Argentina - Leaving the Low-Cost Wilderness

Top 10 Markets from Argentina, 2017

Lower South America has had a chequered history of aviation development in recent years; rapid growth in some markets, economic slowdown, excess capacity and route cutbacks have created a sense of frustration at the failure to realise the opportunities seen in other parts of the world.

The recent announcement by Norwegian Airlines that it will launch a four-time weekly London Gatwick service follows on from its earlier announcement, establishing Norwegian Air Argentina. Both announcements along with other expressions of interest in establishing regional low-cost airlines in the country suggest that the wider global aviation community highlights the increasing interest in the market. But what is really driving that interest?

Today, less than 3% of all services operated to/from and within Argentina are on low-cost services; in comparative terms that places the country behind markets such as China (9%) where low-cost airlines remain restricted in their operation. In Brazil, the largest and closest market of consequence to Argentina, nearly three fifths (58%) of scheduled services are operated by low-cost carriers.

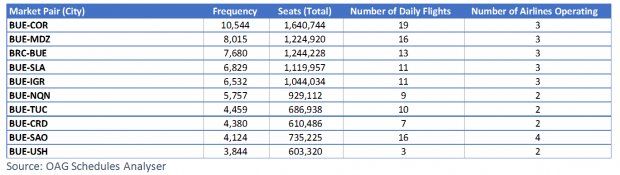

Typically, low-cost airlines begin operations by competing on the largest established markets; the top ten of which are listed in the table above.

*click here to see the full-sized table

With nine of the top ten city pairs being domestic and all featuring Buenos Aires, the Argentinian Government’s ambition of seeing an increase of some 50% in traffic seems within reach. In many cases, markets with similar starting positions have seen traffic surge by over 30% in just one year whilst of course, average fares have also fallen as competition and additional capacity is generated.

To view the full article, click here