owned body, founded in 2003.

EAE was originally part of a larger Aviation Holding Group that included Ethiopian Airlines, but is now one of the core business units within Ethiopian Airlines group with a mandate to execute "quality" airport infrastructure and services to its customers, having its own distinct mission, vision and core values.

As such, it is a rare case of the national airline having a leading role in the management of airports within national boundaries.

There are examples in the Middle East where an airline and the main airport operator are closely integrated, and effectively act as one unit, and historically US airlines have invested in terminals in order to control gates; increasingly do so within public-private partnerships to build or refurbish entire terminals.

But for the national carrier to be the main driver of airport expansion is unusual, and there is concern in organisations such as Airports Council International (ACI) in the region over cross-subsidisation and the consequential impact on the stifling of competition.

A CAPA - Centre for Aviation Special Report was published in 2024 on the subject of airlines investing in airports: 2024 SPECIAL REPORT: Airlines Investing in Airports.

And it is noteworthy that Ethiopian Airlines was prominent at the delegation which met the African Development Bank to sign the deal, including the Chief Finance Officer and the Infrastructure Director, together with Finance Ministry staffers.

Collectively, they agreed that multinational transportation is key to improving interconnectedness and free movement between countries and contributes to regional integration, one of the Bank's 'High Five' priorities.

There will come a time when Abusera must take the lead, but Bole should not be written off

Abusera International Airport will initially complement the recently expanded Bole International Airport, which will reach its annual 25 million passenger capacity limit soon, irrespective of that expansion.

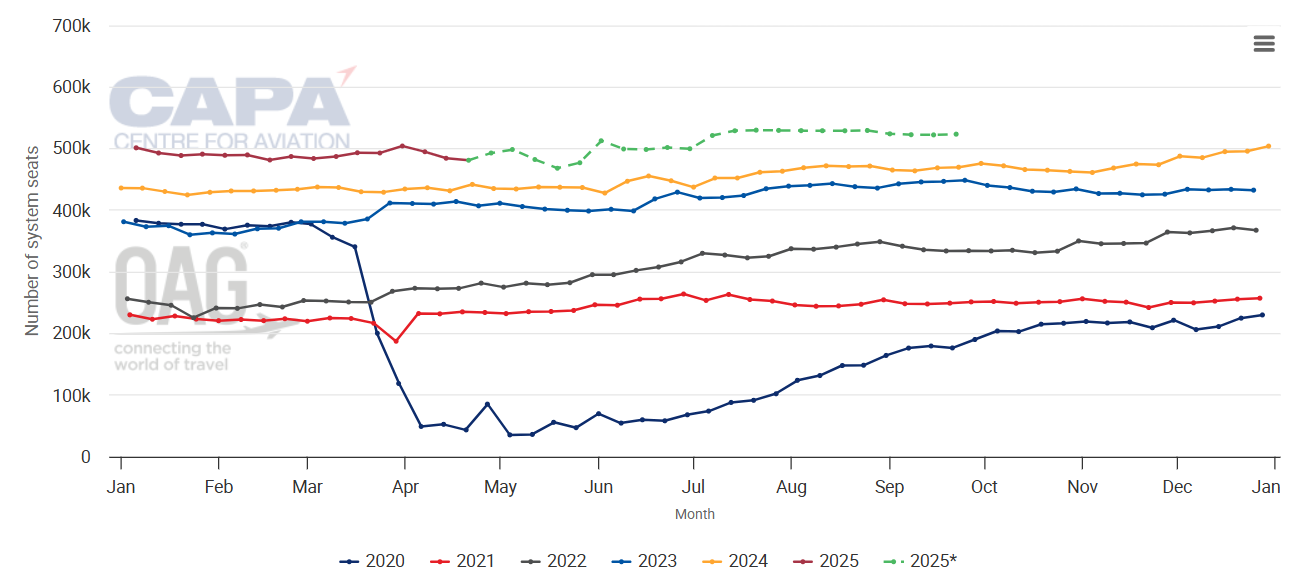

After returning to pre-COVID capacity levels in 1Q2023, Bole International witnessed continued growth through the remainder of that year, during 2024, into 2025. That trend will continue over the rest of the year, according to advanced schedules data from OAG and seat analysis from CAPA - Centre for Aviation.

Addis Ababa Bole International Airport weekly total system seats, 2020-2025 (as at w/c 14-Apr-2025)

Source: CAPA - Centre for Aviation and OAG.

* These values are at least partly predictive up to 6 months from 14-Apr-2025 and may be subject to change.

The new infrastructure will enhance Ethiopian Airlines' role in improving intra-Africa connectivity by enabling a more extensive and efficient network, and strengthening connectivity between Africa and the rest of the world.

There will come a time when Abusera will have to take the lead, but when that will be, and what will then happen to Bole, does not appear to be on the agenda at this time.

History shows that it is imprudent to write off such facilities entirely.

Abusera ties in with Ethiopian's own 2035 growth strategy

Ethiopian is advancing its own ambitious 2035 growth strategy, which emphasises network expansion, infrastructure development, and human capital investment to enhance its global competitiveness, but it would serve the airline no useful purpose to be operating out of Bole as well as Abusera for any longer than it has to.

The AfDB aims to please, but could Abusera be the project that is the tipping point for the airport investment fraternity?

The African Development Bank meanwhile sees the LoI as being "yet another testament to AfDB's commitment to supporting Ethiopia's ambitious flagship air transport project. One that will not only reinforce Ethiopian Airlines' competitive edge in passenger and cargo services, but also enhance Africa's global air connectivity and integration, solidifying the continent's aviation hub status".

Loan (debt) financing seems to be the intention. While Groupe ADP subsidiary ADP Ingenierie conducted the original planning study for the facility there is no suggestion so far that the private sector will have a part to play in the operation or funding of the airport.

Many observers have noted that Africa faces limitations in terms of airport infrastructure, systems and policy compared to other developing continents and calls on governments to invest in airport development and connectivity have been long and loud.

It is ironic that in the absence of public sector funding the mantle has been seized by airlines, either home grown of foreign - as is evident here, and has been in Rwanda with the new Bugesera airport there.

Perhaps that will be enough to spur the international private sector into action, perhaps to work with the development banks and local airlines to provide Africa with the airport infrastructure it needs.

For now, at least, this development at Addis Ababa will place Ethiopia at the forefront of African countries in the air transport sphere, perhaps to the point where it can claim to be the only genuine global aviation hub on that continent.